eToro

Founded Year

2007Stage

Series F | AliveTotal Raised

$460.46MValuation

$0000Last Raised

$250M | 2 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-7 points in the past 30 days

About eToro

eToro offers a social investment platform that operates in the financial services industry. The company provides a platform for investing in stocks and digital assets, trading contracts for difference (CFDs), and a community feature for users to exchange investment strategies and share market insights. eToro primarily serves retail investors looking to engage in stock and cryptocurrency investments and trading. It was founded in 2007 and is based in Limassol, Cyprus.

Loading...

ESPs containing eToro

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

Active trading platforms provide retail investors, active traders, and institutional clients with access to a diverse array of investment options, including stocks, ETFs, options, and cryptocurrencies, often with commission-free trading. They typically feature capabilities such as fractional share trading, advanced charting tools, and educational resources to enhance the trading experience. These …

eToro named as Challenger among 8 other companies, including Charles Schwab, Robinhood, and Interactive Brokers.

eToro's Products & Differentiators

Social

eToro is built around social collaboration. We have created a community where users can connect, share, and learn. On eToro, users can view other investors’ portfolios and statistics, and interact with them to exchange ideas, discuss strategies and benefit from shared knowledge. The eToro platform has a multitude of social features which allow users to interact, access financial education materials, encourage engagement and make the financial markets more accessible. The notable aspects of eToro’s social network include the ability of users to upload, post and comment and allow users to create profiles and engage with eToro’s dynamic Newsfeed.

Loading...

Research containing eToro

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned eToro in 3 CB Insights research briefs, most recently on Oct 3, 2023.

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023

May 26, 2022

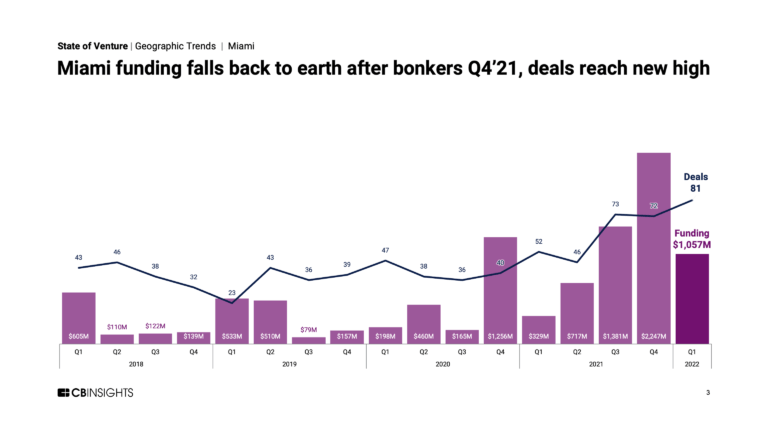

Where are the next US tech hubs?Expert Collections containing eToro

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

eToro is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Blockchain

9,293 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Wealth Tech

2,369 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Fintech

13,662 items

Excludes US-based companies

eToro Patents

eToro has filed 11 patents.

The 3 most popular patent topics include:

- financial markets

- collective intelligence

- derivatives (finance)

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

3/12/2018 | 11/26/2019 | Graphical user interface elements, Graphical user interfaces, Graphical control elements, Graphical user interface testing, User interfaces | Grant |

Application Date | 3/12/2018 |

|---|---|

Grant Date | 11/26/2019 |

Title | |

Related Topics | Graphical user interface elements, Graphical user interfaces, Graphical control elements, Graphical user interface testing, User interfaces |

