Pine Labs

Founded Year

1998Stage

Unattributed - IV | AliveTotal Raised

$1.127BValuation

$0000Last Raised

$50M | 3 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-1 points in the past 30 days

About Pine Labs

Pine Labs is a merchant platform that provides payment solutions across various business sectors. The company offers services, including in-store and online payment processing, customer loyalty programs, prepaid and gifting services, and analytics. Pine Labs serves sectors such as electronics, lifestyle, automobile, grocery, healthcare, and hospitality. It was founded in 1998 and is based in Noida, India.

Loading...

ESPs containing Pine Labs

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

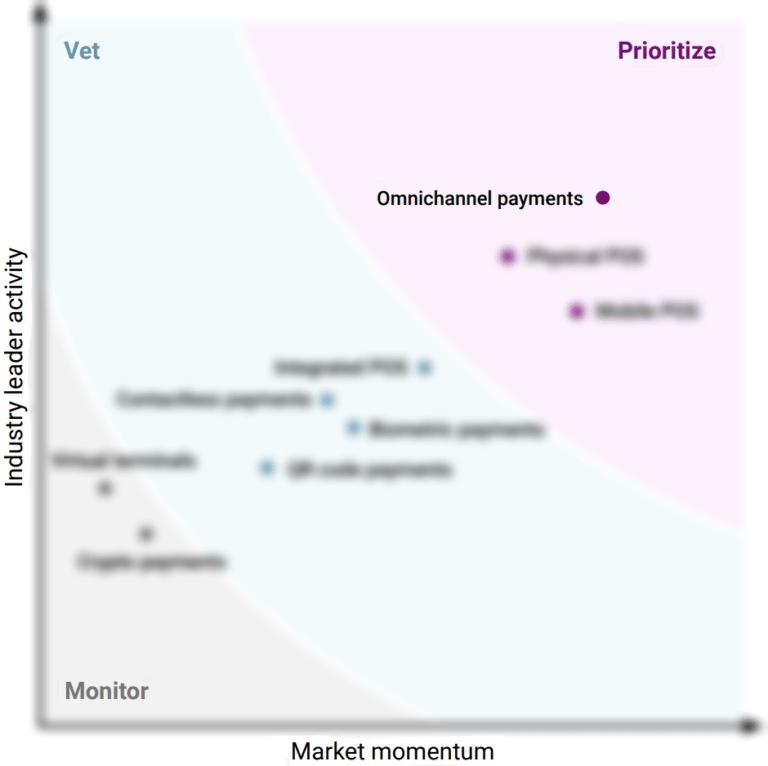

The omnichannel point-of-sale (POS) market, also called unified POS, provides integrated payment acceptance across digital and physical retail sales channels. These solutions provide the hardware and software to sync sales data, allowing for centralized transaction and inventory visibility. Some providers also offer customer service, shopper marketing, or sales analytics features. As more shopping…

Pine Labs named as Outperformer among 15 other companies, including Stripe, Fiserv, and Shopify.

Loading...

Research containing Pine Labs

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Pine Labs in 4 CB Insights research briefs, most recently on Jun 14, 2023.

May 20, 2022 report

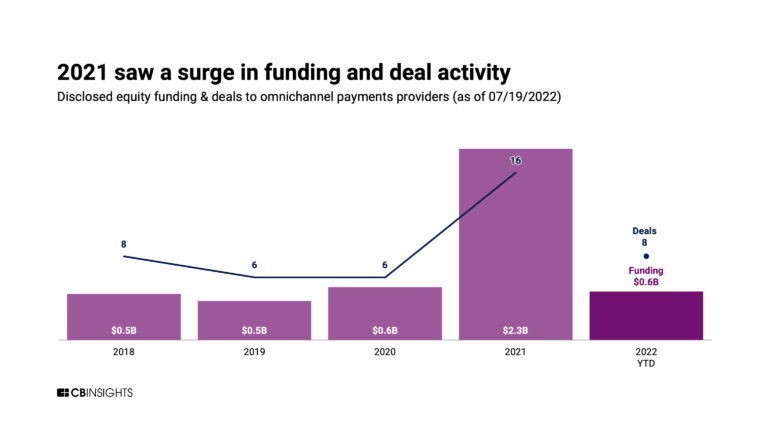

Why vendors are prioritizing omnichannel paymentsExpert Collections containing Pine Labs

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Pine Labs is included in 8 Expert Collections, including Store tech (In-store retail tech).

