Activ Surgical

Founded Year

2017Stage

Series B - IV | AliveTotal Raised

$102.4MLast Raised

$15M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-93 points in the past 30 days

About Activ Surgical

Activ Surgical specializes in intraoperative surgical intelligence within the medical technology sector. The company's primary offering, ActivSight Intelligent Light, provides surgeons with real-time visual insights and information that reveal critical physiological structures and functions during surgery. Activ Surgical's products are designed to enhance surgical precision and patient care by integrating augmented reality, artificial intelligence, and machine learning technologies. Activ Surgical was formerly known as Omniboros, Inc. It was founded in 2017 and is based in Boston, Massachusetts.

Loading...

ESPs containing Activ Surgical

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The augmented reality/virtual reality (AR/VR) surgical guidance & navigation market (also called spatial computing surgical guidance & navigation) is a rapidly advancing field that aims to revolutionize surgical procedures by leveraging immersive technologies. This market offers solutions that utilize AR and VR technologies to provide surgeons with real-time, interactive, and three-dimensional vis…

Activ Surgical named as Highflier among 12 other companies, including Proprio, MediView, and Pixee Medical.

Activ Surgical's Products & Differentiators

ActivInsights™ software suite

The ActivInsights software suite is a proprietary augmented reality (AR)-based bundle that offers real-time tissue assessment for surgeons through previously unavailable visual overlays. The software suite is designed to transform massive amounts of data gathered intra-operatively to provide surgeons real-time guidance in the operating room. The first offering from the ActivInsights software suite that will be available to surgeons is the Perfusion View Insight, will be underpinned by the industry's largest annotated data set and will provide the ability to visualize blood flow and perfusion for procedures such as anastomosis and colorectal cases in real time, without the use of traditional dyes.

Loading...

Research containing Activ Surgical

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Activ Surgical in 4 CB Insights research briefs, most recently on Jan 5, 2024.

