Openly

Founded Year

2017Stage

Debt | AliveTotal Raised

$430.77MLast Raised

$70M | 2 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+60 points in the past 30 days

About Openly

Openly is a home insurance provider focusing on high-value homeowners insurance. The company offers customizable coverage and is sold exclusively through independent agents. Openly uses technology to streamline the quoting process. It was founded in 2017 and is based in Boston, Massachusetts.

Loading...

Openly's Product Videos

ESPs containing Openly

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The full-stack insurtech carriers — home market comprises insurtech carriers that underwrite homeowners and renters insurance. As with established carriers, insurtech carriers will typically also be licensed by respective authorities and undergo review by rating agencies. Customer experience initiatives — particularly those focused on improving the ease of insurance sales and policy management for…

Openly named as Highflier among 13 other companies, including Lemonade, Branch, and Digit Insurance.

Openly's Products & Differentiators

Openly Homeowners Insurnace

H05 insurance product

Loading...

Research containing Openly

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Openly in 2 CB Insights research briefs, most recently on Feb 23, 2024.

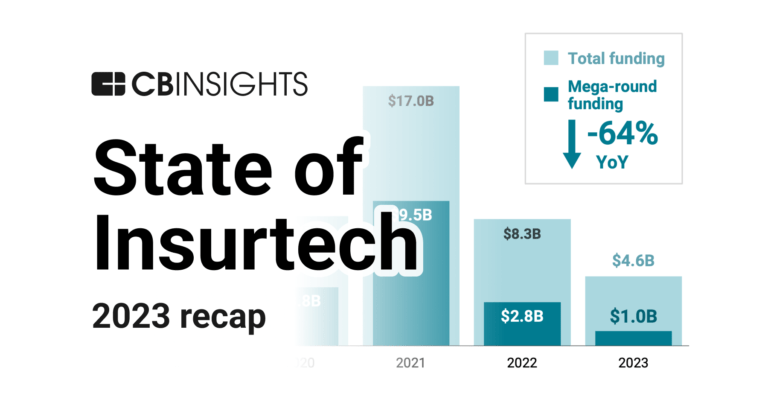

Feb 23, 2024

The B2C US insurtech market map

Feb 9, 2024 report

State of Insurtech 2023 ReportExpert Collections containing Openly

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Openly is included in 3 Expert Collections, including Real Estate Tech.

Real Estate Tech

2,490 items

Startups in the space cover the residential and commercial real estate space. Categories include buying, selling and investing in real estate (iBuyers, marketplaces, investment/crowdfunding platforms), and property management, insurance, mortgage, construction, and more.

Insurtech

4,489 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,450 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Latest Openly News

Jan 31, 2025

Press Release | January 30, 2025 Amid sustained growth, Openly sets its eyes on continued innovation in the homeowners insurance space BOSTON, MA / ACCESS Newswire / January 30, 2025 / Openly , the premium homeowners insurance provider, today announced a $193 million growth financing round led by Eden Global Partners, a merchant bank that specializes in providing long-term capital solutions, and Allianz X, the strategic growth investments arm of Allianz. The round includes participation from existing investors such as Advance Venture Partners, Obvious Ventures, Clocktower Technology Ventures, Point Judith Capital, and others. This additional investment comes just over one year after Openly raised $100 million in Series D funding. Openly remains dedicated to working exclusively with independent agents to serve homeowners with comprehensive coverage. In 2024, Openly expanded into three additional states bringing its total to 24, and partners with nearly 50,000 independent agents with plans for ongoing expansion. "Our investors' belief in Openly proves that we made the right decision nearly a decade ago to operate through independent agents to deliver comprehensive coverage based on homeowners' unique needs and circumstances," said Ty Harris, Co-Founder and CEO of Openly. "As we continue to keep our eyes on the future, the partnership with our investors will go a long way in ensuring we're able to maintain our position as an innovator and leader in this space." Openly's growth financing includes $123 million in equity capital, led by Eden Global Partners, and a $70 million senior note from Allianz X. Participation from Allianz X builds upon a strategic reinsurance partnership between Openly and Allianz Re that has existed since 2023, and was renewed and further expanded in 2024. Eden's investment in Openly follows its initial investment as the Series D lead. "Eden Global Partners is proud to deepen our partnership with Openly and its leadership team. Over the past two years of working together, we've had the privilege of seeing first-hand Openly bring to market innovative solutions for both independent agents, who represent the largest channel of insurance distribution in the U.S., as well as homeowners. We believe Openly is in a prime position to further expand its homeowners' insurance offering nationwide, as well as deploy its innovations to additional lines of insurance. We look forward to working with Openly as they continue to build on their market leadership and convert the biggest challenges facing the insurance industry today," said David Dwek, Chief Executive Officer of Eden Global Partners. "We are thrilled to strengthen our collaboration with Openly, building upon the strategic partnership with Allianz Re. Openly has rapidly emerged as a leader in the insurtech space, renowned for its commitment to sustainable growth, cutting-edge technology, and sophisticated underwriting capabilities. We are confident that this enhanced partnership will empower Openly to leverage its unique strengths and accelerate its impressive growth trajectory," said Dr. Nazim Cetin, CEO of Allianz X. About Openly Openly is a remote-first premium homeowners insurance provider. Its centralized platform offers comprehensive coverage, market-leading technology, and exceptional service. Founded by industry veterans in 2017, Openly is dedicated to delivering modern and transparent homeowners insurance and empowering independent agents across America. In 2024, Openly was named a Forbes America's Best Startup Employer and earned recognition across two Comparably awards; Best Company Outlook for small/medium-sized businesses and Best HR Team . For more information, visit Openly.com or linkedin.com/openlyllc . About Eden Global Partners Based in New York City, Eden Global Partners is a merchant bank dedicated to empowering visionary entrepreneurs shaping a better future. Focusing on permanent capital, we offer a unique blend of advisory services and principal investments, providing business leaders with patient, long-term financial support to tackle pressing challenges. Leveraging decades of transaction experience at leading investment banks and enterprises, our team delivers strategic financial guidance, an extensive network of capital partners, and utilizes our own balance sheet to help companies scale, innovate, and create sustainable value for all stakeholders. Discover more at Eden Global Partners or connect with us on LinkedIn . About Allianz X Allianz X invests in innovative growth companies in ecosystems of strategic relevance to Allianz Group's core business of insurance and asset management. It has a global portfolio of around 25 companies and assets under management of about 1.8 billion U.S. dollars. The heart, brains, and drive behind it all are a talented team of around 40 people in Munich and New York. On behalf of leading global insurer and asset manager Allianz, Allianz X enables collaborative partnerships in insurtech, fintech, wealth management, and beyond. As an investor, Allianz X supports growth companies to take the next bold steps and realize their full potential. Keep up with the latest at Allianz X on Medium , LinkedIn , and X (formerly Twitter) . Media Contacts:

Openly Frequently Asked Questions (FAQ)

When was Openly founded?

Openly was founded in 2017.

Where is Openly's headquarters?

Openly's headquarters is located at 131 Dartmouth Street, Boston.

What is Openly's latest funding round?

Openly's latest funding round is Debt.

How much did Openly raise?

Openly raised a total of $430.77M.

Who are the investors of Openly?

Investors of Openly include Clocktower Technology Ventures, Obvious Ventures, PJC, Advance Venture Partners, Eden Global Partners and 14 more.

Who are Openly's competitors?

Competitors of Openly include Slide Insurance, Sixfold, Kin, Branch, Hippo and 7 more.

What products does Openly offer?

Openly's products include Openly Homeowners Insurnace.

Who are Openly's customers?

Customers of Openly include Iroquois , Goosehead Insurance, Agentero, Reliance Risk and Guaranteed Rate.

Loading...

Compare Openly to Competitors

TypTap is an insurance group that provides homeowners insurance and utilizes technology within the insurance sector. The company offers a quoting platform and pre-underwriting technology. TypTap serves the residential insurance market. It was founded in 2016 and is based in Ocala, Florida.

Branch specializes in providing home and auto insurance services within the insurance industry. The company offers a process for customers to obtain insurance quotes and purchase policies online, with options for personalizing coverage and bundling insurance products for potential savings. It was founded in 2017 and is based in Columbus, Ohio.

Kin provides affordable home insurance solutions within the insurance industry. The company offers a range of products, including homeowners, mobile homes, condos, flood, landlord, and hurricane insurance, all designed to protect customers' properties and interests in the event of disasters or other damages. Kin's insurance products are tailored to meet the needs of homeowners and property investors, offering customizable policies and direct purchasing options to keep costs down. Kin was formerly known as Bright Policy. It was founded in 2016 and is based in Chicago, Illinois.

CSAA Insurance Group provides insurance services within the auto and home insurance sectors. The company offers various insurance products, including policies for automobiles and homes, as well as services such as claims assistance and policy management. CSAA Insurance Group serves individual consumers seeking personal insurance coverage. It was founded in 1914 and is based in Walnut Creek, California.

Branch Media provides home, auto, and umbrella insurance. The company offers options to customize policies and bundle different types of insurance. Branch Media serves individuals looking for personal insurance solutions. Branch Media was formerly known as Roundtable Media. It is based in New York, New York. Branch Media operates as a subsidiary of Meta.

Kalepa focuses on enhancing underwriting performance in the commercial insurance industry. The company's main service is an artificial intelligence (AI)-powered underwriting workbench, which helps underwriters focus on high return on investment opportunities, quickly evaluate submissions, and understand the hidden risks associated with each case. It primarily serves the commercial insurance industry. It was founded in 2018 and is based in New York, New York.

Loading...