Viva Wallet

Founded Year

2010Stage

Shareholder Liquidity | AliveTotal Raised

$287.53MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-42 points in the past 30 days

About Viva Wallet

Viva Wallet is a cloud-based neo-bank using Microsoft Azure with branches in twenty-three countries in Europe. It is a principal member of Visa and Mastercard for acquiring and issuing services with direct connectivity to the card schemes, providing processing services through its own platform. Viva Wallet provides businesses of all sizes with card acceptance services through POS terminals and the new Android Viva Wallet POS app, as well as through advanced payment gateways in online stores. It also offers business accounts with local IBAN and business Viva Wallet Mastercard cards. The company was founded in 2010 and is based in Athens, Greece.

Loading...

Viva Wallet's Product Videos

ESPs containing Viva Wallet

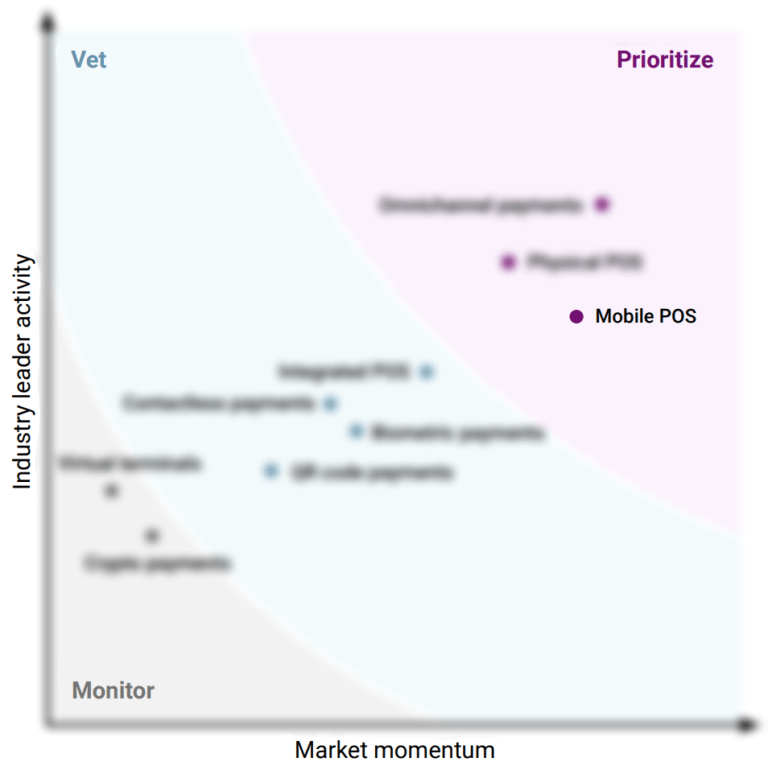

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

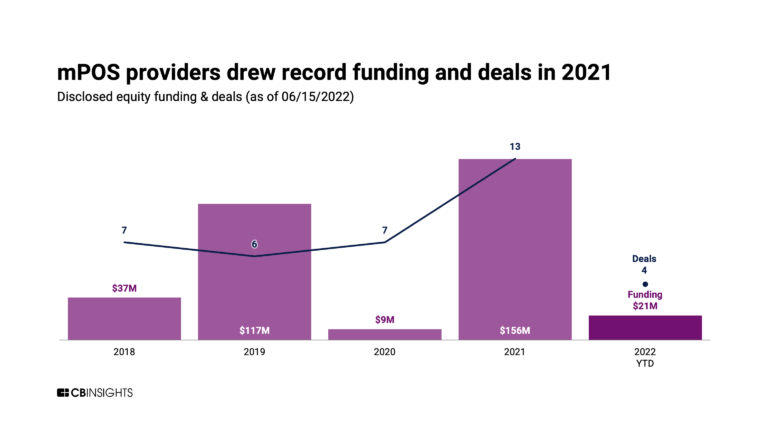

The mobile point-of-sale (mPOS) market offers a range of solutions for merchants to accept payments and engage with customers through mobile devices. These solutions include ordering, payment, and loyalty programs, as well as the ability to accept new payment form factors such as contactless and mobile wallets. The market also offers solutions for legacy POS systems to integrate with mobile platfo…

Viva Wallet named as Leader among 15 other companies, including Fiserv, FIS, and Block.

