Nubank

Founded Year

2013Stage

Corporate Minority - P2P - II | IPOTotal Raised

$2.547BMarket Cap

49.75BStock Price

10.35Revenue

$0000About Nubank

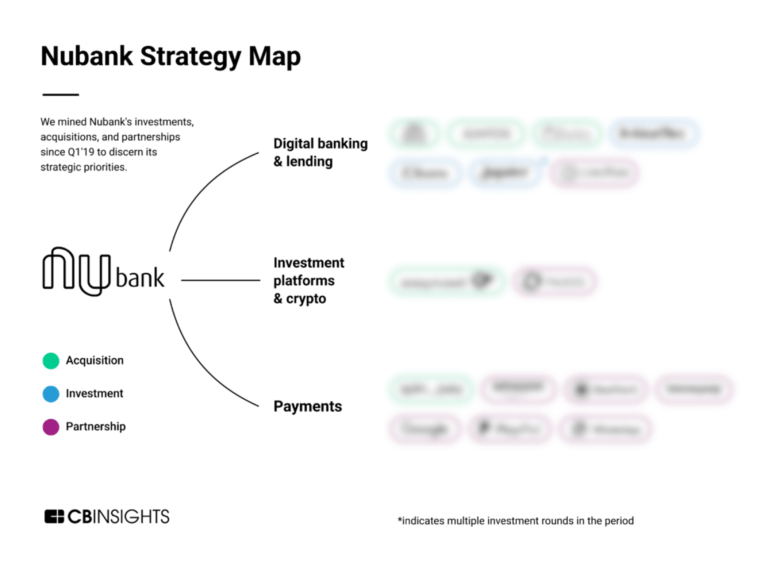

Nubank is a digital banking platform focusing on financial services for individuals and SMEs. The company offers products including credit cards, digital accounts, personal loans, investment options, and insurance. It was founded in 2013 and is based in Sao Paulo, Brazil.

Loading...

Loading...

Research containing Nubank

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Nubank in 7 CB Insights research briefs, most recently on Aug 7, 2023.

Expert Collections containing Nubank

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Nubank is included in 5 Expert Collections, including Fintech 100.

Fintech 100

998 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Digital Lending

2,374 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Conference Exhibitors

5,302 items

Fintech

13,661 items

Excludes US-based companies

Digital Banking

1,105 items

Challenger bank offer digitally native banking products (checking and savings account at the most basic) and either leverage partner banks or are fully-licensed banks themselves.

Latest Nubank News

Mar 29, 2025

Notably, the coin found a new support level at $0.73, as a momentary dip below this price was swiftly cleared off. At the same time, Cardano traders have committed over one billion ADA in Open Interest. What Growing Open Interest Signals For Cardano Price According to CoinGlass data, 1.07 billion ADA, valued at $781.02 million, are now placed on ADA futures bet. The increased figures indicate that Cardano investors have rekindled their interest in the coin, possibly due to the price action. Analysts opine that the uptick in different ADA metrics suggests traders anticipate a likely price breakout. ADA price has been teasing possible rallies as the coin's value has increased by 1.46% in the last seven days. Its 11.04% growth in the last 30 days further boosts confidence among market participants closely monitoring price movements. According to market data, ADA has lost 4.98% of its value to trade at $0.6954 as of this writing. The slight drop has not affected traders' confidence in betting on ADA futures. CoinGlass reveals that most of these traders were pitched with Binance, with 22.83% of the Open Interest figures. These traders committed 243.68 million ADA worth $178.34 million. Other exchanges were Bitget, Gate.io, and Bybit, with 20.27%, 18.27%, and 15.9%, respectively. These four exchanges registered over $100 million worth of ADA. Nubank's ADA Adoption Expands Market Reach In the broader Cardano ecosystem, the adoption of ADA has surged, with a potential addition of over 100 million users. This development followed Nubank's addition of Cardano to its services. Nubank is a major digital bank in Latin America with users in Brazil, Mexico, and Columbia. According to an update by Frederik Gregaard, Cardano Foundation President, Nubank customers can now buy, sell, and interact with ADA via the bank's platform. Image Source: Federik Gregaard on X According to Thomaz Fortes, Executive Director of Nubank's Crypto and Virtual Assets, the move highlights the bank's commitment to providing diversified crypto assets. It assures clients that Nubank will continue to expand its portfolio to meet their needs. Currently, Nubank offers its users 20 different crypto assets, and the inclusion of ADA signals institutional trust in Cardano. Leios Upgrade Could Revolutionize Cardano's Scalability Meanwhile, Cardano's founder, Charles Hoskinson has clarified a game-changing upgrade on the protocol. Notably, Hoskinson referred to Ouroborus Leios, which has been developing for six years. Responding to a user who asked if other chains were utilizing Leios, Hoskinson emphasized that the new technology is specific to Cardano. According to him, it aims to address the “blockchain trilemma.” Image Source: Charles Hoskinson on X That is the challenge of balancing decentralization, security, and scalability without compromising any of the three. Experts consider this a remarkable development as many blockchains struggle to achieve all three aspects simultaneously. They opine that Leios would likely introduce mechanisms to enable faster and more seamless blockchain transactions while maintaining network integrity. Market observers expect the Nubank adoption and Leios upgrade to affect Cardano's price positively. There are predictions that if ADA sustains its current upward trajectory and breaches the $0.77 resistance, it could retest the $1 level. Such a development could mean that ADA is truly on the path to recovery. As of now, market participants remain glued to price movements while anticipating the manifestations of Cardano. Source: https://www.thecoinrepublic.com/2025/03/29/cardano-price-in-spotlight-what-to-expect/

