TrueLayer

Founded Year

2016Stage

Series E - II | AliveTotal Raised

$321.8MValuation

$0000Last Raised

$50M | 6 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+85 points in the past 30 days

About TrueLayer

TrueLayer is an open banking platform that specializes in the financial services industry. The company offers a suite of products that enable instant bank payments, fast and verified payouts, streamlined user onboarding, and variable recurring payments, all designed to facilitate safer and more efficient financial transactions. TrueLayer primarily serves sectors such as e-commerce, gaming, financial services, travel, and cryptocurrency markets. TrueLayer was formerly known as Finport. It was founded in 2016 and is based in London, United Kingdom.

Loading...

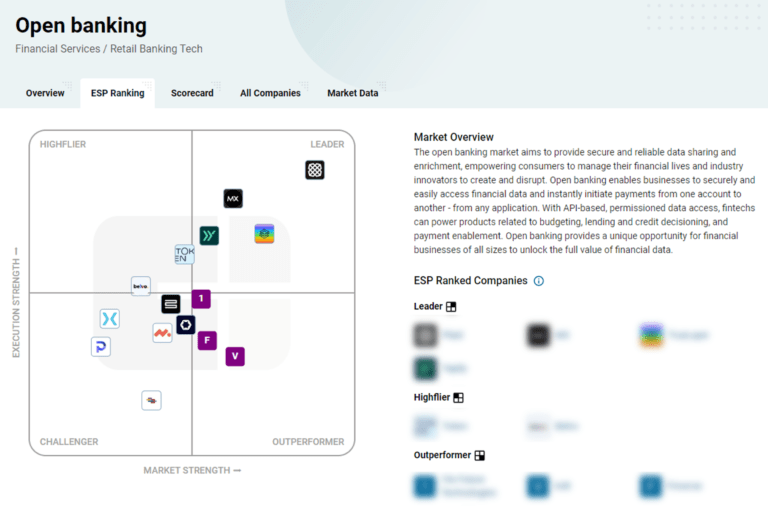

ESPs containing TrueLayer

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The identity verification market focuses on providing technologies and processes to verify the identities of individuals in both online and offline interactions, as well as prevent identity fraud. These solutions cater to a wide variety of industries and include new account and also synthetic fraud prevention, which involve bad actors stealing all or part of a person’s information to open new acco…

TrueLayer named as Highflier among 15 other companies, including SAP, Ping Identity, and Onfido.

TrueLayer's Products & Differentiators

Data API

Connect an app to any bank account: delivering real-time access to account, balance, transaction, and identity data using open banking AIS.

Loading...

Research containing TrueLayer

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned TrueLayer in 6 CB Insights research briefs, most recently on May 8, 2024.

May 8, 2024

The embedded banking & payments market map

Mar 14, 2024

The retail banking fraud & compliance market map

Jan 4, 2024

The core banking automation market map

Expert Collections containing TrueLayer

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

TrueLayer is included in 9 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Regtech

1,453 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

Blockchain

8,819 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech 100

999 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Fintech

13,699 items

Excludes US-based companies

Digital ID In Fintech

268 items

For this analysis, we looked at digital ID companies working in or with near-term potential to work in fintech applications. Startups here are enabling fintech companies to verify government documents, authenticate with biometrics, and combat fraudulent logins.