Viva Wallet's Products & Differentiators

Independent Hardware Vendor & Independent Software Vendor Partnership Programs

We enable payments on any smart device and we can integrate with any software or hardware provider through our cutting-edge software platform. We enable consolidation and less hassle for all businesses that accept payments, while introducing new innovative payment use cases across any industry. All that harnessing the power of our in-house omnichannel technologies, namely Viva Terminal App and Smart Checkout payment gateway.

Loading...

Research containing Viva Wallet

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Viva Wallet in 3 CB Insights research briefs, most recently on Sep 13, 2022.

Jun 2, 2022 report

Why vendors are prioritizing mobile point-of-sale (mPOS) systemsExpert Collections containing Viva Wallet

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Viva Wallet is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Payments

3,132 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,667 items

Excludes US-based companies

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Viva Wallet News

Mar 9, 2025

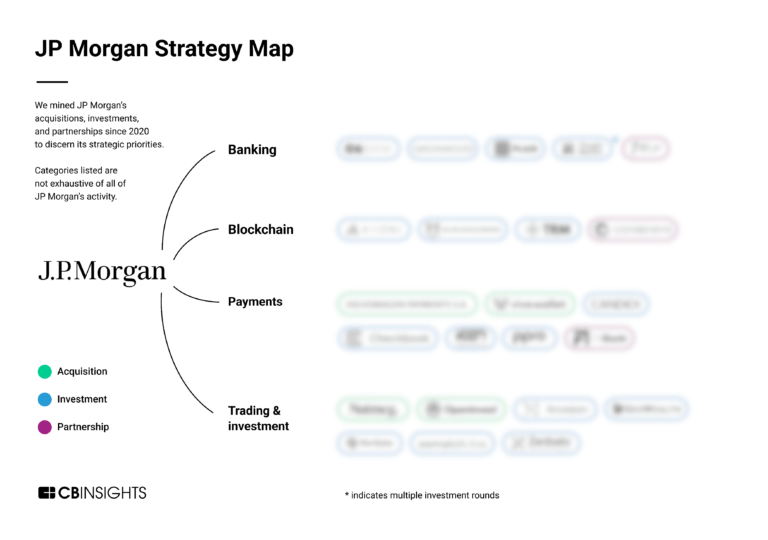

March 9, 2025 Ασφαλιστικά μέτρα κατά της JP Morgan (JPM) κατέθεσε ο διευθύνων σύμβουλος της Viva Wallet, σε μια προσπάθεια να εμποδίσει τον τραπεζικό γίγαντα να συνεχίσει περαιτέρω αγωγές ή προσπάθειες εξαγοράς. Οπως θυμίζει το sifted.eu, το 2022, η JPM απέκτησε ποσοστό 48,5% της Viva Wallet, μιας από τις μεγαλύτερες ελληνικές εταιρείες fintech. Η WRL, μια εταιρεία που ανήκει στον ιδρυτή και διευθύνοντα σύμβουλο της Viva Χάρη Καρώνη, κατείχε το υπόλοιπο μερίδιο. Εκείνη την εποχή, η εξαγορά γιορτάστηκε ως θρίαμβος για το νεοσύστατο οικοσύστημα τεχνολογίας της Ελλάδας, αποτιμώντας τη Viva Wallet σε περισσότερα από 2 δισ. δολάρια. Αλλά μέσα σε λίγα χρόνια, η συνεργασία διαλύθηκε – με τα δύο μέρη να καταθέτουν αγωγές το ένα εναντίον του άλλου το 2024. Σε μια άλλη αγωγή που κατατέθηκε τον Ιανουάριο του τρέχοντος έτους, η JP Morgan απαίτησε αποζημίωση ύψους 916 εκατ. ευρώ για τις απώλειες που υπέστη από την επένδυσή της το 2022. Η τελευταία προσωρινή διαταγή, που κατατέθηκε από τους δικηγόρους του Καρώνη στο Ηνωμένο Βασίλειο, κατηγορεί την JPM ότι παρενοχλεί την ηγεσία της WRL και περιγράφει την απαίτησή της για αποζημίωση ως «αντικειμενικά επιζήμια, καταπιεστική και ασυνείδητη». «Είναι λυπηρό το γεγονός ότι από τότε που έγινε μέτοχος μειοψηφίας στη Viva, η JP Morgan συμπεριφέρθηκε σαν αλεπού στο κοτέτσι αντί να επιδιώξει να δώσει προτεραιότητα στην ανάπτυξη και την επιτυχία της Viva», δήλωσε ο Καρώνης στo sifted. Η ουσία της διαμάχης εστιάζεται σε μια ρήτρα που περιλαμβάνεται στους όρους της συμφωνίας και η οποία αναφέρει ότι η WRL θα χάσει το δικαίωμά της να απορρίψει μια προσφορά εξαγοράς της JPM, εάν η επιχείρηση αποτιμηθεί σε λιγότερο από 5 δισ. ευρώ έως τις 30 Ιουλίου 2025. previous post