Status | Grant |

Latest eToro News

Mar 25, 2025

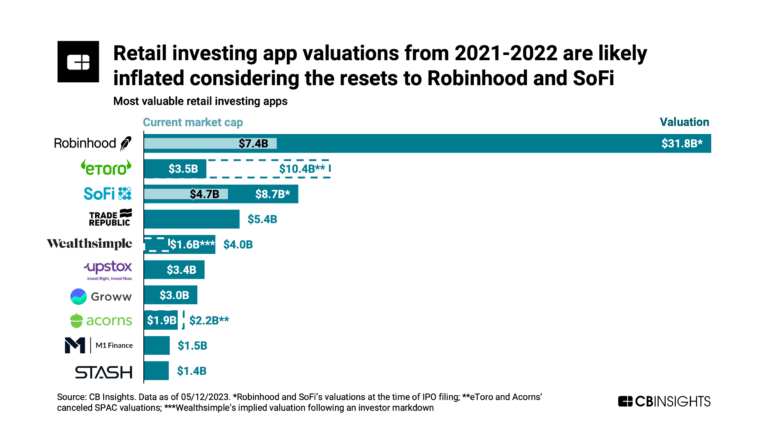

The filing revealed that the Israel-based crypto and stock trading platform brought in $12.6 billion in total revenue and $192 million in net income for 2024. In 2023, it reported $3.89 billion in revenue and just $15.3 million in profit. The numbers show a massive increase year over year. The company hasn't yet said how much it plans to raise or what the share price will be. That information will come in a later filing when eToro is ready to launch the actual sale. The IPO is being led by Goldman Sachs, Jefferies, UBS, and Citigroup. Both the company and some of its shareholders are planning to sell shares as part of the offering. eToro shows profit growth as crypto makes a comeback under Trump About 96% of eToro's revenue in 2024 came from crypto, according to the filing. Crypto prices shot up last year after Donald Trump returned to the White House and took a pro-crypto stance. That policy change helped platforms like eToro, which lets users buy and sell crypto along with stocks, see a surge in demand. Founded in 2007, eToro runs a trading app that allows users to follow and copy popular traders. It has more than 38 million users across 75 countries, based on a recent company statement. The company first tried to go public in 2021 through a $10.4 billion merger with a special purpose acquisition company backed by Betsy Cohen, but the deal was canceled in 2022. Last year, eToro raised $250 million in a funding round that gave it a new valuation of $3.5 billion. That round included investors like ION Group, SoftBank Vision Fund II, and Velvet Sea Ventures. In the U.S., eToro ran into problems with regulators. In September 2024, the company's American division, eToro USA LLC, agreed to pay a $1.5 million fine and restrict which crypto assets it offered to U.S. customers. The penalty was part of a settlement with the SEC, which accused the platform of operating as an unregistered broker and clearing agency. The company signed a cease-and-desist order but didn't admit or deny the charges. The filing didn't include any predictions for 2025 or forward-looking statements. It focused only on past performance. That leaves investors to decide whether the 2024 surge can last, especially since the company is so heavily tied to crypto markets, which are still volatile even under favorable policies. eToro didn't say how many shares it would issue or what valuation it's targeting now. But the last known private valuation was $3.5 billion, which is a steep drop from the canceled SPAC deal's $10.4 billion figure. Whether the IPO beats or matches that number will depend on how crypto performs in early 2025 and how much investors believe in the company's long-term growth. In a related development, Kraken, another crypto exchange, is also planning to go public, though a bit later than eToro. According to its own SEC filing, Kraken is working with Goldman Sachs and JPMorgan Chase to raise up to $1 billion in debt ahead of an expected IPO in early 2026. The debt won't be used to run daily operations. Instead, it will help Kraken expand before it enters public markets. One of the unnamed participants in the talks told the SEC that the final amount could be as low as $200 million, depending on how the talks go. The company is also thinking about raising equity along with the debt, but nothing has been finalized yet. Terms like the structure and total amount may change in the coming months. In a public statement, Kraken said, “We are always exploring strategic paths toward Kraken's Mission: accelerating the global adoption of crypto. We remain fully focused on investing in this goal.” Cryptopolitan Academy: Want to grow your money in 2025? Learn how to do it with DeFi in our upcoming webclass. Save Your Spot Source: https://www.cryptopolitan.com/etoro-files-for-an-ipo-in-the-united-states/

eToro Frequently Asked Questions (FAQ)

When was eToro founded?

eToro was founded in 2007.

Where is eToro's headquarters?

eToro's headquarters is located at 4 Profiti Ilia Street, Germasogeia, Limassol.

What is eToro's latest funding round?

eToro's latest funding round is Series F.

How much did eToro raise?

eToro raised a total of $460.46M.

Who are the investors of eToro?

Investors of eToro include Social Leverage, SoftBank, Spark Capital, Velvet Sea Ventures, ION Group and 26 more.

Who are eToro's competitors?

Competitors of eToro include Ziglu, Starting Finance, BurjX, AlgoPear, Webull and 7 more.

What products does eToro offer?

eToro's products include Social and 4 more.

Loading...

Compare eToro to Competitors

Binance develops a cryptocurrency exchange platform. It specializes in trading various digital assets. The company offers services such as spot market trading, futures and options trading, as well as peer-to-peer transactions. Binance also provides tools for margin trading, automated trading bots, and educational resources. It was founded in 2017 and is based in George Town, Cayman Islands.

Kraken focuses on digital currency exchange. The company provides a platform for trading various digital currencies, including bitcoin, offering a secure and efficient service for its users. Kraken primarily serves the financial technology industry. It was founded in 2011 and is based in San Francisco, California.

Public is an investing platform that offers a diverse range of financial products across multiple asset classes. The company provides tools for trading stocks, options, and cryptocurrencies, as well as investing in bonds, ETFs, and treasuries, complemented by high-yield cash accounts and tailored investment plans. Public also integrates AI-powered data and analysis into the investment experience, fostering a community-driven environment for sharing insights and educational content. Public was formerly known as TapX Trading & Analytics. It was founded in 2019 and is based in New York, New York.

Gemini is a cryptocurrency exchange and custodian that specializes in digital asset services. The company offers a platform for buying, selling, storing, and staking various cryptocurrencies, as well as trading cryptocurrency derivatives. Gemini serves a diverse market, including individual and institutional investors, fintechs, and banks. Gemini was formerly known as Gemini Trust Company. It was founded in 2015 and is based in New York, New York.

BlockFi is a financial services company that offers wealth management products for cryptocurrency investors, operating within the fintech and blockchain technology sectors. The company provides USD loans backed by cryptocurrency, interest-earning accounts for digital assets, and a platform for trading various cryptocurrencies. It was founded in 2017 and is based in Jersey City, New Jersey.

BurjX provides cryptocurrency trading exchange and broker-dealer solutions. It develops a platform for trading digital assets, managing digital asset wallets, and facilitating financial transactions. It was founded in 2022 and is based in New York, New York.

Loading...