Founded Year

2017About SymphonyAI

SymphonyAI specializes in artificial intelligence (AI) driven software as a service (SaaS) solutions. The company offers a suite of products to leverage predictive and generative AI to enhance growth and productivity by providing insights, recommendations, and what-if analysis for various industries. SymphonyAI's solutions address core business challenges and are designed to optimize operations, manage risk, and improve decision-making processes. SymphonyAI was formerly known as Symphony RetailAI. It was founded in 2017 and is based in Palo Alto, California.

Loading...

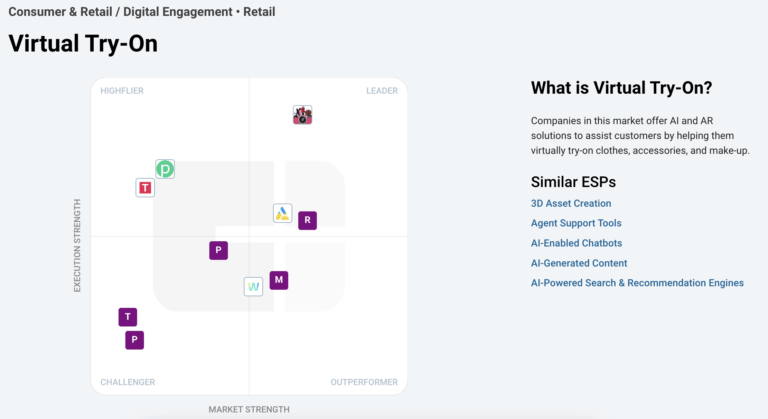

ESPs containing SymphonyAI

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The multi-purpose merchandising platforms market refers to a range of software solutions that enable retailers to manage their product catalogs, pricing, promotions, and inventory across multiple sales channels. These platforms allow retailers to streamline their operations and improve the customer experience by providing a unified view of their products and services. The market is expected to gro…

SymphonyAI named as Leader among 13 other companies, including RELEX, Aptos, and Impact Analytics.

Loading...

Research containing SymphonyAI

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned SymphonyAI in 5 CB Insights research briefs, most recently on Feb 13, 2025.

