Mysten Labs

Founded Year

2021Stage

Unattributed VC | AliveTotal Raised

$336MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-39 points in the past 30 days

About Mysten Labs

Mysten Labs focuses on developing foundational infrastructure for the web3 space. Its main offerings include creating systems that support the acceleration of Web3 adoption by enhancing the underlying technology, such as distributed systems, cryptography, and programming languages. It caters to sectors that are integrating blockchain and decentralized technologies. It was founded in 2021 and is based in Palo Alto, California.

Loading...

Loading...

Research containing Mysten Labs

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Mysten Labs in 3 CB Insights research briefs, most recently on Jun 8, 2023.

Oct 31, 2022 report

State of Blockchain Q3’22 Report

Jul 29, 2022

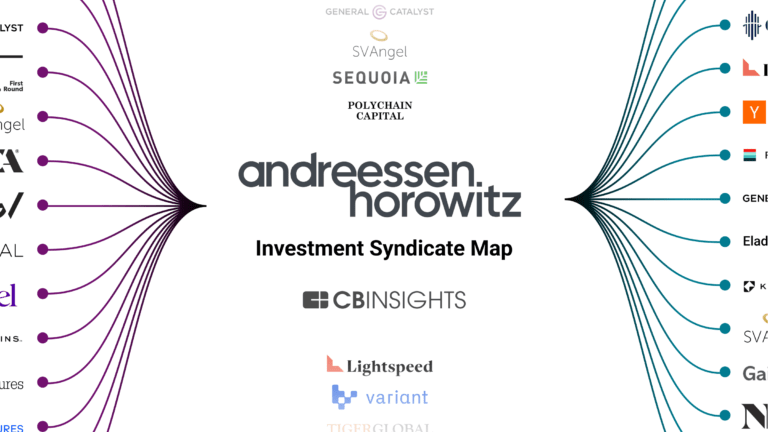

Where a16z is investing in crypto and blockchainExpert Collections containing Mysten Labs

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Mysten Labs is included in 2 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Blockchain

11,886 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Mysten Labs Patents

Mysten Labs has filed 2 patents.

The 3 most popular patent topics include:

- cryptography

- federated identity

- identity management

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

7/17/2023 | 9/24/2024 | Grant |

Application Date | 7/17/2023 |

|---|---|

Grant Date | 9/24/2024 |

Title | |

Related Topics | |

Status | Grant |

Latest Mysten Labs News

Mar 27, 2025

As the court's decision unfolds, Upbit is seizing this opportunity to appeal the penalties imposed by the Financial Intelligence Unit (FIU) for alleged KYC violations. The ruling gives Upbit critical time to enhance its operational strategies, particularly with the launch of new trading pairs for the Wallace (WAL) token. Upbit's business restriction suspension offers the platform more time to contest regulatory penalties and launch new trading pairs for Wallace (WAL). Court Suspends Upbit Business Restriction The Seoul Administrative Court's recent ruling marks a significant moment for Upbit and its parent company, Dunamu, as it provides an emergency suspension of a previously imposed business restriction. This ruling allows Upbit to continue facilitating transactions for new users while the legal battles unfold. In its appeal, Dunamu argued that the sanctions from the Financial Intelligence Unit (FIU) were unduly punitive. The 5th Administrative Division of the court, presided over by Judge Soonyeol Kim, granted the temporary suspension, allowing Upbit to maintain operational stability. “…the effect will be suspended until 30 days from the date of the judgment of the main lawsuit. This is a measure to buy some time for Dunamu,” the report indicated, highlighting a strategic pause for Upbit. FIU's accusations against Upbit included violations of the Special Financial Transactions Act, particularly concerning unregistered overseas exchanges and lack of real-name verification processes. During a thorough anti-money laundering (AML) audit conducted from August to October last year, these infractions came to light. The FIU's actions were aimed at reinforcing the legal compliance landscape surrounding virtual asset transactions. Despite the situation, Upbit responded positively to the regulatory environment, stating, “We deeply sympathize with the purpose of the financial authorities' recent sanctions aimed at establishing a robust anti-money laundering system.” Nonetheless, they faced a three-month suspension that included a halt on deposits and withdrawals for new users. The allegations led to significant repercussions, including the dismissal of Upbit's compliance officer and a reprimand directed at CEO Lee Seok-woo. In exchange, Dunamu swiftly initiated legal proceedings to contest the restrictions, gaining an essential reprieve from the court. While the suspension was slated for March 7, the court's decision allows Upbit to operate uninterrupted until a definitive judgment is reached in the main lawsuit. This ongoing situation is critical as it places Upbit, South Korea's premier crypto exchange, in a nuanced position amid increasing regulatory scrutiny. In a broader context, the government has recently instructed Google to block 17 foreign cryptocurrency exchanges that did not adhere to local compliance requirements, leaving Upbit with less competition. Market Implications and New Developments for Upbit The implications of the court's ruling extend beyond immediate operational impacts for Upbit. With heightened regulatory pressures and scrutiny, the upcoming legal decisions will likely influence investor confidence and overall market sentiment in South Korea. Upbit's ability to navigate this legal challenge could position it as a more resilient player in the volatile cryptocurrency market. In addition to the legal struggles, Upbit is innovating its product offerings with the announcement of Wallace (WAL) trading pairs that include the Korean won (KRW), Bitcoin (BTC), and USDT stablecoin. This strategic launch aims to capture a segment of the market focused on decentralized storage solutions. Wallace (WAL) on Upbit. Source: Upbit announcement The WAL token is part of the innovative Walrus protocol, designed for decentralized blockchain data storage and developed by the Sui (SUI) team at Mysten Labs. Recently securing $140 million in funding, Walrus's mainnet launch aligns with Upbit's strategic enhancements, paving the way for increased visibility in the Korean crypto ecosystem. As the cryptocurrency market in South Korea retains its pivotal role, Upbit's proactive stance could translate to a strengthened market presence. However, historical precedents, such as the fluctuating impact of past token listings like ORCA and BONK, suggest that initial gains may not always be sustainable. Conclusion The suspension of Upbit's business restriction is a temporary yet crucial win in the context of South Korea's evolving regulatory landscape. While the exchange continues operations smoothly, the forthcoming court verdict will serve as a definitive measure of regulatory enforcement in the crypto sphere. For potential investors and users, keeping an eye on these developments will be essential in assessing Upbit's future in a highly competitive space. Don't forget to enable notifications for our Twitter account and Telegram channel to stay informed about the latest cryptocurrency news. Source: https://en.coinotag.com/upbit-secures-temporary-business-suspension-relief-as-legal-challenges-and-new-trading-opportunities-develop/

