Investments

1188Portfolio Exits

170Funds

17Partners & Customers

2Service Providers

1About Tiger Global Management

Tiger Global Management is an investment firm that invests in public and private companies that utilize technological innovation. The company employs public equity strategies including long/short, long-focused, and crossover strategies, as well as private equity investments in companies at various stages. Tiger Global primarily operates within sectors that are influenced by technological advancements and growth. It was founded in 2001 and is based in New York, New York.

Expert Collections containing Tiger Global Management

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Tiger Global Management in 4 Expert Collections, including Direct-To-Consumer Brands (Non-Food).

Direct-To-Consumer Brands (Non-Food)

37 items

Startups selling their own branded products directly to consumers via online/mobile channels, rather than relying on department stores or big online marketplaces.

E-Commerce

22 items

Travel Technology (Travel Tech)

39 items

Tech-enabled companies offering services and products focused on tourism. This collection includes booking services, search platforms, on-demand travel and recommendation sites, among others.

Digital Lending

34 items

This collection contains alternative means for obtaining a loan for personal or business use. Companies included in the application, underwriting, funding, or collection process is included in the collection.

Research containing Tiger Global Management

Get data-driven expert analysis from the CB Insights Intelligence Unit.

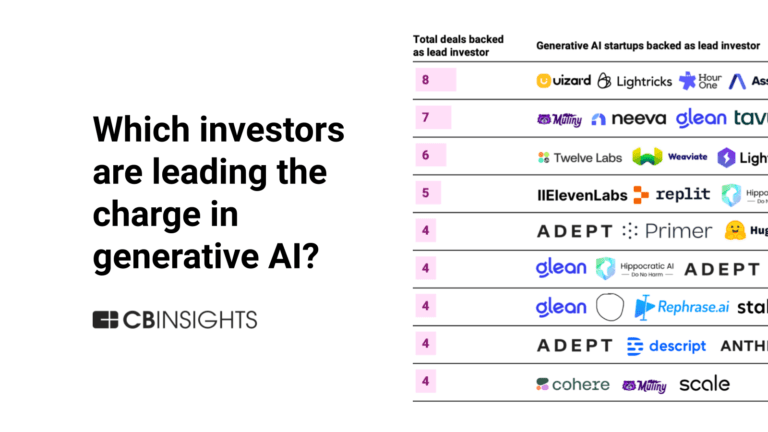

CB Insights Intelligence Analysts have mentioned Tiger Global Management in 9 CB Insights research briefs, most recently on Mar 26, 2024.

