Trustly Group

Founded Year

2008Stage

Private Equity - II | AliveTotal Raised

$30MValuation

$0000Revenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+24 points in the past 30 days

About Trustly Group

Trustly Group focuses on open banking solutions in the financial services and payment processing sectors. The company provides products that facilitate payments, consumer onboarding, and risk assessment using bank-validated financial data. Trustly Group serves sectors including billers, eCommerce, financial services, and gaming. It was founded in 2008 and is based in Stockholm, Sweden.

Loading...

Trustly Group's Product Videos

Trustly Group's Products & Differentiators

Open Banking payments

Open Banking payments allow merchants to accept payments directly from their customers' online bank accounts

Loading...

Research containing Trustly Group

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Trustly Group in 3 CB Insights research briefs, most recently on Jan 4, 2024.

Jan 4, 2024

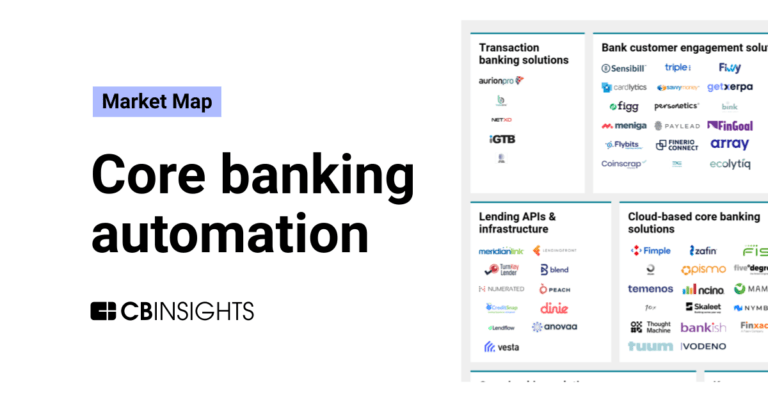

The core banking automation market mapExpert Collections containing Trustly Group

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Trustly Group is included in 3 Expert Collections, including SMB Fintech.

SMB Fintech

1,648 items

Payments

3,123 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,661 items

Excludes US-based companies

Latest Trustly Group News

Mar 14, 2025

Trustly partners with Mollie Friday 14 March 2025 12:31 CET | News Trustly has partnered with Mollie to uncover data-driven insights and actionable tips to help ecommerce businesses optimise their checkout experiences. Following this announcement, the partnership is set to focus on uncovering data-driven insights and actionable tips for ecommerce businesses to optimise their checkout processes. As digital-native shoppers expect the checkout process to be fast, intuitive, and trustworthy, any friction, whether an unexpected payment failure, lack of preferred transaction capabilities, or unnecessary steps, can result in an unfulfilled purchase. The companies focused on the manner in which the checkout experience can be improved, as it can lead to higher conversion rates, reduced operational costs, significant competitive edge, stronger customer loyalty, and lower card abandonment. More information on the Trustly x Mollie partnership The companies also focused on the manner in which businesses can accelerate their development process through checkout optimisation. According to Mollie, 81% of shoppers consider a quick and efficient checkout a critical benefit that a merchant can offer, as even a minor inconvenience can drive them away. The research also provided ways to streamline checkout and keep conversions high, including eliminating manual entry with user recognition (allowing returning customers to skip sign-ins and use saved payment details, making the shopping experience more secure) and offer the right payment options (by delivering diverse options, such as digital wallets, instant bank transfers, and BNPL solutions, businesses can provide clients with the possibility to complete their purchases securely and quickly). In addition, businesses can personalise the checkout in order to boost loyalty, as companies that provide personalisation can significantly improve user trust and retention. Furthermore, by showing location-based payment preferences, firms can offer local payment methods and preferred currencies in order to make transactions feel more familiar and secure, while also leveraging AI-driven transaction routing, as smart payment touting directs transactions through the optimal processing networks to maximise approval rates. At the same time, businesses can use Open Banking to cut costs and improve trust, as card declines are a hidden revenue drain. As Open Banking is gaining traction for companies as a cost-effective solution that gets rid of intermediaries and minimises transaction failures, A2A also bypasses traditional card networks and unlocks faster and protected transactions. The benefits also include instant processing (faster settlements improve cash flow and reduce delays), stronger security (the payments that are authorised directly through a bank reduce fraud risks), and lower fees (in order to eliminate card network fees that are translated into significant cost savings).

Trustly Group Frequently Asked Questions (FAQ)

When was Trustly Group founded?

Trustly Group was founded in 2008.

Where is Trustly Group's headquarters?

Trustly Group's headquarters is located at Rådmansgatan 40, Stockholm.

What is Trustly Group's latest funding round?

Trustly Group's latest funding round is Private Equity - II.

How much did Trustly Group raise?

Trustly Group raised a total of $30M.

Who are the investors of Trustly Group?

Investors of Trustly Group include BlackRock, Investment Corporation of Dubai, Neuberger Berman, Aberdeen Standard Investments, South Carolina Retirement System Investment Commission and 5 more.

Who are Trustly Group's competitors?

Competitors of Trustly Group include Open Payments, Klarna, TrueLayer, Volt, Link Money and 7 more.

What products does Trustly Group offer?

Trustly Group's products include Open Banking payments and 3 more.

Who are Trustly Group's customers?

Customers of Trustly Group include PayPal, Wise and eBay.

Loading...

Compare Trustly Group to Competitors

TrueLayer is an open banking platform that specializes in the financial services industry. The company offers a suite of products that enable instant bank payments, fast and verified payouts, streamlined user onboarding, and variable recurring payments, all designed to facilitate safer and more efficient financial transactions. TrueLayer primarily serves sectors such as e-commerce, gaming, financial services, travel, and cryptocurrency markets. TrueLayer was formerly known as Finport. It was founded in 2016 and is based in London, United Kingdom.

Dapi specializes in open banking solutions and payment infrastructure application programming interfaces (API). The company offers a suite of services, including financial data aggregation, bank identity verification, real-time balance checks, and payment operations for businesses. It primarily serves the fintech industry, e-commerce platforms, and financial institutions looking to integrate advanced payment and financial data functionalities. The company was founded in 2019 and is based in San Francisco, California.

Stripe provides services for businesses to manage online and in-person payments. It offers products including payment processing application programming interfaces (APIs), payment tools, and solutions for handling subscriptions, invoicing, and financial reports. Stripe serves sectors such as e-commerce, Software as a Service (SaaS), platforms, marketplaces, and the creator economy. Stripe was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

Neonomics is a company that focuses on open banking and operates within the financial technology sector. The company offers services such as facilitating payments and providing financial data integration, all through a unified PSD2 API. These services primarily cater to the fintech industry, payment service providers, and banks. It is based in Oslo, Norway.

Volt provides payment solutions within the financial technology sector. It offers a network for account-to-account payments, allowing businesses to send and receive money. Volt's services are available for sectors including retail, travel, wealth, gaming, and crypto. It was founded in 2019 and is based in London, United Kingdom.

Dwolla operates within the financial services sector. The company provides a platform for businesses to integrate bank transfer technology into their systems, facilitating payment methods such as standard Automated Clearing House (ACH), same day ACH, and instant payments. Dwolla's services are used in industries like insurance, lending, real estate, manufacturing, and healthcare. It was founded in 2008 and is based in Des Moines, Iowa.

Loading...