Investments

68Portfolio Exits

23Funds

1Partners & Customers

10Service Providers

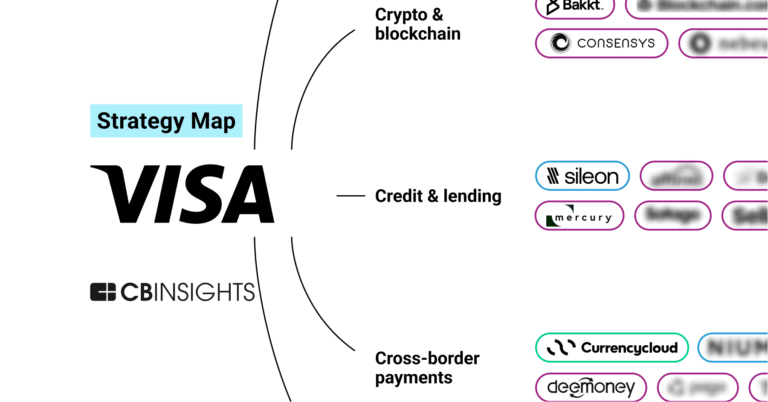

1About Visa

Visa (NYSE:V) is a global,payments technology company that connects consumers, businesses, financial institutions, and governments to fast, secure, and reliable electronic payments. The company operates VisaNet, a processing network with fraud protection for consumers and assured payment for merchants. Visa is not a bank and does not issue cards, extend credit, or set rates and fees for consumers; however, Visa's innovations enable its financial institution customers to offer consumers more choices: pay now with debit, pay ahead of time with prepaid, or pay later with credit products.

Expert Collections containing Visa

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Visa in 4 Expert Collections, including Fortune 500 Investor list.

Fortune 500 Investor list

590 items

This is a collection of investors named in the 2019 Fortune 500 list of companies. All CB Insights profiles for active investment arms of a Fortune 500 company are included.

Gig Economy Value Chain

155 items

Startups in this collection are leveraging technology to provide financial services and HR offerings to the gig economy industry

Fintech

8,122 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Digital Banking

108 items

Research containing Visa

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Visa in 17 CB Insights research briefs, most recently on Apr 28, 2023.

Latest Visa News

Dec 27, 2023

News Provided By Share This Article Despite Visa's dominance, MiCamp is confident that Independent Sales Organizations (ISOs) will ultimately prevail.” — MiCamp Solutions SCOTTSDALE, ARIZONA, USA, December 27, 2023 / EINPresswire.com / -- The lawsuit (Case Number: 3:23-cv-06351) initiated by MiCamp against Visa details allegations of a collaborative effort among Visa and its associated banks to establish a system that negatively affects both Independent Sales Organizations (ISOs) and merchants. The lawsuit specifically points to Visa's alleged efforts to obscure the extent of its interchange fees and claims that Visa has sought to deter ISOs from presenting their programs by enforcing penalties tied to ambiguously formulated regulations. The legal action was initiated by Global Legal Law Firm , which boasts the largest team of payment experts, attorneys, paralegals, and professionals in the United States. Global Legal hopes that Visa will swiftly acknowledge any wrongdoing, put an end to its alleged anti-competitive practices, and permit ISOs, which are the lifeblood of the industry, to continue serving and supporting their customers. A compelling example of MiCamp's claims against Visa revolves around an Arizona Merchant that provided customers the option to waive fees associated with different card types. These fees were meant to fund after-school programs benefiting underprivileged individuals in search of healthier food choices. MiCamp Solutions faced fees exceeding $70,000, with Visa attributing these charges to the non-compliance of the Arizona Merchant. Following MiCamp's appeal of the $70,000 in fees, alleging non-compliance, Visa purportedly initiated secret shopper visits to more than 1,800 merchants, which MiCamp believes was an act of retaliation. Subsequently, these merchants' details were published online for competitors to access, which led to the extraction of data and private information from MiCamp's merchants. This data allegedly fell into the hands of competitors who attempted to blackmail MiCamp Solutions into paying $5 per merchant to prevent it from being sold to other competitors—an offer that MiCamp claims it did not accept. In October 2023, MiCamp initiated contact with Visa through a formal legal demand letter. The purpose behind this communication was to seek comprehensive information regarding Visa's definitions and policies regarding non-compliance. MiCamp's intention was twofold: to gain a clearer understanding of Visa's stance and to enlist Visa's support in preventing the alleged resale of their compromised data. Unfortunately, as reported, Visa did not respond to this crucial demand letter. MiCamp's lawsuit marks a significant turning point in the ongoing narrative of the payment industry, potentially carrying far-reaching implications for ISOs, merchants, and consumers. It serves as a poignant testament to MiCamp's unwavering dedication to championing equitable and transparent business practices within the industry. MiCamp Solutions, through their MiCamp Cares program, has played a pivotal role in preserving businesses, contributing to savings exceeding half a billion dollars since the onset of the pandemic. Each October, Visa's rate hikes have been a challenging factor, pressuring businesses that already grapple with the economic climate and inflation, making it increasingly difficult for them to sustain their operations. To join the class-action lawsuit or to collaborate with MiCamp Solutions, please visit: https://www.micamp.com/micamp-visa-class-action About MiCamp Solutions: MiCamp Solutions, nestled in Scottsdale, Arizona, is a standout in the fintech field for its innovative and secure payment processing solutions. Founded in 2007, the company has achieved considerable growth, serving a diverse array of clients. MiCamp excels in providing tailored consulting and specialized application engineering to tackle the unique payment challenges of its merchants and partners. The firm prides itself on its extensive experience in the electronic payments industry and upholds values such as exceptional service, competitive edge, reliability, security, and clarity. These guiding principles have fortified MiCamp's stature as a respected industry leader and a notable full-service provider for Fiserv, Inc. (FI) and Repay Holdings Corporation (RPAY), also recognized in the Fiserv Chairman’s Circle. For additional information on MiCamp Solutions and its services, please visit www.micamp.com . About Global Legal Law Firm: Based in San Diego since 2008, Global Legal Law Firm specializes in electronic payments litigation. Our experienced attorneys handle complex cases for ISOs, agents, processors, and card brands, providing tailored legal services from contracts to post-judgment enforcement. Visit www.globallegallawfirm.com . Nikki Balich - MiCamp Marketing

