Spiber

Founded Year

2007Stage

Unattributed - XI | AliveTotal Raised

$1.068BLast Raised

$65.26M | 1 yr agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+186 points in the past 30 days

About Spiber

Spiber focuses on creating structural protein solutions. The company develops the Brewed Protein™ platform, a material solution inspired by nature's diversity, using precision fermentation to engineer proteins. Spiber's materials are tailored to meet specific needs in various industries, including apparel, food, and automotive. It was founded in 2007 and is based in Tsuruoka, Japan.

Loading...

ESPs containing Spiber

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The bio-based textile manufacturing market uses material science and new production processes to develop alternative apparel fabrics. The fabrics are typically made from renewable resources, such as plants, mushrooms, agricultural waste, or bio-based polymers. They offer brands alternatives to materials such as petroleum-based polyester and animal leather. This market aims to reduce the environmen…

Spiber named as Leader among 14 other companies, including Newlight Technologies, Bolt Threads, and AMSilk.

Loading...

Research containing Spiber

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Spiber in 1 CB Insights research brief, most recently on Jul 26, 2023.

Jul 26, 2023

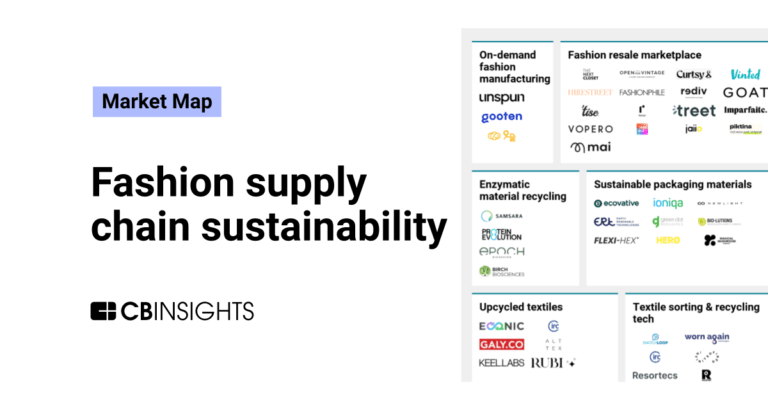

The fashion supply chain sustainability market mapExpert Collections containing Spiber

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Spiber is included in 2 Expert Collections, including Luxury Tech.

Luxury Tech

419 items

Tech-enabled companies launching new luxury brands, as well as startups providing tech solutions to the luxury industry, including e-commerce tools, marketing, and more. While these companies may not exclusively target luxury companies, they have notable luxury partners.

Unicorns- Billion Dollar Startups

1,270 items

Spiber Patents

Spiber has filed 118 patents.

The 3 most popular patent topics include:

- silk

- synthetic fibers

- woven fabrics

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

9/27/2019 | 1/14/2025 | Silk, Woven fabrics, Fibers, Sheep breeds, Proteins | Grant |

