Ripple

Founded Year

2012Stage

Corporate Minority | AliveTotal Raised

$393.91MLast Raised

$100M | 4 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+181 points in the past 30 days

About Ripple

Ripple provides digital asset infrastructure for financial services, focusing on cross-border payments and digital asset management. The company offers solutions for payment settlement, liquidity management, and a global payout network, as well as services for storing and managing digital assets. Ripple was formerly known as OpenCoin. It was founded in 2012 and is based in San Francisco, California.

Loading...

Ripple's Product Videos

ESPs containing Ripple

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

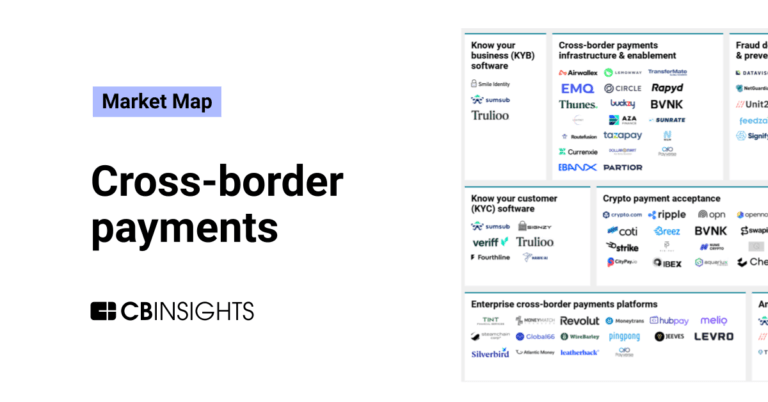

The cross-border payments infrastructure & enablement market allows businesses to send and accept global payments on their own websites and payment platforms. Companies in this market offer APIs and technology solutions that enable businesses to process payments across currencies and platforms, make payouts, verify user identities, issue credit cards, and manage international transactions. These s…

Ripple named as Leader among 15 other companies, including Circle, Adyen, and Nium.

Ripple's Products & Differentiators

Ripple Payments

Ripple Payments is the first enterprise-grade solution to address and eliminate the pain points associated with cross-border payments using digital assets at scale. As it has evolved, Ripple Payments has expanded from a cross-border payments network to a platform providing tokenized services that will bring crypto capabilities to enterprises – paving the way for a future where digital assets are front and center.

Loading...

Research containing Ripple

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Ripple in 10 CB Insights research briefs, most recently on May 8, 2024.

May 8, 2024

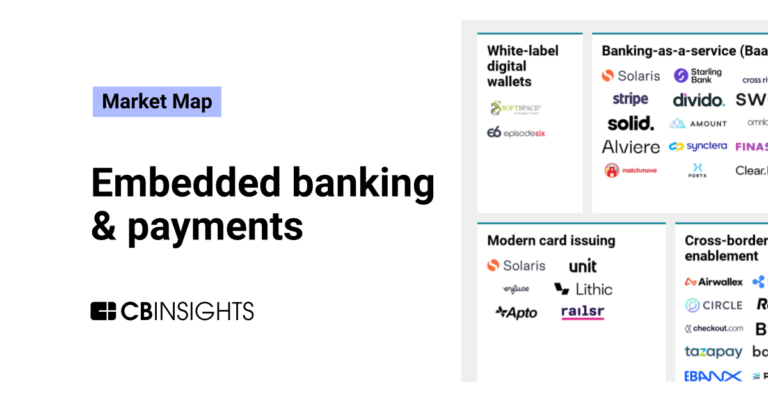

The embedded banking & payments market map

Dec 14, 2023

Cross-border payments market map

Oct 18, 2022

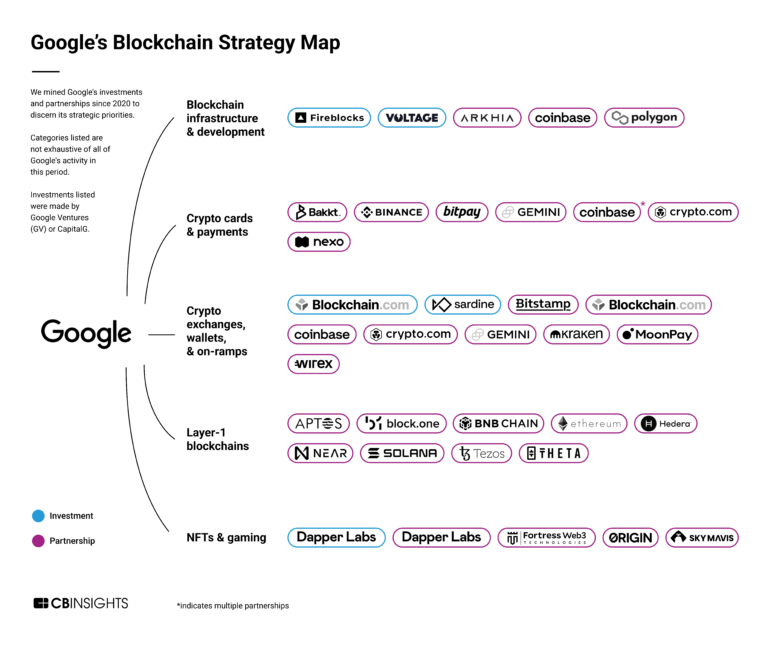

How blockchain could disrupt bankingExpert Collections containing Ripple

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Ripple is included in 7 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Blockchain

9,692 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech 100

1,097 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Payments

3,134 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Conference Exhibitors

5,302 items

Fintech

9,464 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Ripple Patents

Ripple has filed 112 patents.

