LemFi

Founded Year

2020Stage

Series B | AliveTotal Raised

$86.86MLast Raised

$53M | 6 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+47 points in the past 30 days

About LemFi

LemFi offers international payment solutions. It offers services such as international money transfers, multi-currency accounts, and cross-border card transactions. It serves the immigrant population, facilitating financial transactions across borders. It was formerly known as Lemonade Finance. It was founded in 2020 and is based in the United Kingdom.

Loading...

LemFi's Product Videos

ESPs containing LemFi

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The P2P (peer-to-peer) cross-border payments platforms market facilitates the direct transfer of funds between consumers located in different countries. Some providers specialize in remittances more broadly, while others target money movement between specific countries. Most offer accounts where users can hold their money as well.

LemFi named as Challenger among 15 other companies, including PayPal, Wise, and Remitly.

LemFi's Products & Differentiators

Digital Wallets

We provide users with wallets/accounts in both their country of origin (ie Ghana, NG, KE) as well as their country of residence (NA, Europe)

Loading...

Research containing LemFi

Get data-driven expert analysis from the CB Insights Intelligence Unit.

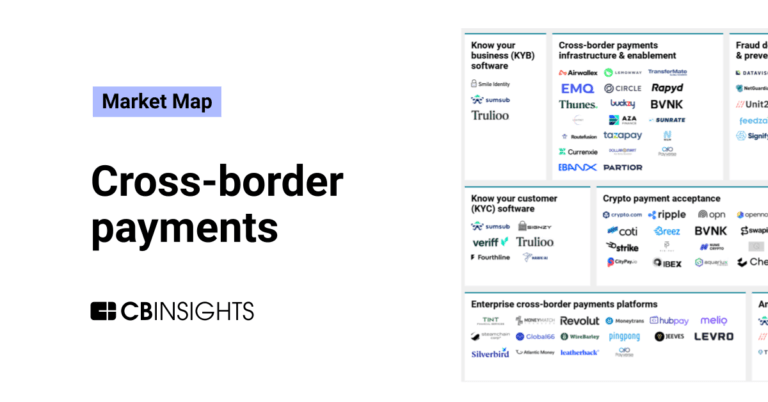

CB Insights Intelligence Analysts have mentioned LemFi in 2 CB Insights research briefs, most recently on Dec 14, 2023.

Dec 14, 2023

Cross-border payments market map

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing LemFi

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

LemFi is included in 2 Expert Collections, including Payments.