Store tech (In-store retail tech)

1,800 items

Companies that make tech solutions to enable brick-and-mortar retail store operations.

Unicorns- Billion Dollar Startups

1,270 items

SMB Fintech

1,648 items

Payments

3,331 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech 100

999 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Fintech

13,667 items

Excludes US-based companies

Latest Pine Labs News

Mar 24, 2025

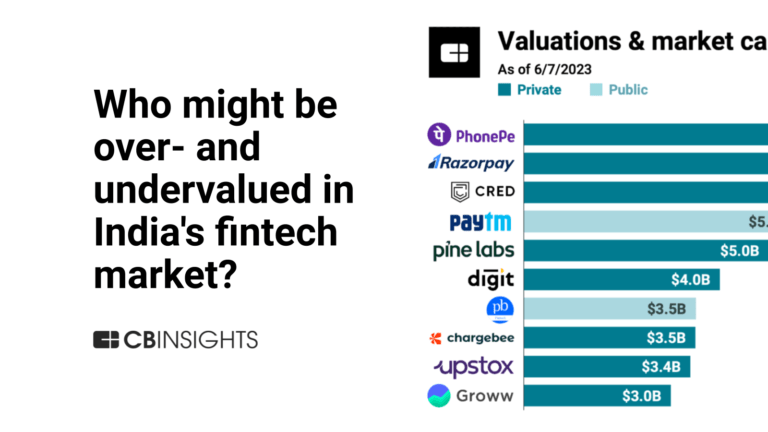

Collectively, India’s fintech startups boast a USD $125 billion valuation and contribute USD $20 billion in annual revenue, underscoring their economic impact. Get the hottest Fintech Singapore News once a month in your Inbox Back in 2013, venture capitalist Aileen Lee introduced the term “ unicorn ” to describe the rarity of startups achieving a valuation of over USD $1 billion. A decade later, unicorns in India have become a defining symbol of the country’s booming startup ecosystem, particularly in fintech. Today, India’s fintech startups have reshaped financial services, making them more accessible, efficient, and technology-driven. India’s fintech success is backed by massive investor interest, strong government support, and a growing digital economy. Since InMobi, the country’s first unicorn in 2011 , fintech has been at the heart of India’s startup growth story. Government-led initiatives like Startup India (2015) have provided tax incentives, funding programs, and incubation support, fostering a thriving ecosystem. The country’s fintech industry has also witnessed a wave of IPOs, mergers, and acquisitions, with deals exceeding USD $4 billion in the last decade. India Fintech Achieving Unicorn Status A major turning point came in May 2022, when neobanking startup Open became India’s 100th unicorn after raising USD $50 million. This milestone was the result of an extraordinary funding surge in 2021, during which Indian startups raised USD $42 billion across 1,583 deals, creating 45 new unicorns in a single year. Today, as of March 2025, India is home to 27 fintech unicorns. These unicorns also include one decacorn (valued over USD $10 billion). The country also ranks third globally in terms of the amount of fintech unicorns, trailing only to the United States and China. The fintech sector now represents 5% of total revenues generated by all banking, financial services, and insurance (BFSI) companies in India. Within fintech, payments and lending have been the most dominant segments, attracting 85% of the capital raised. The number of registered fintech startups in India has also grown fivefold in the past three years. It has risen from 2,100 in 2021 to 10,200 in 2024. As India continues to lead in digital financial innovation, its fintech unicorns are expanding their influence across all emerging financial services. These companies are not only reshaping the financial landscape domestically but are also setting the stage for global fintech leadership. To help our readers to know better each of these fintech companies in India that have reached its unicorn status in 2025, we have divided them into 6 categories. They are Payments, Lending Tech, Fintech Infra/Saas, InsurTech, WealthTech and Others. Last Updated: 24 March 2025 A list of the current total valuation of the Fintech Unicorns in India in 2025 Payments PhonePE Founded in 2015, PhonePe has become India’s largest UPI-based payment platform. It has since enabled seamless bank transfers, mobile recharges, bill payments, and digital insurance services. Acquired by Flipkart in 2016, PhonePe quickly gained market dominance and reached unicorn status in 2018, just three years after its inception. As of December 2024, PhonePe processed USD $95.81 million transactions , a 7.8% increase from the previous month. With over 400 million users, the platform continues to expand its offerings, including mutual fund investments and stock trading. In a recent funding round, Flipkart’s Singapore-based parent company invested USD $282 million to fuel further growth. The company is now valued at USD 12.6 billion, the highest and first decacorn on this list. Paytm A pioneer in India’s fintech revolution, Paytm was founded in 2010. The company started as a mobile wallet and has since expanded into banking, lending, insurance, and travel bookings. Despite facing revenue