Mar 26, 2024

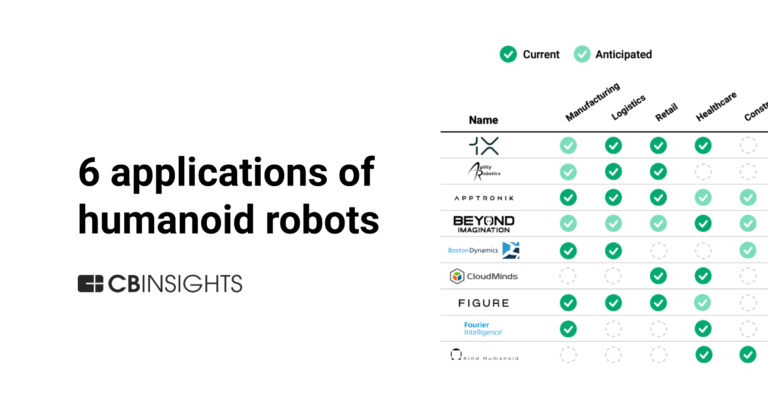

6 applications of humanoid robots across industries

Jan 4, 2024 report

State of Venture 2023 Report

Nov 20, 2023 report

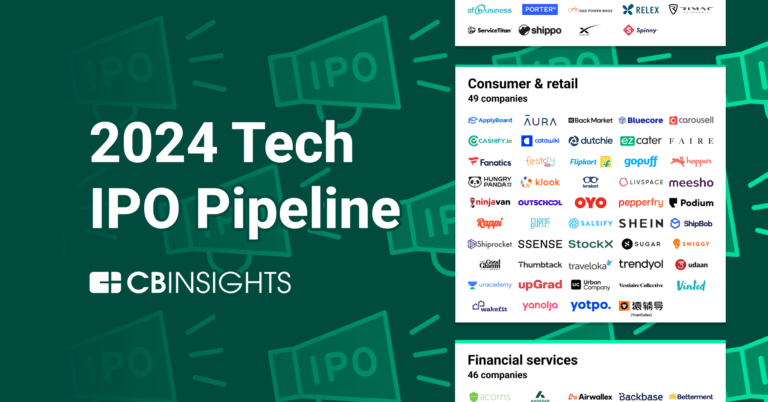

The 2024 Tech IPO Pipeline

Jul 14, 2023

The state of LLM developers in 6 charts

Latest Tiger Global Management News

Mar 27, 2025

Copy the “BAM” Strategy Like The stock market is terrifying right now. Last month alone, fears about global tariffs and a potential recession erased $4 trillion from the S&P 500. In times like this, it’s helpful to see what professional investors are doing — and if possible, copy them. So today, I’ll show you the surprising move a legendary investor just made… And then I’ll show you exactly how to copy it. BAM’s Big Move Balyasny Asset Management (BAM) is a $23 billion money manager. It employs over 2,000 professionals across more than 20 global locations. Founded in 2001, the firm is known for its data-driven approach and diversified investment strategies. This approach has helped it earn market-beating returns, even during turbulent times. Check out this chart of its recent performance (in red) against the S&P (in blue): It’s launching a $350 million venture-capital fund. In other words, it’s decided to invest in private startups. Specifically, it plans to invest in startups focused on AI, data infrastructure, health-tech, and cybersecurity — areas where adoption is accelerating and valuations are still competitive. But why exactly is a top money manager like BAM deciding to “forget stocks” and focus on the private venture market instead? A Strategy to “Juice Returns” As industry research company PitchBook reported: “Balyasny has long viewed venture as a place to find excess returns… Balyasny’s bet on VC reflects the long-held view of founder Dmitry Balyasny that the biggest hedge funds would eventually begin backing startups to juice returns.” In other words, it’s investing in startups so it can “juice” its returns and beat the stock market. The thing is, BAM is hardly alone… As PitchBook alludes to, BAM’s move follows a broader trend among major money managers to aggressively expand into the private markets. For example, mutual fund giant Fidelity — which has traditionally only invested in public companies — started investing in private startups. And Tiger Global, one of the most prominent funds in the world, pulled back on its stock investments so it could allocate more capital to the private markets. According to The Financial Times, it invested in about 230 startups before their IPOs, including Warby Parker, Peloton, and Spotify. What do BAM and Fidelity and Tiger know that we don’t? Let’s take a look. The Facts Year after year, decade after decade, regardless of what’s happening in the world, the private market continues to help turn small starting stakes into windfalls. The “secret” here is simple: historically, early-stage private investing has been the most profitable long-term asset class. For example, according to Cambridge Associates (a financial advisor with clients like the Rockefeller Foundation and Bill Gates), on average, for the past 25 years, these investments have returned roughly 55% per year. At 55% per year, in just 20 years, you could turn $250 into more than $1.6 million. So even if you took just a tiny piece of your nest egg and put it into the private markets, you could potentially multiply your total returns many times over. Now It’s Your Turn For the past 85 years or so, the U.S. government legally prohibited all but the wealthiest citizens from investing in startups. But because of a new set of laws called The JOBS Act, now anyone can invest in these young, private companies — and anyone can put themselves in position to “juice” their returns. This is why, about ten years ago, I launched Crowdability: my mission is to help individual investors like you make sense of, and profit from, this newly available market. It doesn’t take much capital to get started. You can start building a portfolio, just like a venture capitalist, with just a few hundred dollars. Here are two easy (and free) ways to get started: First, take a look at our weekly “Deals” email. We send this out every Monday at 11am EST, and it contains a handful of new startup deals for you to explore. Second, check out our free white papers like “ Tips from the Pros .” These easy-to-read reports will teach you how to separate the good deals from the bad. So get ready to copy the “BAM” strategy — And Happy Investing!