Application Date | 9/27/2019 |

|---|---|

Grant Date | 1/14/2025 |

Title | |

Related Topics | Silk, Woven fabrics, Fibers, Sheep breeds, Proteins |

Status | Grant |

Latest Spiber News

Mar 6, 2025

[Disclosure: AgFunder is AgFunderNews’ parent company.] We’d all be forgiven for assuming the next batch of agrifoodtech investment data would be dismal. After all, the sector has been in freefall for the last few years, pulled down by macroeconomic trends and venture capital investor disenchantment , not to mention a pullback across venture capital more broadly. All of that still exists, and it’s now compounded by geopolitical tensions, tariff wars , and the ever-present threat of climate change. But at least when it comes to agrifoodtech investment, there are some signs of recovery. Global agrifoodtech investment reached $16 billion in 2024, according to a new report from AgFunder . While this is nowhere near the record-breaking $51 billion in 2021 , nor even at pre-pandemic levels, it’s nonetheless just a 4% drop from 2023 . The numbers suggest a slowing — though not necessarily a full stop — to the freefall. Increased investment in developed markets such as the US and the Netherlands and developing nations such as India hints at better days to come. However, we’re not out of the woods yet: some markets were still significantly down, including China, the UK, and Spain. Source: AgFunder Global AgriFoodTech Investment Report 2025 Downstream ahead in 2024 Upstream categories — those closest to the farm or lab — continued to outpace those downstream in 2024, taking 51% of total funding over 1,265 deals. Yet investment upstream declined 22% year-on-year, with the worst-hit areas being Bioenergy & Biomaterials as well as Novel Farming Systems; both posted 50%+ drops in funding compared to 2023. Meanwhile, downstream categories — those closest to the consumer — increased their share of total agrifoodtech funding, with investment increasing 38% year-over-year in 2024. What’s more, eGrocery retook the title of top-funded category for the year after losing it to Bioenergy & Biomaterials in 2023 . eGrocery accounted for almost 12% of all agrifoodtech investment in 2024, and a 17% increase year-over-year. Counterintuitively, the biggest decline in the number of deals closed came in the downstream sectors, where just 497 deals closed, a 37% year-over-year decrease. However, 14% YoY increase in the median deal size downstream helped push totals up. Upstream startups closed 1,265 deals, a more muted 16% drop compared to 2023 deal activity. Source: AgFunder Global AgriFoodTech Investment Report 2025 US leads global funding, India leads developing markets The US once again topped the list for global agrifoodtech investment, with startups there garnering almost half ($6.6 billion) of all capital raised in 2024, a 14% increase on 2023. Other countries posting increases included India (+215%), the Netherlands (+118%), Finland (+403%), and Japan (+76%). India, home to nearly 18% of the world’s population, rose from fourth to second place in 2024, reeling in $2.5 billion. The figure is on par with pre-pandemic levels, though much of it was due to a few sizeable late-stage deals from food delivery and eGrocery startups. India also garnered the majority of funding for developing markets, which are defined in the report (with the exception of China and South Korea) as those part of the United Nations’ intergovernmental organization G77 . Source: AgFunder AgriFoodTech Investment Report 2025 Elsewhere, Finland posted positive growth, thanks mostly to a $260 million deal for aquaculture company Finnforel. In Japan, alternative materials giant and fashion darling Spiber raised a $65 million round that boosted Japan’s growth. Key takeaways Deal count dropped 24% year-over-year, with the greatest drop in downstream categories. Investment increased in five countries: United States (+14%), India (+215%), the Netherlands (+118%), Finland (+403%), Japan (+76%). Investment in downstream categories accounted for much of the increase, up 20% year-over-year, to take 38% of total agrifoodtech funding. Midstream Tech was also up, 41% YoY, accounting for 11% of the sector with 269 deals. Upstream categories continued to outpace those downstream, taking 51% of total agrifoodtech funding in 2024 over 1,265 deals, yet funding dropped 22% YoY. eGrocery reclaimed its spot as the top-funded category in 2024, accounting for almost 12% of all agrifoodtech investment, and a 17% increase year-over-year. Cloud Retail Infrastructure was the fastest-growing category of the year, recording a 45% increase in total investment across 52 deals. Novel Farming Systems funding declined the most, down 53% YoY. Ag Biotechnology, with $1.9 billion, was the best-funded Upstream category in 2024 despite a 12% YoY drop in funding. North America (US & Canada) was the only region among developed markets to show a positive trend in total funding, growing 10% YoY. The United States was the best-performing developed market, raising $6.6 billion, followed by China with $848 million, and the United Kingdom with $616 million. Up an impressive 202%, South Asia was the only developing market region to post growth, thanks in large part to India, which accounted for 70% of developing markets’ total funding. India led developing markets, thanks to a 208% growth in total funding with $2.5 billion across 218 deals. Early-stage investment accounted for 1,556 deals (77%) out of the total 2,031 deal count in 2024, growth stage contributed 246 deals (12%), while D+ stages provided 83 deals (4%); debt financing recorded 146 deals (7%). Download the full 77-page report here . Share this article

Spiber Frequently Asked Questions (FAQ)

When was Spiber founded?

Spiber was founded in 2007.

Where is Spiber's headquarters?

Spiber's headquarters is located at 234-1 Minakami, Kakuganji, Yamagata Prefecture, Tsuruoka.

What is Spiber's latest funding round?

Spiber's latest funding round is Unattributed - XI.

How much did Spiber raise?

Spiber raised a total of $1.068B.

Who are the investors of Spiber?

Investors of Spiber include Kanematsu, Komatsu Matere, The Yamagata Bank, Cool Japan Fund, Carlyle and 22 more.

Loading...

Loading...