Plaid

Founded Year

2013Stage

Series D - II | AliveTotal Raised

$734.8MRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-32 points in the past 30 days

About Plaid

Plaid is a fintech company that connects users to financial data and services. The company provides products that link users' financial accounts to applications, verify identities, and support secure money movement. Plaid's solutions include fraud prevention, credit underwriting, and personal finance insights. Plaid was formerly known as Plaid Technologies. It was founded in 2013 and is based in San Francisco, California.

Loading...

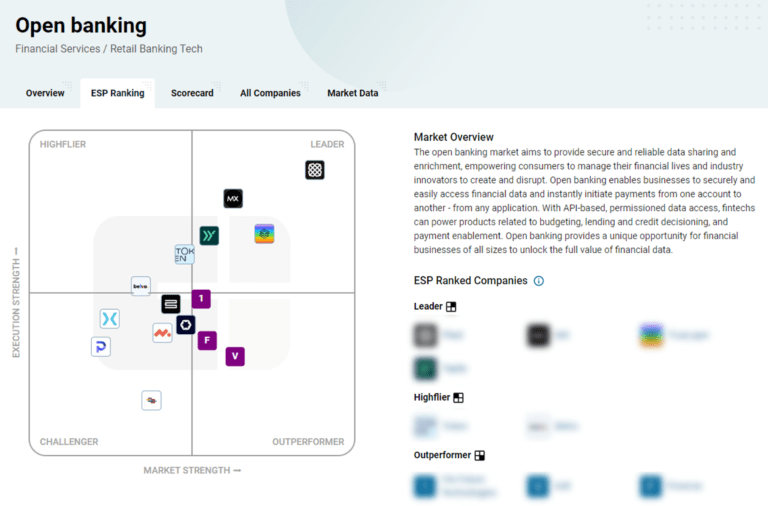

ESPs containing Plaid

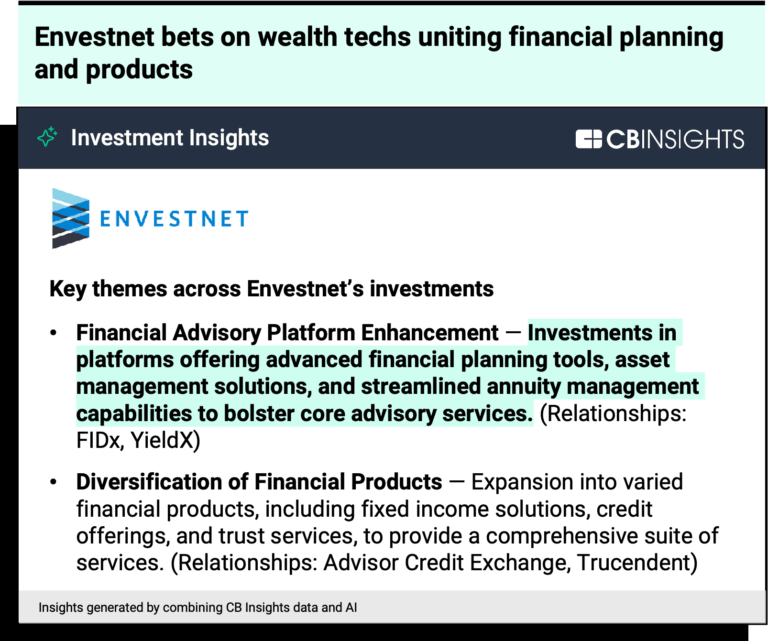

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The lending APIs & infrastructure market provides end-to-end solutions for digital lending operations, including loan management systems, risk management tools, and compliance management capabilities. These platforms enable financial institutions to originate, process, and service loans through API-driven architecture that supports integration with existing systems. The market encompasses core ban…

Plaid named as Highflier among 15 other companies, including Fiserv, nCino, and Finastra.

Plaid's Products & Differentiators

Transacttions

Retrieve typically 24 months of transaction data, including enhanced geolocation, merchant, and category information. Stay up-to-date by receiving notifications via a webhook whenever there are new transactions associated with linked accounts.

Loading...

Research containing Plaid

Get data-driven expert analysis from the CB Insights Intelligence Unit.

