Raydiant Oximetry

Founded Year

2016Stage

Grant - IV | AliveTotal Raised

$26.17MLast Raised

$1M | 6 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+183 points in the past 30 days

About Raydiant Oximetry

Raydiant Oximetry focuses on improving maternal-fetal medicine by developing noninvasive sensor technology for childbirth. Its main product, Lumerah™, is a fetal pulse oximeter designed to measure fetal oxygen levels accurately and reduce unnecessary cesarean deliveries. The company primarily serves the healthcare sector, offering tools for obstetric providers to evaluate fetal well-being during labor. It was founded in 2016 and is based in San Ramon, California.

Loading...

ESPs containing Raydiant Oximetry

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

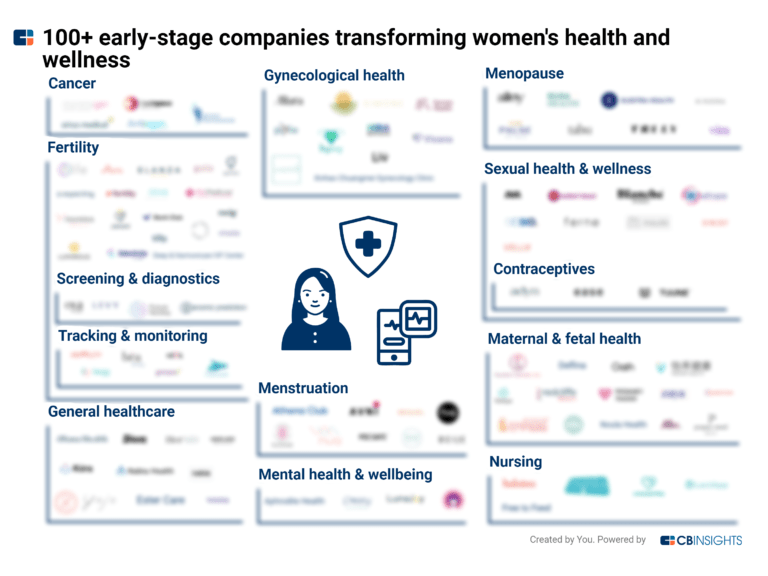

The maternal & fetal health screening market helps to improve patient outcomes by offering remote patient monitoring services & medical devices to diagnose and monitor maternal and fetal health conditions, including maternal preeclampsia, premature birth risk, and fetal oxygenation levels during labor. Some companies supplement their screening products with support services for comprehensive care.…

Raydiant Oximetry named as Highflier among 15 other companies, including Babyscripts, Bloomlife, and Nuvo Group.

Loading...

Research containing Raydiant Oximetry

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Raydiant Oximetry in 3 CB Insights research briefs, most recently on Mar 28, 2024.

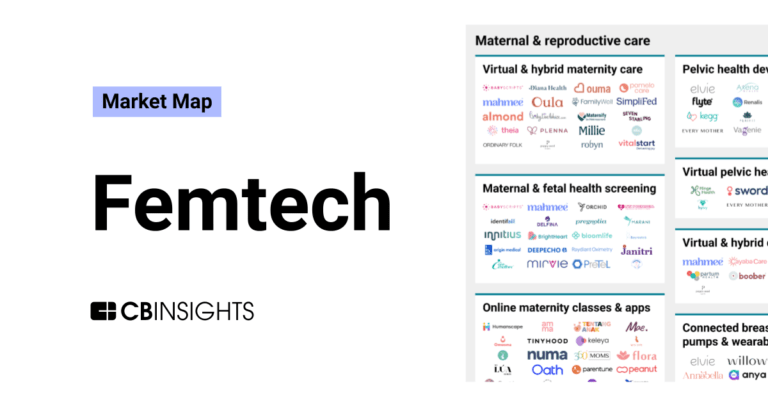

Mar 28, 2024

The femtech market map

Expert Collections containing Raydiant Oximetry

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Raydiant Oximetry is included in 2 Expert Collections, including Digital Health.

Digital Health

11,305 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Women's Health Tech

698 items

This collection includes companies applying technology to address a spectrum of physical, mental, and social well-being concerns specific to women. Examples include companies in reproductive health, maternal care, fertility tracking, and menopause support.

Raydiant Oximetry Patents

Raydiant Oximetry has filed 20 patents.

