Investments

2442Portfolio Exits

62Funds

8Partners & Customers

7About SOSV

SOSV operates as a venture capital firm with a focus on deep technology aimed at improving human and planetary health. The company provides multi-stage investments and operates startup development programs, such as HAX and IndieBio, to accelerate product development and scale innovative technologies. SOSV's programs support startups in sectors like hard tech and life sciences, offering expertise, lab facilities, and supply chain access. It was founded in 1995 and is based in Princeton, New Jersey.

Expert Collections containing SOSV

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find SOSV in 4 Expert Collections, including Direct-To-Consumer Brands (Non-Food).

Direct-To-Consumer Brands (Non-Food)

37 items

Startups selling their own branded products directly to consumers via online/mobile channels, rather than relying on department stores or big online marketplaces.

Synthetic Biology

382 items

Food & Beverage

123 items

Game Changers 2018

20 items

Research containing SOSV

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned SOSV in 7 CB Insights research briefs, most recently on Jul 3, 2024.

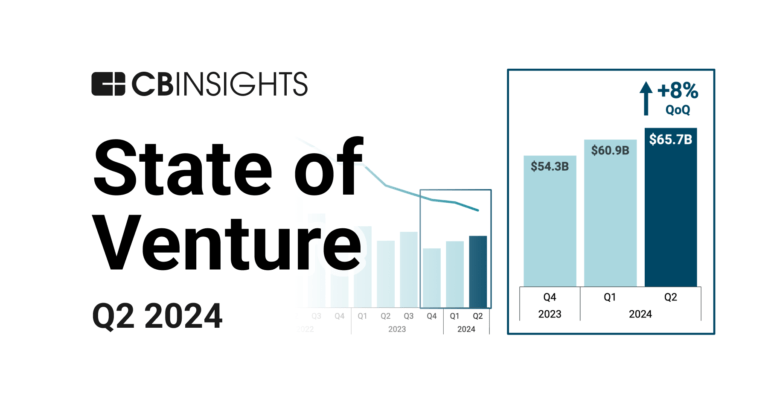

Jul 3, 2024 report

State of Venture Q2’24 Report

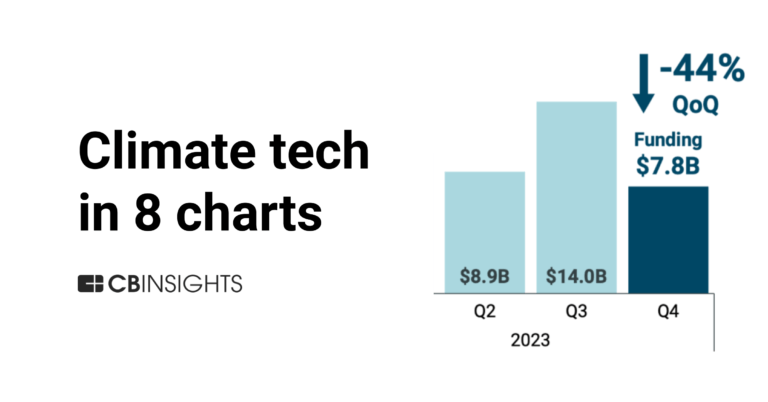

Mar 12, 2024

Climate tech in 8 charts: 2023

Dec 8, 2023 report

The top 25 most successful startup accelerators

Oct 10, 2023 report

The most active startup accelerators and where they’re investing

Jul 26, 2023 report

State of Digital Health Q2’23 Report

Oct 11, 2022 report

State of Venture Q3’22 ReportLatest SOSV News

Feb 20, 2025

February 12, 2025 Sabriya Stukes, Partner, SOSV & Chief Scientific Officer, IndieBio, Alexander Hall-Daniels, Principal, IndieBio, Deborah Zajac, General Partner, SOSV and IndieBio NY, Stephen Chambers, General Partner, SOSV & Managing Director, IndieBio NY IndieBio NY launched in 2020 thanks to a five-year, $25M grant from New York State’s Empire State Development. The mission was to bring the startup savvy of SOSV’s IndieBio startup development program, first established in San Francisco, to the life sciences ecosystem in New York. Not long after our start, COVID struck, necessitating much improvisation in how we worked with founders and delaying the development of our 25,000 sq. ft. office, event and lab space near Penn Station . When I think back on those really difficult days, it’s incredible to realize that five years later we have 80 IndieBio NY alums and they have raised more than $180 million, including $47 million from SOSV. That’s on par with the early years at IndieBio SF, not that we’re competing! And true to our mission to encourage more life science startups in New York, 32% of the founders are from NY, 24% joined us from overseas, and 44% landed here from elsewhere in the U.S. Our program is more popular than ever and our alumni ranks are growing fast, as is the workload for the New York team. For the past year, we’ve been hunting for a second SOSV general partner to join me at IndieBio NY, and I am happy to report that the search is complete. “At GE Ventures and Columbia University’s research labs, she guided “science” out of the lab and into the market, investing and building businesses from seed to growth stage in deep tech…” What we see in Deborah is 20 years of investing experience that is fantastically well-suited to our work here at SOSV and the IndieBio NY program. At GE Ventures and Columbia University’s research labs, she guided “science” out of the lab and into the market, investing and building businesses from seed to growth stage in deep tech, healthcare, industrial, energy, consumer, and digital solutions for a decade. Her prior experience in operations and consulting for industrial companies at GE, Celarix.com, and Andersen has made her an invaluable partner to founders. Deborah Zajac, General Partner, SOSV and IndieBio NY For the past nine years, Deborah has helped build Touchdown Ventures (now Cerity Partners Ventures after a merger with Cerity Partners), into a multi-sector, multi-stage corporate venture capital firm that has managed over 25 venture programs in 5 sectors, including ag & food, the built world, healthcare, industrial, and IT & media. Deborah co-founded the healthcare sector practice and 5 corporate venture programs, and has worked with 12 corporations on 15 funds. Her experience in corporate venture is very welcome at SOSV, where a rapidly growing contingent of corporate investors invest in our portfolio companies’ series seed and A rounds. Deborah earned her MBA in Finance and Entrepreneurship from NYU’s Stern School of Business and her BS and BA from Lehigh University, where she was an Iacocca and Trustee Scholar. She has since served as a Lehigh trustee and founding advisor to the nationally-ranked Baker Institute for Entrepreneurship, Creativity, and Innovation and as an Exec-In-Residence at Columbia Technology Ventures. Deborah is from the Northeast and is an enthusiastic traveler. She has visited over 60 countries, 40 states and, in a former life, lived in Tokyo. She has worked with corporations, NGOs, and governments in 25 countries. One of her superpowers, which SOSV will embrace with open arms, is a superb record negotiating difficult partnerships and investments around the globe. Please join us in welcoming Deborah Zajac as the tenth general partner at SOSV. Did you know?

