NICE Actimize

Founded Year

1999Stage

Acquired | AcquiredTotal Raised

$24MValuation

$0000Revenue

$0000About NICE Actimize

NICE Actimize develops financial crime, risk, and compliance solutions. The company offers services such as fraud prevention, anti-money laundering detection, and trading surveillance, aimed at identifying financial crime, preventing fraud, and ensuring regulatory compliance. It primarily serves global financial institutions and government regulators. It was formerly known as Actimize. It was founded in 1999 and is based in Hoboken, New Jersey. In July 2007, Actimize was acquired by NICE Systems.

Loading...

NICE Actimize's Product Videos

NICE Actimize's Products & Differentiators

SURVEIL-X Holistic Conduct Surveillance Suite

The SURVEIL-X Holistic Trade Compliance platform analyzes and relates all trade related data: Comprehensive surveillance coverage for all regulatory needs; Breaks down barriers between data silos enabling deeper analysis and true risk detection; oes beyond simple thresholds and detection rules to correlate all relevant data sources; Can connect to, ingest and analyze data from many real-time data sources, including all forms of communications

Loading...

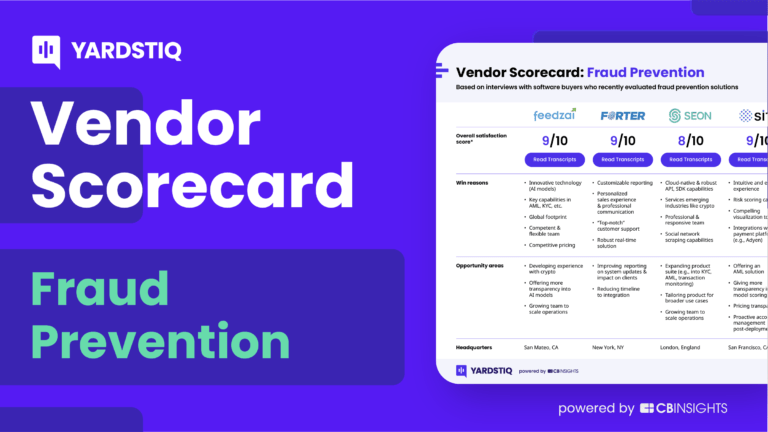

Research containing NICE Actimize

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned NICE Actimize in 1 CB Insights research brief, most recently on Feb 27, 2023.

Feb 27, 2023 report

Top fraud prevention companies — and why customers chose themExpert Collections containing NICE Actimize

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

NICE Actimize is included in 1 Expert Collection, including Regtech.

Regtech

1,721 items

NICE Actimize Patents

NICE Actimize has filed 1 patent.

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

10/15/2013 | Financial risk, Financial risk modeling, Financial risk management, Financial data vendors, Actuarial science | Application |

Application Date | 10/15/2013 |

|---|---|

Grant Date | |

Title | |

Related Topics | Financial risk, Financial risk modeling, Financial risk management, Financial data vendors, Actuarial science |

Status | Application |

Latest NICE Actimize News

Mar 26, 2025

HOBOKEN, N.J.--(BUSINESS WIRE)-- #NICEActimize--NICE Actimize, a NICE (NASDAQ: NICE) business, has released "The 2025 Fraud Survey: EMEA Financial Fraud Trends and Investment Priorities” report which identifies the fraud trends landscape across Europe, the Middle East and Africa (EMEA). Addressing the challenges and drivers of change in the region, the report includes a deep dive into current changes in regulations and policy, as well as insights into investments and prioritization in new technologies. The rep

NICE Actimize Frequently Asked Questions (FAQ)

When was NICE Actimize founded?

NICE Actimize was founded in 1999.

Where is NICE Actimize's headquarters?

NICE Actimize's headquarters is located at 221 River Street, Hoboken.

What is NICE Actimize's latest funding round?

NICE Actimize's latest funding round is Acquired.

How much did NICE Actimize raise?

NICE Actimize raised a total of $24M.

Who are the investors of NICE Actimize?

Investors of NICE Actimize include NICE, Viola Ventures, Vertex Ventures Israel, Giza Venture Capital and FTV Capital.

Who are NICE Actimize's competitors?

Competitors of NICE Actimize include Quantexa, Clari5, Napier, Hawk, Tookitaki and 7 more.

What products does NICE Actimize offer?

NICE Actimize's products include SURVEIL-X Holistic Conduct Surveillance Suite and 4 more.

Loading...

Compare NICE Actimize to Competitors

ComplyAdvantage offers artificial intelligence-driven solutions for fraud and anti-money laundering (AML) risk detection within the financial services industry. The company provides services including customer and company screening, ongoing monitoring, transaction and payment screening, and fraud detection. It serves sectors such as banking, cryptocurrency, insurance, lending, and wealth management. The company was founded in 2014 and is based in London, United Kingdom.

Quantexa specializes in decision intelligence within the technology sector, providing solutions for data-driven decision-making across various industries. The company offers a platform that integrates artificial intelligence to unify data and resolve entities, performing graph analytics for risk management, customer intelligence, and financial crime prevention. Quantexa serves sectors including banking, insurance, government, telecommunications, health and social care, and the public sector. It was founded in 2016 and is based in London, United Kingdom.

DataVisor focuses on fraud and risk management within the financial technology sector. It offers an AI-powered SaaS platform that provides enterprise-level fraud prevention and AML compliance solutions. The company primarily serves financial institutions and large organizations, offering a suite of tools to combat various types of fraud and financial crimes. It was founded in 2013 and is based in Mountain View, California.

ThetaRay provides AI-powered solutions for transaction monitoring, customer risk assessment, and financial crime screening within the banking and fintech sectors, focusing on compliance and false positive management. It was founded in 2013 and is based in Hod Hasharon, Israel.

Sift operates in the fields of cybersecurity and financial technology. Its main offerings include a platform that uses machine learning and user identity verification to address fraud, including account takeover, payment fraud, and policy abuse. Sift serves sectors that require digital trust solutions, such as e-commerce, fintech, and online marketplaces. Sift was formerly known as Sift Science. It was founded in 2011 and is based in San Francisco, California.

Ripjar specializes in anti-money laundering (AML) and intelligence solutions within the financial services sector. The company offers products that assist in the detection, investigation, and monitoring of threats from criminal activity, utilizing artificial intelligence to identify risks from various data sources. Ripjar serves sectors that require compliance and security measures, such as banking, financial services, casinos, and gaming industries. It was founded in 2012 and is based in Cheltenham, United Kingdom.

Loading...