The 3 most popular patent topics include:

- payment systems

- project management

- domain name system

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

3/30/2022 | 2/25/2025 | Electrical signal connectors, Printed circuit board manufacturing, Electrical connectors, Computer connectors, Spinal nerves | Grant |

Application Date | 3/30/2022 |

|---|---|

Grant Date | 2/25/2025 |

Title | |

Related Topics | Electrical signal connectors, Printed circuit board manufacturing, Electrical connectors, Computer connectors, Spinal nerves |

Status | Grant |

Latest Ripple News

Apr 2, 2025

FILE PHOTO: Tyler Winklevoss speaks at the White House Crypto Summit at the White House in Washington, D.C., U.S., March 7, 2025. REUTERS/Evelyn Hockstein/File Photo NEW YORK (Reuters) - An exchange run by billionaire twins Tyler and Cameron Winklevoss may soon resolve a U.S. Securities and Exchange Commission lawsuit claiming they failed to register a cryptocurrency asset lending program before offering it to retail investors. In a joint letter filed on Tuesday in Manhattan federal court, the twins' Gemini Trust and the SEC asked to put all deadlines in the civil case over Gemini Earn on hold for 60 days to allow the parties to explore a potential resolution. The letter did not say whether this might entail a settlement, the SEC dropping its case, or some other outcome. Neither lawyers for Gemini nor the SEC immediately responded to requests for comment. The SEC sued Gemini and cryptocurrency lender Genesis Global Capital in January 2023 over Gemini Earn, which let customers lend crypto assets including Bitcoin to Genesis in exchange for interest payments, with Gemini taking a fee as high as 4.29%. Genesis halted withdrawals in November 2022, the same month Sam Bankman-Fried's FTX cryptocurrency exchange collapsed, and filed for bankruptcy two months later. It held $900 million of assets from about 340,000 Gemini Earn customers at the time. The SEC said that in creating Gemini Earn, Genesis and Gemini bypassed disclosure requirements meant to protect investors. Genesis agreed in March 2024 to pay a $21 million fine to settle, pending the resolution of claims in its Chapter 11 case, without admitting wrongdoing. Gemini has denied wrongdoing. The SEC has eased oversight of the cryptocurrency industry since Donald Trump became president in January, and is widely expected to remain more supportive of the industry than under the Biden administration. In recent weeks, the SEC has ended civil lawsuits against crypto exchanges Coinbase and Kraken, and agreed to settle a case against cryptocurrency company Ripple Labs over the unregistered sale of securities. Tyler and Cameron Winklevoss are each worth $3 billion according to Forbes magazine. The case is SEC v Gemini Trust Co et al, U.S. District Court, Southern District of New York, No. 23-00287. (Reporting by Jonathan Stempel in New York; Editing by Richard Chang) Open Modal

Ripple Frequently Asked Questions (FAQ)

When was Ripple founded?

Ripple was founded in 2012.

Where is Ripple's headquarters?

Ripple's headquarters is located at 600 Battery Street, San Francisco.

What is Ripple's latest funding round?

Ripple's latest funding round is Corporate Minority.

How much did Ripple raise?

Ripple raised a total of $393.91M.

Who are the investors of Ripple?

Investors of Ripple include Kaj Labs, Tokentus, Tetragon Financial Group, Ripple, Route 66 Ventures and 36 more.

Who are Ripple's competitors?

Competitors of Ripple include Zepz, Iron Fish, MobiKwik, BVNK, WadzPay and 7 more.

What products does Ripple offer?

Ripple's products include Ripple Payments and 2 more.

Who are Ripple's customers?

Customers of Ripple include Hai Ha, Travelex, Instarem and DBS Bank.

Loading...

Compare Ripple to Competitors

BitGo provides digital asset custody and financial services within the cryptocurrency sector. The company offers secure wallet solutions, qualified custody, and financial services including trading, financing, and wealth management. BitGo serves institutional investors, trading firms, investment advisors, exchanges, retail platforms, and developers. It was founded in 2013 and is based in Palo Alto, California.

Zepz is a company in the financial technology sector that facilitates international payments. It provides digital solutions for sending money across borders, including options for bank deposits, cash collections, and mobile money services. Zepz serves the ecommerce industry by offering online money transfers. It was founded in 2010 and is based in London, United Kingdom.

Ledger involved in the security and management of digital assets in the cryptocurrency domain. The company offers hardware wallets for storing cryptocurrencies, as well as a companion application for managing and interacting with digital assets. Ledger's products are available for individual consumers and institutional investors, focusing on storage, transaction, and portfolio management. It was founded in 2014 and is based in Paris, France.

Lianlian Pay operates a network of agents in China where consumers can convert cash into mobile-phone minutes. It allows customers to purchase airline tickets, video gaming credits, and utility bills with its network. It was founded in 2003 and is based in Hangzhou, China.

Xapo Bank operates as a financial institution integrating traditional banking with cryptocurrency. The company offers banking services that allow customers to manage both US Dollar and Bitcoin accounts, providing a platform for transactions and wealth growth. The bank primarily serves individuals interested in blending traditional finance with the cryptocurrency economy. It was founded in 2014 and is based in Gibraltar, United Kingdom.

Airwallex develops a global financial platform that focuses on providing business payment solutions within the financial technology domain. The company offers an array of services including global business accounts for managing finances, international transfers, multi-currency corporate cards, and online payment processing capabilities. It primarily serves the payment industry. The company was founded in 2015 and is based in Melbourne, Australia.

Loading...