The 3 most popular patent topics include:

- respiratory physiology

- medical tests

- blood

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

4/23/2021 | 2/18/2025 | Medical tests, Blood, Blood tests, Respiratory physiology, Cardiology | Grant |

Application Date | 4/23/2021 |

|---|---|

Grant Date | 2/18/2025 |

Title | |

Related Topics | Medical tests, Blood, Blood tests, Respiratory physiology, Cardiology |

Status | Grant |

Latest Raydiant Oximetry News

Jan 28, 2025

Respiratory Care Devices Market is expected to reach US$ 49.19 billion in 2033 from US$ 24.17 billion in 2024, with a CAGR of 8.22% from 2025 to 2033 driven by the introduction of small devices and the increased prevalence of lung cancer and other serious respiratory diseases. The growing incidence of respiratory conditions including asthma, COPD, and sleep apnea, especially as a result of aging populations and unhealthy lifestyles, is one of the major drivers propelling the market for respiratory care equipment. Technology breakthroughs and heightened awareness of respiratory health have resulted in more effective, portable, and user-friendly equipment. Additionally, the need for respiratory care is rising due to environmental causes and rising air pollution levels. Government programs to enhance respiratory care and the expansion of healthcare infrastructure, particularly in emerging nations, are important factors driving market growth. The demand for respiratory care devices is driven by all of these causes together. Growth Drivers for the Respiratory Care Devices Market Growing Government Initiatives Globally, governments are acting to enhance access to respiratory treatment and address the growing prevalence of respiratory illnesses. The demand for the respiratory market is also being increased by the introduction of regulations by regulatory organizations in different nations that are intended to enhance the prevention, diagnosis, and treatment of respiratory disorders. To assist healthcare facilities in putting respiratory protection programs into place, the Centers for Disease Control and Prevention (CDC) created the Hospital Respiratory Protection Program Toolkit. The toolkit offers instructions on how to set up and keep up a thorough respiratory protection program to shield medical staff members from influenza and TB. To lower the prevalence of respiratory illnesses, government agencies are also starting vaccine campaigns, smoking cessation programs, and pollution control initiatives. Increasing Respiratory Disease Prevalence Asthma, sleep apnea, chronic obstructive pulmonary disease (COPD), and other respiratory conditions are serious global health concerns that impact people all over the world. The need for respiratory care equipment is being driven by the rising incidence of chronic illnesses, the aging population, rising air pollution, and changing lifestyles. In addition, it is anticipated that the need for respiratory care equipment would increase in the upcoming years due to the increased prevalence of unhealthy lifestyles, alcohol consumption, and chain smoking. Growing Number of Elderly People Respiratory diseases include pneumonia, sleep apnea, and chronic obstructive pulmonary disease (COPD) are more common in the elderly population. The World Health Organization (WHO), for example, predicts that by 2030, one in sixty persons worldwide would be 60 years of age or older. By 2050, there will be more elderly people worldwide. Elderly people are especially vulnerable to respiratory problems because aging can weaken the respiratory muscles and decrease lung function. Nebulizers, CPAP machines, and oxygen therapy devices are examples of respiratory care devices that are frequently used to treat respiratory disorders in the senior population. Additionally, manufacturers are creating cutting-edge devices, like portable, user-friendly devices that can be utilized at home, to cater to the unique demands of senior people. Challenges in the Respiratory Care Devices Market Maintainance and Training In the market for respiratory care devices, maintenance and training present major obstacles. To guarantee optimum performance, many devices - including oxygen concentrators, CPAP machines, and ventilators - need routine maintenance, which can be expensive and time-consuming. Furthermore, in order to use these devices correctly, particularly in emergency situations or home care settings, patients and healthcare personnel frequently require specialized training. Patient outcomes may be impacted by inappropriate use brought on by inadequate training. Maintaining appropriate care and training for patients and healthcare workers continues to be a major concern, especially in developing nations with little access to resources and knowledge. Regulatory Obstacle In the market for respiratory care devices, regulatory obstacles pose a serious problem. The FDA, EMA, and other regulatory bodies have specific rules that must be followed during the lengthy and complicated approval procedure for medical devices. Comprehensive clinical trials, quality assurance procedures, and safety testing are all part of these rules. Manufacturers may incur more costs and postpone product launches in order to meet these standards. In addition, differing national laws may make it more difficult to enter international markets and impede the expansion of respiratory care device manufacturers. The pulse oximetry market is projected to grow in the upcoming years The pulse oximetry market is poised for enduring expansion in healthcare technology because it traverses the forecast period. This sector plays a pivotal role in monitoring oxygen levels in patients, with its demand displaying no signs of slowing down. The continual growth displays the growing importance of pulse oximeters in clinical and home settings, as they offer essential data for respiratory health. As this vital sector progresses, it offers promising potentialities for companies and buyers within the healthcare industry. As an instance, consistent with records from clinicaltrials.gov, the study supported RaydiantOximetry, Inc., which started in July 2022 and is projected to conclude in December 2023. The RaydiantOximetry Sensing System, known as Lumerah, is a non-invasive fetal pulse oximeter designed for measuring fetal arterial oxygen saturation via secure and non-invasive transabdominal close-to-infrared spectroscopy. Therapeutic respiratory devices are vital in treating respiration situations, presenting crucial remedies, and raising patients' standard, high-quality lifestyles Therapeutic respiratory devices stand as indispensable equipment in the management of respiratory conditions. These devices play a pivotal role in alleviating breathing problems, imparting a lifeline to people grappling with chronic obstructive pulmonary sickness (COPD), bronchial asthma, or even acute respiratory distress. These treatments facilitate stepped-forward airflow through mechanisms like nebulizers, inhalers, and acceptable airway pressure devices, making each breath more effortless. This, in turn, translates into a remarkable enhancement in the overall quality of lifestyles for patients, letting them interact in day-by-day activities with increased comfort and independence, a true testament to the importance of these life-enhancing medical devices. Oxygen Concentrates thrive in the respiratory care device market The Oxygen Concentrators market is a pivotal sector within the expansive realm of the Respiratory Care Device industry. These devices have profoundly impacted the lives of individuals with numerous respiratory situations, including chronic obstructive pulmonary disease (COPD), asthma, and many more. Oxygen concentrators are instrumental in delivering reliable and continuous oxygen to patients, changing the need for traditional oxygen tanks. Their convenience, cost-effectiveness, and sustainability make them increasingly essential in healthcare settings and at home. With the prevalence of respiration illnesses growing, the oxygen concentrator market is poised for continued demand, promising improved quality of life for countless patients. The healthcare facility sector, particularly hospitals, held the predominant market share in the Respiratory Care Device industry In the dynamic landscape of the Respiratory Care Device industry, hospitals emerged as the undisputed leaders, commanding the market with authority. Their dominance is rooted in their pivotal role as primary healthcare providers, where various respiratory conditions are diagnosed and treated. Hospitals utilize an array of respiratory care devices, from ventilators to oxygen concentrators, to ensure the well-being of patients. This extensive application of respiratory care technology solidifies their prominence. Furthermore, their advanced infrastructure, skilled healthcare professionals, and comprehensive approach to respiratory health cement hospitals as the industry's epicenter of innovation and care. Respiratory Care Devices Market Overview by Regions The demand for respiratory care equipment is high in North America, Europe, and Asia-Pacific, and the market is expanding globally. While Asia-Pacific has significant growth due to rising respiratory diseases and better access to healthcare, North America leads due to its sophisticated healthcare infrastructure. Global players have the opportunity to expand in emerging markets. Key Attributes:

Raydiant Oximetry Frequently Asked Questions (FAQ)

When was Raydiant Oximetry founded?

Raydiant Oximetry was founded in 2016.

Where is Raydiant Oximetry's headquarters?

Raydiant Oximetry's headquarters is located at 2603 Camino Ramon, San Ramon.

What is Raydiant Oximetry's latest funding round?

Raydiant Oximetry's latest funding round is Grant - IV.

How much did Raydiant Oximetry raise?

Raydiant Oximetry raised a total of $26.17M.

Who are the investors of Raydiant Oximetry?

Investors of Raydiant Oximetry include Bill & Melinda Gates Foundation, Cross-Border Impact Ventures, March of Dimes, Global Health Impact Network, V Capital and 24 more.

Who are Raydiant Oximetry's competitors?

Competitors of Raydiant Oximetry include Baymatob and 7 more.

Loading...

Compare Raydiant Oximetry to Competitors

Baymatob develops artificial intelligence-guided solutions aimed at enhancing maternal and neonatal health outcomes. The company offers a wearable sensor named Oli, which monitors complex physiological information to provide early warnings for complications like postpartum hemorrhage. It primarily serves the healthcare sector. The company was founded in 2017 and is based in Leichhardt, Australia.

Bloomlife operates as a women's health company that focuses on improving maternal health through technology in the healthcare sector. The company offers remote patient monitoring and connected devices that provide data analytics for maternal and fetal health, as well as digital health assessments to manage pregnancies. Bloomlife primarily serves healthcare providers and pregnant women. Bloomlife was formerly known as Bloom Technologies. It was founded in 2014 and is based in San Francisco, California.

Marani Health operates as an artificial intelligence (AI)-powered maternal healthcare technology company focused on improving patient outcomes and enhancing clinical workflows in the healthcare sector. The company offers a platform that delivers individual insights through connected devices, enabling personalized and proactive care for pregnant individuals. Marani Health primarily serves maternity providers, health plans, employers, and patients with its solutions for prenatal and postpartum care. Marani Health was formerly known as Odonata Health. It was founded in 2018 and is based in Oakdale, Minnesota.

Bonraybio develops medical instruments and solutions in the healthcare sector. The company provides sperm analysis, sperm DNA fragmentation assessment, and sperm separation technologies to address male infertility. It is based in Taichung City, Taiwan.

Little Hippo is a company that creates children's products in the parenting sector. Their offerings include a sleep trainer clock for kids, a humidifier that also acts as a diffuser and night light, and a nursery night light that monitors room temperature and humidity. It is based in San Francisco, California.

Monit operates as a smart healthcare solution company. It focuses on monitoring elderly patients' diaper status suffering from recognition impairment and dementia to prevent pressure ulcers and urinary tract infections. The company was founded in 2017 and is based in Seoul, South Korea.

Loading...