Treasury Prime

Founded Year

2017Stage

Series C - II | AliveTotal Raised

$103.19MLast Raised

$40M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-33 points in the past 30 days

About Treasury Prime

Treasury Prime is an embedded banking platform that specializes in connecting businesses with a network of banks and financial service providers. Its main offerings include API banking integrations that enable companies to develop and launch financial products such as FDIC-insured accounts, payment processing solutions, and debit card issuance. Treasury Prime's platform is designed to support compliance program integration and multi-bank operations, facilitating the creation of investment vehicles and instant payout ecosystems for various industries. It was founded in 2017 and is based in San Francisco, California.

Loading...

ESPs containing Treasury Prime

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

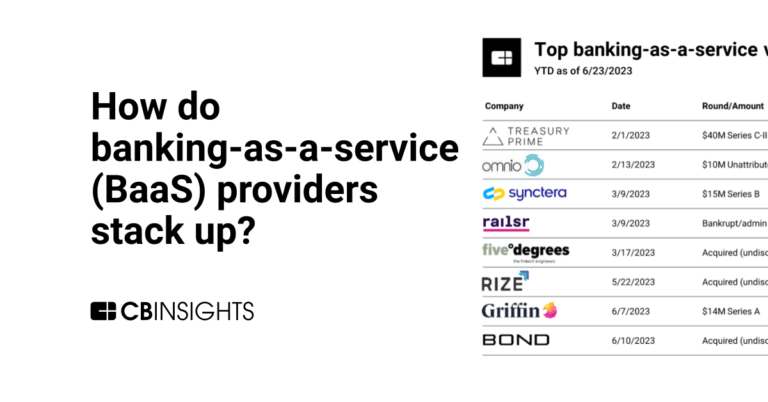

The banking-as-a-service (BaaS) market provides infrastructure platforms for banks and fintechs to modernize their services and expand their customer base through embedded banking and payment options. These providers offer APIs that enable businesses to integrate banking capabilities such as account opening, transaction processing, card issuance, payment rails, and compliance tools. BaaS solutions…

Treasury Prime named as Outperformer among 15 other companies, including Stripe, FIS, and Finastra.

Treasury Prime's Products & Differentiators

Treasury Prime API Platform

Treasury Prime API Platform enables companies to embed a full range of banking services into their product or application from cards to opening accounts to payments. Our easy-to-use API provides the scale and security required for the most sensitive and demanding applications. The Treasury Prime Platform is fully integrated into core banking systems so developers can launch new offerings in days, not months. Treasury Prime’s experience with banking requirements and its range of bank partners have helped dozens of fintechs get to market fast.

Loading...

Research containing Treasury Prime

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Treasury Prime in 4 CB Insights research briefs, most recently on May 8, 2024.

May 8, 2024

The embedded banking & payments market map

Jan 4, 2024

The core banking automation market mapExpert Collections containing Treasury Prime

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Treasury Prime is included in 3 Expert Collections, including Fintech.

Fintech

9,464 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Digital Banking

1,083 items

The open banking ecosystem is facilitated by three main categories of startups including those focused on banking-as-a-service, core banking, and open banking startups (i.e. data aggregators, 3rd party providers). These are primarily B2B companies, though some are also B2C.

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Treasury Prime News

Mar 19, 2025

By PYMNTS | March 19, 2025 | The shakeup and shakeout of banking as a service (BaaS), in the wake of the Synapse bankruptcy last year, has opened up new potential for embedded finance. Money mobility’s at the center of it all, enabling the evolution of BaaS, where the original iteration of the service — call it BaaS 1.0 — had depended on intermediaries between banks and FinTechs. Synapse, of course, had acted as one of those intermediaries, and unraveled when inconsistencies in ledger accounts and record keeping tied to “for benefit of” (FBO) accounts came to light. In an interview with Karen Webster last June, QED Investors partner Amias Gerety offered up a roadmap of sorts for BaaS — which might be likened to BaaS 2.0. “I hope we find some middle ground in terms of expectations … especially around fund segregation, account keeping and data flows,” he said, as regulators, FinTechs and banks scrutinized BaaS more closely. “And we’ll make these best practices … this will actually increase the confidence of both banks and FinTechs coming into the market, which will make everything better.” What’s Changing The movement, now, is toward BaaS as a direct relationship between banks and tech providers, which then allows FinTechs and banks to offer deposit accounts and other offerings to non-financial firms who in turn offer those embedded financial products. In but two recent examples, Treasury Prime, which last year began moving to a direct model (and now is billed as “the bank direct embedded banking platform”), said earlier this month that it was adding KeyBank to its banking network, to help expand software and FinTech programs and virtual account management. Elsewhere, BaaS firm Synctera raised $15 million and signed on Bolt, a FinTech facilitating one-click checkouts, as a new customer. Synctera’s platform helps businesses launch embedded banking products. As BaaS powers and is influences by money mobility, as PYMNTS Intelligence reports have found that the virtual accounts that can be tied to a range of businesses, with critical infrastructure in place to bring new customers to those non-financial firms, but also to create new revenues for the BaaS providers themselves, while winnowing down reliance on third parties as FinTechs, banks and tech providers work more closely with one another. “Accounts are the heartbeat of the money mobility ecosystem,” we wrote in our framework, adding that “they act as both the origin and destination for financial transactions as well as the opportunity to use a payment to create a new one.” Those accounts can be issued by non-banks, we noted, as banks hold those accounts and lend their regulatory and compliance and expertise to that account creation and maintenance. The non-banks can range from FinTechs to retailers to businesses that see an opportunity to bank outbound payments and monetize those accounts, per the report. The expansion of the ecosystem is evident in the fact that nearly half of all checking accounts consumers opened through the past several months were with FinTech platforms. Burgeoning use cases include buy now, pay later (BNPL) and instant outbound payments, and payouts across a range of end-customer choices ranging from virtual accounts to push to debit scenarios. Recommended