Visa Investments

68 Investments

Visa has made 68 investments. Their latest investment was in Enfuce as part of their Series C - II on November 30, 2023.

Visa Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

11/30/2023 | Series C - II | Enfuce | $8.73M | Yes | 2 | |

11/8/2023 | Seed | Agrotoken | Yes | 3 | ||

10/23/2023 | Seed VC - VII | Finerio Connect | $6.5M | Yes | Alaya Capital, Bancolombia Ventures, Gaingels, Krealo, Plug and Play Ventures, Third Prime Capital, Undisclosed Angel Investors, and Winklevoss Capital | 2 |

9/19/2023 | Series A - II | |||||

9/12/2023 | Corporate Minority - II |

Date | 11/30/2023 | 11/8/2023 | 10/23/2023 | 9/19/2023 | 9/12/2023 |

|---|---|---|---|---|---|

Round | Series C - II | Seed | Seed VC - VII | Series A - II | Corporate Minority - II |

Company | Enfuce | Agrotoken | Finerio Connect | ||

Amount | $8.73M | $6.5M | |||

New? | Yes | Yes | Yes | ||

Co-Investors | Alaya Capital, Bancolombia Ventures, Gaingels, Krealo, Plug and Play Ventures, Third Prime Capital, Undisclosed Angel Investors, and Winklevoss Capital | ||||

Sources | 2 | 3 | 2 |

Visa Portfolio Exits

23 Portfolio Exits

Visa has 23 portfolio exits. Their latest portfolio exit was Ecebs on August 10, 2023.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

8/10/2023 | Divestiture | 4 | |||

3/10/2023 | Acquired | 6 | |||

10/13/2021 | Acq - Fin - II | 11 | |||

Date | 8/10/2023 | 3/10/2023 | 10/13/2021 | ||

|---|---|---|---|---|---|

Exit | Divestiture | Acquired | Acq - Fin - II | ||

Companies | |||||

Valuation | |||||

Acquirer | |||||

Sources | 4 | 6 | 11 |

Visa Acquisitions

19 Acquisitions

Visa acquired 19 companies. Their latest acquisition was PROSA on December 15, 2023.

Date | Investment Stage | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Total Funding | Note | Sources |

|---|---|---|---|---|---|---|

12/15/2023 | Corporate Majority | 4 | ||||

6/28/2023 | Series B | $108.89M | Acquired | 12 | ||

7/22/2021 | Series E+ | $153.97M | Acquired | 5 | ||

6/24/2021 | Series E+ | |||||

10/28/2020 | Series D |

Date | 12/15/2023 | 6/28/2023 | 7/22/2021 | 6/24/2021 | 10/28/2020 |

|---|---|---|---|---|---|

Investment Stage | Series B | Series E+ | Series E+ | Series D | |

Companies | |||||

Valuation | |||||

Total Funding | $108.89M | $153.97M | |||

Note | Corporate Majority | Acquired | Acquired | ||

Sources | 4 | 12 | 5 |

Visa Fund History

1 Fund History

Visa has 1 fund, including Visa Generative AI Venture Fund I.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

Visa Generative AI Venture Fund I | 1 |

Closing Date | |

|---|---|

Fund | Visa Generative AI Venture Fund I |

Fund Type | |

Status | |

Amount | |

Sources | 1 |

Visa Partners & Customers

10 Partners and customers

Visa has 10 strategic partners and customers. Visa recently partnered with Copia on December 12, 2023.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