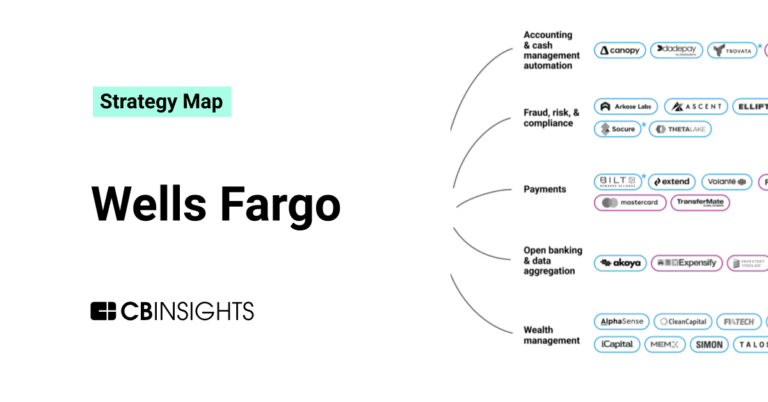

CB Insights Intelligence Analysts have mentioned Plaid in 15 CB Insights research briefs, most recently on Sep 27, 2024.

May 8, 2024

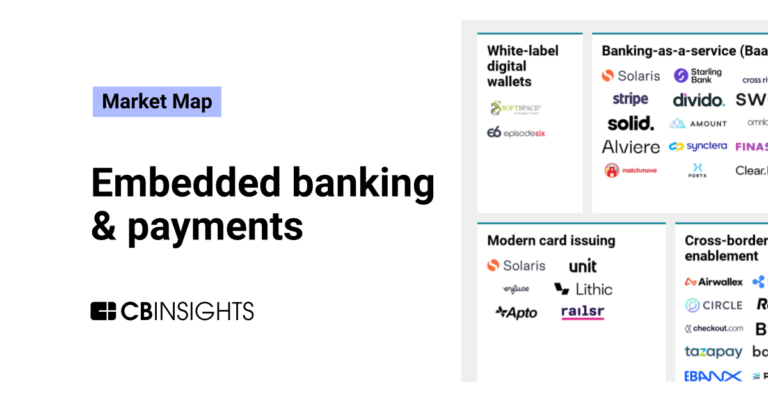

The embedded banking & payments market map

Jan 4, 2024

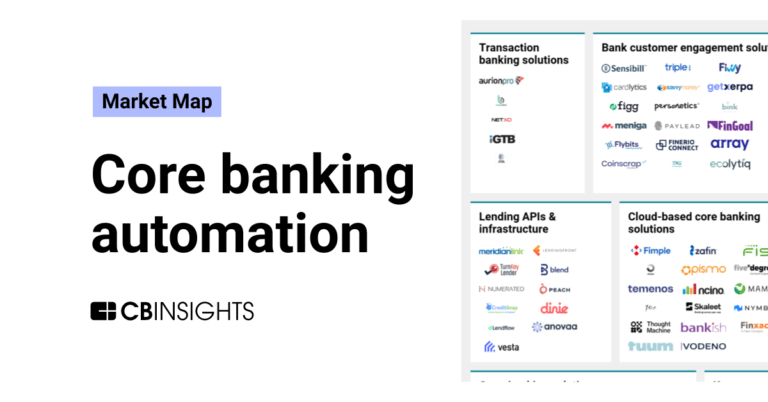

The core banking automation market map

Expert Collections containing Plaid

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Plaid is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Wealth Tech

2,369 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Fintech 100

997 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Digital Lending

2,477 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Tech IPO Pipeline

825 items

Fintech

9,451 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Plaid Patents

Plaid has filed 70 patents.

The 3 most popular patent topics include:

- data management

- payment systems

- banking technology

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

6/16/2022 | 3/25/2025 | Data management, Computer network security, Computer security, Payment systems, Banking | Grant |

Application Date | 6/16/2022 |

|---|---|

Grant Date | 3/25/2025 |

Title | |

Related Topics | Data management, Computer network security, Computer security, Payment systems, Banking |