Tiger Global Management Investments

1,188 Investments

Tiger Global Management has made 1,188 investments. Their latest investment was in Temporal as part of their Series C - II on March 31, 2025.

Tiger Global Management Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

3/31/2025 | Series C - II | Temporal | $146M | Yes | 3 | |

3/27/2025 | Convertible Note | Carma | $18.92M | No | 4 | |

3/13/2025 | Series F | Flock Safety | $275M | No | 6 | |

3/11/2025 | Series C - II | |||||

3/10/2025 | Series C |

Date | 3/31/2025 | 3/27/2025 | 3/13/2025 | 3/11/2025 | 3/10/2025 |

|---|---|---|---|---|---|

Round | Series C - II | Convertible Note | Series F | Series C - II | Series C |

Company | Temporal | Carma | Flock Safety | ||

Amount | $146M | $18.92M | $275M | ||

New? | Yes | No | No | ||

Co-Investors | |||||

Sources | 3 | 4 | 6 |

Tiger Global Management Portfolio Exits

170 Portfolio Exits

Tiger Global Management has 170 portfolio exits. Their latest portfolio exit was Moveworks on March 10, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

3/10/2025 | Acquired | 5 | |||

2/26/2025 | Acquired | 3 | |||

2/18/2025 | Acquired | 6 | |||

Date | 3/10/2025 | 2/26/2025 | 2/18/2025 | ||

|---|---|---|---|---|---|

Exit | Acquired | Acquired | Acquired | ||

Companies | |||||

Valuation | |||||

Acquirer | |||||

Sources | 5 | 3 | 6 |

Tiger Global Management Acquisitions

2 Acquisitions

Tiger Global Management acquired 2 companies. Their latest acquisition was Cobone on March 11, 2013.

Date | Investment Stage | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Total Funding | Note | Sources |

|---|---|---|---|---|---|---|

3/11/2013 | Acq - Fin | 1 | ||||

6/30/2007 | Other |

Date | 3/11/2013 | 6/30/2007 |

|---|---|---|

Investment Stage | Other | |

Companies | ||

Valuation | ||

Total Funding | ||

Note | Acq - Fin | |

Sources | 1 |

Tiger Global Management Fund History

17 Fund Histories

Tiger Global Management has 17 funds, including Tiger Private Investment Partners Fund XVI.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

4/2/2024 | Tiger Private Investment Partners Fund XVI | $2,200M | 2 | ||

6/16/2023 | Tiger Global Private Investment Partners XVI | $622.65M | 2 | ||

2/3/2022 | Tiger Private Investment Partners XV | $11,000M | 1 | ||

5/4/2021 | Tiger Global Tech Venture Fund | ||||

3/31/2021 | Tiger Global Private Investment Partners XIV |

Closing Date | 4/2/2024 | 6/16/2023 | 2/3/2022 | 5/4/2021 | 3/31/2021 |

|---|---|---|---|---|---|

Fund | Tiger Private Investment Partners Fund XVI | Tiger Global Private Investment Partners XVI | Tiger Private Investment Partners XV | Tiger Global Tech Venture Fund | Tiger Global Private Investment Partners XIV |

Fund Type | |||||

Status | |||||

Amount | $2,200M | $622.65M | $11,000M | ||

Sources | 2 | 2 | 1 |

Tiger Global Management Partners & Customers

2 Partners and customers

Tiger Global Management has 2 strategic partners and customers. Tiger Global Management recently partnered with Evercore on May 5, 2023.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

5/19/2023 | Vendor | United States | 1 | ||

Vendor |

Date | 5/19/2023 | |

|---|---|---|

Type | Vendor | Vendor |

Business Partner | ||

Country | United States | |

News Snippet | ||

Sources | 1 |

Tiger Global Management Service Providers

1 Service Provider

Tiger Global Management has 1 service provider relationship

Service Provider | Associated Rounds | Provider Type | Service Type |

|---|---|---|---|

Counsel | General Counsel |

Service Provider | |

|---|---|

Associated Rounds | |

Provider Type | Counsel |

Service Type | General Counsel |

Partnership data by VentureSource

Tiger Global Management Team

12 Team Members

Tiger Global Management has 12 team members, including , .

