Investments

732Portfolio Exits

166Funds

7Partners & Customers

7About Qualcomm Ventures

Qualcomm Ventures is the venture capital arm of Qualcomm, focusing on investments in the technology sector. The company provides funding and support to mobile technology companies, focusing on 5G, IoT, connected automotive, AI, consumer, enterprise, and cloud. Qualcomm Ventures connects entrepreneurs with resources and relationships. It was founded in 2000 and is based in San Diego, California.

Expert Collections containing Qualcomm Ventures

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Qualcomm Ventures in 5 Expert Collections, including AR/VR.

AR/VR

33 items

Store tech (In-store retail tech)

56 items

Startups aiming work with retailers to improve brick-and-mortar retail operations.

Grocery Retail Tech

16 items

Startups providing tools to grocery businesses to improve in-store operations. Includes IoT tools, customer analytics platforms, in-store robots, predictive inventory management systems,and more. (Does not include on-demand grocery delivery startups or online-only grocery stores)

Fortune 500 Investor list

590 items

This is a collection of investors named in the 2019 Fortune 500 list of companies. All CB Insights profiles for active investment arms of a Fortune 500 company are included.

Digital Lending

34 items

This collection contains alternative means for obtaining a loan for personal or business use. Companies included in the application, underwriting, funding, or collection process is included in the collection.

Research containing Qualcomm Ventures

Get data-driven expert analysis from the CB Insights Intelligence Unit.

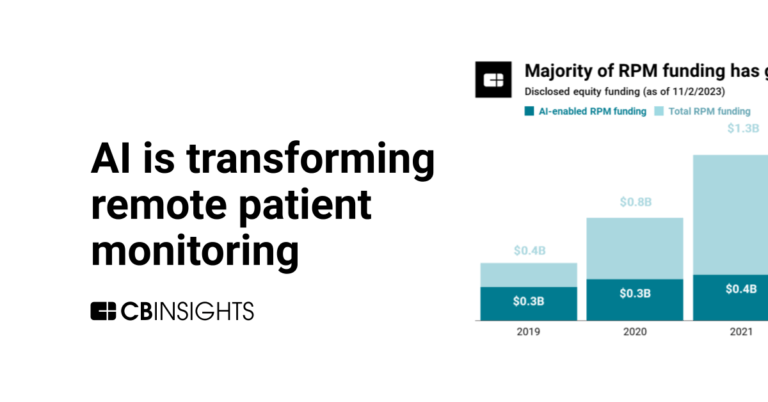

CB Insights Intelligence Analysts have mentioned Qualcomm Ventures in 3 CB Insights research briefs, most recently on Jan 30, 2025.

Jan 30, 2025 report

State of AI Report: 6 trends shaping the landscape in 2025

May 29, 2024

483 startup failure post-mortemsLatest Qualcomm Ventures News

Mar 17, 2025

Mar 17, 2025 • GCV reporters Boaz Peer, managing director of Europe and Israel for Qualcomm Ventures, is one of our top 50 Emerging Leaders in corporate venturing for 2025. Boaz Peer has been with chipmaker Qualcomm for almost 20 years, joining Qualcomm Ventures in 2016, before moving his way up to a managing director position. He is someone who enjoys his work. “This is one of the best jobs in the world,” he says. “You meet great people and great teams that can really change the technology landscape. They are different technologies that are changing over a long time. “Being close to that, supporting them, being part of their success and helping them – that is a great thing to do.” Peer is the Israel-based head of the unit’s Israel and Europe branch, running a three-person team that includes representatives in Switzerland and London. He was promoted to his current role in mid-2023 and has led 12 investments in startups, including internet-of-things tech provider Wiliot and manufacturing automation company CoreTigo. “This is one of the best jobs in the world. You meet great people and great teams that can really change the technology landscape” “I am involved as managing director doing my own deals, as well as supporting the team’s deals,” he says. “But they have a lot of independence, which is important for a fund like us. We are trying to keep it the way it was before, and would be ideal, moving forward.” The large geographical area his team covers and the variety of technologies are both part of the reason that Peer enjoys his role. What interests him is the way AI and robotics – both areas Qualcomm as a company is involved in – are coming together on the startup side. Add to that how AI agents can disrupt the software industry and the way smaller language models targeted at specific datasets can outperform their larger rivals, and it is an exciting time to be an investor. “This year is going to be better in terms of investments and in terms of recovery over the past two years,” he says. “You are going to see the highest concentration of money going to the best companies.” See the full list of Emerging Leaders 2025 here . LEADERSHIP SOCIETY Informing, connecting, and transforming the global corporate venture capital ecosystem. The Global Corporate Venturing (GCV) Leadership Society’s mission is to help bridge the different strengths and ambitions of investors across industry sectors, geography, structure, and their returns.

Qualcomm Ventures Investments

732 Investments

Qualcomm Ventures has made 732 investments. Their latest investment was in Augury as part of their Series F on February 19, 2025.