challenges in recent quarters, Paytm has raised a staggering funding of USD $3.48 billion over 16 rounds . The company’s largest funding boost came in 2017, when it secured USD $1.4 billion from SoftBank. The move has pushed its valuation beyond USD $10 billion, also making it a decacorn. Paytm made history in November 2021 with an USD $2.12 million IPO , one of India’s largest fintech public offerings. The company’s valuation stands at USD $15.6 billion but do note that Paytm is now a publicly listed company after its IPO, and its valuation fluctuates in the market. BillDesk Founded in 2000, BillDesk is one of India’s earliest digital payment platforms, specialising in payment gateway services. The Indian company took nearly two decades to achieve unicorn status, joining the elite club in 2018 after a significant funding round. As of today, BillDesk is valued at USD $1.59 billion as per the latest available filings, making it the third fintech unicorns in India, on this list for 2025. Razorpay Razorpay , launched in 2014, has revolutionised B2B digital payments with its API-driven payment gateway for businesses . Initially focused on online transactions, Razorpay has expanded its services to include payroll management, SME lending, and banking solutions. On December 2021, Razorpay had processed USD $60 billion in total payment volume (TPV), with a goal to hit USD $90 billion by the end of 2022. As of 2025, arguably one of the biggest fintech unicorns in India achieved a USD $7.5 billion valuation in its latest funding round , having raised a total of USD $742 million from investors like Sequoia Capital India, Tiger Global, MasterCard, and Salesforce, just to name a few. Pine Labs Pine Labs achieved its unicorn status in 2020, having raised its valuation to USD $1.6 billion thaks to investors such as Flipkart, Mastercard, PayPal Ventures, and Temasek Holdings. Today, they are valued at USD $2.28 billion . CRED CRED , founded in 2018, has disrupted India’s fintech space with its premium rewards-based credit card bill payment platform. By offering exclusive perks for timely bill payments, CRED has built a niche customer base of high-net-worth individuals. CRED became a unicorn in April 2021, after raising USD $215 million in Series D funding , reaching a USD $2.2 billion valuation the same year. Later that year, it secured USD $251 million in Series E funding , pushing its valuation to USD $4 billion. Now it is valued at roughly USD 6.4 billion. BharatPe The company entered the unicorn club in 2021 after securing USD $370 million in Series E funding , led by Tiger Global, at a USD $2.85 billion valuation, making it the seventh unicorns in India on this list as of 2025. PayU PayU is a global payment service provider operating in multiple emerging markets. While not a traditional startup, PayU has been a key investor in India’s fintech space, crossing the USD $1 billion investment mark in 2021. Owned by Prosus , PayU functions as both a payment gateway and a major fintech investor, growing through strategic mergers and acquisitions. PayU is valued at USD $5.2 billion as per the latest available filings. Lending Tech Slice Founded in 2016, Slice targets Indian citizens with its credit cards and payment cards, offering flexible repayment options and rewards. The startup partners with Visa and SBM Bank to issue its credit line, which ranges from approximately USD $120 to USD $12,000 USD Slice is the first in our list of fintech unicorns in India for 2025 under the lending tech category. Yubi (formerly CredAvenue) Yubi , one of India’s debt marketplace, connects enterprises with lenders and investors through an end-to-end platform. Founded in 2017, the startup facilitates a range of loan and lending solutions, making institutional borrowing seamless. Yubi entered the unicorn club in March 2022, raising USD $137 million in its Series B round from Insight Partners, B Capital, and Dragoneer Investment Group. The company has since acquired Corpository (a financial SaaS startup) and Spocto (a digital collections firm) to strengthen its offerings. Oxyzo Oxyzo , the lending arm of B2B commerce unicorn OfBusiness, was founded in 2016. The startup specialises in cash flow and working capital financing for SMEs in manufacturing and contracting sectors. InCred Finance InCred , founded in 2016 