Status | Grant |

Latest Plaid News

Mar 25, 2025

the Fraud Cycle Javelin’s 22nd Annual Identity Fraud Study Reveals 7 in 10 Scam Victims Were Deceived into Providing the Scammer with Personal Information, Increasing Their Risk of Future Attacks March 25, 2025 10:10 ET Javelin Strategy & Research SAN FRANCISCO, March 25, 2025 (GLOBE NEWSWIRE) -- Today, Javelin Strategy & Research, part of the Escalent Group, published the 22nd edition of its landmark Identity Fraud Study, titled “ Breaking Barriers to Innovation ”. This year’s findings reveal a dangerous shift in fraud tactics—scammers are no longer just after quick cash; they also want information. By seeking personally identifiable information (PII), scammers can exploit victims long after the initial scam, either by opening new fraudulent accounts, taking over existing financial or non-financial accounts, using the information to commit additional scams, or selling their data to other bad actors. These attacks not only affect individual consumers but also affect financial institutions and the entire fraud landscape. The more information these attackers have, the easier it is to quickly conduct large scale fraud attacks. The scale of this deception is alarming: 7 in 10 victims who lost money to a scam were also tricked into handing over PII, unwittingly fueling a cycle of fraud. The top pieces of information stolen—email addresses (43%), phone numbers (38%), and banking details (28%)—may seem harmless to share, but serve as digital keys to financial and non-financial accounts. Many consumers fail to realize that something as simple as an email address can provide fraudsters with a gateway to multiple accounts, increasing the risk of ongoing identity theft and financial loss. “Fraud professionals must start thinking beyond the existing regulatory and privacy restrictions, and start envisioning future possibilities,” says Jennifer Pitt, senior analyst in Javelin's Fraud & Security practice and the report’s author. “The traditional mindset focuses on short-term risks, but real innovation comes from looking ahead and developing future-ready solutions. This means strengthening fraud detection, enhancing identity verification, fostering greater collaboration across industries, and employing advanced technology to disrupt fraud before it happens.” Javelin’s Identity Fraud Study continues to set the standard for identity fraud research, thanks to the support of industry leaders committed to fraud prevention. This year’s sponsors include AARP, TransUnion, Plaid, BioCatch, Mitek, and Sigma Loyalty Group whose expertise and innovation help drive forward the fight against fraud. Other highlights from this year’s report: Fraud and scam losses surged to $47 billion, up $4 billion from the prior year, affecting 40 million victims—1 million more than in 2023. Identity fraud accounted for $27 billion in losses across 18 million victims, while scams led to $20 billion in losses affecting 22 million victims. 54% of consumers saw more unusual text messages, 47% more emails with suspicious links, 44% more robo-calls, and 42% more emails with suspicious attachments. 39% of account takeover fraud victims had their checking accounts compromised, and 23% had their email accounts taken over. 12% of fraud victims didn’t report their incident to anyone. Among them, 22% believed nothing could be done, and 22% didn’t know where or how to report it. Pitt advises fraud and cyber security professionals to help consumers slow down and think before they act. “Fraud and cybersecurity professionals must push a “verify, then maybe trust” mindset, which will essentially help consumers to pause before taking an action (like clicking a link or providing information).” Javelin’s Identity Fraud Study is an essential guide to understanding the financial impact and emotional devastation caused by identity fraud in the United States. The online survey of 5,000 U.S. adults is conducted every autumn and publishes the following spring. To learn more about identity fraud trends or speak with the report’s author, contact Marketing Coordinator Allison Bondi . About Javelin Strategy & Research Javelin Strategy & Research , part of the Escalent Group , helps its clients make informed decisions in a digital financial world. It provides strategic insights to financial institutions including banks, credit unions, brokerages and insurers, as well as payments companies, technology providers, fintechs and government agencies. Javelin’s independent insights result from a rigorous research process that assesses consumers, businesses, providers, and the transactions ecosystem. It conducts in-depth primary research studies to pinpoint dynamic risks and opportunities in digital banking, payments, fraud & security, lending, and wealth management. Learn more at javelinstrategy.com . PLATINUM SPONSORS AARP AARP is the nation's largest nonprofit, nonpartisan organization dedicated to empowering Americans 50 and older to choose how they live as they age. With a nationwide presence, AARP strengthens communities and advocates for what matters most to the more than 100 million Americans 50-plus and their families: health security, financial stability and personal fulfillment. AARP also works for individuals in the marketplace by sparking new solutions and allowing carefully chosen, high-quality products and services to carry the AARP name. As a trusted source for news and information, AARP produces the nation's largest circulation publications, AARP The Magazine and AARP Bulletin. To learn more, visit www.aarp.org/about-aarp/ , www.aarp.org/español or follow @AARP, @AARPenEspañol and @AARPadvocates on social media. TransUnion TransUnion is an information and insights company that has been enabling trust in commerce for over 50 years. Originally established as a credit reporting agency, TransUnion has expanded its capabilities to include fraud prevention, marketing, and customer-driven analytics. The company's mission is to provide a holistic picture of each consumer, leveraging a collection of online, offline, public, and proprietary information to create an actionable view of individuals. GOLD SPONSOR Plaid Plaid is a global data network that powers the tools millions of people rely on to live healthier financial lives. Our ambition is to facilitate a more inclusive, competitive, and mutually beneficial financial system by simplifying payments, revolutionizing lending, and leading the fight against fraud. Plaid works with thousands of companies, including fintechs like Venmo and SoFi, several Fortune 500 companies, and many of the largest banks to empower people with more choice and control over how they manage their money. Headquartered in San Francisco, Plaid’s network spans over 12,000 institutions across the U.S., Canada, U.K., and Europe. SILVER SPONSORS BioCatch BioCatch stands at the forefront of digital fraud detection, pioneering behavioral intelligence grounded in advanced cognitive science and machine learning. BioCatch analyzes thousands of user interactions to support a digital banking environment where identity, trust, and ease coexist. Today, more than 250 financial institutions, including 34 of the world's largest 100 banks, rely on BioCatch Connect™ to combat fraud, facilitate digital transformation, and grow customer relationships. BioCatch's Client Innovation Board – an industry-led initiative featuring American Express, Barclays, Citi Ventures, HSBC, and National Australia Bank – collaborates to pioneer creative and innovative ways to leverage customer relationships for fraud prevention. With more than a decade of data analysis, 93 registered patents, and unmatched expertise, BioCatch continues to lead innovation to address future challenges. For more information, visit www.biocatch.com . Mitek Mitek is a global leader in digital access, founded to bridge the physical and digital worlds. Mitek’s advanced identity verification technologies and global platform make digital access faster and more secure than ever, providing companies new levels of control, deployment ease and operation, while protecting the entire customer journey. With solutions trusted by 7,900 organizations around the world, including the majority of North American financial institutions which rely on our mobile check deposit solutions, Mitek helps companies reduce risk and meet regulatory requirements. Learn more at www.miteksystems.com . BRONZE SPONSOR Sigma Loyalty Group Sigma Loyalty Group is a leader in Identity Protection Solutions. With unique technology, expertise and continued innovation, we help financial institutions offer identity theft protection to their customers and reassure their peace of mind. Your customers shouldn’t have to worry about protecting their identity. With our turnkey and customizable solutions, they won’t have to. Learn more at http://sigmaloyaltygroup.com/ .