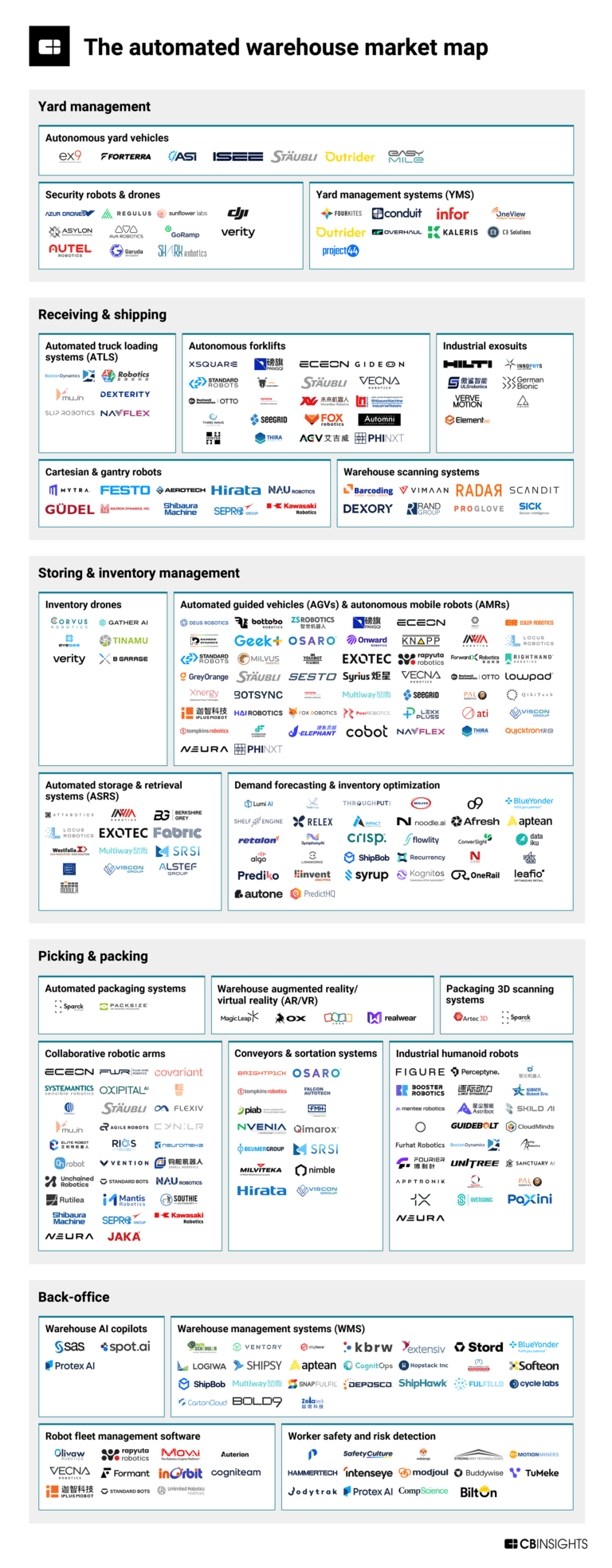

Feb 13, 2025

The automated warehouse market map

Expert Collections containing SymphonyAI

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

SymphonyAI is included in 5 Expert Collections, including Store tech (In-store retail tech).

Store tech (In-store retail tech)

2,336 items

Companies that make tech solutions to enable brick-and-mortar retail store operations.

Supply Chain & Logistics Tech

5,319 items

Companies offering technology-driven solutions that serve the supply chain & logistics space (e.g. shipping, inventory mgmt, last mile, trucking).

Grocery Retail Tech

648 items

Startups providing B2B solutions to grocery businesses to improve their store and omni-channel performance. Includes customer analytics platforms, in-store robots, predictive inventory management systems, online enablement for grocers and consumables retailers, and more.

Market Research & Consumer Insights

734 items

This collection is comprised of companies using tech to better identify emerging trends and improve product development. It also includes companies helping brands and retailers conduct market research to learn about target shoppers, like their preferences, habits, and behaviors.

Artificial Intelligence

7,221 items

SymphonyAI Patents

SymphonyAI has filed 6 patents.

The 3 most popular patent topics include:

- classification algorithms

- data management

- data modeling

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

11/3/2020 | 7/23/2024 | Data warehousing, Data management, Data modeling, Online analytical processing, Database management systems | Grant |

Application Date | 11/3/2020 |

|---|---|

Grant Date | 7/23/2024 |

Title | |

Related Topics | Data warehousing, Data management, Data modeling, Online analytical processing, Database management systems |

Status | Grant |

Latest SymphonyAI News

Oct 21, 2022

Gina Hargrave, Symphony RetailAI Image Convenience store retailers know how to cope with gas price volatility; it’s a must-have skill for operators in the segment. Another skill quickly turning into a must-have is adapting to the price volatility of items inside the store. It used to be that convenience stores could rely on a certain percentage of drivers to go inside. Now, when they must factor in geopolitical instability in key food production regions and inflation, which is particularly steep with gas prices, that percentage erodes faster than operators’ margins. Even if it surprised many when the American Automobile Association (AAA) reported that a record 42 million Americans planned to drive over the Fourth of July weekend, it doesn’t mean the segment wasn’t impacted by double-whammy woes already known to the c-store operator: inflation and reduced buying power. Demand at the pump may have been healthier than expected, but it doesn’t necessarily mean that drivers were rushing inside. This means convenience stores must manage price expectations both at the pump and in the convenience store to drive total basket. However, just as with most challenges, there are abundant opportunities to help overcome them. How Did Convenience Stores Get Here? The first prong, gas price increases, aren’t unique to this period. But generally, volatility in prices is cause for concern for convenience stores. It’s typically related to higher-than-usual prices, but even during oil’s contango period of 2020 when gas prices plummeted, consumers were equally surprised. These volatilities drive away customers and create a double-edged sword for the operator: if gas prices are too high, then shoppers may not have enough disposable income to spend inside. Even if they had more income to spend inside, as they may have in 2020 because of lower gas prices, that didn’t necessarily translate to more sales inside. This also could have been because of the early stages of the pandemic, when drivers may have been nervous about going inside, and the shift to working and schooling from home sharply reduced overall miles driven. The second prong, inside the convenience store, comes amid the convenience channel’s ongoing pivot to increase sales of categories such as foodservice, coffee, select grocery categories, and on-trend general merchandise items. These efforts at diversifying the sales mix also stem from ongoing pressures on the tobacco category, which accounts for roughly 30 percent of the U.S. convenience channel’s in-store sales — a sizable secondhand exposure to a category with negative trends. Tobacco usage is declining with cigarette smoking among adults down to 12.5 percent of the population in 2020, compared to nearly 21 percent in 2005, according to data from the Centers for Disease Control and Prevention (CDC). With the traditional trip drivers of gas and tobacco under pressure, some leading c-store operators have made artificial intelligence (AI) driven store planning and category optimization a priority, recognizing that the traditional concept of a c-store is evolving to fit a new definition of convenience based on lifestyle trends and evolving shopper preferences. A select group of c-store operators has ascended to a new place in the consumer psyche where their stores are destinations for a broader range of needs, but they also happen to sell gas. Maximizing the Space Inside To solve this, retailers must create enticing store layouts that are easy to shop. They must stay true to the convenience value proposition, but provide compelling merchandising presentations of spot-on product assortments, and intelligent promotions that make convenience stores an important destination. Such an environment requires excellent agility on the part of retailers, whose processes must accommodate dynamic and continuous planning to move with the market. Using AI for category planning and optimization is key for realizing the maximum value from the available space, especially given recent ebbs and flows in fuel prices in the U.S. and globally. These changing dynamics of the convenience channel require retailers to leverage AI in new ways to make optimal decisions about store and shelf layouts, category space allocations, and assortments. This will ensure convenience stores can turn into a destination for multiple reasons beyond fuel, and encourage customers whose trip was motivated by the need to fill up to venture inside for additional purchases. Gina Hargrave serves as head of category planning at Symphony RetailAI and has 20 years of experience in FMCG retail, focused on category and space management business processes and solutions. For more information, visit symphonyretailai.com . Editor's note: The opinions expressed in this column are the author's and do not necessarily reflect the views of Convenience Store News.

