Solana

Founded Year

2018Stage

Shareholder Liquidity | AliveTotal Raised

$22.59MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+10 points in the past 30 days

About Solana

Solana provides a blockchain platform that enables the processing of transactions, catering to both power users and new consumers. It facilitates game tooling, payment tooling, financial infrastructure, and more. Its services are primarily utilized in the cryptocurrency and decentralized applications industries. The company was founded in 2018 and is based in San Francisco, California.

Loading...

ESPs containing Solana

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The layer-1 blockchains market focuses on the development and adoption of blockchain platforms at the foundational layer of the blockchain technology stack. The market consists of various blockchain platforms that offer unique value propositions, such as high performance use cases, optimized payments and asset issuance, and economic identity for the unbanked. These platforms aim to provide fast, s…

Solana named as Leader among 15 other companies, including Consensys, Algorand Technologies, and Avalanche.

Solana's Products & Differentiators

Solana Saga

Saga is a flagship Android mobile phone with unique functionality and features tightly integrated with the Solana blockchain making it easy and secure to transact in web3 and manage digital assets, such as tokens and NFTs.

Loading...

Research containing Solana

Get data-driven expert analysis from the CB Insights Intelligence Unit.

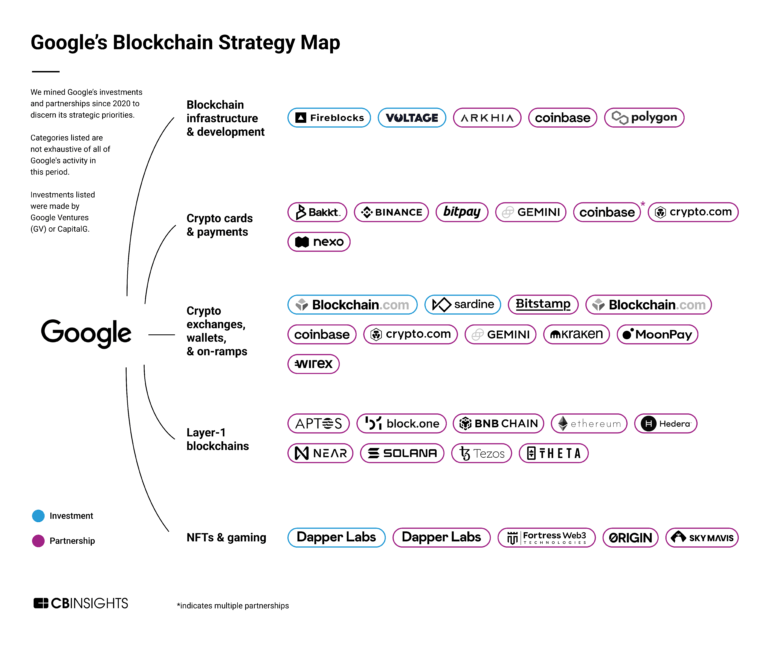

CB Insights Intelligence Analysts have mentioned Solana in 2 CB Insights research briefs, most recently on Dec 20, 2022.

Expert Collections containing Solana

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Solana is included in 2 Expert Collections, including Blockchain.

Blockchain

12,849 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Blockchain 50

50 items

Solana Patents

Solana has filed 14 patents.

The 3 most popular patent topics include:

- blockchains

- cryptocurrencies

- cryptography

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

12/9/2022 | 1/7/2025 | Cryptography, Cryptocurrencies, Blockchains, Payment systems, Cryptographic hash functions | Grant |

Application Date | 12/9/2022 |

|---|---|

Grant Date | 1/7/2025 |

Title | |

Related Topics | Cryptography, Cryptocurrencies, Blockchains, Payment systems, Cryptographic hash functions |

