Investments

784Portfolio Exits

100Funds

12Research containing SMBC Venture Capital

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned SMBC Venture Capital in 3 CB Insights research briefs, most recently on Feb 4, 2025.

Feb 4, 2025 report

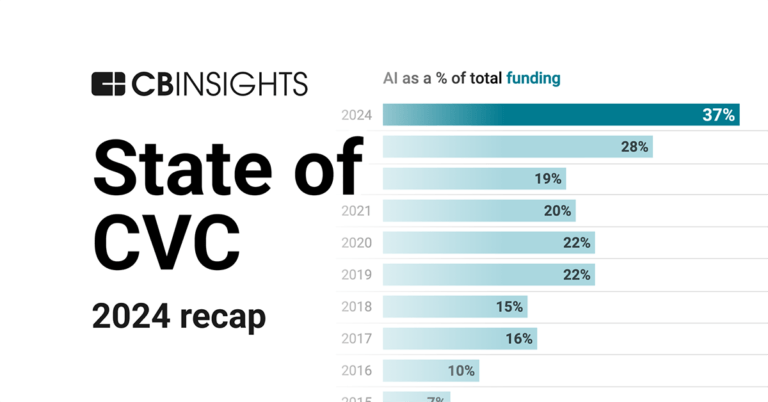

State of CVC 2024 Report

Jan 4, 2024 report

State of Venture 2023 Report

Nov 1, 2023 report

State of CVC Q3’23 ReportLatest SMBC Venture Capital News

Mar 27, 2025

Global Brain has decided to invest in CADDi Inc. (CADDi), a provider of an AI data platform for manufacturing, through SMBC-GB Growth Fund jointly managed with SMBC Venture Capital Management Co., Ltd. CADDi provides a manufacturing AI data platform with the mission to “unleash the potential of manufacturing.” The product enhances production activities and decision-making by analyzing and correlating data on the engineering chain and supply chain of the manufacturing industry and extracting insights. CADDi is driving digital transformation in the manufacturing industry by structuring scattered experiences and data with its unique technology and expertise, transforming them into assets. CADDi operates its business in four countries globally, namely Japan, Vietnam, Thailand, and the United States, and continues to grow significantly beyond T2D3*, a benchmark for top-performing SaaS companies, accelerating its global business expansion. The number of companies introducing CADDi’s platform is rapidly increasing, and many of the user companies are achieving results such as reducing procurement costs and shortening lead times. Through this funding, CADDi will enhance its platform’s functions, strengthen the development of AI technology, and expand its business globally. Global Brain has decided to additionally invest in CADDi, highly recognizing its rapid growth, the significant results achieved by its client companies, and the management team that makes it all possible. Through this investment, Global Brain will provide multifaceted support to CADDi for its further growth. Note: Global Brain announced its investment in CADDi through its GB-VI Growth Fund Investment Limited Partnership in December 2018, GB-VII Growth Fund Investment Limited Partnership in August 2021, and GB-VIII Growth Fund Investment Limited Partnership in July 2023. https://globalbrains.com/en/posts/invested-in-caddi https://globalbrains.com/en/posts/follow-on-investment-in-caddi https://globalbrains.com/en/posts/follow-on-investment-in-caddi-2 * T2D3 is a benchmark that indicates a SaaS company’s growth from JPY 100 million in annual recurring revenue (ARR) to approximately JPY 10 billion over five years, during which the ARR is tripled for two consecutive years and then doubled for three consecutive years. Companies such as ServiceNow, Marketo, and Zendesk have achieved such growth. About CADDi

SMBC Venture Capital Investments

784 Investments

SMBC Venture Capital has made 784 investments. Their latest investment was in Penetrator as part of their Series A on April 02, 2025.

SMBC Venture Capital Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

4/2/2025 | Series A | Penetrator | $3.66M | Yes | Great Wave Ventures, Mizuho Capital, Resona Capital, SKY Perfect JSAT Corporation, and SPARX Asset Management | 2 |

3/27/2025 | Series C - II | CADDi | $26.61M | No | 5 | |

3/12/2025 | Seed VC - IV | Letara | Yes | 2 | ||

3/7/2025 | Series B | |||||

3/3/2025 | Series C |

Date | 4/2/2025 | 3/27/2025 | 3/12/2025 | 3/7/2025 | 3/3/2025 |

|---|---|---|---|---|---|

Round | Series A | Series C - II | Seed VC - IV | Series B | Series C |

Company | Penetrator | CADDi | Letara | ||

Amount | $3.66M | $26.61M | |||

New? | Yes | No | Yes | ||

Co-Investors | Great Wave Ventures, Mizuho Capital, Resona Capital, SKY Perfect JSAT Corporation, and SPARX Asset Management | ||||

