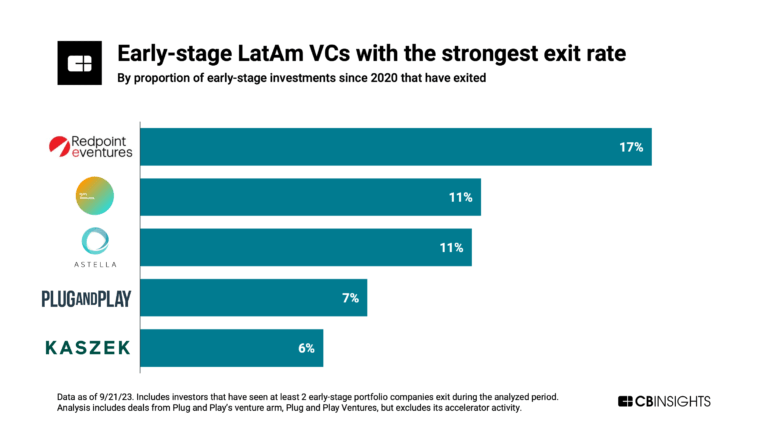

Plug and Play Ventures

Investments

2163Portfolio Exits

243Funds

4Partners & Customers

10About Plug and Play Ventures

Plug and Play Ventures is a global technology accelerator and venture fund. Plug and Play Ventures participates in Seed, Angel and Series A funding where they often co-invest with strategic partners. Through years of experience and as part of its network, the firm has put together a world-class group of serial entrepreneurs, strategic investors, and industry leaders who actively assist the firm with successful and growing investment portfolio.

Expert Collections containing Plug and Play Ventures

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Plug and Play Ventures in 2 Expert Collections, including Store tech (In-store retail tech).

Store tech (In-store retail tech)

56 items

Startups aiming work with retailers to improve brick-and-mortar retail operations.

Travel Technology (Travel Tech)

39 items

Tech-enabled companies offering services and products focused on tourism. This collection includes booking services, search platforms, on-demand travel and recommendation sites, among others.

Research containing Plug and Play Ventures

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Plug and Play Ventures in 5 CB Insights research briefs, most recently on Oct 24, 2024.