operates in the BFSI space through three divisions which are InCred Finance (lending), InCred Capital (wealth & asset management) and InCred Money (retail bonds & alternative investments). InCred’s lending arm, InCred Finance, became a unicorn in December 2023, after raising a USD $60 million Series D round, valuing it at USD $1.04 billion . The company has witnessed significant growth, with net profits quadrupling in FY23, and revenue surging 77%. DMI Finance DMI Finance , an Indian shadow bank, has emerged as one of the digital lending solutions in the country. The company secured fresh funding from Japan’s Mitsubishi UFJ Financial Group (MUFG) in 2024, at a USD $3 billion valuation. With over USD $338.5 million in investments from MUFG, DMI Finance is aggressively expanding its digital lending footprint. They are offering tailored personal loans, BNPL (Buy Now, Pay Later), and embedded credit solutions. It sits in the 13th place in the list of fintech unicorns in India for 2025. MoneyView MoneyView operates a one-stop lending platform, offering personal loans, credit tracking tools and personal finance management solutions The startup joined the unicorn club in September 2024, raising USD $4.6 million from Accel India and Nexus Ventures at a USD $1.21 billion valuation. Fintech Infra/SaaS Chargebee Chargebee is a subscription revenue management platform that automates the billing and revenue operations of high-growth SaaS businesses. The company helps enterprises manage subscriptions, pricing, invoicing, taxes, and revenue analytics with a seamless, no-code solution. In 2022, the startup doubled its valuation to USD $3.5 billion following a USD $250 million funding round led by Tiger Global and Sequoia Capital. Zeta Zeta is a cloud-native banking and credit card issuance platform. The company enables banks, fintech startups, and enterprises to issue and manage digital-first debit, credit, and prepaid cards. Perfios Perfios operates in the fintech SaaS space, specialising in real-time credit decisioning, analytics, and fraud detection. The startup provides AI-powered solutions for financial institutions, banks, and NBFCs across 18 countries. The company is now valued at USD $2.57 billion. InsurTech Digit Insurance Digit Insurance (backed by Fairfax Holdings) is a tech-driven general insurance company that offers customised policies for health, auto, travel, and commercial properties. The insurance company became India’s first InsureTech unicorn in 2021 , after raising USD $18 million. The move was led by A91 Partners, Faering Capital, and TVS Capital at a USD $1.9 billion valuation. In 2024, the company now is valued at USD $3.79 billion. Acko Insurance Acko Insurance is a fully digital insurance provider, offering auto, health, and employee insurance. The company partners with Zomato and Swiggy to cover gig workers and has expanded into flexible term life insurance and chronic care management. Acko became a unicorn in 2021, raising USD $255 million in its Series D round . The move was led by Intact Ventures, General Atlantic and Multiples Alternate Asset Management, taking its value to USD $1.07 billion. PB Fintech PB Fintech or Policybazaar is India’s largest insurance aggregator, offering life, health, automobile, and travel insurance. The company also operates PaisaBazaar, a marketplace for loans and credit cards. The company achieved unicorn status in 2018, raising USD $200 million from SoftBank Vision Fund and InfoEdge. The startup then went public in 2021. As of March 2025 PB Fintech has a market cap of USD $8.25 billion . WealthTech Zerodha Moving on the the wealthtech category for our 2025 list of fintech unicorns in India, first up we have Zerodha . Founded in 2010, Zerodha is one of India’s largest stock brokerage firm, known for its discount broking model. The platform offers zero-commission stock trading, direct mutual fund investments, and portfolio management tools. Unlike most startups, Zerodha reached unicorn status in 2021 without raising external capital, making it a rare bootstrapped fintech unicorn , the first on this list. It is now valued at USD $3.6 billion. Groww Founded in 2017 by a bunch of ex-Flipkart employees, Groww simplifies direct mutual fund investments, stock trading, ETFs, and gold investments. The platform has gained popularity among