Wave

Founded Year

2017Stage

Loan | AliveTotal Raised

$305.24MValuation

$0000Last Raised

$91.44M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+15 points in the past 30 days

About Wave

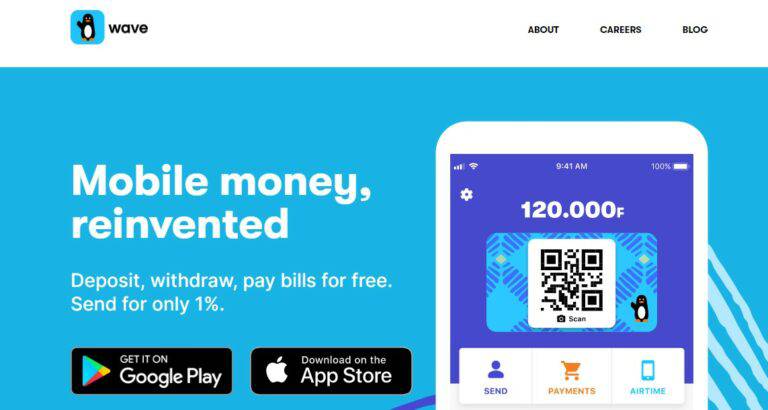

Wave provides financial services and focuses on reinventing mobile money. It offers services such as depositing and withdrawing money, sending money to others, paying bills, and buying airtime, all primarily through a mobile application. It primarily serves the unbanked population. It was founded in 2017 and is based in Dakar, Senegal.

Loading...

Loading...

Research containing Wave

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Wave in 1 CB Insights research brief, most recently on Jul 8, 2022.

Expert Collections containing Wave

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Wave is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Payments

3,123 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,661 items

Excludes US-based companies

Digital Banking

860 items

Latest Wave News

Mar 25, 2025

Sénégal : Après Wave, Quickpay obtient l’agrément d’établissement de monnaie électronique Date de création: 25 mars 2025 07:46 (Agence Ecofin) - Quickpay devient la deuxième fintech de l’espace UEMOA à obtenir la licence d’EME. Elle peut désormais émettre et gérer de la monnaie électronique à partir du Sénégal. La fintech sénégalaise Quickpay a obtenu son agrément d’établissement de monnaie électronique (EME) délivré par la Banque centrale des Etats de l’Afrique de l’Ouest (BCEAO). Délivré depuis le 3 mars 2025, il est officiellement annoncé le lundi 24 mars. Grâce à cette licence, la filiale du groupe sénégalais Edkoil peut désormais émettre et gérer directement de la monnaie électronique à partir du Sénégal. Elle est en mesure de proposer à ses clients des services financiers incluant les paiements marchands, l’épargne, le crédit et les transferts d’argent internationaux. Quickpay devient ainsi la deuxième fintech de l’Union économique et monétaire ouest-africaine (UEMOA) à recevoir son agrément après Wave Digital Finance en avril 2022. La filiale du groupe Wave Mobile Money était également la première structure non bancaire, et pas opérateur de télécommunications à obtenir une licence d’EME accordée par la BCEAO. Un marché en plein essor Au 31 décembre 2024, le Sénégal comptait trois établissements de monnaie électronique (Wave Digital Finance, Mobile Cash et Orange Finance Mobiles Sénégal), tandis que l’ensemble des 8 pays de l’UEMOA en dénombre 14, hormis des structures d’émission de monnaie électronique issues de partenariats entre banques et opérateurs de télécommunications. En 2023 , le secteur a connu une croissance marquée avec une augmentation significative du chiffre d’affaires, des encours et du nombre de comptes ouverts. Le chiffre d’affaires de l’ensemble des EME de la zone UEMOA a progressé de 79,3 milliards FCFA, soit environ 130 millions $ (+45,9%), pour s’établir à 252,2 milliards FCFA, selon le plus récent rapport annuel (2023) de la Commission bancaire de l’UMOA. Au plan de la rentabilité, le résultat net provisoire est ressorti déficitaire de 21,3 milliards FCFA en 2023, après une perte de 32,8 milliards un an plus tôt. L’encours de la monnaie électronique émise par les EME a progressé de 29,6%, à 959,3 milliards contre 740,0 milliards en 2022. Il est principalement détenu par les EME de la Côte d’Ivoire (35,1%), du Sénégal (27,5%) et du Burkina Faso (24,7%). Le nombre de comptes de monnaie électronique ouverts auprès des EME s’est établi à 138,1 millions FCFA à fin décembre 2023 contre 110,7 millions à fin 2022, soit une hausse de 24,7%. Le nombre de transactions réalisées par l’entremise des EME a enregistré une hausse annuelle de 61,5%, à 8779 millions d’opérations au cours de la période sous revue contre 5437 millions d’opérations en 2022. Chamberline Moko

Wave Frequently Asked Questions (FAQ)

When was Wave founded?

Wave was founded in 2017.

Where is Wave's headquarters?

Wave's headquarters is located at Liberté VI Extension Immeuble Namer 1, Dakar.

What is Wave's latest funding round?

Wave's latest funding round is Loan.

How much did Wave raise?

Wave raised a total of $305.24M.

Who are the investors of Wave?

Investors of Wave include Finnish Fund for Industrial Cooperation, Pario Ventures, responsAbility Investments, BlueOrchard, Lendable and 14 more.

Who are Wave's competitors?

Competitors of Wave include MobiKwik and 7 more.

Loading...

Compare Wave to Competitors

AZA Finance specializes in cross-border payment solutions and foreign exchange services for the business-to-business (B2B) sector. The company offers an online payment platform that facilitates multi-currency transactions, Treasury management, and payment collections, designed to support businesses operating in Africa. AZA Finance primarily serves enterprises requiring financial services across multiple African and global markets. AZA Finance was formerly known as BitPesa. It was founded in 2013 and is based in Grand Duchy of Luxembourg City, Luxembourg.

Zepz is a company in the financial technology sector that facilitates international payments. It provides digital solutions for sending money across borders, including options for bank deposits, cash collections, and mobile money services. Zepz serves the ecommerce industry by offering online money transfers. It was founded in 2010 and is based in London, England.

Opay is a digital payment platform that provides financial services. The company allows fund transfers, cashback on airtime and data top-ups, and has a savings account with daily interest. Opay provides a debit card that can be used for online transactions and offers customer service support. It was founded in 2018 and is based in Lagos, Nigeria.

PalmPay develops a secure, digital payment experience in an effort to promote financial inclusion and enhance consumer experiences. The company improves its users' digital payment experiences by offering financial account creation, money transfers, bill payments, and instant access to credit services. It was founded in 2019 and is based in Lagos, Nigeria.

Lianlian Pay operates a network of agents in China where consumers can convert cash into mobile-phone minutes. It allows customers to purchase airline tickets, video gaming credits, and utility bills with its network. It was founded in 2003 and is based in Hangzhou, China.

FairMoney is a fintech company focused on providing digital banking and financial services. The company offers instant personal loans, savings and investment products, and convenient bill payment options through its mobile application. FairMoney primarily serves individuals and small businesses seeking accessible financial services. FairMoney was formerly known as Predictus. It was founded in 2017 and is based in Ikeja, Nigeria.

Loading...