BitGo

Founded Year

2013Stage

Option/Warrant - III | AliveTotal Raised

$186.14MLast Raised

$6.32M | 3 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-8 points in the past 30 days

About BitGo

BitGo provides solutions for the digital asset economy within the financial technology sector. Its offerings include custody, digital asset wallets, and financial services such as trading, borrowing, lending, and staking, which are used to manage digital assets. BitGo serves institutional clients, cryptocurrency exchanges, and investment platforms with services designed for the crypto space. It was founded in 2013 and is based in Palo Alto, California.

Loading...

ESPs containing BitGo

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

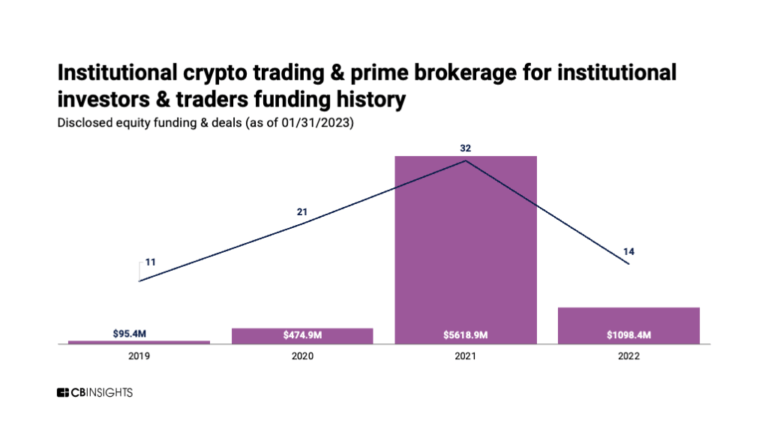

The institutional staking market provides platforms to institutional investors, crypto platforms, and investment funds looking to earn yield on their digital assets through staking. Staking involves holding and locking up cryptocurrencies to support the network and validate transactions, earning rewards in return. The market offers solutions for managing and securing digital assets, as well as pro…

BitGo named as Leader among 15 other companies, including Fireblocks, Gemini, and Ledger.

BitGo's Products & Differentiators

Wallet Platform

BitGo’s wallet platform creates an ideal balance between security and accessibility—enabling clients to move assets seamlessly and reliably, protected by BitGo’s pioneering multi-key security, multi-user policy controls, and advanced security configurations. BitGo offers flexible wallet security and transaction policy features to address a range of business needs. Protect your wallet against any single point of failure with BitGo's multi-key security. Enforce controls and policies using whitelists, velocity limits, and administrative approvals.

Loading...

Research containing BitGo

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned BitGo in 4 CB Insights research briefs, most recently on Oct 18, 2023.

Expert Collections containing BitGo

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

BitGo is included in 7 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Blockchain

8,705 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Wealth Tech

2,369 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Digital Lending

2,374 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Fintech 100

350 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Fintech

9,451 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

BitGo Patents

BitGo has filed 3 patents.

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

12/14/2018 | 9/14/2021 | Cryptocurrencies, Cryptography, Alternative currencies, Key management, Bitcoin exchanges | Grant |

Application Date | 12/14/2018 |

|---|---|

Grant Date | 9/14/2021 |

Title | |

Related Topics | Cryptocurrencies, Cryptography, Alternative currencies, Key management, Bitcoin exchanges |

Status | Grant |

Latest BitGo News

Mar 26, 2025

紐約--(BUSINESS WIRE)--(美國商業資訊)-- World Liberty Financial Inc. (“WLFI”)是受Donald J. Trump總統啟發而建立的開創性去中心化金融(DeFi)協議和治理平台的開發商。該公司今日宣布計畫推出穩定幣USD1,該穩定幣可按1:1的比例兌換美元(USD)。 WLFI的USD1將由美國短期國債、美元存款和其他現金等價物提供100%擔保。最初,USD1代幣將在以太坊(ETH)和幣安智慧鏈(BSC)區塊鏈上鑄造,未來計畫擴充到其他協議。每個代幣均錨定1美元的價值,並由第三方會計事務所定期稽核的儲備資產組合提供全額擔保。 WLFI共同創辦人Zach Witkoff表示:「USD1提供了演算法型和匿名加密專案無法提供的價值——在傳統金融界最受尊敬機構的信譽和保障支援下獲得DeFi的力量。主權投資人和大型機構可以放心地將我們推出的數位美元穩定幣納入其策略,用於順暢、安全的跨境交易。」 USD1的儲備將由全球最大的獨立合格代管機構以及數位資產安全、代管和流動性領域的領導者BitGo代管。BitGo為多個國際司法管轄區的數千家機構客戶

BitGo Frequently Asked Questions (FAQ)

When was BitGo founded?

BitGo was founded in 2013.

Where is BitGo's headquarters?

BitGo's headquarters is located at 2443 Ash Street, Palo Alto.

What is BitGo's latest funding round?

BitGo's latest funding round is Option/Warrant - III.

How much did BitGo raise?

BitGo raised a total of $186.14M.

Who are the investors of BitGo?

Investors of BitGo include Hana Financial Group, SK Telecom, The Brink's Company, Redpoint Ventures, Valor Equity Partners and 17 more.

Who are BitGo's competitors?

Competitors of BitGo include Hex Trust, MobiKwik, Ripple, AZA Finance, Propine and 7 more.

What products does BitGo offer?

BitGo's products include Wallet Platform and 4 more.

Who are BitGo's customers?

Customers of BitGo include Nike, BitcoinIRA, SoFi and Bullish.

Loading...

Compare BitGo to Competitors

Ledger involved in the security and management of digital assets in the cryptocurrency domain. The company offers hardware wallets for storing cryptocurrencies, as well as a companion application for managing and interacting with digital assets. Ledger's products are available for individual consumers and institutional investors, focusing on storage, transaction, and portfolio management. It was founded in 2014 and is based in Paris, France.

Ripple provides digital asset infrastructure for financial services, focusing on cross-border payments and digital asset management. The company offers solutions for payment settlement, liquidity management, and a global payout network, as well as services for storing and managing digital assets. Ripple was formerly known as OpenCoin. It was founded in 2012 and is based in San Francisco, California.

Zepz is a company in the financial technology sector that facilitates international payments. It provides digital solutions for sending money across borders, including options for bank deposits, cash collections, and mobile money services. Zepz serves the ecommerce industry by offering online money transfers. It was founded in 2010 and is based in London, England.

Paga is a mobile money company that focuses on facilitating digital financial transactions. The company offers services that allow users to send and receive money, pay bills, and top up airtime and data. Paga primarily serves the financial technology sector by simplifying access to financial services for individuals. It was founded in 2009 and is based in Lagos, Nigeria.

Xapo Bank operates as a financial institution integrating traditional banking with cryptocurrency. The company offers banking services that allow customers to manage both US Dollar and Bitcoin accounts, providing a platform for transactions and wealth growth. The bank primarily serves individuals interested in blending traditional finance with the cryptocurrency economy. It was founded in 2014 and is based in Gibraltar, United Kingdom.

AZA Finance specializes in cross-border payment solutions and foreign exchange services for the business-to-business (B2B) sector. The company offers an online payment platform that facilitates multi-currency transactions, Treasury management, and payment collections, designed to support businesses operating in Africa. AZA Finance primarily serves enterprises requiring financial services across multiple African and global markets. AZA Finance was formerly known as BitPesa. It was founded in 2013 and is based in Grand Duchy of Luxembourg City, Luxembourg.

Loading...