first-time investors, offering an intuitive, mobile-first experience. However, in November 2024, Groww’s valuation fell below USD $2 billion following its domicile shift from the US to India. The company is now preparing for an IPO in the next 12-18 months , targeting a USD $6 billion to USD $8 billion valuation. Upstox Upstox started as a proprietary trading firm before expanding into retail stockbroking, mutual funds, and advisory services. The platform offers commission-free equity trading, making it a strong competitor to Zerodha and Groww. Upstox has raised a total funding of USD $220M over 6 rounds, with its first being in 2016. Its latest funding round was a Series C round in 2022 for an undisclosed amount from 3 investors. The company is valued at USD $2.98 billion as per the latest available filings. Others Open Open is one of India’s neobanking platform, designed to help small and midsize businesses (SMBs) manage banking, payments, and expenses in a single interface. In April 2022, Open became India’s 100th unicorn , raising USD $50 million at a USD $1 billion valuation. Backed by Temasek, BEENEXT, and Trifecta Capital, the company has secured around a total funding of USD $186M over 7 rounds. OneCard OneCard offers metal credit cards with zero joining fees, flexible EMIs, and personalised rewards. It also operates OneScore, a free credit score tracking platform. The company became a unicorn in July 2022, after raising USD $100 million in a Temasek-led round , pushing its valuation to USD $1.25 billion. OneCard has raised a total funding of USD $262 million over 9 rounds. Its first funding round dates back in 2019. Its latest funding round was a Series D round in 2024 for USD $28.5 million lead by QED Investors. CoinDCX CoinDCX became India’s first cryptocurrency unicorn in 2021 , after raising USD $90 million in a Series C round, backed by B Capital Group and Coinbase Ventures. In 2024, CoinDCX acquired Dubai-based crypto exchange BitOasis , marking its international expansion. The company is valued at USD $2.15 billion as of today. CoinSwitch Kuber CoinSwitch Kuber started as a crypto exchange aggregator before launching its India-exclusive crypto platform in 2020. The crypto-based company became India’s second crypto unicorn in 2021. During that time, it has raised USD $260 million at a USD $1.9 billion valuation , led by Andreessen Horowitz (a16z) and Coinbase Ventures. This marks the list of all of our 27 fintech unicorns in India that still retain its status in 2025. FAQs What is a fintech unicorn? A fintech unicorn is a privately held financial technology company valued at over USD $1 billion. These companies achieve unicorn status by securing significant investment, demonstrating rapid market adoption, and driving innovation in the financial services sector. How many fintech unicorns are in India? As of 2025, India has 27 fintech unicorns, including one decacorn valued at over USD $10 billion. The country ranks third globally in terms of fintech unicorns, following the United States and China. What are the top fintech unicorns in India? India’s leading fintech unicorns include PhonePe, Razorpay, Paytm, Slice, Groww, Policybazaar, Digit Insurance, Open, and CoinDCX, among others. These companies operate across various fintech categories, including payments, lending, insuretech, wealthtech, and neobanking, and play a crucial role in transforming India’s digital finance landscape. Why is Paytm Mall and Mobikwik not included in this list? Paytm Mall and Mobikwik once valued as a unicorn, lost its USD $1 billion+ valuation. It can all be due to declining investor confidence, rising competition, and regulatory challenges. As a result, it no longer qualifies as a fintech unicorn in India. Why is India a global fintech hub? India has become a global fintech hub due to rapid digital adoption, strong government support, and increasing investor confidence. Initiatives like Startup India, Digital India, and UPI have provided the necessary infrastructure for fintech startups to thrive. Additionally, fintech companies have benefited from a large smartphone user base, progressive regulatory policies, and financial inclusion efforts. In return, it has enabled millions of Indians to access digital financial services for the first time. Featured image credit: Edited from Freepik

