Credit Key

Founded Year

2015Stage

Series B | AliveTotal Raised

$151.35MLast Raised

$15M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+53 points in the past 30 days

About Credit Key

Credit Key specializes in providing B2B credit solutions within the financial services sector. The company offers instant business credit at the point of purchase, enabling merchants to increase revenue and improve cash flow by providing their customers with flexible payment options such as net terms and pay over time. Credit Key primarily serves the eCommerce industry, offering a standalone module that integrates with various shopping cart platforms to facilitate real-time credit decisions and financing. It was founded in 2015 and is based in Los Angeles, California.

Loading...

Credit Key's Product Videos

_thumbnail.png?w=3840)

ESPs containing Credit Key

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The buy now pay later (BNPL) — B2B payments market offers flexible financing options for businesses to enhance their purchasing power and manage their working capital and cash flow by acquiring goods or services immediately and paying for them in installments over time. BNPL solutions in the B2B market provide streamlined application processes, quick approvals, and transparent terms for businesses…

Credit Key named as Challenger among 15 other companies, including Affirm, PayPal, and Amount.

Credit Key's Products & Differentiators

B2B Buy Now Pay Later

Instant financing payment, offering business buyers instant payment options of up to $50K and 12 month financing

Loading...

Research containing Credit Key

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Credit Key in 2 CB Insights research briefs, most recently on Aug 23, 2024.

Aug 23, 2024

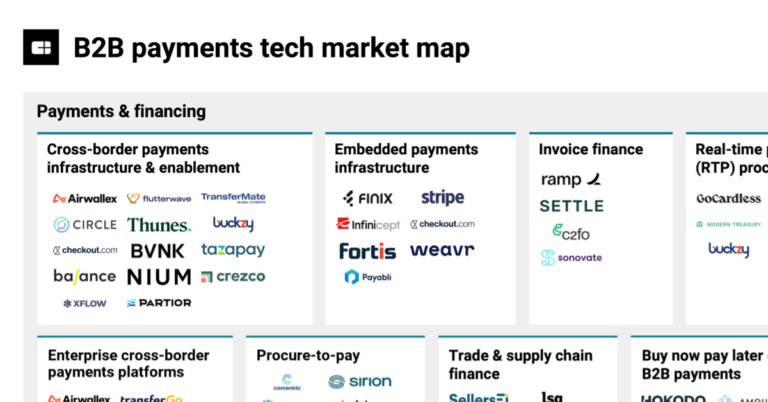

The B2B payments tech market map

May 8, 2024

The embedded banking & payments market mapExpert Collections containing Credit Key

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Credit Key is included in 2 Expert Collections, including Digital Lending.

Digital Lending

2,380 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Fintech

9,464 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Latest Credit Key News

Mar 18, 2025

ID Tech March 18, 2025 Credit Key, a leading B2B financial technology company, has secured two new patents for its innovative digital lending solutions, including biometric verification methods and real-time underwriting capabilities. The patents protect Credit Key’s proprietary systems for B2B credit facility provisioning and processing. The newly patented technology incorporates state-of-the-art biometric identification methods, including fingerprinting, facial recognition, and voice authentication. This multi-factor approach ensures robust security while maintaining user convenience. A standout feature of Credit Key’s system is its real-time underwriting capability, which delivers credit decisions within five seconds. The technology also introduces QR code payment functionality for physical store transactions, creating a seamless bridge between online and offline commerce. For merchants, the system offers straightforward integration with major eCommerce platforms while ensuring compliance with financial regulations through partnerships with chartered banks. “Our mission is to redefine how businesses access credit,” said John Tomich, CEO of Credit Key. “We’re setting a new standard in the industry by delivering a user-centric lending experience that combines speed, security, and unprecedented payment flexibility.” The system offers flexible repayment terms ranging from Net 30 to 12 months, addressing a key need in the B2B marketplace while helping merchants increase conversion rates. “These patents are a strategic milestone for Credit Key,” Tomich added, “underscoring our leadership in financial technology and our vision to redefine B2B payments.” Partners Founded in 2007, Lakota Software Solutions is an American company with a world-renowned reputation for developing robust biometric software and systems. Our vendor-agnostic products are tailored to ensure compliance with ANSI/NIST-ITL standards and EBTS specifications, facilitate seamless integration with other biometric systems, and optimize accuracy, cost-effectiveness, and scalability. https://lakotasoftware.com/ Oz Forensics is the independent private vendor of robust, technology-based, and AI-powered liveness detection and face-matching solutions founded in 2017 and headquartered in Dubai, UAE. We confirm the security level of our solution by certifying the ISO-30107 Level 1 and 2 standards. https://ozforensics.com/ AuthenticID provides 100% automated identity verification and fraud detection solutions that are leveraged by companies worldwide, including 2 of the top 3 U.S. Banks, 8 out the top 10 wireless providers in North America, and 2 of the 3 credit bureaus. Using proprietary computer vision and machine learning technology, these solutions help companies accurately verify the identity of their users across retail, digital and call center environments for onboarding and ongoing re-authentication events; KYC, IAM, and more. The solutions are easy to integrate and provide customers a large ROI by stopping fraud losses, increasing customer conversion at onboarding, reducing operational costs and allowing quick and cost-effective operational scalability, all while ensuring global privacy regulations are complied with. https://www.authenticid.com/ FaceTec’s patented, industry-leading 3D Face Verification and Reverification software anchors digital identity, creating a chain of trust from user onboarding to ongoing authentication on all modern smart devices and webcams. FaceTec’s 3D FaceMaps™ finally make trusted, remote identity verification possible. As the only technology backed by a persistent spoof bounty program and NIST/iBeta Certified Liveness Detection, FaceTec is the global standard for 3D Liveness and Face Matching with millions of users on six continents in financial services, border security, transportation, blockchain, e-voting, social networks, online dating and more. www.facetec.com Identity Week aims to be a significant identity industry catalyst. It’s our mission is to help accelerate the move towards a world where trusted identity solutions enable governments and commercial organisations to provide citizens, employees, customers and consumers with a multitude of opportunities to transact in a seamless, yet secure manner. All the while preventing the efforts of those intent on doing harm. https://identityweek.net/ The Biometric Digital Identity Prism is a market landscape framework designed to help influencers and decision makers understand, innovate, and implement digital identity technologies and solutions. This innovative framework for understanding and evaluating the rapidly evolving biometric digital identity marketplace is the only market model that is truly biometric-centric based on the foundational conviction that in the age of digital transformation the only true, reliable link between humans and their digital data is biometrics. https://www.the-prism-project.com