Latest TrueLayer News

Feb 24, 2025

LONDON, GREATER LONDON, UNITED KINGDOM, February 24, 2025 / EINPresswire.com / -- Updated 2025 Market Reports Released: Trends, Forecasts to 2034 – Early Purchase Your Competitive Edge Today! Is The Artificial Intelligence (Ai) In Finance Market Set To Witness Substantial Growth? Initiating the discourse on the propelling forces, the generative artificial intelligence AI in finance market has marked an exponential growth spurt. It has grown from $2.05 billion in 2024, forecasted to appreciate at an impressive 38.3% compound annual growth rate CAGR, reaching $2.83 billion in 2025. The upward curve in the historic period is attributed to digitalization of services, demand for personalized customer responses, strengthening of security and trust in financial services, burgeoning concerns regarding data privacy and security, and the necessity of regulatory compliance and governance. Captivating attention is the prosperous future predicted for the market—it is set to rise significantly to $10.29 billion in 2029 at an extraordinary CAGR of 38.1%. The forecasted surplus can be credited to increased productivity, prevalent application of generative AI in fraud detection and prevention, automation of complex financial tasks through leading-edge AI technology, enhancement of customer experience in finance, along with marked upgrades in operational efficiency which significantly reduces cost. The futuristic pulse of the market lies in innovative solutions, data analysis and reporting, AI-driven chatbots, an integration of machine learning ML, and evolving AI tools. Get Your Free Sample Market Report: https://www.thebusinessresearchcompany.com/sample.aspx?id=20806&type=smp What Drives The Generative Artificial Intelligence (Ai) In Finance Market Growth Driving the anticipated expansion of the generative AI in finance market is the rising demand for personalized financial services, which are customized to fit the specific needs, preferences, and circumstances of individual clients. The growing trend for personalized financial services owes to consumer expectations, an array of better financial management alternatives, and superior risk management solutions. Generative AI effectively integrates data from a variety of platforms, including social media, transaction histories, and financial accounts, compiling a more comprehensive and personalized portrait of a client's financial scenario. Research findings in May 2024 mirror the way forward—data strategy leaders surveyed by MX Technologies, the US-based financial insights provider, assert that 81% perceive personalizing experiences based on consumer financial data as indispensable for future advancements. With 45% of consumers attesting to having personalized experiences with finance-related mobile apps and 36% preferring to securely share their financial data to receive individualized guidance, the tide is clearly in the favor of the generative artificial intelligence AI in finance market. Order Your Report Now For A Swift Delivery: https://www.thebusinessresearchcompany.com/report/generative-artificial-intelligence-ai-in-finance-global-market-report Who Are The Key Players In The Artificial Intelligence (Ai) In Finance Market? Asserting dominance in the generative AI in finance market are industry powerhouses like Alphabet Inc., International Business Machines Corporation, The Allstate Corporation, The Goldman Sachs Group Inc., Mastercard Incorporated, Intuit Inc., S&P Global Inc., Plaid Inc., SAS Institute Inc., Klarna Inc., Qlik Technologies Inc., C3.ai Inc., AlphaSense Inc., Marqeta Inc., Upstart Holdings Inc., Hugging Face Inc., ZestFinance Inc., TrueLayer Limited, Featurespace Limited, Numerai Inc. What Are The Emerging Trends In The Artificial Intelligence (Ai) In Finance Market? Pioneering players are fully engaged in curating innovative solutions such as responsible generative AI, planted firmly on the pillars of safe and ethical AI practices, resonating well with the high-stakes domain of banking. For instance, Switzerland-based software company Temenos AG blazed the trail in May 2024 with the launch of the maiden Responsible Generative AI solutions custom-fitted for the core banking and financial sector, enabling banks to create real-time products based on customer preferences. How Is The Artificial Intelligence (Ai) In Finance Market Segmented? The market flourishes in segments encompassing technology, deployment models, and applications. 1 By Technology, the market can be subdivided into Deep Learning Technology; Natural Language Processing Technology; Computer Vision Technology; Reinforcement Learning Technology; Other Technologies. 2 By Deployment Model, it splits into Cloud Deployment; On-Premises Deployment; Hybrid Deployment. 3 By Application, the range extends to Risk Management; Fraud Detection; Investment Research; Trading Algorithms; Other Applications. What Is The Regional Analysis Of Artificial Intelligence (Ai) In Finance Market? As the market garners increasingly global appreciation, North America continues to lead the pack while Asia-Pacific nimbly steps up to be the fastest-growing region. The market overview comprehensively covers Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. Browse For More Similar Reports- Financial App Global Market Report 2025 https://www.thebusinessresearchcompany.com/report/financial-app-global-market-report Financial Auditing Professional Services Global Market Report 2025 https://www.thebusinessresearchcompany.com/report/financial-auditing-professional-services-global-market-report Banking, Financial Services and Insurance (BFSI) Security Global Market Report 2025 https://www.thebusinessresearchcompany.com/report/banking-financial-services-and-insurance-bsfi-security-global-market-report Explore More Similar Reports By The Business Research Company . Boasting of over 15000+ reports from 27 industries spanning 60+ geographies, The Business Research Company offers exhaustive, data-rich research, and valuable insights. Harness a firm edge with our troves of expert-crafted data, in-depth secondary research, and exclusive inputs from industry forerunners. Get in touch: The Business Research Company: https://www.thebusinessresearchcompany.com/ Americas +1 3156230293 Asia +44 2071930708 Europe +44 2071930708 Email us: info@tbrc.info Stay connected: LinkedIn: https://in.linkedin.com/company/the-business-research-company YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model Oliver Guirdham The Business Research Company info@tbrc.info Visit us on social media: Facebook X LinkedIn Legal Disclaimer: EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

TrueLayer Frequently Asked Questions (FAQ)

When was TrueLayer founded?

TrueLayer was founded in 2016.

Where is TrueLayer's headquarters?

TrueLayer's headquarters is located at 40 Finsbury Square, London.

What is TrueLayer's latest funding round?

TrueLayer's latest funding round is Series E - II.

How much did TrueLayer raise?

TrueLayer raised a total of $321.8M.

Who are the investors of TrueLayer?

Investors of TrueLayer include Northzone, Temasek, Tiger Global Management, Stripe, Tencent and 15 more.

Who are TrueLayer's competitors?

Competitors of TrueLayer include Volt, Bud, Yaspa, Here, Vyne and 7 more.

What products does TrueLayer offer?

TrueLayer's products include Data API and 3 more.

Loading...

Compare TrueLayer to Competitors

Fabrick is a open finance platform. The company offers payment solutions that enable and foster a fruitful exchange between players that discover, collaborate, and create solutions for end customers. Fabrick was founded in 2018 and is based in Biella, Italy.

Meniga specializes in digital banking solutions within the financial technology sector. The company offers a suite of products that enhance digital banking experiences by leveraging data consolidation, customer engagement, and revenue generation strategies. Meniga primarily serves financial institutions looking to improve their digital services. It was founded in 2009 and is based in London, United Kingdom.

Here offers an enterprise browser that aims to improve productivity and security for various work applications without the need for technical knowledge. It primarily serves sectors such as the financial services industry, government agencies, and contact centers, providing tailored solutions for workflow and operational automation. It was formerly known as OpenFin. The company was founded in 2010 and is based in New York, New York.

Leveris has developed an end-to-end platform to allow financial institutions and fintech startups such as digital-only banks or challenger banks to run their services.

Trustly Group focuses on open banking solutions in the financial services and payment processing sectors. The company provides products that facilitate payments, consumer onboarding, and risk assessment using bank-validated financial data. Trustly Group serves sectors including billers, eCommerce, financial services, and gaming. It was founded in 2008 and is based in Stockholm, Sweden.

Yapily is an open banking infrastructure platform that specializes in providing secure connectivity between customers and banks across Europe. The company offers services that enable access to financial data and the initiation of payments, aiming to facilitate the creation of personalized financial experiences. Yapily primarily serves industries such as payment services, i-gaming, accounting, lending and credit, crypto, property technology (PropTech), investing, and digital banking. Yapily was formerly known as Acacia Connect. It was founded in 2017 and is based in London, United Kingdom.

Loading...