StockGro

Founded Year

2020Stage

Debt | AliveTotal Raised

$61.66MLast Raised

$24.66M | 1 yr agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+39 points in the past 30 days

About StockGro

StockGro focuses on financial education in the domain of stock trading and investing. The company offers a trading platform where users can learn about stock market trading and investing from industry experts, build their portfolios, and engage in social trading. The primary customers of. It was founded in 2020 and is based in Bengaluru, India.

Loading...

StockGro's Product Videos

StockGro's Products & Differentiators

Gaming

StockGro is a play to earn & learn platform with free trading & investing competitions for users of varying expertise. It appeals to all stock market enthusiasts keen about experiencing live stock market & earning money without taking any risks.

Loading...

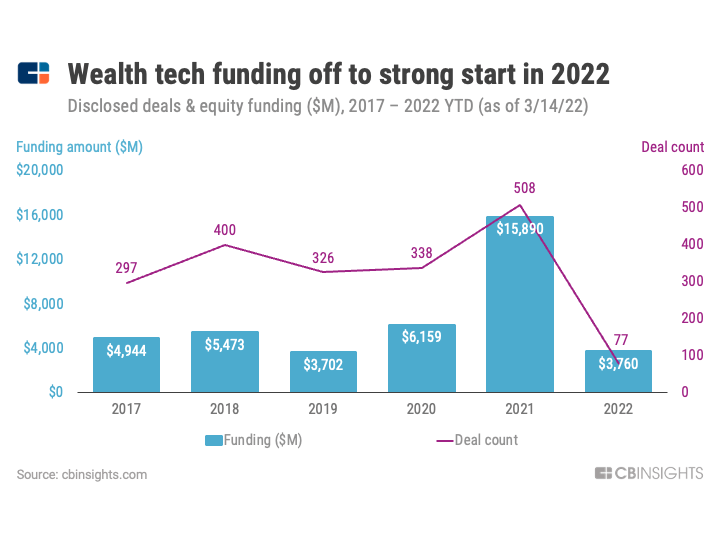

Research containing StockGro

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned StockGro in 2 CB Insights research briefs, most recently on Oct 4, 2022.

Oct 4, 2022 report

The Fintech 250: The most promising fintech companies of 2022Expert Collections containing StockGro

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

StockGro is included in 2 Expert Collections, including Wealth Tech.

Wealth Tech

2,367 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Fintech 100

349 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest StockGro News

Feb 25, 2025

experience prefer a mix of real estate, gold, and equity investments, according to a report by StockGro and 1Lattice. The study highlights how investment preferences shift with experience. It shows that Investors with less than a year of experience allocate nearly half (48 per cent) of their funds to mutual funds and 31 per cent to stocks. In contrast, only 13 per cent of their portfolio is dedicated to gold and silver, and just 6 per cent to real estate. On the other hand, experienced investors--those with over 10 years in the market--show a different approach. They invest only 25 per cent in mutual funds but allocate more to real estate (17 per cent) and gold and silver (18 per cent). This indicates a preference for stable assets among seasoned investors, while newer investors lean towards high-risk, high-return opportunities. The increasing interest in stocks is reflected in the surge of demat accounts in India. The report mentioned that the number of demat accounts more than doubled post-COVID-19, rising from 3.6 crore in March 2019 to 7.7 crore in November 2021. A significant portion of these accounts belong to first-time investors under the age of 30, highlighting a growing appetite for equities. Additionally, trading in futures and options (F&O) saw a 500 per cent increase between FY19 and FY21. However, 90 per cent of traders reported losses, underlining the need for financial literacy and technical expertise. The report also sheds light on the reasons behind investment choices. About 42 per cent of investors focus on long-term wealth creation, while 32 per cent seek passive income. Another 20 per cent invest for upskilling, and 6 per cent aim to beat inflation. Stock market participation remains strong, the survey in the report stated that 81 per cent of surveyed investors having invested in equities. Notably, 45 per cent of young investors (under 35) now prefer stocks as their primary investment, marking a shift from traditional savings instruments to direct equity investments. This change is driven by improved financial awareness, better access to investment tools, and a rising focus on wealth creation. Overall, newer investors are more focused on stocks and mutual funds, while experienced investors diversify their portfolios with real estate and gold. The report suggests that financial knowledge and experience play a crucial role in shaping investment strategies over time. (ANI)

StockGro Frequently Asked Questions (FAQ)

When was StockGro founded?

StockGro was founded in 2020.

Where is StockGro's headquarters?

StockGro's headquarters is located at WeWork Galaxy, 43, Residency Road, Bengaluru.

What is StockGro's latest funding round?

StockGro's latest funding round is Debt.

How much did StockGro raise?

StockGro raised a total of $61.66M.

Who are the investors of StockGro?

Investors of StockGro include Hindustan Media Ventures, Trifecta Capital Advisors, Nitish Mittersain, U1 Technologies, General Catalyst and 16 more.

Who are StockGro's competitors?

Competitors of StockGro include Public, eToro, Bullspree, StockPe, Cuanz and 7 more.

What products does StockGro offer?

StockGro's products include Gaming and 2 more.

Loading...

Compare StockGro to Competitors

Shares is a social investing platform that operates within the financial services industry. The company offers a mobile application that allows users to invest in a wide range of US stocks and facilitates the sharing of investment insights within a community. Shares primarily cater to individual investors seeking to engage with a community for better financial decision-making. It was founded in 2021 and is based in Paris, France.

Stocktwits is a social network tailored for investors and traders across various asset classes, operating within the financial services sector. The company offers a platform for real-time stock and cryptocurrency market data, sentiment analysis, and community discussions, enabling users to connect, share insights, and manage their investment portfolios. Stocktwits primarily serves individual investors, traders, and the broader social finance community. It was founded in 2008 and is based in New York, New York.

Spiking is an investment platform that focuses on stock trading, options, and cryptocurrency, utilizing AI technology for trading strategies. The company provides services such as insider data, trading strategies, and investment education programs aimed at individual investors. Spiking caters to the retail investment community, offering resources for investment decision-making. It was founded in 2016 and is based in Singapore.

Appreciate is an online trading and investment platform that focuses on providing access to US equities and financial markets. The company offers a range of services that include automated SIPs, AI-driven recommendations for low-cost ETFs, and the ability to invest in global stocks with micro-investments. It provides advanced trading analytics, secure transaction processing, and educational resources to help users make informed investment decisions. It was founded in 2019 and is based in Gandhinagar, India.

Bullspree is a company focused on stock market education through a gamified learning experience, operating within the edtech and fintech sectors. The company offers a virtual trading platform where users can participate in stock market contests, create virtual portfolios, and learn trading strategies in a risk-free environment. Bullspree primarily caters to individuals seeking to enhance their knowledge of the stock market and trading practices. It was founded in 2020 and is based in Ahmedabad, India.

Bitso specializes in cryptocurrency transactions and borderless payments. The company offers a platform for buying, selling, and trading a variety of cryptocurrencies, as well as facilitating crypto-based international transfers. Bitso primarily serves individuals and businesses looking to utilize cryptocurrencies for investment, trading, and payment solutions. It was founded in 2014 and is based in Mexico City, Mexico.

Loading...