Binance

Founded Year

2017Stage

Corporate Minority | AliveTotal Raised

$2.001BLast Raised

$2B | 23 days agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+223 points in the past 30 days

About Binance

Binance develops a cryptocurrency exchange platform. It specializes in trading various digital assets. The company offers services such as spot market trading, futures and options trading, as well as peer-to-peer transactions. Binance also provides tools for margin trading, automated trading bots, and educational resources. It was founded in 2017 and is based in George Town, Cayman Islands.

Loading...

ESPs containing Binance

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The fiat-backed stablecoins market provides digital currencies that maintain stable value by being fully backed by fiat currency reserves held in bank accounts or other financial instruments. These stablecoins offer protection against cryptocurrency volatility while enabling fast, global transactions, cross-border payments, and digital asset trading. Companies in this market issue stablecoins pegg…

Binance named as Highflier among 14 other companies, including Coinbase, Circle, and Paxos.

Binance's Products & Differentiators

Binance Exchange

Trusted by millions worldwide, Binance has an unmatched portfolio of crypto products and offerings. Binance Exchange alone consists of Spot, Margin, Futures, P2P, OTC, staking/savings, crypto loans, BUSD, Binance Card, and Binance Pool.

Loading...

Research containing Binance

Get data-driven expert analysis from the CB Insights Intelligence Unit.

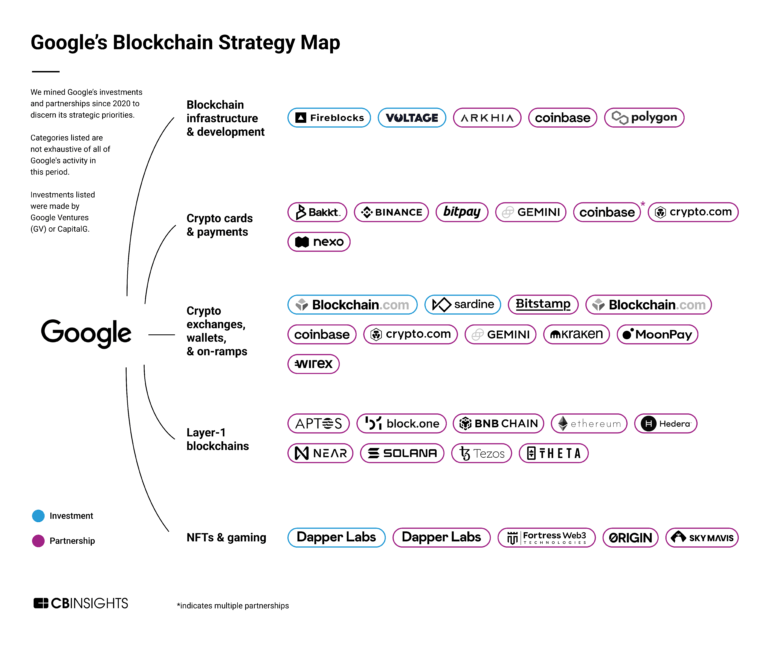

CB Insights Intelligence Analysts have mentioned Binance in 8 CB Insights research briefs, most recently on Jun 21, 2024.

Oct 4, 2022 report

The Fintech 250: The most promising fintech companies of 2022

Jul 30, 2022

What are Layer 2 blockchain scaling solutions?Expert Collections containing Binance

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Binance is included in 4 Expert Collections, including Blockchain.