May 17, 2022 report

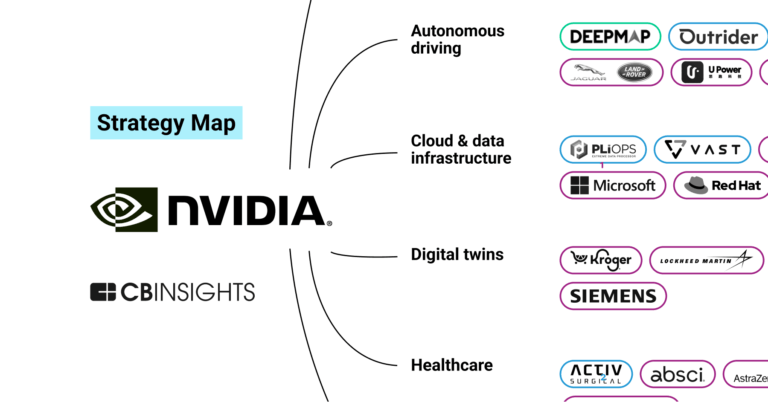

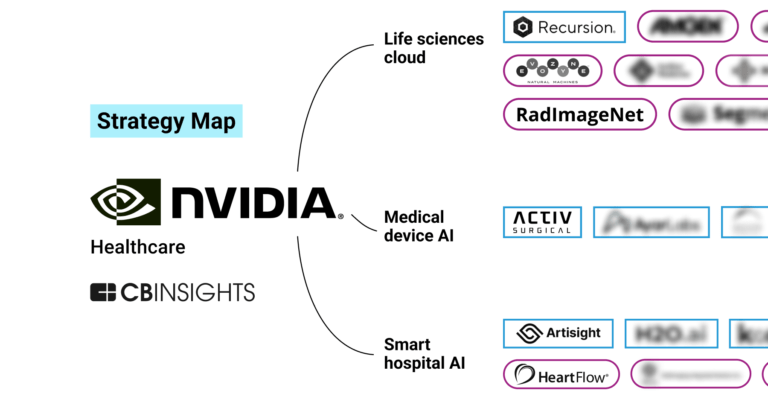

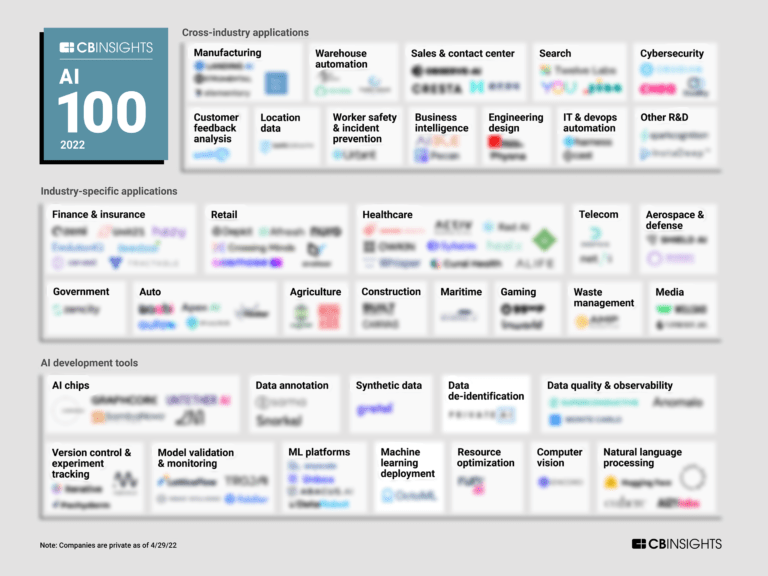

AI 100: The most promising artificial intelligence startups of 2022Expert Collections containing Activ Surgical

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Activ Surgical is included in 4 Expert Collections, including Digital Health.

Digital Health

11,305 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Digital Health 50

150 items

The winners of the third annual CB Insights Digital Health 150.

AI 100

100 items

Artificial Intelligence

7,221 items

Activ Surgical Patents

Activ Surgical has filed 30 patents.

The 3 most popular patent topics include:

- medical imaging

- medical equipment

- surgical instruments

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

10/15/2021 | 1/21/2025 | Surgery, Surgical instruments, Surgical robots, Surgical procedures and techniques, Special relativity | Grant |

Application Date | 10/15/2021 |

|---|---|

Grant Date | 1/21/2025 |

Title | |

Related Topics | Surgery, Surgical instruments, Surgical robots, Surgical procedures and techniques, Special relativity |