Payments

3,123 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech 100

100 items

Latest LemFi News

Mar 15, 2025

Lately, I’ve had several friends and acquaintances reaching out to me, asking the same question: “Which app is the fastest and cheapest for sending money from abroad to Nigeria?” At first, I thought it was just one or two random requests. But as more people asked, I realized something—More Nigerians are travelling abroad, which highlights a significant trend. The increasing dependence on remittances for business, family support, and daily transactions has grown. But the major problem is that Nigerians abroad struggle to find a reliable way to send and receive money without dealing with high fees, bad exchange rates, and long delays. As a result, finding the best remittance platform has become more crucial than ever. To put things in context, according to the Central Bank of Nigeria (CBN), Nigeria’s diaspora remittances through International Money Transfer Operators (IMTOs) totalled $4.22 billion from January to October 2024, a staggering 61.1% rise and almost doubling the $2.62 billion recorded in the corresponding period in 2023. This article has compiled a list of the top five remittance platforms facilitating cross-border payments. The guide focuses on important factors such as fees, speed, reliability, user feedback, app experience, and ratings. If you frequently send money home, receive funds from abroad, or make cross-border payments generally, this guide will help you choose the best platform for your needs. 1. Wise (Formerly TransferWise) Wise is a transparent and cost-effective platform for sending money internationally. The IMTO utilizes the real mid-market rate, allowing users to avoid hidden charges. This feature makes it a preferred choice for those wishing to send money borderless without excessive fees. Operating in over 160 countries, including Nigeria, the UK, the USA, Canada, Australia, and much of Europe, it’s particularly accessible for Nigerians abroad needing to send money home. Wise (TransferWise) to suspend USD transactions to Nigeria from November 1st until further notice The platform is commonly used by students studying overseas and freelancers receiving international payments. Business owners who conduct frequent cross-border transactions also benefit from Wise’s cost efficiency and reliability. With fees typically ranging from 0.5% to 1% of the transfer amount, Wise stands out as one of the cheapest options available, focusing on providing users with the best value. Transfers with Wise are generally processed within hours, though they may take one to two days depending on the recipient’s bank. The service is highly secure, adhering to strict financial regulations across multiple countries to ensure user safety and prevent fraud. User feedback is largely positive, praising its low fees, excellent exchange rates, and easy-to-use tracking system. On the Google Play Store, Wise has a rating of 4.6/5 with over 10 million downloads, while on the App Store, it holds a notable 4.7/5 rating. 2. Remitly Remitly is an easy-to-use remittance platform that offers users the choice between speed and cost savings through its Express and Economy transfer options. Users can opt for Express transfers, which arrive within minutes but come with higher fees, or Economy transfers, which have lower fees but take 3–5 business days to process. This balance has made Remitly a popular choice among Nigerians abroad sending money home. The platform is known for its secure transactions and global trust. While its exchange rates are competitive, they are slightly marked up, meaning users may not always receive the best conversion rates. User feedback is largely positive, with many appreciating the flexibility offered, although some have experienced delays with Economy transfers to specific banks. Remitly is rated 4.7/5 on the Google Play Store and 4.7/5 on the App Store. The app features a well-designed, intuitive interface that allows users to navigate easily between transfer options. With transparent pricing and reliable service, Remitly remains a trusted choice for international remittances. 3. WorldRemit WorldRemit allows users to send money directly to Nigerian bank accounts, mobile wallets, or cash pickup at designated centres. This flexibility makes it a popular choice for Nigerians abroad looking to send funds to their loved ones conveniently. The platform charges a fixed fee based on transfer destination and method, with exchange rates slightly marked up compared to the mid-market rate but still competitive with traditional banks. One of the key advantages of WorldRemit is its speed, as 90% of transfers are processed instantly. Bank deposits typically take just a few minutes to a few hours, making it a reliable option for urgent transactions. The platform is globally regulated and highly secure, ensuring that users’ funds and personal information are always protected. User feedback on WorldRemit highlights its fast transfers, multiple payout options, and ease of use. While some customers have noted that exchange rates aren’t always the most competitive compared to other platforms, the convenience of various delivery options continues to position WorldRemit as a top choice in the remittance market. On the Google Play Store, WorldRemit boasts a rating of 4.6/5 with over 5 million downloads and holds a 4.7/5 rating on the App Store. The app is designed to be user-friendly, with clear tracking features that allow users to monitor their transactions in real time. Overall, WorldRemit remains one of the most convenient remittance services available. 4. LemFi (formerly Lemonade Finance) LemFi is a specialized remittance platform designed for fast, affordable, and seamless cross-border money transfers for Nigerians and other African expatriates with features like a multi-currency wallet, allowing users to send and receive money with minimal conversion fees. Available in Nigeria, Ghana, Kenya, Canada, the UK, and parts of Europe, LemFi offers free international transfers from supported countries to Nigeria, helping users avoid the high costs associated with traditional banks. With its competitive exchange rates, users can benefit from excellent conversion rates without hidden markups. Moreover, the ability to hold and convert balances in multiple currencies gives users greater control over their funds. LemFi ensures speed and reliability with instant transfers to Nigerian bank accounts, with most transactions processing within minutes. Withdrawals to local banks are also quick and secure, making it ideal for urgent remittances. The platform is fully regulated in its supported regions, ensuring compliance with necessary financial security standards. User feedback has been largely positive, citing fast transfers, free transactions, and excellent exchange rates. Although some users have encountered delays with verification for first-time transfers. Overall, LemFi holds strong ratings of 4.7/5 on the Google Play Store and 4.8/5 on the App Store. 5. Chipper Cash Chipper Cash is a rapidly growing remittance platform that facilitates cross-border payments across Africa, the UK, and the USA. It is especially popular among Nigerians for its zero-fee transfers between Chipper Cash users, making it an affordable option for sending and receiving money internationally. Beyond traditional money transfers, the platform supports crypto transactions, mobile airtime purchases, and bill payments. Image Source: ChipperCash Available in countries like Nigeria, Ghana, Kenya, and South Africa, Chipper Cash is an ideal choice for Africans living abroad who want to send money home quickly. The platform allows peer-to-peer (P2P) transactions, enabling users to send money instantly to friends and family within its network at no additional cost. Although transfers between Chipper Cash users are free, small charges may apply for sending to non-users or withdrawing funds to bank accounts. Speed and reliability are key advantages of Chipper Cash, with instant transfers between users and bank withdrawals typically taking just a few minutes to hours. The platform is fully regulated in all supported countries, ensuring safe and secure transactions, and user feedback has been largely positive. Although, there are multiple reports of occasional delays with bank withdrawals and account verification issues. Chipper Cash is rated 4.4/5 on the Google Play Store and 4.3/5 on the App Store. The app is designed to be user-friendly, making it easy to manage money in multiple currencies of the top options available. Lastly, Choosing the right remittance platform depends on your needs, location, and priorities—whether it’s low fees, fast transfers, or the best exchange rates. Wise is ideal for those seeking transparent fees and mid-market rates, while WorldRemit and Remitly offer flexibility between speed and cost. LemFi stands out for Nigerians abroad needing free transfers and multi-currency wallets, and Chipper Cash is perfect for Africans making low-cost cross-border transactions. Technext Newsletter

