Uzum

Founded Year

2022Stage

Debt | AliveTotal Raised

$114MValuation

$0000Last Raised

$62M | 1 yr agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+239 points in the past 30 days

About Uzum

Uzum focuses on developing a digital services ecosystem within the e-commerce and fintech sectors. The company offers a marketplace for a wide range of products with fast delivery, a digital banking platform, installment payment services, and business development tools. Uzum primarily serves the e-commerce industry, the financial sector, and entrepreneurs looking to grow their businesses. It was founded in 2022 and is based in Tashkent, Uzbekistan.

Loading...

Loading...

Research containing Uzum

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Uzum in 1 CB Insights research brief, most recently on Aug 23, 2024.

Expert Collections containing Uzum

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

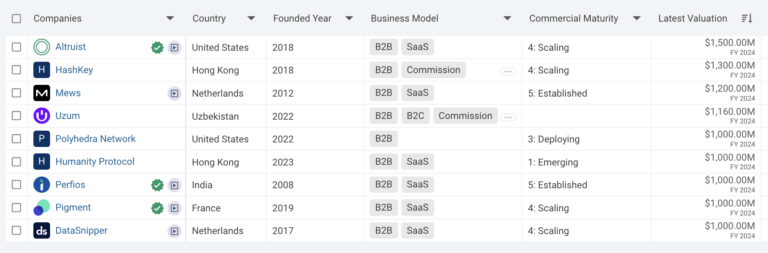

Uzum is included in 3 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Digital Banking

860 items

Fintech

13,661 items

Excludes US-based companies

Latest Uzum News

Mar 7, 2025

Uzbek unicorn Uzum reports net income up by half in 2024 Uzbek unicorn Uzum reports net income up by half in 2024 Uzbekistan's first tech unicorn reported that net income grew by half in 2024 to $150mn. And the company expects income to rise again this year, as it gets ready for a second and final funding round ahead of an eventual IPO. / bne IntelliNews By Ben Aris in BerlinMarch 6, 2025 Uzum, Uzbekistan’s first tech unicorn, had a good year in 2024 with net income up by half year on year to $150mn, company head of strategy Nikolai Seleznev told bne IntelliNews. “It as a good result as we continued to expand the top line that was reflected in the bottom line,” said Seleznev speaking from the company’s headquarters in Tashkent. “This year, we are cautiously guiding for another 30-40% of growth to $200mn net income, if you are being conservative, but I am expecting more than that, driven by our fast growing fintech business.” Set up in 2022, the company has grown by leaps and bounds as e-commerce comes of age in Central Asia’s most populous market. “We have 16mn users on all platforms now. That is about half the population of the whole country and two thirds of all smartphone users,” Seleznev says. Uzbekistan has gone through a rapid transformation since Uzbekistan’s President Shavkat Mirziyoyev took over in 2016 and launched a wide-ranging economics liberalisation and reform programme. Since then growth has averages around 6% a year and incomes have risen sharply, creating and emerging middle class. One of the new products the company introduced in 2024 was DBS, delivery by seller, as a new model where product producers can use Uzum’s distribution to get their goods to customers as part of the company’s market place platform offering. “We are active in 18 cities of Uzbekistan and have the widest coverage in the country,” say Seleznev. Uzum has managed to tap into this flourishing consumerism by establishing its own logistics and distribution system that reaches all the major towns and cities in the country and the widespread use of smartphones by a population, 60% of which is in its 20s or below. Fintech In the last quarter of last year Uzum’s offering has increasingly become intertwined with banking and payments services. The fintech part of the business ballooned when the company offered a debit card with a pre-approved credit limit and 700,000 people took up the offer despite the fact the company had done no marketing ahead of the launch at all. “The credit limit is means tested by the usual means. Users apply online and have to give basic information that allows you score them and set the credit limit,” said Seleznev, who added that the average credit is $50 in soum equivalent, but can go up to $2,500. The launch of the debit cards has turbo-boosted Uzum’s fintech offering and expanded its loan portfolio. In the current year the company intends to roll out new services targeting B2C and B2B customers, which are currently underserved by the banking sector but represent a large part of the Uzbek economy. One of Uzum’s competitive advantages in fintech is it has created its own clearance system, rather than rely on the central bank’s system. This allows the company to introduce new products that are hard for its rivals to copy. For example, Uzum is widely used by customers to transfer money between themselves, because as long as the transfers are in-system they are free of charge. Other banks have to charge for transfers as they have to pay fees to the UzCard central settlement system. “Thanks to the free transfers our service has become the main way that people share money between themselves,” says Seleznev. Uzum’s fintech user base is already up to 1mn people versus the total active banking users of around 15mn. “Things are changing fast. The young population are hungry for modern products and keen to learn about new technologies. There are 5mn debit cards in circulation, an active banking population of about 15mn and the cash economy is about 20mn people. Our core audience is all the smartphone users,” say Seleznev. “And so far we have relied largely on word-of-mouth to market our fintech services.” Series B fund raising As reported by bne IntelliNews, Uzum plans to raise a series B funding to continue investing into the company’s fast growth. However, given the much better than expected growth in 2024, Seleznev says the plans have been altered somewhat. “We still plan to go to investors, but we want to take a little more time to build on what we have achieved already. You need money to make money and we will ask for a little more. We were looking at raising $150mn but now I think it will be more like $200mn in the second half of 2025,” say Seleznev. “It will be the last round of funding before the IPO.” Uzum has already started conversations with some sovereign wealth funds from the GCC countries as well as US tier one growth equity funds who are interested in the story and can help with a listing on Nasdaq when Uzum is ready for that. Seleznev in the meantime and his colleagues are simply trying to get the word out about Uzbekistan’s flourishing tech sector. He travelled to the recent TechCrunch annual meeting in the US to meet investors and partners. “Talking to people changes everything. It’s so much better than sending emails or doing Zoom calls,” says Seleznev. “There are a number of funds now that are actively following our story.” 17 hours ago 11 days ago 6 days ago 13 days ago 7 months ago To continue viewing our content you need to complete the registration process. Please look for an email that was sent to with the subject line "Confirmation bne IntelliNews access". This email will have instructions on how to complete registration process. Please check in your "Junk" folder in case this communication was misdirected in your email system. If you have any questions please contact us at sales@intellinews.com Close Subscribe to bne IntelliNews website and magazine Sorry, but you have used all your free articles fro this month for bne IntelliNews. Subscribe to continue reading for only $119 per year. Your subscription includes:

Uzum Frequently Asked Questions (FAQ)

When was Uzum founded?

Uzum was founded in 2022.

Where is Uzum's headquarters?

Uzum's headquarters is located at Fidokor, 30, Tashkent.

What is Uzum's latest funding round?

Uzum's latest funding round is Debt.

How much did Uzum raise?

Uzum raised a total of $114M.

Who are the investors of Uzum?

Investors of Uzum include FinSight Ventures and Xanara Investment Management.

Who are Uzum's competitors?

Competitors of Uzum include Alif and 6 more.

Loading...

Compare Uzum to Competitors

Alif is a FinTech company that provides personal loans, mobile banking, vehicle financing, and online shopping through its platform, along with investment and insurance products. Alif serves the financial technology sector with various services. It was founded in 2014 and is based in Dushanbe, Tajikistan.

Finmedia operates as a payment aggregator for games, social networks, and entertainment projects. The company provides payment processing solutions and works with entertainment projects while using modern technologies. It was founded in 2016 and is based in Tashkent, Uzbekistan.

Dushanbe City is a financial institution focused on providing a range of banking services within the financial sector. The company offers consumer and corporate banking solutions, including credit facilities, deposit accounts, and money transfer services. Dushanbe City caters to both private individuals and legal entities, offering products such as named, co-branded, express, and payroll cards with home delivery, as well as leasing, insurance, and trade finance solutions. It was founded in 2018 and is based in Dushanbe, Tajikistan.

Juni is a financial technology company that specializes in modern banking solutions for finance teams within the eCommerce sector. The company offers a suite of services, including business banking, spend management, financing, and accounting, all integrated into a single platform designed to streamline financial operations and enhance growth. Juni's platform caters primarily to e-commerce businesses, providing tools for real-time financial control and operational efficiency. It was founded in 2020 and is based in Gothenburg, Sweden.

Yandex.Market is an online marketplace that operates in the retail sector. The company offers a platform for purchasing a wide range of products, including electronics and children's toys, from various partner stores. Yandex.Market facilitates order processing, delivery, and customer communication. It was founded in 2000 and is based in Moscow, Russian Federation.

Trendyol operates as a marketplace and e-commerce platform. The company offers men's and women's apparel, home furniture, cosmetics, shoes, electronics, sports goods, and more. It was founded in 2010 and is based in Istanbul, Turkey.

Loading...