Blockchain

11,070 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Fintech

13,699 items

Excludes US-based companies

Blockchain 50

100 items

Latest Binance News

Apr 1, 2025

The continuing rise in Binance's market share highlights its significant influence amid a broader market uncertainty that has characterized recent trading activities in the crypto sphere. As noted by analyst Joao Wedson, “Binance's spot volume has surpassed all other exchanges combined,” affirming its substantial lead in the market. This article explores Binance's unprecedented market dominance, implications for BNB, and the contrasting bearish sentiment driving investor actions in the cryptocurrency space. Binance's Unmatched Market Dominance in 2024 Binance's influence in the cryptocurrency market has reached astonishing heights, as evidenced by its trading volume exceeding that of all competitors, which illustrates its operational strength as 2024 progresses. Recent data reveals that Binance's spot trading volume has surpassed all other exchanges combined—a notable feat that cements its role as a leader in the crypto market. This dominance became pronounced in January 2024 when Binance's trading activity notably contributed to Bitcoin's price surge from $42,000 to $73,000. Liquidity and Market Dynamics Driven by Binance Such dominance not only demonstrates Binance's operational strength but also has profound implications for liquidity and market dynamics. The volatility observed within Bitcoin's price amidst Binance's growth was a strong indication of the exchange's liquidity influence. Furthermore, Binance's native cryptocurrency, BNB, experienced significant appreciation, highlighting investor confidence in the exchange's long-term viability. Source: CryptoQuant Impact on Binance Coin (BNB) Despite Binance's escalating dominance, the sentiment surrounding Binance Coin (BNB) remains lukewarm, with indications of a bearish trend prevailing among investors. Large holders, including Gnomelabs, have recently liquidated substantial amounts of BNB, which reflects a broader hesitance in the market. This sentiment is accentuated by the transfer of approximately $6.51 million worth of BNB, thereby indicating an overall lack of market confidence. Source: Coinalyze Bearish Sentiment in Futures Trading The broader bearish sentiment is validated as futures basis turns negative; this critical indicator reinforces expectations of diminishing prices ahead. As traders anticipate lower prices, the aggregated funding rate for BNB reflects this sentiment, trending consistently into negative territory over the past week. This environment signals that traders are predominantly taking short positions, further amplifying the bearish outlook. Source: Coinalyze Conclusion To sum up, although Binance's trading volume surges indicate significant market dominance, the corresponding sentiment in BNB remains bearish, suggesting a divergence between trading activity and investor sentiment. Current indications point to a potential price decline for BNB, although historical data suggests that previous cycles led to recovery phases. Moving forward, traders should remain vigilant, as the prospects for a price rebound depend heavily on shifts in market sentiment and Binance's continued operational strength. Don't forget to enable notifications for our Twitter account and Telegram channel to stay informed about the latest cryptocurrency news. Source: https://en.coinotag.com/binances-market-dominance-rises-amid-spot-volume-surge-yet-bnb-faces-bearish-sentiment/

Binance Frequently Asked Questions (FAQ)

When was Binance founded?

Binance was founded in 2017.

Where is Binance's headquarters?

Binance's headquarters is located at 23 Lime Tree Bay Avenue, George Town.

What is Binance's latest funding round?

Binance's latest funding round is Corporate Minority.

How much did Binance raise?

Binance raised a total of $2.001B.

Who are the investors of Binance?

Investors of Binance include MGX, K5 Global Technology, Vertex Ventures SE Asia, Vertex Ventures China, AU21 and 4 more.

Who are Binance's competitors?

Competitors of Binance include CryptoMate, BurjX, Bitpanda, Bit2Me, BitOasis and 7 more.

What products does Binance offer?

Binance's products include Binance Exchange and 4 more.

Loading...

Compare Binance to Competitors

Kraken focuses on digital currency exchange. The company provides a platform for trading various digital currencies, including bitcoin, offering a secure and efficient service for its users. Kraken primarily serves the financial technology industry. It was founded in 2011 and is based in San Francisco, California.

Crypto.com is a cryptocurrency trading platform and financial services provider in the fintech sector. The company provides services for buying, selling, and trading Bitcoin, Ethereum, and over 350 other cryptocurrencies, as well as decentralized finance services like staking and various crypto financial products. Crypto.com serves individuals and businesses involved in cryptocurrency transactions and investments. Crypto.com was formerly known as Monaco. It was founded in 2016 and is based in Singapore.

eToro offers a social investment platform that operates in the financial services industry. The company provides a platform for investing in stocks and digital assets, trading contracts for difference (CFDs), and a community feature for users to exchange investment strategies and share market insights. eToro primarily serves retail investors looking to engage in stock and cryptocurrency investments and trading. It was founded in 2007 and is based in Limassol, Cyprus.

BlockFi is a financial services company that offers wealth management products for cryptocurrency investors, operating within the fintech and blockchain technology sectors. The company provides USD loans backed by cryptocurrency, interest-earning accounts for digital assets, and a platform for trading various cryptocurrencies. It was founded in 2017 and is based in Jersey City, New Jersey.

BitPay focuses on Bitcoin payments and cryptocurrency transaction services within the financial technology sector. The company provides solutions for buying, storing, swapping, and spending cryptocurrencies, as well as services for businesses to accept crypto payments and manage crypto payroll. BitPay's offerings cater to both individual consumers and businesses, with a range of tools designed to facilitate the use of cryptocurrencies in various transactions. It was founded in 2011 and is based in Atlanta, Georgia.

BurjX provides cryptocurrency trading exchange and broker-dealer solutions. It develops a platform for trading digital assets, managing digital asset wallets, and facilitating financial transactions. It was founded in 2022 and is based in New York, New York.

Loading...