Stori

Founded Year

2019Stage

Debt - III | AliveTotal Raised

$666.5MLast Raised

$107M | 8 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+36 points in the past 30 days

About Stori

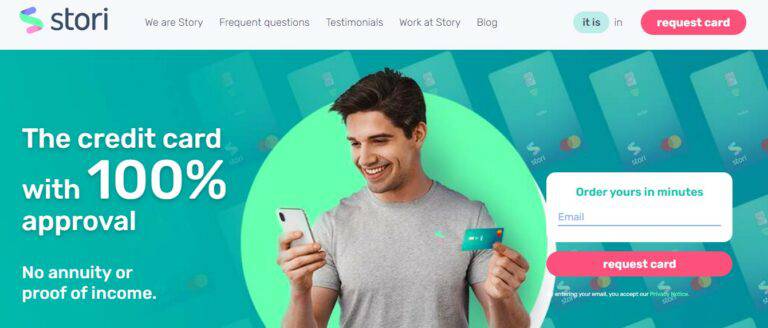

Stori is a financial technology company that focuses on providing credit access and financial services. The company offers credit cards with high approval rates and cashback rewards, as well as deposit accounts with competitive returns. Stori primarily serves the underbanked population in Latin America, offering financial products that aim to democratize credit access and enhance financial inclusion. It was founded in 2019 and is based in Mexico City, Mexico.

Loading...

Loading...

Research containing Stori

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Stori in 1 CB Insights research brief, most recently on Jul 22, 2022.

Expert Collections containing Stori

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Stori is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Payments

3,123 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,662 items

Excludes US-based companies

Digital Banking

1,105 items

Challenger bank offer digitally native banking products (checking and savings account at the most basic) and either leverage partner banks or are fully-licensed banks themselves.

Latest Stori News

Mar 26, 2025

以下为本次合作详细情况 Stori, el unicornio mexicano especializado en innovación financiera, en una nueva apuesta por la inclusión financiera, selló una importante alianza con AliExpress. Esta alianza estratégica tiene la misión de incentivar las compras en línea entre los usuarios mexicanos. Además, permitirá a los usuarios de la startup acceder a beneficios exclusivos para adquirir productos de calidad en AliExpress. Como primera acción de esta alianza, del 11 al 18 de noviembre, los clientes de Stori disfrutarán de beneficios únicos en AliExpress:un descuento de $80 MXN en su primera compra mayor a $200 MXN y un cashback del 10% para nuevos usuarios en sus primeras cinco compras. Además, los clientes podrán recibir un incremento temporal en sus líneas de crédito de hasta $4,000 MXN hasta el 30 de noviembre, impulsando tanto el consumo individual como el de emprendedores que buscan abastecerse para sus negocios. Stori y una alianza que impulsa la inclusión financiera «En AliExpress, nos motiva hacer que el comercio global sea accesible para más personas. Vemos esta colaboración como el primer paso de muchas acciones de la mano con Stori.Queremos brindar a los usuarios acceso seguro y fluido a sus productos favoritos«, menciona Briza Rocha, directora latinoamericana de AliExpress. Para Stori, esta colaboración refuerza su misión de inclusión financiera en México y su compromiso con los consumidores y emprendedores que buscan calidad y precios accesibles en sus compras. «En Stori, creemos firmemente en la inclusión financiera como un catalizador de desarrollo. Esta alianza buscasumar beneficios para ampliar el acceso a productos de buena calidad a precios accesibles, beneficiando a los usuarios finales y a quienes buscan excelentes productos tecnológicos«, señaló Alejandro Berman, vicepresidente de Marketing y Adquisición de Stori. Un futuro compartido de crecimiento en el ecommerce AliExpress y Stori planean expandir esta alianza con más iniciativas que beneficien a los usuarios de ambas plataformas. AliExpress tiene como meta posicionarse en México como un aliado clave en el estilo de vida de los consumidores y emprendedores, proyectando para 2025 un comercio digital accesible y respaldado por opciones de financiamiento. Por su parte, Stori continúa su camino hacia la consolidación en el mercado financiero digital, con un 2024 enfocado en fortalecer la economía digital mexicana y apoyar a emprendedores en la adquisición de productos tecnológicos. Con esta alianza, Stori reafirma su papel como referente en inclusión financiera en el país.

Stori Frequently Asked Questions (FAQ)

When was Stori founded?

Stori was founded in 2019.

Where is Stori's headquarters?

Stori's headquarters is located at 213 Juarez Colonia, Cuauhtemoc, Mexico City.

What is Stori's latest funding round?

Stori's latest funding round is Debt - III.

How much did Stori raise?

Stori raised a total of $666.5M.

Who are the investors of Stori?

Investors of Stori include Lightspeed Venture Partners, General Catalyst, BAI Capital, Notable Capital, Tresalia Capital and 11 more.

Who are Stori's competitors?

Competitors of Stori include Uala, Aplazo, Vexi, C6 Bank, Klar and 7 more.

Loading...

Compare Stori to Competitors

Fondeadora is a financial technology company that provides personal and corporate banking solutions. The company offers a platform that allows users to open personal and business debit accounts and earn interest on their savings. Fondeadora primarily serves individuals and businesses seeking financial services. It was founded in 2011 and is based in Mexico City, Mexico.

Cuenca offers electronic funds payment accounts within the digital banking sector. Its services include easy account opening, SPEI bank transfers, bill payments, and 24/7 access to funds through a mobile app. Cuenca provides various account levels to meet different customer needs, from those making cash deposits to those receiving regular transfers. Cuenca was formerly known as Cuenca Health. It was founded in 2018 and is based in Mexico City, Mexico.

Banamex offers financial services to companies and individuals, including commercial banking and investment, insurance, and investment management. Banamex was formerly known as Citibanamex. It was founded in 1884 and is based in Santa Fe, Mexico.

Banco Original specializes in providing digital banking services for both individual and corporate clients. The bank offers a range of financial products, including online account opening, personalized credit solutions, and specialized services for the agribusiness sector. It caters to large enterprises and the agricultural industry with tailored financial services and support. It was founded in 2001 and is based in Sao Paulo, Brazil.

Finsus is a financial services company focused on providing digital solutions for savings, investment, and credit services. The company offers financial products including savings accounts, investment opportunities with interest rates, and credit schemes. Finsus serves individuals and businesses seeking financial services. It was founded in 2013 and is based in Benito Juarez, Mexico.

Prex is a financial technology company that offers digital banking services within the fintech sector. The company provides an international prepaid Mastercard, digital account management, real-time transaction alerts, foreign currency exchange, and the ability to send and receive money globally. Prex's services are aimed at individuals who utilize digital financial services. It was founded in 2015 and is based in Montevideo, Uruguay.

Loading...