SumUp

Founded Year

2012Stage

Loan - III | AliveTotal Raised

$4.045BLast Raised

$1.608B | 1 yr agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-1 points in the past 30 days

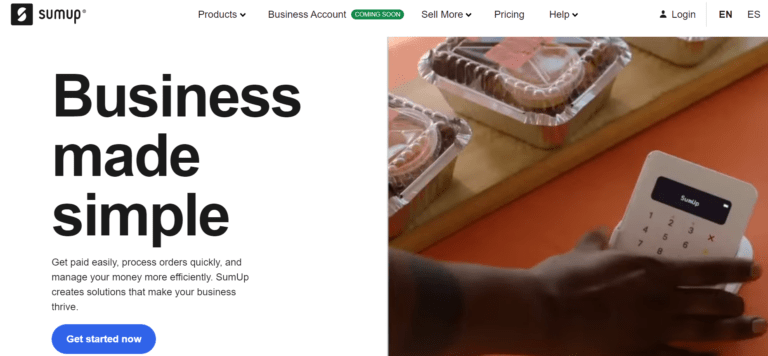

About SumUp

SumUp is a financial technology company that specializes in payment processing solutions and point-of-sale systems for small businesses. The company offers a range of products including mobile payment applications, card readers, and business bank accounts, designed to facilitate transactions and manage sales. SumUp's services cater to various sectors such as restaurants, salons, spas, and retail, providing tools for appointment management, loyalty rewards, and inventory management. SumUp was formerly known as Ka-Ching Payments. It was founded in 2012 and is based in Wilmington, Delaware.

Loading...

ESPs containing SumUp

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The virtual payment terminals market refers to a type of payment solution that allows merchants to accept payments through a web-based platform, without the need for a physical payment terminal. Virtual payment terminals are typically used by e-commerce businesses and other remote merchants who do not have a physical store or who need to accept payments from customers who are not present. The mark…

SumUp named as Challenger among 15 other companies, including Stripe, Fiserv, and Worldpay.

SumUp's Products & Differentiators

SumUp Solo Lite

Our card readers, like SOLO Lite, are also a major milestone. They’re portable, affordable, and designed for merchants who are always on the go. We’ve also developed business accounts that allow merchants to manage their finances, pay suppliers, and track income, all in one place.

Loading...

Research containing SumUp

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned SumUp in 7 CB Insights research briefs, most recently on Jan 18, 2024.

Jan 18, 2024 report

State of Fintech 2023 Report

Oct 4, 2022 report

The Fintech 250: The most promising fintech companies of 2022

Sep 13, 2022

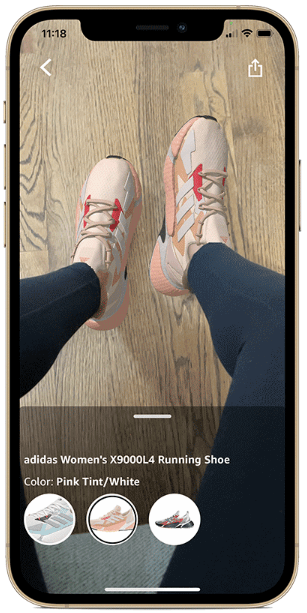

3 retail tech trends to watch in Q3’22Expert Collections containing SumUp

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

SumUp is included in 7 Expert Collections, including Store tech (In-store retail tech).

Store tech (In-store retail tech)

1,766 items

Companies that make tech solutions to enable brick-and-mortar retail store operations.

Unicorns- Billion Dollar Startups

1,270 items

SMB Fintech

1,648 items

Payments

3,123 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,662 items

Excludes US-based companies

Fintech 100

249 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

SumUp Patents

SumUp has filed 9 patents.