Name | Work History | Title | Status |

|---|---|---|---|

Chase Coleman | Founder | Current | |

Name | Chase Coleman | ||||

|---|---|---|---|---|---|

Work History | |||||

Title | Founder | ||||

Status | Current |

Compare Tiger Global Management to Competitors

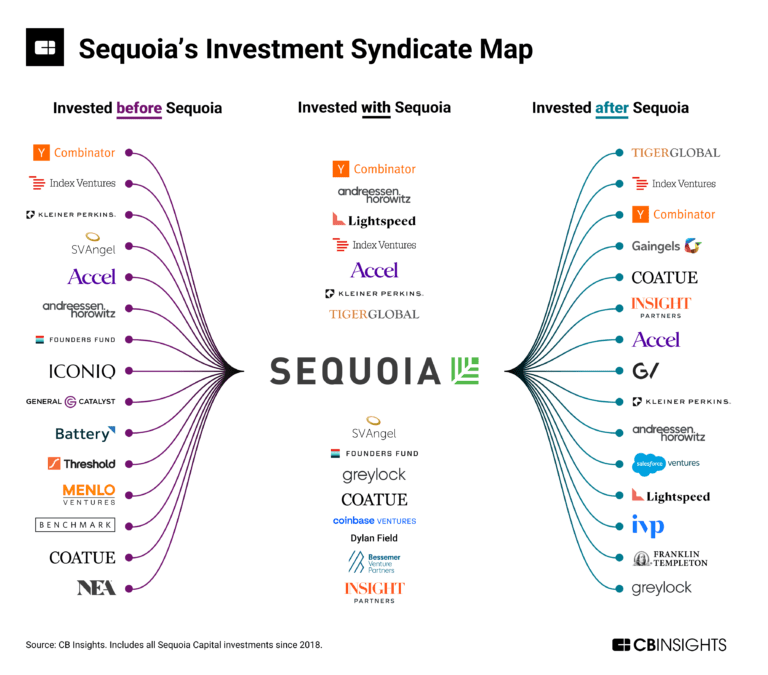

Sequoia Capital is a venture capital firm that focuses on supporting startups from inception to initial-public offering (IPO) within sectors. They provide investment funding and strategic support to help companies grow and succeed. Sequoia Capital primarily serves technology-driven sectors and businesses aiming to become market leaders. It was founded in 1972 and is based in Menlo Park, California.

Battery Ventures operates as a technology-focused investment firm operating across sectors, including application software, infrastructure software, consumer internet, and industrial technologies. The firm provides capital and support services, including business development and talent recruitment, to its portfolio companies. Battery Ventures invests in businesses at stages, from seed to growth and private equity, with a global investment strategy. It was founded in 1983 and is based in Boston, Massachusetts.

Accel is a venture capital firm that invests in and partners with teams from the inception of private companies through their growth phases, primarily in the technology sector. Accel was formerly known as Accel Partners. It was founded in 1983 and is based in Palo Alto, California.

Coatue works as a lifecycle investment platform specializing in technology sector investments. The company offers venture, growth, thematic, and structured capital strategies to support technology companies. Coatue primarily serves the technology industry, with a focus on supporting innovative tech startups and growth-stage companies. It was founded in 1999 and is based in New York, New York.

Warburg Pincus is a private equity firm that focuses on growth investing. The company provides capital and expertise to management teams across various sectors. Warburg Pincus' investments include private equity, real estate, and capital solutions, with a portfolio that includes companies in business services, consumer goods, energy transition, financial services, healthcare, industrials, real estate, and technology. It was founded in 1966 and is based in New York, New York.

Greylock Partners is a venture capital firm that focuses on early-stage investments in the technology sector. The company provides funding to AI-focused companies at the pre-seed, seed, and Series A stages. Greylock Partners offers a company-building program to support pre-idea and pre-seed founders in developing their startups. It was founded in 1965 and is based in Menlo Park, California.

Loading...