Sources | 2 | 5 | 2 |

SMBC Venture Capital Portfolio Exits

100 Portfolio Exits

SMBC Venture Capital has 100 portfolio exits. Their latest portfolio exit was ZenmuTech on March 27, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

3/27/2025 | IPO | Public | 4 | ||

3/21/2025 | IPO | Public | 3 | ||

1/25/2025 | Merger | Ophyx | 2 | ||

Date | 3/27/2025 | 3/21/2025 | 1/25/2025 | ||

|---|---|---|---|---|---|

Exit | IPO | IPO | Merger | ||

Companies | |||||

Valuation | |||||

Acquirer | Public | Public | Ophyx | ||

Sources | 4 | 3 | 2 |

SMBC Venture Capital Acquisitions

1 Acquisition

SMBC Venture Capital acquired 1 company. Their latest acquisition was Collabos on June 30, 2011.

Date | Investment Stage | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Total Funding | Note | Sources |

|---|---|---|---|---|---|---|

6/30/2011 | Other | Management Buyout | 1 |

Date | 6/30/2011 |

|---|---|

Investment Stage | Other |

Companies | |

Valuation | |

Total Funding | |

Note | Management Buyout |

Sources | 1 |

SMBC Venture Capital Fund History

12 Fund Histories

SMBC Venture Capital has 12 funds, including Next Generation Corporate Growth Support I.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

3/29/2017 | Next Generation Corporate Growth Support I | Early-Stage Venture Capital | Open | $8.72M | 1 |

12/31/2016 | SMBC VC 3 | Early-Stage Venture Capital | Closed | 1 | |

12/31/2014 | SMBC VC 2 | Early-Stage Venture Capital | Closed | 1 | |

6/6/2012 | SMBC Business Development II | ||||

7/22/2011 | SMBC VC 1 |

Closing Date | 3/29/2017 | 12/31/2016 | 12/31/2014 | 6/6/2012 | 7/22/2011 |

|---|---|---|---|---|---|

Fund | Next Generation Corporate Growth Support I | SMBC VC 3 | SMBC VC 2 | SMBC Business Development II | SMBC VC 1 |

Fund Type | Early-Stage Venture Capital | Early-Stage Venture Capital | Early-Stage Venture Capital | ||

Status | Open | Closed | Closed | ||

Amount | $8.72M | ||||

Sources | 1 | 1 | 1 |

SMBC Venture Capital Team

3 Team Members

SMBC Venture Capital has 3 team members, including current Chief Executive Officer, President, Akira Ochiai.

Name | Work History | Title | Status |

|---|---|---|---|

Akira Ochiai | Chief Executive Officer, President | Current | |

Name | Akira Ochiai | ||

|---|---|---|---|

Work History | |||

Title | Chief Executive Officer, President | ||

Status | Current |

Compare SMBC Venture Capital to Competitors

Skyland Ventures is a Japanese investment company focused on seed-stage startups. It provides cashback and MEV (Miner Extractable Value) solutions with BNB, Polygon chain, etc. The company was founded in 2012 and is based in Tokyo, japan.

31VENTURES is the corporate venture capital arm ("Venture Co-creation Department") of Mitsui Fudosan, engaging in the seed stage to Series A investments. Its primary investment focus is real estate, IoT, security, energy and green tech, sharing economy, fin-tech, e-commerce, robotics, and life sciences. The company was founded in 2015 and is based in Tokyo, Japan.

Spiral Ventures is a venture capital firm. The film invests in fintech, logistics/transportation, artificial intelligence, IoT, sharing economy, marketplace, HR tech, big data, media platforms, healthcare, and online advertising sectors. Spiral Ventures was formerly known as IMJ Investment Partners. Spiral Ventures was founded in 2012 and is based in Tokyo, Japan.

KSK Angel Fund, founded by Keisuke Honda, makes angel investments in areas such as blockchain, sports, artificial intelligence, IoT, robotics, rockets, and more.

Carta Ventures is a wholly-owned venture capital subsidiary of Carta Holdings, a Japanese media, and advertising technology company. Carta Ventures focuses its efforts on the rapidly growing Asian markets.

Smilegate Investment operates as a venture capital firm, focusing on investing in potential unicorn companies across various industries. Smilegate Investment was formerly known as MVP창업투자가. It was founded in 1999 and is based in Gangnam-gu, South Korea.

Loading...