Status | Grant |

Latest Activ Surgical News

Mar 13, 2025

The global market for Artificial Intelligence and Analytics in Surgery was valued at US$255.3 Million in 2024 and is projected to reach US$950.8 Million by 2030, growing at a CAGR of 24.5% from 2024 to 2030. This comprehensive report provides an in-depth analysis of market trends, drivers, and forecasts, helping you make informed business decisions. Artificial Intelligence (AI) and analytics are revolutionizing the field of surgery, making procedures more precise, efficient, and safer. Advanced AI algorithms are being employed to analyze complex patient data, enabling surgeons to make well-informed decisions before, during, and after surgeries. Preoperative planning has seen significant advancements, as AI-powered systems provide detailed simulations and predictive models to optimize surgical approaches. These tools reduce errors and enhance patient outcomes by tailoring procedures to individual needs. What's Driving the Growth of AI and Analytics in Surgery? The growth in the Artificial Intelligence and Analytics in Surgery market is driven by several key factors, reflecting the increasing integration of these technologies into surgical practices. Rapid advancements in AI algorithms, coupled with the availability of high-resolution imaging and real-time analytics, are enabling more precise and effective surgical interventions. The rising prevalence of complex diseases such as cancer and cardiovascular disorders is also driving demand for advanced surgical solutions, where AI and analytics play a pivotal role in improving outcomes. Consumer expectations for personalized and minimally invasive procedures are pushing healthcare providers to adopt cutting-edge technologies. AI-driven preoperative planning tools and robotic assistance systems are meeting these demands by enhancing precision and reducing recovery times. Furthermore, the growing emphasis on data-driven healthcare and regulatory requirements for patient safety are encouraging the integration of analytics into surgical workflows. These technologies are proving indispensable for improving operational efficiency, enhancing patient care, and addressing the evolving needs of the healthcare sector. As innovation continues to advance, AI and analytics are poised to play an even greater role in shaping the future of surgery. What Is Driving AI and Analytics Adoption in Surgery? The growing adoption of AI and analytics in surgery is fueled by advancements in technology and an increasing demand for improved patient outcomes. AI-enabled surgical robots are becoming more sophisticated, allowing for minimally invasive procedures that result in shorter recovery times and reduced hospital stays. These systems integrate seamlessly with advanced imaging technologies, providing surgeons with a comprehensive view of the surgical field. This is particularly valuable in complex surgeries such as neurosurgery and oncology, where precision is critical. The shift toward value-based healthcare is also a significant driver. Hospitals and surgical centers are under pressure to improve efficiency and reduce costs without compromising care quality. AI and analytics help optimize resource allocation, streamline workflows, and enhance surgical team coordination. Furthermore, advancements in natural language processing and voice-activated systems are simplifying documentation processes, enabling surgeons to focus more on patient care. These factors collectively underscore the growing reliance on AI and analytics to meet the demands of modern surgical environments. Can AI and Analytics Address Challenges in Postoperative Care? Postoperative care is a critical aspect of surgical success, and AI is playing an increasingly vital role in this phase. AI-driven predictive models analyze patient data to forecast recovery trajectories and identify potential risks, such as infections or complications. This allows healthcare providers to intervene proactively, reducing readmission rates and improving long-term outcomes. AI-powered monitoring systems can track patients' vital signs remotely, providing real-time updates to clinicians and enabling early detection of any abnormalities. Analytics also contribute to improving patient engagement and adherence to postoperative care plans. By personalizing recovery recommendations based on patient-specific data, healthcare providers can ensure better compliance and quicker recoveries. Additionally, AI is being used to analyze large datasets from past surgeries, identifying trends and best practices that inform evidence-based improvements in postoperative protocols. These technologies are not only enhancing recovery experiences but also contributing to broader improvements in surgical care standards. Report Features: Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030. In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa. Company Profiles: Coverage of major players such as Activ Surgical, Asensus Surgical, Brainlab AG, Brainomix Limited, care.ai and more. Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments. Key Insights: Market Growth: Understand the significant growth trajectory of the Software Component segment, which is expected to reach US$513.2 Million by 2030 with a CAGR of a 21.5%. The Services Component segment is also set to grow at 28.9% CAGR over the analysis period. Regional Analysis: Gain insights into the U.S. market, valued at $67.1 Million in 2024, and China, forecasted to grow at an impressive 23.4% CAGR to reach $145.8 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific. Segments: Component (Software Component, Services Component) Technology (Machine Learning Technology, Deep Learning Technology, Natural Language Processing Technology, Other Technologies) End-Use (Hospitals End-Use, Surgical Specialty Units End-Use, Ambulatory Surgery Centers End-Use) Key Attributes: Report Attribute Details No. of Pages Forecast Period Estimated Market Value (USD) in 2024 $255.3 Million Forecasted Market Value (USD) by 2030 $950.8 Million Compound Annual Growth Rate Regions Covered Global Key Topics Covered: MARKET OVERVIEW Influencer Market Insights World Market Trajectories Economic Frontiers: Trends, Trials & Transformations Artificial Intelligence and Analytics in Surgery - Global Key Competitors Percentage Market Share in 2024 (E) Competitive Market Presence - Strong/Active/Niche/Trivial for Players Worldwide in 2024 (E) MARKET TRENDS & DRIVERS AI-Powered Surgical Assistants Drive Precision and Reduce Human Errors in Complex Procedures Analytics-Driven Decision Support Systems Strengthen Case for AI Adoption in Preoperative Planning Demand for Minimally Invasive Techniques Drives Adoption of AI-Enhanced Robotic Surgery Systems AI Algorithms for Predictive Patient Monitoring Bode Well for Enhanced Post-Surgical Care Increasing Surgical Volumes Amplify Need for AI-Driven Workflow Optimization Tools AI-Powered Image Analysis Strengthens Use Cases in Complex Oncology Surgeries Advancements in AI-Driven Surgical Robotics Create New Revenue Streams for Healthcare Providers Growing Investment in AI for Risk Assessment Prior to Surgery Enhances Market Potential Real-Time AI Analysis of Surgical Videos Improves Training and Skill Development for Surgeons AI in Remote Surgery Applications Expands Opportunities for Cross-Border Healthcare Access Rise in Chronic Diseases Spurs Adoption of AI-Integrated Surgical Interventions Global Push for Digital Transformation in Healthcare Drives Growth in AI for Surgery FOCUS ON SELECT PLAYERS: Some of the 27 companies featured in this report include Activ Surgical Asensus Surgical Brainlab AG Brainomix Limited care.ai Caresyntax Intuitive Surgical, Inc. Johnson & Johnson Services, Inc. LeanTaaS Medtronic Plc For more information about this report visit https://www.researchandmarkets.com/r/bdoz9m About ResearchAndMarkets.com ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends. View source version on businesswire.com: https://www.businesswire.com/news/home/20250312967885/en/ Contacts ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Activ Surgical Frequently Asked Questions (FAQ)