Qualcomm Ventures Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

2/19/2025 | Series F | Augury | $75M | No | Eclipse, Electric Ventures, Insight Partners, Lerer Hippeau, Lightrock, Munich Re Ventures, Qumra Capital, and SE Ventures | 4 |

2/19/2025 | Series A - II | guidde | $15M | Yes | Entree Capital, Honeystone Ventures, Inkberry Ventures, Norwest Venture Partners, and Tiferes Ventures | 3 |

1/28/2025 | Series C | SafelyYou | $43M | Yes | 2 | |

1/16/2025 | Series D | |||||

12/19/2024 | Series C |

Date | 2/19/2025 | 2/19/2025 | 1/28/2025 | 1/16/2025 | 12/19/2024 |

|---|---|---|---|---|---|

Round | Series F | Series A - II | Series C | Series D | Series C |

Company | Augury | guidde | SafelyYou | ||

Amount | $75M | $15M | $43M | ||

New? | No | Yes | Yes | ||

Co-Investors | Eclipse, Electric Ventures, Insight Partners, Lerer Hippeau, Lightrock, Munich Re Ventures, Qumra Capital, and SE Ventures | Entree Capital, Honeystone Ventures, Inkberry Ventures, Norwest Venture Partners, and Tiferes Ventures | |||

Sources | 4 | 3 | 2 |

Qualcomm Ventures Portfolio Exits

166 Portfolio Exits

Qualcomm Ventures has 166 portfolio exits. Their latest portfolio exit was Weights & Biases on March 04, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

3/4/2025 | Acquired | 5 | |||

2/18/2025 | Acquired | 6 | |||

1/28/2025 | Acquired | 2 | |||

Date | 3/4/2025 | 2/18/2025 | 1/28/2025 | ||

|---|---|---|---|---|---|

Exit | Acquired | Acquired | Acquired | ||

Companies | |||||

Valuation | |||||

Acquirer | |||||

Sources | 5 | 6 | 2 |

Qualcomm Ventures Fund History

7 Fund Histories

Qualcomm Ventures has 7 funds, including Qualcomm BNDES Fund.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

1/13/2020 | Qualcomm BNDES Fund | $19.31M | 2 | ||

11/28/2018 | Qualcomm AI Fund | ||||

9/27/2015 | Qualcomm India Startup Fund | ||||

7/1/2015 | Qualcomm South Korea Startup Fund | ||||

1/11/2015 | Qualcomm Life |

Closing Date | 1/13/2020 | 11/28/2018 | 9/27/2015 | 7/1/2015 | 1/11/2015 |

|---|---|---|---|---|---|

Fund | Qualcomm BNDES Fund | Qualcomm AI Fund | Qualcomm India Startup Fund | Qualcomm South Korea Startup Fund | Qualcomm Life |

Fund Type | |||||

Status | |||||

Amount | $19.31M | ||||

Sources | 2 |

Qualcomm Ventures Partners & Customers

7 Partners and customers

Qualcomm Ventures has 7 strategic partners and customers. Qualcomm Ventures recently partnered with Arriver on January 1, 2022.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

1/5/2022 | Partner | United States | 1 | ||

1/4/2022 | Partner | ||||

3/23/2021 | Partner | ||||

2/4/2021 | Partner | ||||

1/9/2017 | Partner |

Date | 1/5/2022 | 1/4/2022 | 3/23/2021 | 2/4/2021 | 1/9/2017 |

|---|---|---|---|---|---|

Type | Partner | Partner | Partner | Partner | Partner |

Business Partner | |||||

Country | United States | ||||

News Snippet | |||||

Sources | 1 |

Qualcomm Ventures Team

13 Team Members

Qualcomm Ventures has 13 team members, including current Senior Vice President, Quinn Li.

Name | Work History | Title | Status |

|---|---|---|---|

Quinn Li | IBM, Broadcom, and Lucent Technologies | Senior Vice President | Current |

Name | Quinn Li | ||||

|---|---|---|---|---|---|

Work History | IBM, Broadcom, and Lucent Technologies | ||||

Title | Senior Vice President | ||||

Status | Current |

Compare Qualcomm Ventures to Competitors

Samsung Ventures is the venture investment arm of Samsung Group, focusing on technologies and industries through venture capital. The company invests in anticipatory technologies and industries to support the growth of a venture ecosystem. Samsung Ventures aims to contribute to society and the group. It was founded in 1999 and is based in Seoul, South Korea.

Intel Capital is a venture capital firm that invests in early-stage startups within the tech ecosystem, which includes Cloud, Devices, Frontier, and Silicon sectors. It was founded in 1991 and is based in Santa Clara, California.

Google Ventures (GV) seeks to discover and invest in companies across a broad range of industries, including consumer internet, software, hardware, clean technology, biotechnology, and health care. It invests amounts ranging from seed funding to tens of millions of dollars, depending on the stage of the opportunity and the company's need for capital. It was founded in 2009 and is based in Mountain View, California.

Dell Technologies Capital is focused on driving innovation and delivering results. The Ventures team invests in innovative early-stage companies, providing crucial business guidance and access to the power of the Dell Technologies brand and channel.

ATX Venture Partners operates as a venture capital firm. It specializes in early-stage investments in the technology sector. The company focuses on funding business-to-business (B2B) software, application programming interfaces (APIs), marketplaces, and emerging frontier technologies, aiming to support solutions across various industries. ATX Venture Partners provides capital, strategic guidance, and access to a network of industry experts to help portfolio companies accelerate growth and achieve success. ATX Venture Partners was formerly known as ATX Seed Ventures. It was founded in 2014 and is based in Austin, Texas.

Sony Innovation Fund operates as a venture capital initiative focused on investing in early-stage companies within the technology, content, and services sectors. The fund provides investment and access to Sony's global network, fostering business creation and innovation in various areas of interest to Sony, including entertainment, health, and emerging technologies. It primarily targets seed to Series B funding stages for consumer and enterprise-facing businesses. It was founded in 2016 and is based in Tokyo, Japan. Sony Innovation Fund operates as a subsidiary of Sony.

Loading...