Pine Labs Frequently Asked Questions (FAQ)

When was Pine Labs founded?

Pine Labs was founded in 1998.

Where is Pine Labs's headquarters?

Pine Labs's headquarters is located at Candor TechSpace, 4th & 5th Floor, Noida.

What is Pine Labs's latest funding round?

Pine Labs's latest funding round is Unattributed - IV.

How much did Pine Labs raise?

Pine Labs raised a total of $1.127B.

Who are the investors of Pine Labs?

Investors of Pine Labs include Vitruvian Partners, Alpha Wave Global, State Bank of India, Invesco, BlackRock and 24 more.

Who are Pine Labs's competitors?

Competitors of Pine Labs include Innoviti, ToneTag, Satispay, Klarna, Resal and 7 more.

Loading...

Compare Pine Labs to Competitors

Stripe provides services for businesses to manage online and in-person payments. It offers products including payment processing application programming interfaces (APIs), payment tools, and solutions for handling subscriptions, invoicing, and financial reports. Stripe serves sectors such as e-commerce, Software as a Service (SaaS), platforms, marketplaces, and the creator economy. Stripe was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

PayNearMe develops technology to facilitate the end-to-end customer payment experience. It offers a billing and payment platform. Its platform helps users pay with cash for a range of goods and services from companies in e-commerce, property management, consumer finance, and transportation, enabling businesses and government agencies as well as retail stores to digitize cash collection processes. PayNearMe was formerly known as Handle Financial. The company was founded in 2009 and is based in Santa Clara, California.

Lemonway is a payment institution that specializes in providing payment processing and wallet management solutions for marketplaces, crowdfunding platforms, and e-commerce websites. The institution offers a modular payment system that enables clients to handle transactions, from collection to disbursement, with a focus on KYC/AML regulatory compliance. Lemonway primarily serves the e-commerce industry, crowdfunding platforms, and other online marketplaces. It was founded in 2007 and is based in Paris, France.

Klarna provides payment solutions and shopping services. The company offers price comparison, installment payments, and consumer financing for online shopping. Klarna serves the ecommerce industry, providing services to both consumers and retailers. Klarna was formerly known as Kreditor . It was founded in 2005 and is based in Stockholm, Sweden.

Cellulant develops an electronic payment service connecting customers with banks and utility services to create a payment ecosystem. It offers a single application program interface payments platform that provides locally relevant and alternative payment methods for global, regional, and local merchants. Its platform enables businesses to collect payments online and offline while allowing anyone to pay from their mobile money, local and international cards, and directly from their bank. It was founded in 2004 and is based in Nairobi, Kenya.

Previse specializes in accelerating B2B payments through data-driven solutions in the financial technology sector. The company offers services that enable instant invoice payments and supply chain payment optimization using artificial intelligence to assess invoices and facilitate early payments. Previse's solutions cater to large enterprises looking to improve their working capital efficiency and supplier payment processes. It was founded in 2016 and is based in London, England.

Loading...