SymphonyAI Frequently Asked Questions (FAQ)

When was SymphonyAI founded?

SymphonyAI was founded in 2017.

Where is SymphonyAI's headquarters?

SymphonyAI's headquarters is located at 3300 Hillview Avenue, Palo Alto.

Who are SymphonyAI's competitors?

Competitors of SymphonyAI include Reactor, HIVERY, Orbital Insight, Pensa Systems, Impact Analytics and 7 more.

Loading...

Compare SymphonyAI to Competitors

Syrup Tech develops machine learning models predicting demand and optimizing inventory. The company offers an omnichannel decision support engine powered by artificial intelligence and machine learning using advanced machine learning models for demand forecasting and probabilistic optimizations of inventory. It was founded in 2020 and is based in New York, New York.

Nextail specializes in the fashion industry. It leverages AI and advanced analytics to optimize retail operations. The company offers solutions for assortment planning, buying, reorder, allocation and replenishment, inventory rebalancing, and store operations, aimed at increasing sales and margins while reducing stock levels. Nextail primarily serves the fashion apparel, jewelry and accessories, luxury and designer, fashion footwear, outdoor and sportswear, and lingerie and swimwear sectors. It was founded in 2014 and is based in Madrid, Spain.

RELEX focuses on supply chain and retail planning in the retail and consumer goods industry. The company offers a unified platform that helps retailers and consumer brands optimize their planning across demand, merchandise, supply chain, and operations to customers. It primarily sells to the retail industry and consumer goods companies. It was formerly known as RELEX Solutions. It was founded in 2005 and is based in Helsinki, Finland.

Crisp provides a collaborative commerce platform within the retail data analytics and supply chain optimization sectors. The company offers services including data ingestion automation, real-time inventory management, retail analytics, and electronic data interchange (EDI) integration for brands, retailers, and distributors. Crisp primarily serves the consumer packaged goods (CPG) industry, aiming to provide insights for improving sales and reducing waste. It was founded in 2016 and is based in Miami, Florida.

Anaplan provides connected planning solutions for business performance in various sectors. The company offers a platform that allows organizations to model scenarios, forecast, and make informed decisions. Anaplan's services are utilized in finance, supply chain, sales, human resources, and workforce planning across industries like consumer goods, financial services, manufacturing, and retail. It was founded in 2006 and is based in Miami, Florida.

Retalon provides analytics and AI for the retail sector. The company offers solutions that address challenges in planning, inventory, pricing, and promotions, derived from an analytics platform. Retalon's platform integrates with any ERP or OMS, allowing retailers to manage their operations and scale their businesses without requiring extensive data science expertise. It was founded in 2002 and is based in Toronto, Ontario.

Loading...