Viva Wallet Frequently Asked Questions (FAQ)

When was Viva Wallet founded?

Viva Wallet was founded in 2010.

Where is Viva Wallet's headquarters?

Viva Wallet's headquarters is located at Avenue Halandri Maroussi 18-20, Athens.

What is Viva Wallet's latest funding round?

Viva Wallet's latest funding round is Shareholder Liquidity.

How much did Viva Wallet raise?

Viva Wallet raised a total of $287.53M.

Who are the investors of Viva Wallet?

Investors of Viva Wallet include J.P. Morgan Chase, DECA Investments, Hedosophia, Latsis Family, Tencent and 5 more.

Who are Viva Wallet's competitors?

Competitors of Viva Wallet include SumUp and 7 more.

What products does Viva Wallet offer?

Viva Wallet's products include Independent Hardware Vendor & Independent Software Vendor Partnership Programs and 2 more.

Loading...

Compare Viva Wallet to Competitors

Ingenico is a company focused on payment acceptance and services within the financial technology sector. It offers a range of products including smart terminals, a cloud-based payments platform, and terminal management solutions. Ingenico also provides services such as advanced payment methods, buy now pay later options, digital receipts, and omnichannel services. It was founded in 1980 and is based in Suresnes, France.

Easypay is a payment gateway company that provides payment solutions for businesses across various sectors. The company offers services including online payment processing, integration with ecommerce platforms, and support for multiple payment methods such as credit and debit cards, direct debits, and digital wallets. Easypay primarily serves the ecommerce industry, financial institutions, and non-profit organizations, offering services to manage transactions and subscriptions. It was founded in 2000 and is based in Lisbon, Portugal.

Opn provides payment processing solutions and digital transformation services. The company offers products that enable businesses to accept payments, issue virtual cards, manage transactions, and automate payouts, all designed to facilitate seamless financial operations. It provides payment infrastructure for banks and platforms, as well as professional consulting services to help brands optimize their payment systems. It was founded in 2013 and is based in Bangkok, Thailand.

Talk Bank is a neo-bank that reduces costs for customer support costs by AI chat-bot in messengers, providing white-label banking solutions for banks, insurance companies, and marketplaces. Talk Bank platform includes advanced remote KYC, behavioral anti-fraud solutions, service for freelancers and self-employed, transparent transaction control.

Checkout.com is a financial technology company that provides payment processing services. The company offers a platform for businesses to accept payments, issue cards, and manage payouts. Checkout.com serves sectors such as e-commerce, fintech, gaming, cryptocurrency, marketplaces, payment facilitators, and travel. Checkout.com was formerly known as Opus Payments. It was founded in 2012 and is based in London, United Kingdom.

Mangopay is a provider of modular and flexible payment infrastructure services within the fintech sector. The company offers a suite of financial technology solutions including e-wallets, payment processing, payouts, identity verification, fraud prevention, and foreign exchange services. These services cater to various sectors such as C2C, B2B, and B2C marketplaces, as well as rental and retail platforms. It was founded in 2013 and is based in Luxembourg, Luxembourg.

Loading...