Credit Key Frequently Asked Questions (FAQ)

When was Credit Key founded?

Credit Key was founded in 2015.

Where is Credit Key's headquarters?

Credit Key's headquarters is located at 145 South Fairfax Avenue, Los Angeles.

What is Credit Key's latest funding round?

Credit Key's latest funding round is Series B.

How much did Credit Key raise?

Credit Key raised a total of $151.35M.

Who are the investors of Credit Key?

Investors of Credit Key include Greycroft, Bonfire Ventures, RedBird Capital Partners, Fortress Investment Group, Loeb.NYC and 3 more.

Who are Credit Key's competitors?

Competitors of Credit Key include SplitIt, Balance, Resolve, Billie, Jifiti and 7 more.

What products does Credit Key offer?

Credit Key's products include B2B Buy Now Pay Later.

Who are Credit Key's customers?

Customers of Credit Key include WebstaurantStore and BobCat.

Loading...

Compare Credit Key to Competitors

Klarna provides payment solutions and shopping services. The company offers price comparison, installment payments, and consumer financing for online shopping. Klarna serves the ecommerce industry, providing services to both consumers and retailers. Klarna was formerly known as Kreditor . It was founded in 2005 and is based in Stockholm, Sweden.

Billie specializes in BNPL payment methods for the B2B sector and offers digital payment services. The company's main offerings include modern checkout solutions that enable businesses to pay and get paid on their terms, with features such as upfront payment for sellers and flexible payment terms for buyers. Billie's services cater to a variety of sectors, including e-commerce, telesales, and in-person sales channels. It was founded in 2016 and is based in Berlin, Germany.

Jifiti provides embedded lending solutions within the financial services sector. The company has a platform that allows banks, lenders, and merchants to offer consumer and business financing options at points of sale, including online, in-store, and via call centers. Jifiti's platform includes financing options such as installment loans, lines of credit, split payments, and Buy Now, Pay Later services for B2C and B2B customers. It was founded in 2011 and is based in Columbus, Ohio.

Atome provides payment services within the financial technology sector. The company allows consumers to split purchases into installment payments without interest. Atome serves the retail industry by partnering with various online and offline merchants to facilitate consumer spending. It was founded in 2019 and is based in Singapore.

Amount specializes in digital origination and decisioning within the financial technology sector. The company offers a platform that facilitates account origination for lenders, integrating decisioning for credit, fraud, and compliance, as well as customer journeys to support the lending process. Amount primarily serves regional and community banks, large commercial banks, and credit unions, providing them with tools for their operations. It was founded in 2014 and is based in Chicago, Illinois.

Mondu specializes in Buy Now, Pay Later (BNPL) solutions for B2B transactions within the financial services sector. The company offers a suite of payment solutions that allow businesses to provide their customers with various deferred payment options, including flexible payment terms, installment plans, and digital trade accounts. Mondu primarily serves the ecommerce industry, B2B marketplaces, and multichannel sales sectors. It was founded in 2021 and is based in Berlin, Germany.

Loading...