LemFi Frequently Asked Questions (FAQ)

When was LemFi founded?

LemFi was founded in 2020.

What is LemFi's latest funding round?

LemFi's latest funding round is Series B.

How much did LemFi raise?

LemFi raised a total of $86.86M.

Who are the investors of LemFi?

Investors of LemFi include Y Combinator, Left Lane, Highland Europe, Palm Drive Capital, Endeavor Catalyst and 9 more.

Who are LemFi's competitors?

Competitors of LemFi include Chipper Cash and 1 more.

What products does LemFi offer?

LemFi's products include Digital Wallets and 3 more.

Loading...

Compare LemFi to Competitors

Zepz is a company in the financial technology sector that facilitates international payments. It provides digital solutions for sending money across borders, including options for bank deposits, cash collections, and mobile money services. Zepz serves the ecommerce industry by offering online money transfers. It was founded in 2010 and is based in London, England.

KiaKiaFX is an online platform that allows users to buy and sell foreign exchange from their home or office via a computer, smartphone, or tablet. It specializes in foreign exchange (FX) transfers, FX intermediation, consulting, and more. The company was founded in 2017 and is based in London, United Kingdom.

Wave provides financial services and focuses on reinventing mobile money. It offers services such as depositing and withdrawing money, sending money to others, paying bills, and buying airtime, all primarily through a mobile application. It primarily serves the unbanked population. It was founded in 2017 and is based in Dakar, Senegal.

Travel Tao is a fintech company that provides currency exchange services for travelers. The company offers a currency exchange calculator and a currency tool that assists with currency conversion and calculation for travelers. Travel Tao serves the travel and tourism sector, addressing the financial needs of travelers. It was founded in 2018 and is based in Zhuhai, Guangdong.

First Digital Trade operates as a financial technology company providing digital banking and payment solutions. The company develops digital banking applications, issues credit cards, manages IBANs, and facilitates payments. They offer banking as a service and provide white label products. They integrate embedded finance and payment systems and technology. It was founded in 2021 and is based in Vilnius, Lithuania.

Narvi is a tech company that focuses on providing modern banking solutions, operating within the financial technology sector. The company offers dedicated business accounts that enable users to send and receive euro payments to and from over 100 countries worldwide, with features such as instant SEPA payments and global SWIFT wire transfers. Primarily, Narvi caters to global businesses, providing a banking platform that facilitates efficient international transactions. It was founded in 2021 and is based in Helsinki, Finland.

Loading...