12/13/2023 | Partner | Kenya | Copia inks a deal with Visa for digital financial services `` Our partnership with Visa will impact millions of lives by providing unparalleled access to digital financial services and fulfills Copia 's ambition to be a one-stop shop for all underserved customers in Africa , '' he said . | 2 | |

12/13/2023 | Partner | Austria | IXOPAY partners with Visa to support network tokenization In July 2023 , IXOPAY revealed a partnership with TrustPay to offer improved payment solutions to merchants and clients worldwide . | 1 | |

12/5/2023 | Partner | Kenya | Visa and Oxfam America expand pre-disaster financial support programme Visa and Oxfam America have declared their intent to collaborate in scaling Oxfam America 's Building Resilient , Adaptive and Disaster-Ready Communities project to deliver real-time streamlined money movement and relief payments to individuals and businesses in the Philippines , Kenya , Colombia , and Puerto Rico . | 2 | |

12/5/2023 | Partner | ||||

12/4/2023 | Partner |

Date | 12/13/2023 | 12/13/2023 | 12/5/2023 | 12/5/2023 | 12/4/2023 |

|---|---|---|---|---|---|

Type | Partner | Partner | Partner | Partner | Partner |

Business Partner | |||||

Country | Kenya | Austria | Kenya | ||

News Snippet | Copia inks a deal with Visa for digital financial services `` Our partnership with Visa will impact millions of lives by providing unparalleled access to digital financial services and fulfills Copia 's ambition to be a one-stop shop for all underserved customers in Africa , '' he said . | IXOPAY partners with Visa to support network tokenization In July 2023 , IXOPAY revealed a partnership with TrustPay to offer improved payment solutions to merchants and clients worldwide . | Visa and Oxfam America expand pre-disaster financial support programme Visa and Oxfam America have declared their intent to collaborate in scaling Oxfam America 's Building Resilient , Adaptive and Disaster-Ready Communities project to deliver real-time streamlined money movement and relief payments to individuals and businesses in the Philippines , Kenya , Colombia , and Puerto Rico . | ||

Sources | 2 | 1 | 2 |

Visa Service Providers

1 Service Provider

Visa has 1 service provider relationship

Service Provider | Associated Rounds | Provider Type | Service Type |

|---|---|---|---|

IPO | Investment Bank | Financial Advisor |

Service Provider | |

|---|---|

Associated Rounds | IPO |

Provider Type | Investment Bank |

Service Type | Financial Advisor |

Partnership data by VentureSource

Visa Team

135 Team Members

Visa has 135 team members, including current Chief Executive Officer, Alfred F. Kelly.

Name | Work History | Title | Status |

|---|---|---|---|

Alfred F. Kelly | Chief Executive Officer | Current | |

Name | Alfred F. Kelly | ||||

|---|---|---|---|---|---|

Work History | |||||

Title | Chief Executive Officer | ||||

Status | Current |

Compare Visa to Competitors

Stripe develops a financial infrastructure platform. The company offers a suite of services including online payment processing, revenue and finance automation, and banking-as-a-service. Its services allow businesses to accept payments online or in person, automate their revenue and finance operations and embed financial services into their platforms or products. It primarily serves the e-commerce, software as a service (SaaS), marketplace, and finance automation sectors. It was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

SWIFT is a global cooperative and provider of secure financial messaging services. It provides its community with a platform for messaging and standards for communicating, and offers products and services to facilitate access and integration, identification, analysis, and regulatory compliance.

Citibank provides commercial and consumer banking products and services, and offers checking accounts, savings accounts, certificates of deposit, and individual retirement accounts and rollovers; credit cards; lending products, such as home equity lines and loans, personal lines and loans, and mortgages; and investment products, which include insurance, annuities, advisory accounts, bonds, mutual funds, and securities backed lending; and financial education on wealth management.

Plaid focuses on financial technology, operating within the financial technology industry. The company provides services that enable businesses to build financial technology solutions, facilitating the secure and efficient connection of users' financial accounts to various applications and services. Its services are utilized by companies in the financial technology sector. It was founded in 2013 and is based in San Francisco, California.

Fidel API operates as a financial infrastructure platform. It offers financial infrastructure application programming interfaces (APIs) that enable developers to build programmable experiences and purchases made in real-time using a card. It gets granular transaction data, including amount, location, date, and merchant. The company was founded in 2013 and is based in London, United Kingdom.

Ant Group operates as a company focused on supporting the digital transformation of the service industry. Its main services include providing a platform and infrastructure that allows consumers and small businesses to access financial and other services that are inclusive, green, and sustainable. It was formerly known as Zhejiang Ant Small. It was founded in 2014 and is based in Hangzhou, China.

Loading...