Socotra

Founded Year

2014Stage

Series C | AliveTotal Raised

$84.2MLast Raised

$50M | 4 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+2 points in the past 30 days

About Socotra

Socotra is a cloud-native insurance technology company that provides a core policy administration platform for the insurance industry. The company's main offerings include a platform for policy management, underwriting, billing, and claims, designed to integrate with various internal and external tools and data sources. Socotra primarily serves the insurance sector, providing solutions for insurers. It was founded in 2014 and is based in San Francisco, California.

Loading...

Socotra's Product Videos

ESPs containing Socotra

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The embedded insurance infrastructure market consists of tech vendors that offer products to enable insurance sales on third-party platforms via APIs (application programming interfaces). These companies sell their products to insurance providers or third-party platforms. Some embedded insurance infrastructure providers may also provide insurance (as a licensed carrier, managing general agent, or …

Socotra named as Leader among 15 other companies, including Bolttech, Igloo, and Cover Genius.

Socotra's Products & Differentiators

Socotra Connected Core

The only true cloud-native insurance platform, productized with publicly published open APIs and seamless automatic updates. Built to scale as your business grows, Socotra Connected Core accelerates your ability to bring innovative ideas to market while eliminating the inflexibility and expense of customized legacy software. Lower your total cost of ownership and get the control and flexibility needed to compete in today’s insurance market.

Loading...

Research containing Socotra

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Socotra in 8 CB Insights research briefs, most recently on Jun 7, 2024.

Dec 18, 2023

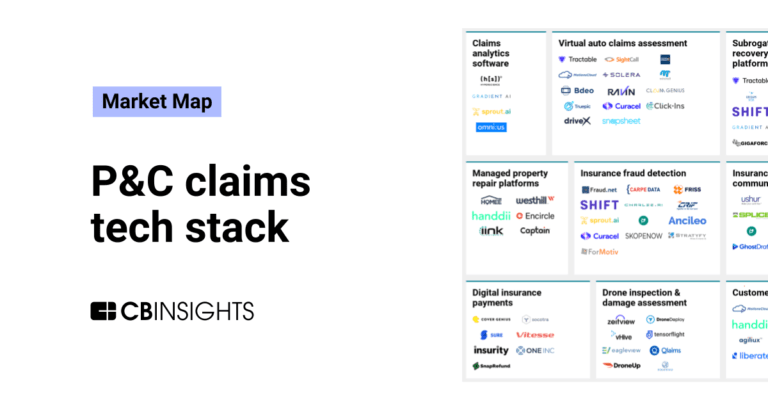

The P&C claims tech stack market map

Apr 13, 2022 report

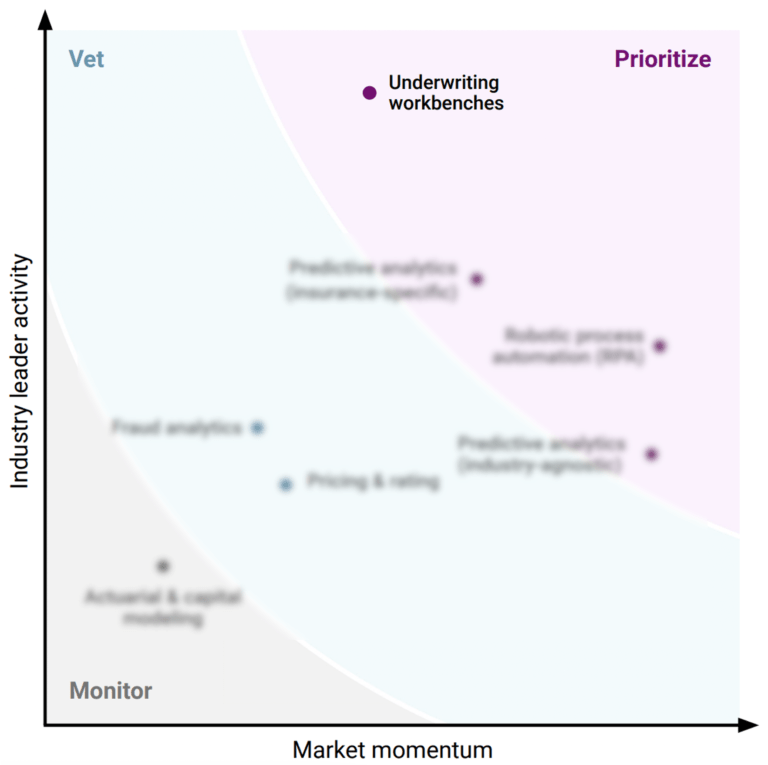

Why life insurance underwriters are prioritizing underwriting workbenchesExpert Collections containing Socotra

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Socotra is included in 5 Expert Collections, including Insurtech.