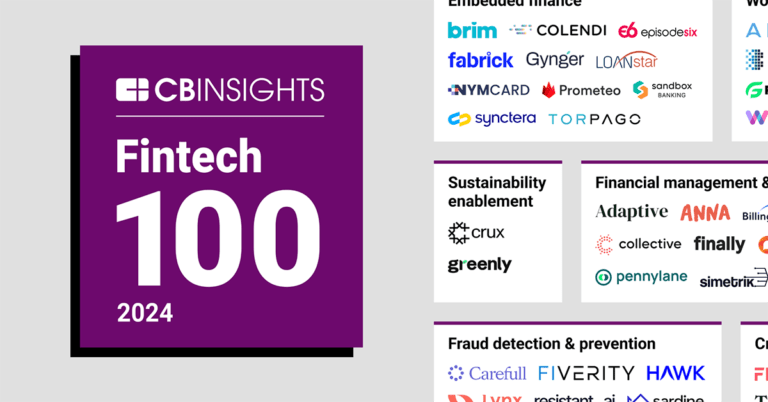

Oct 24, 2024 report

Fintech 100: The most promising fintech startups of 2024

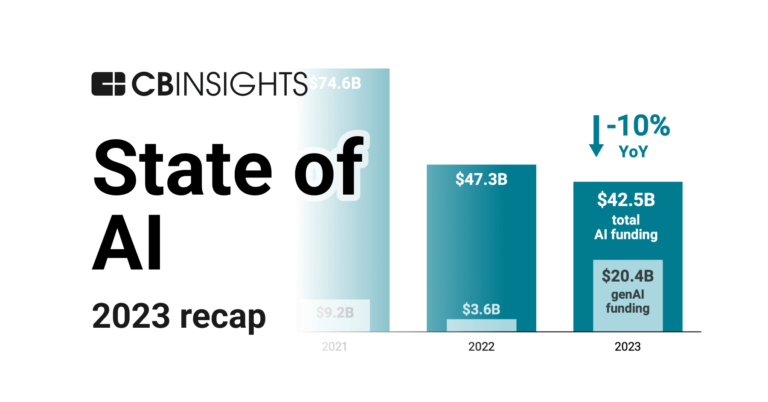

Feb 1, 2024 report

State of AI 2023 Report

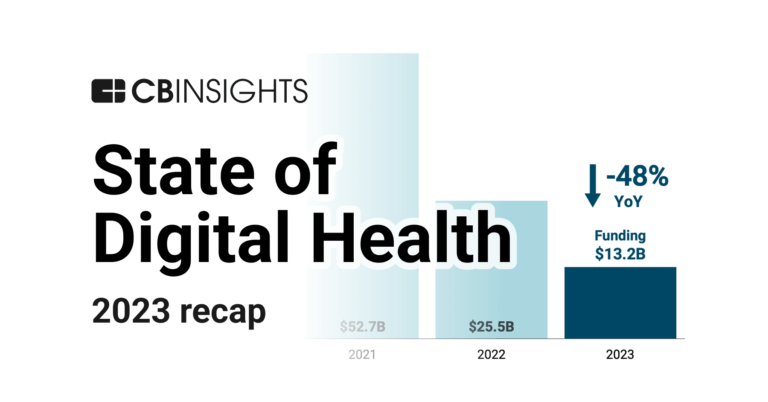

Jan 25, 2024 report

State of Digital Health 2023 Report

Jan 4, 2024 report

State of Venture 2023 ReportLatest Plug and Play Ventures News

Mar 19, 2025

UPDATED: March 19, 2025 at 12:07 PM PDT SAN JOSE — A housing tower and data center project may sprout by year’s end at a choice downtown San Jose site, marking the launch of a push to transform the city’s urban core into a green energy hub. Utility titan PG&E, high-profile developer Westbank and San Jose city leaders are eyeing eco-friendly housing towers and data centers as ways to pave pathways of innovation that can create a green energy downtown Downtown San Jose skyline, as seen in September 2024. (George Avalos/Bay Area News Group) Canada-based Westbank, a developer with a global reach, is planning multiple housing projects at downtown San Jose sites the real estate firm owns where residential highrises would be built next to data centers. Related Articles A vacant lot at 323 Terraine Street in downtown San Jose is poised to become the location of the first of the housing and data center projects, Andrew Jacobson, vice president of the U.S. for Westbank, said in an interview with this news organization on Wednesday. “We hope to break ground by the end of the year,” Jacobson said. “We are working closely with the city. It needs the city’s approval.” Jacobson made the comments after a PG&E-hosted “Power Hour Breakfast” on Wednesday, part of a quarterly series of events organized by the San Jose Chamber of Commerce. Canada-based Westbank and San Jose-based real estate executives Gary Dillabough, Jeff Arrillaga, Tony Arreola and Mark Lazzarini, acting through an alliance, own the property, which is near the lively San Pedro Square area. Westbank envisions a 345-unit housing tower with an adjacent data center facility. Originally, Westbank had proposed the residential highrise and an office building, but the collapse of the office market prompted a shift to the data center. “The data center would be in the same footprint as the office building,” Jacobson said. The real estate alliance bought the property in 2021, paying $11.4 million for the choice site, which is next to State Route 87. The Terraine Street project would represent a major milestone for Westbank and downtown San Jose. The housing tower and data center project on Terraine Street would mark Westbank’s first ground-up development in downtown San Jose. Westbank is about to embark in earnest on a project to convert the Bank of Italy historic tower at 12 South First Street from offices to housing. The Bank of Italy project, however, involves an existing building. The wide-ranging PG&E Power Breakfast included a presentation by Tevin Panchal, head of growth with Plug & Play Ventures, which is planning to establish an AI Center of Excellence in downtown San Jose. The AI Center of Excellence, which is close to signing a lease in downtown San Jose, will have startups that it will finance and nurture, a learning center in an alliance with San Jose State University, and a physical space available to the public. “Everyone can come look, touch, feel, the applications of AI,” Panchal said. “We are very excited about this.” The learning space will be made available to students as early as the 7th and 8th grades, Panchal said. “The new center in San Jose will boost the local economy by fostering innovation and talent in Silicon Valley,” Plug & Play Ventures states on its website. Advanced manufacturing, data and AI, cybersecurity, energy, health tech, and information technology will be the primary areas of interest at Plug & Play’s AI Center of Excellence in San Jose, according to the website. Oakland-based PG&E is greatly widening its efforts to accommodate anticipated growth in San Jose and the South Bay, which could be the site of a boom in data centers and housing. “We are preparing for rapid economic expansion, particularly in tech and AI in San Jose,” Teresa Alvarado, PG&E vice president for the utility’s South Bay and Central Coast Region, said during a presentation for the gathering. Westbank believes that developing housing next to data centers could be a huge catalyst for environmentally friendly housing projects by using excess heat from a data center to provide energy to nearby homes. “Our long-term vision is with multiple data centers and housing clusters, the idea is to connect them all and create a downtown San Jose district energy system,” Jacobson said in an interview with this news organization in November 2024.

Plug and Play Ventures Investments

2,163 Investments

Plug and Play Ventures has made 2,163 investments. Their latest investment was in Arsenale Bioyards as part of their Seed VC - II on February 25, 2025.

Plug and Play Ventures Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

2/25/2025 | Seed VC - II | Arsenale Bioyards | $10M | No | Acequia Capital, byFounders, CDP Venture Capital, Grey Silo Ventures, Planet A Ventures, and Undisclosed Private Equity Investors | 2 |

2/14/2025 | Pre-Seed - II | Claro | $0.68M | Yes | 2 | |

1/28/2025 | Seed VC | Upwell | $6.5M | Yes | 3 | |

1/27/2025 | Pre-Seed - II | |||||

12/10/2024 | Seed VC - II |

Date | 2/25/2025 | 2/14/2025 | 1/28/2025 | 1/27/2025 | 12/10/2024 |

|---|---|---|---|---|---|

Round | Seed VC - II | Pre-Seed - II | Seed VC | Pre-Seed - II | Seed VC - II |

Company | Arsenale Bioyards | Claro | Upwell | ||

Amount | $10M | $0.68M | $6.5M | ||

New? | No | Yes | Yes | ||

Co-Investors | Acequia Capital, byFounders, CDP Venture Capital, Grey Silo Ventures, Planet A Ventures, and Undisclosed Private Equity Investors | ||||