Status | Grant |

Latest Solana News

Mar 22, 2025

As Bitcoin trades in a narrow range, the implications for the altcoin market remain uncertain, with potential reactions hinging on Bitcoin's price action. Notably, BlackRock's Robbie Mitchnick stated that institutional clients view current market conditions as a potential buying opportunity despite economic challenges. This article reviews Bitcoin's recent price movements and the potential impact on altcoins amid mixed market signals, with insights from industry experts. Bitcoin's Ongoing Price Struggle Amid Mixed Signals Bitcoin's recent attempts to regain momentum have been hindered at the resistance level, pointing to persistent selling pressure from the bears. Trading resource Material Indicators noted the role of a prominent investor, referred to as “Spoofy the Whale,” in keeping Bitcoin's price below this psychological barrier. Despite these challenges, analysts such as BitMEX co-founder Arthur Hayes suggest that Bitcoin's recent low around could mark a significant bottom, especially in light of the Federal Reserve's decision to ease quantitative tightening. Analyzing Altcoin Reactions to Bitcoin's Performance The current trading dynamics for Bitcoin are crucial not just for its own trajectory but also for the broader altcoin ecosystem. As Bitcoin struggles to break through the level, questions linger about how altcoins will respond. Historical correlations point towards altcoins typically following Bitcoin's lead, but with recent market complexities, their reactions may vary widely. Bitcoin Price Trends: Key Levels to Watch The BTC/USDT pair recently demonstrated volatility, breaking above the 20-day exponential moving average (EMA) at on March 19, only to face a strong rejection at resistance. Should the price fall below the uptrend line, the next support targets are and , potentially drawing in buyers. Conversely, a rebound that breaches could lead to significant upside momentum, with targets at and the critical mark. Ethereum's Ambiguous Position in the Market Ethereum has also seen a retest at the 20-day EMA of , indicating bearish pressure at these levels. A drop below could signal further declines towards . However, a bounce back above could pave the way for a rally toward . With ETH exhibiting such volatility, traders should remain vigilant. Ripple's Daily Struggles Amid Market Sentiment XRP has recently faced challenges in maintaining upward momentum despite breaching moving averages. The critical 20-day EMA is currently at , with bearish sentiment dominant. A failure to hold this level could see the XRP/USDT pair retracing to , reinforcing support at BNB's Potential Resurgence Following Dips Recent bullish activity has seen BNB pull back to the 20-day EMA at , attracting dip buyers. The potential for a breakout above could lead BNB towards , but a failure to hold the 20-day EMA could lead to declines towards Market Dynamics of Solana and Cardano Solana's drop from the 20-day EMA at highlights bears' control, with significant support expected at . Cardano, on the other hand, could face a retracement toward the uptrend line if current resistance holders prevail, potentially leading the ADA/USDT pair toward Dogecoin's Fear of Lower Supports Dogecoin continues to struggle at the 20-day EMA ($0.18), with critical support seen at . A fall below this level may set the stage for a deeper descent to . A definitive break above the 20-day EMA could signal a return of bullish momentum. Chainlink's Price Action under Pressure Chainlink recently surged above its 20-day EMA only to fall back, indicating selling pressure. The vital support at is currently under threat; should it break, it could lead to further downside. Conclusion The ongoing fluctuations in Bitcoin's price are pivotal not just for its immediate future but also for the collective behavior of altcoins. Observers should monitor key resistance and support levels closely. A potential breakout could have broad implications for market recoveries, while sustained bearish actions will likely lead to lower price targets across the spectrum of cryptocurrencies. Don't forget to enable notifications for our Twitter account and Telegram channel to stay informed about the latest cryptocurrency news. Source: https://en.coinotag.com/bitcoin-faces-resistance-at-87500-analysts-explore-potential-outcomes-for-altcoins-and-market-dynamics/

Solana Frequently Asked Questions (FAQ)

When was Solana founded?

Solana was founded in 2018.

Where is Solana's headquarters?

Solana's headquarters is located at 530 Divisadero Street, San Francisco.

What is Solana's latest funding round?

Solana's latest funding round is Shareholder Liquidity.

How much did Solana raise?

Solana raised a total of $22.59M.

Who are the investors of Solana?

Investors of Solana include 500 Global, FJ Labs, Alameda Research, CoinShares, SeaX Ventures and 19 more.

Who are Solana's competitors?

Competitors of Solana include Polygon, Category Labs, Taiko, Avalanche, CasperLabs and 7 more.

What products does Solana offer?

Solana's products include Solana Saga and 2 more.

Loading...

Compare Solana to Competitors

Ethereum is a decentralized platform that allows the creation and execution of smart contracts and decentralized applications (dApps) on its blockchain. The platform supports cryptocurrency transactions, digital asset management, and the development of various blockchain-based applications, including those for finance, gaming, and social interaction. Ethereum's infrastructure enables the tokenization of assets and the operation of decentralized finance (DeFi) services, while also addressing user privacy and data security. It was founded in 2014 and is based in Zug, Switzerland.

Polygon builds aggregated blockchains and scaling solutions for the blockchain industry. The company's offerings include layer 2 scaling solutions for Ethereum, using zero-knowledge technology to improve scalability and security. It develops a framework that allows for the development of applications within the web3 ecosystem. Polygon was formerly known as Matic Network. It was founded in 2017 and is based in Camana Bay, Cayman Islands.

Cardano Foundation is a nonprofit organization that works on Cardano as a public digital infrastructure in the blockchain sector. The company collaborates with institutions, businesses, regulators, and policymakers to provide enterprise solutions to improve traceability, authenticity, and sustainability in various industries. It was founded in 2016 and is based in Zug, Switzerland.

Algorand Technologies specializes in blockchain technology, focusing on the development of a high performance Layer-1 blockchain. The company offers a platform designed to support various applications with an emphasis on sustainability and powerful computing capabilities. It was founded in 2017 and is based in Singapore, Singapore.

Traent focuses on providing Web3 enterprise blockchain solutions across various industries. Its main offerings include the creation of hybrid blockchains for secure and private business interactions and no-code smart contract platforms for easy onboarding. It specializes in tailor-made solutions that simplify complex interactions and workflows for fact-driven enterprises. It was founded in 2020 and is based in Pisa, Italy.

Avalanche is a blockchain platform that enables the development of decentralized applications (dApps) across various sectors including finance, art, and gaming. The platform provides tools and services for the creation, deployment, and scaling of dApps. It was founded in 2018 and is based in Tortola, Virgin Islands (British).

Loading...