Nubank Frequently Asked Questions (FAQ)

When was Nubank founded?

Nubank was founded in 2013.

Where is Nubank's headquarters?

Nubank's headquarters is located at Rua Capote Valente, 39, Sao Paulo.

What is Nubank's latest funding round?

Nubank's latest funding round is Corporate Minority - P2P - II.

How much did Nubank raise?

Nubank raised a total of $2.547B.

Who are the investors of Nubank?

Investors of Nubank include SoftBank Latin America Fund, Berkshire Hathaway, Sequoia Capital, CPP Investments, Sunley House Capital Management and 27 more.

Who are Nubank's competitors?

Competitors of Nubank include Uala, Agibank, Albo, Sicredi, Neon and 7 more.

Loading...

Compare Nubank to Competitors

Banco Original specializes in providing digital banking services for both individual and corporate clients. The bank offers a range of financial products, including online account opening, personalized credit solutions, and specialized services for the agribusiness sector. It caters to large enterprises and the agricultural industry with tailored financial services and support. It was founded in 2001 and is based in Sao Paulo, Brazil.

Neon is a fintech company that provides digital banking services. The company offers a digital account, a credit card, CDBs, personal loans, and rewards, which can be accessed through a mobile application. Neon serves individual consumers and microentrepreneurs with its products. Neon was formerly known as ControlY. It was founded in 2016 and is based in Sao Paulo, Brazil.

Agibank is a financial institution that operates in the banking sector. The company offers a range of financial services, including personal loans, consigned loans, and investment services, all designed to facilitate the economic lives of its customers. It primarily serves individuals, offering solutions for various financial needs. It was founded in 1999 and is based in Campinas, Brazil.

Klar is a financial services company that offers credit card services, personal savings, and investment products. The company provides credit cards with no annual fees, savings accounts with daily growth, and flexible investment options with competitive returns. Klar's offerings are designed to cater to individuals seeking accessible financial products and tools for managing their finances. It was founded in 2019 and is based in Mexico City, Mexico.

Uala provides a financial technology platform for the digital payment services sector. It offers a mobile application that allows users to manage their finances by purchasing, transferring, investing, and earning interest on their funds. It serves consumers looking for financial services. Uala was formerly known as Bancar Technologies. It was founded in 2017 and is based in Caba, Argentina.

Bnext operates as a financial technology company that offers a range of financial management services. The company provides an online banking platform with features such as international money transfers, virtual cards, expense tracking, and a marketplace for various financial products. Bnext also supports cryptocurrency transactions and integrates with mobile payment services. It was founded in 2016 and is based in Madrid, Spain.

Loading...