Plaid Frequently Asked Questions (FAQ)

When was Plaid founded?

Plaid was founded in 2013.

Where is Plaid's headquarters?

Plaid's headquarters is located at San Francisco.

What is Plaid's latest funding round?

Plaid's latest funding round is Series D - II.

How much did Plaid raise?

Plaid raised a total of $734.8M.

Who are the investors of Plaid?

Investors of Plaid include American Express Ventures, J.P. Morgan Private Bank, New Enterprise Associates, Spark Capital, Andreessen Horowitz and 24 more.

Who are Plaid's competitors?

Competitors of Plaid include Solaris, Finix, Nymbus, Bud, Aeropay and 7 more.

What products does Plaid offer?

Plaid's products include Transacttions and 4 more.

Loading...

Compare Plaid to Competitors

Yapily is an open banking infrastructure platform that specializes in providing secure connectivity between customers and banks across Europe. The company offers services that enable access to financial data and the initiation of payments, aiming to facilitate the creation of personalized financial experiences. Yapily primarily serves industries such as payment services, i-gaming, accounting, lending and credit, crypto, property technology (PropTech), investing, and digital banking. Yapily was formerly known as Acacia Connect. It was founded in 2017 and is based in London, United Kingdom.

Budget Insight focuses on open finance and embedded finance solutions. The company offers a range of services including instant money transfers, real-time revenue checking, automated bank identity verifications, and a platform for aggregating financial data from various institutions. Its services primarily cater to sectors such as banking, insurance, technology companies, and utilities. It was founded in 2012 and is based in Roubaix, France.

Railsr is a global embedded finance platform that operates within the financial services sector. The company provides financial services, including digital wallets, payment processing, and card issuance, all facilitated through API integration. Railsr's platform is designed to integrate into a brand's digital journey, offering rewards programs, loyalty points, and various types of cards. Railsr was formerly known as Railsbank. It was founded in 2016 and is based in London, United Kingdom.

TrueLayer is an open banking platform that specializes in the financial services industry. The company offers a suite of products that enable instant bank payments, fast and verified payouts, streamlined user onboarding, and variable recurring payments, all designed to facilitate safer and more efficient financial transactions. TrueLayer primarily serves sectors such as e-commerce, gaming, financial services, travel, and cryptocurrency markets. TrueLayer was formerly known as Finport. It was founded in 2016 and is based in London, United Kingdom.

Fabrick is a open finance platform. The company offers payment solutions that enable and foster a fruitful exchange between players that discover, collaborate, and create solutions for end customers. Fabrick was founded in 2018 and is based in Biella, Italy.

Sila operates as a financial technology company that focuses on providing a payment platform. The company offers a range of services including fast money transfers, identity verification, fraud prevention, and bank account linking. Its services are primarily targeted towards the fintech industry. It was founded in 2018 and is based in Portland, Oregon.

Loading...