SOSV Investments

2,442 Investments

SOSV has made 2,442 investments. Their latest investment was in VISION IV as part of their Seed VC on March 25, 2025.

SOSV Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

3/25/2025 | Seed VC | VISION IV | Yes | |||

3/21/2025 | Convertible Note - II | Q5D Technology | No | |||

3/21/2025 | Seed VC | NavLive | Yes | |||

3/21/2025 | Seed VC | |||||

3/19/2025 | Series A |

SOSV Portfolio Exits

62 Portfolio Exits

SOSV has 62 portfolio exits. Their latest portfolio exit was Trikl on October 29, 2024.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

10/29/2024 | Acquired | 2 | |||

9/25/2024 | Acquired | 3 | |||

3/11/2024 | Acquired | 4 | |||

Date | 10/29/2024 | 9/25/2024 | 3/11/2024 | ||

|---|---|---|---|---|---|

Exit | Acquired | Acquired | Acquired | ||

Companies | |||||

Valuation | |||||

Acquirer | |||||

Sources | 2 | 3 | 4 |

SOSV Fund History

8 Fund Histories

SOSV has 8 funds, including SOSV V Fund.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

4/16/2024 | SOSV V Fund | $306M | 2 | ||

6/11/2021 | SOSV Select Fund | ||||

12/12/2019 | SOSV IV | ||||

10/15/2019 | SOSV IV-A | ||||

1/3/2017 | SOSV III |

Closing Date | 4/16/2024 | 6/11/2021 | 12/12/2019 | 10/15/2019 | 1/3/2017 |

|---|---|---|---|---|---|

Fund | SOSV V Fund | SOSV Select Fund | SOSV IV | SOSV IV-A | SOSV III |

Fund Type | |||||

Status | |||||

Amount | $306M | ||||

Sources | 2 |

SOSV Partners & Customers

7 Partners and customers

SOSV has 7 strategic partners and customers. SOSV recently partnered with Bioeutectics on December 12, 2023.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

12/18/2023 | Partner | Argentina | |||

2/2/2023 | Partner | ||||

10/2/2020 | Partner | ||||

11/7/2019 | Partner | ||||

2/25/2019 | Partner |

Date | 12/18/2023 | 2/2/2023 | 10/2/2020 | 11/7/2019 | 2/25/2019 |

|---|---|---|---|---|---|

Type | Partner | Partner | Partner | Partner | Partner |

Business Partner | |||||

Country | Argentina | ||||

News Snippet | |||||

Sources |

SOSV Team

16 Team Members

SOSV has 16 team members, including , .

Name | Work History | Title | Status |

|---|---|---|---|

Sean O'Sullivan | Founder | Current | |

Name | Sean O'Sullivan | ||||

|---|---|---|---|---|---|

Work History | |||||

Title | Founder | ||||

Status | Current |

Compare SOSV to Competitors

500 Global operates a venture capital firm. It is an early-stage seed fund that invests primarily in consumer and small and medium business (SMB) internet companies and related web infrastructure services. It prefers to invest in media, consumer services, computer hardware, software, commercial services, software-as-a-service, mobile, financial technology, big data, the internet of Things (IoT), and e-commerce sectors. It was founded in 2010 and is based in San Francisco, California.

Y Combinator operates as a seed-stage venture firm. It specializes in funding early-stage startups, primarily in software and web services. It works intensively with the companies for three months to refine their pitch to investors. It was founded in 2005 and is based in Mountain View, California.

Techstars works as a global network. It focuses on helping early-stage startups succeed in various industries, including technology and finance. The company offers accelerator programs, investment opportunities, and mentorship to support startups in areas such as capital access, customer acquisition, and talent recruitment. Techstars serves a diverse range of sectors, providing resources and guidance to entrepreneurs worldwide. It was founded in 2006 and is based in New York, New York.

Founders Factory operates in the fintech, climate, health, and deep tech sectors. It provides capital investment and dedicated operational support to startups, leveraging a network of industry-leading corporate partners. Founders Factory primarily serves sectors such as fintech, climate solutions, healthcare innovation, and deep technology. It was founded in 2015 and is based in London, United Kingdom.

Seedcamp provides venture capital funds to support startups in the pre-seed and seed stages. The firm invests in companies and encourages them across the product market fit, traction, growth, and scale stages from seed funding to initial public offerings (IPO). The company was founded in 2007 and is based in London, United Kingdom.

Entrepreneur First operates as a startup incubator in the business services sector. The company primarily focuses on bringing together and funding exceptional individuals to help them meet co-founders, develop ideas, and raise money from leading investors. Its services are mainly utilized by the startup industry. It was founded in 2011 and is based in London, United Kingdom.

Loading...