Mysten Labs Frequently Asked Questions (FAQ)

When was Mysten Labs founded?

Mysten Labs was founded in 2021.

Where is Mysten Labs's headquarters?

Mysten Labs's headquarters is located at 379 University Avenue, Palo Alto.

What is Mysten Labs's latest funding round?

Mysten Labs's latest funding round is Unattributed VC.

How much did Mysten Labs raise?

Mysten Labs raised a total of $336M.

Who are the investors of Mysten Labs?

Investors of Mysten Labs include No Limit Holdings, Andreessen Horowitz, Lightspeed Venture Partners, Coinbase Ventures, Jump Crypto and 22 more.

Who are Mysten Labs's competitors?

Competitors of Mysten Labs include Agingo.

Loading...

Compare Mysten Labs to Competitors

Cosmos develops a decentralized network of independent, scalable, and interoperable blockchains, creating the foundation for a new token economy. It offers an ever-expanding ecosystem of interoperable and sovereign blockchain applications and services, built for a decentralized future. The company was founded in 2014 and is based in Zug, Switzerland.

Ethereum is a decentralized platform that allows the creation and execution of smart contracts and decentralized applications (dApps) on its blockchain. The platform supports cryptocurrency transactions, digital asset management, and the development of various blockchain-based applications, including those for finance, gaming, and social interaction. Ethereum's infrastructure enables the tokenization of assets and the operation of decentralized finance (DeFi) services, while also addressing user privacy and data security. It was founded in 2014 and is based in Zug, Switzerland.

Ava Labs focuses on digitizing assets and providing high-performance solutions for Web 3. It offers a smart contract platform known as Avalanche, which is characterized by its speed, low cost, and eco-friendliness. Additionally, Ava Labs provides AvaCloud, a service that assists businesses in building and scaling custom blockchains, and Core, a free browser extension for seamless and secure use of Web3 powered by Avalanche. The company was founded in 2018 and is based in New York, New York.

Aptos Foundation is an organization focused on the development and support of the Aptos Layer 1 blockchain platform, which is designed for safety and scalability within the decentralized network and developer ecosystem. The foundation leads initiatives to foster network growth, cultivate the ecosystem, and attract developers to improve the blockchain infrastructure. Its main offerings include technical documentation for developers, governance participation through voting on AIPs, and grants for innovation on the Aptos blockchain. It was founded in 2021 and is based in Grand Cayman, Cayman Islands.

Agingo is a company that provides decentralized platform services within the blockchain technology sector. Its main offerings include a multi-ledger blockchain platform that supports applications such as asset tokenization, secure exchanges, and clearing house functions, primarily serving sectors like financial services and personal privacy. It is based in Charlotte, North Carolina.

Loading...