Sources | 2 | 2 | 3 |

Plug and Play Ventures Portfolio Exits

243 Portfolio Exits

Plug and Play Ventures has 243 portfolio exits. Their latest portfolio exit was DONNA.ai on March 17, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

3/17/2025 | Acquired | 2 | |||

3/17/2025 | Acquired | 2 | |||

3/11/2025 | Acquired | Founderpath | 2 | ||

Plug and Play Ventures Fund History

4 Fund Histories

Plug and Play Ventures has 4 funds, including Plug and Play Supply Chain Fund I.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

4/19/2022 | Plug and Play Supply Chain Fund I | $25.5M | 1 | ||

Plug & Play Umbrella Fund | |||||

Plug & Play Future Commerce Fund I | |||||

Plug & Play Growth Fund |

Closing Date | 4/19/2022 | |||

|---|---|---|---|---|

Fund | Plug and Play Supply Chain Fund I | Plug & Play Umbrella Fund | Plug & Play Future Commerce Fund I | Plug & Play Growth Fund |

Fund Type | ||||

Status | ||||

Amount | $25.5M | |||

Sources | 1 |

Plug and Play Ventures Partners & Customers

10 Partners and customers

Plug and Play Ventures has 10 strategic partners and customers. Plug and Play Ventures recently partnered with The Rawlings Group on June 6, 2024.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

6/17/2024 | Partner | United States | We 're confident the unique insights provided by the Plug and Play Ventures team and new relationships available to Rawlings through this relationship will further our success and growth in the healthcare ecosystem , '' said Ryan Little , CEO of The Rawlings Company . | 1 | |

6/1/2023 | Partner | Netherlands | The joint partnership was officially announced at Plug and Play Travel Vienna 's EXPO on June 1 , 2023 , in the AirportCity Space at the Vienna International Airport , where one of Plug and Play programs is based and where SkyTeam will become an official partner . | 1 | |

11/15/2022 | Partner | Netherlands, Gibraltar, United Kingdom, and United States | `` AllianceBlock is excited about our partnership with Plug and Play Crypto . | 1 | |

8/23/2022 | Partner | ||||

6/15/2022 | Partner |

Date | 6/17/2024 | 6/1/2023 | 11/15/2022 | 8/23/2022 | 6/15/2022 |

|---|---|---|---|---|---|

Type | Partner | Partner | Partner | Partner | Partner |

Business Partner | |||||

Country | United States | Netherlands | Netherlands, Gibraltar, United Kingdom, and United States | ||

News Snippet | We 're confident the unique insights provided by the Plug and Play Ventures team and new relationships available to Rawlings through this relationship will further our success and growth in the healthcare ecosystem , '' said Ryan Little , CEO of The Rawlings Company . | The joint partnership was officially announced at Plug and Play Travel Vienna 's EXPO on June 1 , 2023 , in the AirportCity Space at the Vienna International Airport , where one of Plug and Play programs is based and where SkyTeam will become an official partner . | `` AllianceBlock is excited about our partnership with Plug and Play Crypto . | ||

Sources | 1 | 1 | 1 |

Compare Plug and Play Ventures to Competitors

500 Global operates a venture capital firm. It is an early-stage seed fund that invests primarily in consumer and small and medium business (SMB) internet companies and related web infrastructure services. It prefers to invest in media, consumer services, computer hardware, software, commercial services, software-as-a-service, mobile, financial technology, big data, the internet of Things (IoT), and e-commerce sectors. It was founded in 2010 and is based in San Francisco, California.

Betaworks Studios is a company that hosts events in the technology, art, politics, and science sectors. They facilitate discussions on advancements in these fields. It was founded in 2018 and is based in New York, New York.

Y Combinator operates as a seed-stage venture firm. It specializes in funding early-stage startups, primarily in software and web services. It works intensively with the companies for three months to refine their pitch to investors. It was founded in 2005 and is based in Mountain View, California.

Techstars works as a global network. It focuses on helping early-stage startups succeed in various industries, including technology and finance. The company offers accelerator programs, investment opportunities, and mentorship to support startups in areas such as capital access, customer acquisition, and talent recruitment. Techstars serves a diverse range of sectors, providing resources and guidance to entrepreneurs worldwide. It was founded in 2006 and is based in New York, New York.

Lightspeed Venture Partners operates as an early-stage venture capital firm. It focuses on accelerating disruptive innovations and trends in the enterprise and consumer sectors. It was founded in 2000 and is based in Menlo Park, California.

Seedcamp provides venture capital funds to support startups in the pre-seed and seed stages. The firm invests in companies and encourages them across the product market fit, traction, growth, and scale stages from seed funding to initial public offerings (IPO). The company was founded in 2007 and is based in London, United Kingdom.

Loading...