The 3 most popular patent topics include:

- payment systems

- banking technology

- banks

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

9/24/2021 | 9/17/2024 | Payment systems, Banking technology, Banks, Interbank networks, Circulating currencies | Grant |

Application Date | 9/24/2021 |

|---|---|

Grant Date | 9/17/2024 |

Title | |

Related Topics | Payment systems, Banking technology, Banks, Interbank networks, Circulating currencies |

Status | Grant |

Latest SumUp News

Mar 20, 2025

March 20, 2025 4 The European fintech sector has witnessed significant growth over the past decade, spurred by technological advancements, increasing digital adoption, and a favorable regulatory environment. While many fintech startups prioritize scaling and customer acquisition, only a select few have managed to achieve substantial profitability. This essay delves into the most profitable fintech companies in Europe, examining their business models, revenue streams, and the key factors driving their success. The Rise of Fintech in Europe The fintech revolution has disrupted traditional banking and financial services, providing consumers with faster, more efficient, and often more cost-effective alternatives. The ability to leverage digital platforms has enabled fintech firms to scale rapidly while reducing overhead costs associated with brick-and-mortar operations. This shift has allowed companies such as Revolut, Klarna, Adyen, and Wise to establish themselves as major players in the financial landscape. Revolut: A Digital Banking Powerhouse Headquartered in London and founded in 2015, Revolut has evolved from a simple currency exchange app into a comprehensive financial services provider. The company’s revenue model is based on several key streams, including subscription fees for premium accounts, interchange fees from card transactions, foreign exchange commissions, and cryptocurrency trading fees. In 2022, Revolut reported its first full-year profit, marking a major milestone in its journey toward long-term sustainability. Klarna: The Leader in Buy Now, Pay Later Stockholm-based Klarna, established in 2005, has pioneered the “Buy Now, Pay Later” (BNPL) segment, offering flexible payment solutions to consumers and merchants. Klarna generates revenue through merchant transaction fees, late payment penalties, interest from financed purchases, and data monetization. Despite facing regulatory challenges and increasing competition, Klarna remains one of the most profitable fintechs in Europe, catering to the growing consumer demand for alternative payment methods. Adyen: Dominating the Global Payments Industry Founded in 2006 in Amsterdam, Adyen has carved out a dominant position in the global payments processing market. Unlike its competitors, Adyen operates a unified payment platform without reliance on third-party banking services. Its revenue streams include processing fees for global transactions, merchant acquiring fees, and subscription-based software solutions for large enterprises. Serving high-profile clients like Uber, Spotify, and eBay, Adyen has achieved consistent profitability through its high-margin business model. Wise: Transforming International Money Transfers London-based Wise (formerly TransferWise) was established in 2011 to offer transparent, low-cost international money transfers. Its primary sources of revenue include transfer fees, currency exchange margins, and business account services. By focusing on efficiency and cost transparency, Wise has positioned itself as a leading player in cross-border payments, maintaining a scalable and profitable business model. N26: Redefining Digital Banking Founded in 2013 and headquartered in Berlin, N26 is a fully digital bank that provides users with seamless banking services without the need for physical branches. The company’s revenue is driven by premium subscription plans, interchange fees from card transactions, and lending services, including overdraft fees. Despite regulatory challenges and market exits from certain regions, N26 continues to be one of Europe’s leading digital banks. Checkout.com: A Payment Processing Giant London-based Checkout.com, founded in 2012, has emerged as a major player in online payment processing. It generates revenue through transaction fees, custom enterprise solutions, and value-added services such as fraud detection and analytics. By focusing on enterprise clients and offering sophisticated payment solutions, Checkout.com has sustained high levels of profitability. SumUp: Enabling Small Businesses SumUp, headquartered in London and founded in 2012, specializes in point-of-sale (POS) solutions and digital payment services for small businesses. The company’s primary revenue sources include transaction fees, POS hardware sales, and subscription-based business software services. SumUp’s focus on small business solutions has allowed it to carve out a profitable niche in the fintech market. Rapyd: Providing Fintech as a Service Founded in 2016 and headquartered in London, Rapyd offers an integrated fintech-as-a-service platform that enables businesses to incorporate payments, banking, and fraud prevention solutions. The company earns revenue through API transaction fees, merchant banking services, and regulatory compliance solutions. Its innovative approach to financial infrastructure has positioned it as a rapidly growing and profitable fintech firm. Key Drivers of Profitability in European Fintech Several factors contribute to the sustained profitability of fintech firms in Europe: Scalability – Digital platforms allow fintech firms to expand operations without significant infrastructure costs. Diversified Revenue Streams – Successful fintechs generate income from multiple sources, including subscriptions, transactions, and lending services. Strategic Partnerships – Collaborations with banks, enterprises, and regulators facilitate expansion and compliance. Regulatory Adaptation – Navigating complex financial regulations effectively ensures long-term sustainability. Customer Trust and Retention – Providing seamless and transparent services enhances brand loyalty and reduces churn. Europe’s fintech industry has evolved into a powerhouse of financial innovation, with numerous companies achieving profitability through strategic growth, strong revenue models, and technological advancements. While Revolut, Klarna, Adyen, and Wise stand out as the most profitable, emerging fintechs continue to challenge traditional financial services. As the industry matures, the focus will shift from rapid expansion to sustainable profitability, ensuring that fintech remains a transformative force in the European financial landscape.