Insurtech

4,489 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,450 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Insurtech 50

100 items

Report: https://app.cbinsights.com/research/report/top-insurtech-startups-2022/

ITC Vegas 2024 - Exhibitors and Sponsors

699 items

Created 9/9/24. Updated 10.22.24. Company list source: ITC Vegas. Check ITC Vegas' website for final list: https://events.clarionevents.com/InsureTech2024/Public/EventMap.aspx?shMode=E&ID=84001

Latest Socotra News

Mar 3, 2025

Three Best Practices for Improving Reliability in Insurance Technology Insights by Sonny Patel, Chief Product and Technology Officer at Socotra. Today’s insurers rely on digital platforms to manage policies, interact with customers, and connect with partners. As a result, slow service and system outages can seriously impact the business. Uptime and reliability are no longer just technical metrics; they’re now essential for business continuity, customer satisfaction, and profitability. By focusing on reducing both planned and unplanned downtime, insurers can maintain a consistent, high-quality experience for customers and stay competitive in a rapidly evolving market. Here are three best practices for improving reliability in insurance technology. Reduce Unplanned Downtime with Cloud-Native Infrastructure Unplanned downtime refers to unforeseen system interruptions caused by factors like hardware failures, bugs, or human error. This type of downtime often happens during peak usage times, leading to significant business disruptions. Many insurers, as well as insurance core systems, have migrated to the cloud in an effort to improve reliability. However, these “lifted and shifted” systems miss out on the true benefits of the cloud, because they’re merely ported versions of on-premise software. To minimize the risk of unplanned downtime, insurers need to leverage a cloud-native core platform, which is architected from the ground up to provide built-in redundancy across availability zones and multi-site failover capabilities. This makes it much less likely that end customers will experience disruptions, even in the event of localized outages. Additionally, cloud-native platforms enable automated testing for every feature, across all customers. This comprehensive approach ensures that any potential issues are identified and addressed proactively, reducing the chances of unplanned downtime and keeping critical systems running smoothly. Minimize Planned Downtime by Implementing Frequent, Small Updates Planned downtime occurs when a system is intentionally taken offline to accommodate upgrades, configuration changes, data transformations, new integrations, customizations, or preventative maintenance. While it is an unavoidable part of keeping systems up-to-date and secure, minimizing the frequency and duration of planned downtime is key to maintaining continuous service delivery. Most core systems are bulky and monolithic, building their updates into large, once or twice-per-year events. These systems make updates—no matter how small—costly, resource-intensive, and prone to massive downtime. One of the most effective ways to reduce planned downtime is by implementing small, frequent updates, which can be tested more easily and rolled out more quickly than larger, more disruptive upgrades. Insurers can enable this approach to updates by choosing a cloud-native core platform that is built from the ground up to support small, self-contained updates. This practice of frequent updates—particularly when scheduled during off-peak hours—ensures that system downtime is kept to a minimum, typically lasting only a few minutes when necessary, and that business operations remain largely unaffected. Additionally, when updates are designed to be backwards compatible, insurers can avoid breaking changes that would otherwise require extended downtime to address. Case Study: Socotra Delivers Industry-Leading Reliability in 2024 Many insurers today are still struggling with reliability. A recent report showed that 30% of financial and insurance organizations experienced high-impact outages at least once per week. These companies also shared that outages generally took more than 30 minutes to resolve. Socotra, a provider of cloud-native core technology, can help insurers improve the reliability and resiliency of their operations. In 2024, we announced industry-leading reliability metrics for our global insurance customers: 99.9941% average uptime across all customers Less than 32 minutes of planned and unplanned downtime per customer Planned downtime includes 50 upgrades per customer Socotra’s consumer-grade reliability is built on the same technologies and techniques used by platforms like Gmail, LinkedIn, and Zoom. As a true cloud-native platform, we offer zero-downtime and backwards-compatible upgrades, as well as the industry’s most advanced resiliency capabilities. Conclusion As the insurance industry relies more on technology, ensuring systems are reliable and high-performing is key to maintaining trust and business continuity. By leveraging cloud-native infrastructure and making smaller and more frequent updates, insurers can reduce disruptions and deliver consistent service. Focusing on these strategies will ultimately boost efficiency, strengthen customer loyalty, and support growth. Insurers that prioritize performance and reliability can better position themselves to adapt to the digital age and meet changing customer needs. About Sonny Patel Sonny Patel is the Chief Product and Technology Officer at Socotra, where she leads the Product and Engineering teams and owns and executes on Socotra’s product strategy. She is a recognized thought leader in AI with over 20 years of experience building and launching products at Fortune 500 companies. Prior to Socotra, Sonny was an integral leader at Dell, Microsoft, Amazon, and LivePerson. She holds an MBA in Strategy & Entrepreneurship from the Haas School of Business at the University of California, Berkeley and a Master’s in Computer Science from Texas A&M University. Share this:

Socotra Frequently Asked Questions (FAQ)

When was Socotra founded?

Socotra was founded in 2014.

Where is Socotra's headquarters?

Socotra's headquarters is located at 33 New Montgomery Street, San Francisco.

What is Socotra's latest funding round?

Socotra's latest funding round is Series C.

How much did Socotra raise?

Socotra raised a total of $84.2M.

Who are the investors of Socotra?

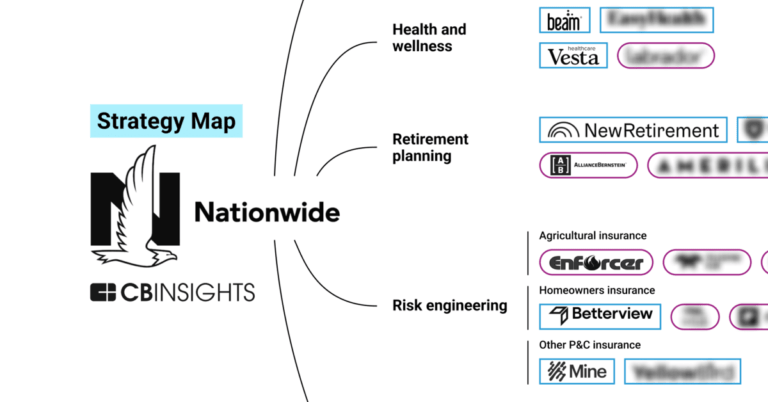

Investors of Socotra include MS&AD Ventures, 8VC, Nationwide Ventures, Portage Ventures, Brewer Lane Ventures and 4 more.

Who are Socotra's competitors?

Competitors of Socotra include OneShield, Wefox, Korint, Boost, Insly and 7 more.

What products does Socotra offer?

Socotra's products include Socotra Connected Core and 4 more.

Who are Socotra's customers?

Customers of Socotra include Lavalier (Berkley Asset Protection).

Loading...

Compare Socotra to Competitors

INSTANDA specializes in providing no-code software solutions for the insurance industry and focuses on policy administration and product technologies. The company offers a platform that enables carriers, MGAs, and brokers to design, build, and launch insurance products rapidly, with capabilities for seamless integration into existing systems. INSTANDA's platform is utilized by various sectors within the insurance industry, including property and casualty and life and health. It was founded in 2012 and is based in London, United Kingdom.

Majesco (NASDAQ: MJCO) provides core insurance technology software and information technology (IT) services to carriers worldwide. It delivers solutions and IT services in core insurance areas including policy administration, billing, claims, and distribution. The company was founded in 1982 and is based in Morristown, New Jersey.

OneShield provides core systems for property and casualty insurers, managing general agents, and startups within the insurance industry. The company offers cloud-based and SaaS platforms that include policy management, billing, claims, rating, relationship management, product configuration, business intelligence, and analytics. It was founded in 1999 and is based in Marlborough, Massachusetts.

Duck Creek Technologies operates as a solutions provider focused on the property and casualty (P&C) and general insurance industry. The company offers a cloud-based platform that supports insurance systems, enabling operations for the insurance sector. It was founded in 2000 and is based in Boston, Massachusetts.

Ebix provides on-demand software and e-commerce services to the insurance, financial, e-governance, e-learning, and healthcare industries. The company offers a range of services including infrastructure exchanges, enterprise systems, outsourced administrative and custom software development, as well as risk compliance solutions. Ebix was formerly known as Delphi Systems. It was founded in 1976 and is based in Johns Creek, Georgia.

CaseWare specializes in cloud-enabled audit, financial reporting, and data analytics solutions for various sectors within the accounting industry. The company provides tools that automate and streamline financial reporting, tax engagements, practice management, and audit processes to enhance efficiency and insights. It was founded in 1988 and is based in Toronto, Canada.

Loading...