Treasury Prime Frequently Asked Questions (FAQ)

When was Treasury Prime founded?

Treasury Prime was founded in 2017.

Where is Treasury Prime's headquarters?

Treasury Prime's headquarters is located at 2261 Market Street , San Francisco.

What is Treasury Prime's latest funding round?

Treasury Prime's latest funding round is Series C - II.

How much did Treasury Prime raise?

Treasury Prime raised a total of $103.19M.

Who are the investors of Treasury Prime?

Investors of Treasury Prime include QED Investors, Deciens Capital, BAM Elevate, SaaStr Fund, Invicta Growth and 9 more.

Who are Treasury Prime's competitors?

Competitors of Treasury Prime include Sandbox Banking, Infinant, Synctera, Moov, Staq.io and 7 more.

What products does Treasury Prime offer?

Treasury Prime's products include Treasury Prime API Platform.

Who are Treasury Prime's customers?

Customers of Treasury Prime include MaxMyInterest, Brex, Bench, Alto IRA and Challenger Finance.

Loading...

Compare Treasury Prime to Competitors

Unit is a financial technology company that specializes in embedded finance and financial infrastructure within the banking and lending sectors. The company offers a platform that enables tech companies to integrate banking services, such as storing, moving, and lending money, into their products. Unit's services are designed to facilitate compliance and simplify technical integration for businesses looking to offer financial services. It was founded in 2019 and is based in New York, New York.

Synctera is a banking and payments platform that provides technology infrastructure and a compliance framework for companies to launch FinTech and embedded banking products. The company offers services including APIs for digital wallets, debit and charge cards, and money movement experiences, supporting financial solutions. Synctera primarily serves FinTechs, embedded banking providers, and banks looking to build their sponsor banking programs. It was formerly known as Entangle. It was founded in 2020 and is based in Palo Alto, California.

Productfy is a platform that specializes in the embedding of financial products within various business sectors. The company offers a suite of services, including branded card programs, digital banking solutions, secured charge card issuance, and disbursement mechanisms, all designed to be integrated seamlessly into clients' applications. Productfy primarily serves sectors such as community banks, credit unions, real estate, financial services, and insurance. It was founded in 2018 and is based in San Jose, California.

NovoPayment specializes in providing Banking as a Service (BaaS) platforms and focuses on digital financial and transactional services. The company offers a suite of bank-grade solutions, including digital banking, payment processing, card issuing, and risk management services, all designed to integrate with existing systems for financial operations and customer experiences. NovoPayment primarily serves banks, financial institutions, merchants, and other financial service providers looking to digitize and modernize services. It was founded in 2007 and is based in Miami, Florida.

Zeta provides cloud-native, API-integrated solutions for the financial services industry. The company offers a platform for banks and financial institutions to launch and manage card programs, loans, and deposit products with features like transaction processing, digital banking applications, and customer engagement. Zeta serves the financial industry with services such as card issuance, transaction processing, and customer support. It was founded in 2015 and is based in San Ramon, California.

Agora Financial Technologies specializes in modular banking platforms and operates within the financial technology sector. The company provides digital banking solutions that allow banks, credit unions, and fintech companies to integrate new fintech products without overhauling their existing core banking systems. Agora's services include white-label solutions, APIs for developers, and a challenger bank platform. Agora Financial Technologies was formerly known as Agora Services. It was founded in 2018 and is based in New York, New York.

Loading...