SumUp Frequently Asked Questions (FAQ)

When was SumUp founded?

SumUp was founded in 2012.

Where is SumUp's headquarters?

SumUp's headquarters is located at 1209 Orange St, Wilmington.

What is SumUp's latest funding round?

SumUp's latest funding round is Loan - III.

How much did SumUp raise?

SumUp raised a total of $4.045B.

Who are the investors of SumUp?

Investors of SumUp include BlackRock, Oaktree Capital Management, Goldman Sachs Asset Management, Apollo Global Management, Vista Credit Partners and 33 more.

Who are SumUp's competitors?

Competitors of SumUp include CloudWalk, Melio, Tide, Zoop, Clip and 7 more.

What products does SumUp offer?

SumUp's products include SumUp Solo Lite and 4 more.

Who are SumUp's customers?

Customers of SumUp include Deb Dobney-Cobb, Aidan Conway and Arlene Wedgbury.

Loading...

Compare SumUp to Competitors

Worldpay is a payments technology company specializing in omni-commerce solutions across various business sectors. The company offers services that enable businesses to accept, manage, and make payments in-person, online, and across multiple channels, including embedded payments for software platforms. Worldpay primarily serves small businesses, enterprises, software platforms, and marketplaces across various industries such as financial services, retail, and travel. It was founded in 1993 and is based in London, England.

Stripe provides services for businesses to manage online and in-person payments. It offers products including payment processing application programming interfaces (APIs), payment tools, and solutions for handling subscriptions, invoicing, and financial reports. Stripe serves sectors such as e-commerce, Software as a Service (SaaS), platforms, marketplaces, and the creator economy. Stripe was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

Hash operates a financial technology platform. It enables companies to create and test payment and other financial solutions. It provides non-financial business-to-business (B2B) enterprises wishing to offer banking services with payment infrastructure. The company was founded in 2017 and is based in Sao Paulo, Brazil.

Ingenico is a company focused on payment acceptance and services within the financial technology sector. It offers a range of products including smart terminals, a cloud-based payments platform, and terminal management solutions. Ingenico also provides services such as advanced payment methods, buy now pay later options, digital receipts, and omnichannel services. It was founded in 1980 and is based in Suresnes, France.

NearPay provides payment infrastructure solutions within the fintech sector. The company offers a software development kit (SDK) that allows merchants to accept in-person NFC card payments. NearPay's services include transaction processes for businesses, offering purchase, refund, and reconciliation functionalities. It was founded in 2020 and is based in Riyadh, Saudi Arabia.

Mswipe offers mobile POS solutions that enable merchants to accept various card payments using compact, wireless devices without the need for a bank account or paper charge slips. Mswipe primarily caters to the needs of small enterprises with mainstream financial services and digital commerce. It was founded in 2011 and is based in Mumbai, India.

Loading...