When was Activ Surgical founded?

Activ Surgical was founded in 2017.

Where is Activ Surgical's headquarters?

Activ Surgical's headquarters is located at 30 Thomson Place, Boston.

What is Activ Surgical's latest funding round?

Activ Surgical's latest funding round is Series B - IV.

How much did Activ Surgical raise?

Activ Surgical raised a total of $102.4M.

Who are the investors of Activ Surgical?

Investors of Activ Surgical include Tao Capital Partners, LRVHealth, Cota Capital, Magnetar Capital, Hikma Ventures and 21 more.

Who are Activ Surgical's competitors?

Competitors of Activ Surgical include CMR Surgical, Asensus Surgical, Quantum Surgical, Theator, Vicarious Surgical and 7 more.

What products does Activ Surgical offer?

Activ Surgical's products include ActivInsights™ software suite and 1 more.

Loading...

Compare Activ Surgical to Competitors

Quantum Surgical focuses on interventional oncology. The company offers the Epione robotic platform, which is designed for the planning, targeting, delivery, and confirmation of tumor ablation treatments. The technology primarily serves the healthcare sector, with a focus on improving cancer treatment through minimally invasive procedures. It was founded in 2017 and is based in Montpellier, France.

CMR Surgical specializes in the development of robotic-assisted surgical devices within the medical devices industry. The company offers the Versius Surgical System, which is designed to assist surgeons in performing minimal access surgery. It primarily serves the healthcare sector, focusing on hospitals and medical professionals. CMR Surgical was formerly known as Cambridge Medical Robotics. It was founded in 2014 and is based in Cambridge, United Kingdom.

Asensus Surgical focuses on the development and manufacturing of digital laparoscopy and surgical robotics. The company's main offerings include the surgical system and the intelligent surgical unit. It primarily serves the healthcare industry, particularly the surgical technology sector. Asensus Surgical was formerly known as TransEnterix. It was founded in 2006 and is based in Durham, North Carolina. In August 2024, Asensus Surgical was acquired by Karl Storz.

Caresyntax focuses on surgical outcomes through its AI-powered, vendor-neutral surgical data platform. The company offers a suite of services that include operational analytics, clinical outcome improvement, and financial optimization for healthcare providers. Caresyntax primarily serves hospitals, surgery centers, surgeons, perioperative leaders, insurers, risk managers, and medtech partners. It was founded in 2013 and is based in Larkspur, California.

Karl Storz specializes in medical technology with a focus on endoscopy. It offers products including endoscopic instruments, medical imaging solutions, and operating room integration systems for various surgical procedures. The company serves the healthcare sector, providing solutions for human and veterinary medicine across multiple medical specialties. It was founded in 1945 and is based in Tuttlingen, Germany.

Proximie is a technology company that provides a cloud-based software platform in the healthcare sector. The company offers solutions for connectivity, data management, and analytics aimed at surgical procedures and medtech. Proximie's products are intended for medtech companies and hospital systems. It was founded in 2016 and is based in London, England.

Loading...