Momenta

Founded Year

2016Stage

Series C - II | AliveTotal Raised

$1.283BLast Raised

$500M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-4 points in the past 30 days

About Momenta

Momenta operates in the autonomous driving technology domain and focuses on developing software solutions for full vehicle autonomy. The company offers products such as MSD, a fully autonomous driving solution designed for taxis and private cars, and Mpilot, a mass-production-ready software for highly automated driving in private vehicles. Momenta's solutions are built on a unique 'flywheel approach' that combines a data-driven methodology with iterative algorithm enhancements to address complex driving scenarios. It was founded in 2016 and is based in Beijing, China.

Loading...

ESPs containing Momenta

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The autonomous driving systems market focuses on developing technologies that enable vehicles to achieve various automation levels, from partial (Level 2) to full autonomy (Level 5), moving beyond the driver support of ADAS to complete self-driving capabilities. It includes advances in sensors, AI, mapping, and connectivity to achieve higher levels of automation. Driven by potential safety improve…

Momenta named as Outperformer among 14 other companies, including Waymo, Aurora Innovation, and May Mobility.

Loading...

Research containing Momenta

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Momenta in 3 CB Insights research briefs, most recently on Nov 22, 2024.

Expert Collections containing Momenta

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Momenta is included in 5 Expert Collections, including Auto Tech.

Auto Tech

2,557 items

Companies working on automotive technology, which includes vehicle connectivity, autonomous driving technology, and electric vehicle technology. This includes EV manufacturers, autonomous driving developers, and companies supporting the rise of the software-defined vehicles.

Unicorns- Billion Dollar Startups

1,270 items

Smart Cities

2,139 items

AI 100

200 items

Artificial Intelligence

9,986 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Latest Momenta News

Mar 25, 2025

Momenta的短期胜利和长期战役 中国科技领域有个惯例,当某个赛道全面进入洗牌期时,常常会有大佬公开进行预言,“未来N年内,只会有最多N个玩家存活”。 这是对自身企业的一种“居安思危”的鞭策,更是一种充分的自信——其背后的潜台词是,几个最终成功“吃鸡”的玩家之中,必定有自己的一席之地。 例如2015年时,余承东认为未来3-5年内,只有2-3家手机厂商能够存活。在汽车领域,何小鹏也在今年两会期间表示,中国 新能源车企 最终存活的可能在7家以内。 前不久, 智能驾驶 公司Momenta创始人曹旭东在采访中表示,智驾行业已进入“大逃杀”时刻,2026年就会分出胜负,未来中国智驾公司只会剩下3家。 从技术实力和市场份额来看,Momenta目前确实处于不错的身位。目前国内仅有 华为 、Momenta、 百度 Apollo、元戎启行四家第三方智驾供应商实现了端到端 大模型 量产,实现了“一段式端到端”量产的则只有华为和Momenta——这一被视作“更接近人类驾驶思维”的前沿技术,可减少数据处理延迟,更好地处理复杂场景,是当下各家车企重点发力的方向。 而随着今年各大车企智驾成果的“井喷式”爆发,其背后的第三方智驾公司也逐步浮出水面,其中“刷脸”最多的正是Momenta,包括与 比亚迪 合作开发天神之眼A/B,以及助力广汽 丰田 铂智3X成为首个实现“全场景无图智驾领航”的合资车型。 事实上,闷声干大事的Momenta此前就已是智驾领域的“隐形王者”。据佐思汽研数据显示,2024年1-10月,Momenta在城市NOA第三方智能驾驶市场的份额超过60%,以“断崖式”优势位居市场首位,而华为HI模式占比近30%,其他公司总共占比约10%。 这或许得益于Momenta在技术路线布局上与其他对手的差异化,坚持L2和L4“两条腿并行”的Momenta,更早也更多地积累起民用车智驾量产经验,这成为其能够连续拿下合资车企合作订单的一大关键。 在比亚迪的强劲“东风”下,同时伴随广汽丰田铂智3X和东风日产N7等更多量产车型的陆续落地,Momenta的份额将在今年迎来新的爆发。 这家公司的“另类”之处还有很多,例如相比文远知行、小马智行、地平线、黑芝麻等公司,作为头部阵营的Momenta至今还未完成IPO,尽管最近的一笔融资已经要追溯到2021年的C+轮——在争先恐后的智驾公司上市浪潮中,不急于搭赶“末班车”的Momenta可能并没有那么缺钱。曹旭东此前曾在采访中表示,每年百亿级的研发投入,大部分都来自收入。 但不可否认的是,第三方智驾公司与车企之间的合作是一场危机四伏的博弈,双方相互依存又相互制衡,无论是话语权和利益层面的反复拉扯,还是面对车企智驾自研以及对手们的冲击,Momenta的处境都好似“钢丝上跳舞”。 综合来看,Momenta正在收获一场属于务实主义者的“短期胜利”,但其“长期战役”还笼罩着重重迷雾。根本原因是Momenta尚未建立起足够宽的“护城河”,相比地平线,Momenta在“软硬一体化”布局和成果上还有较大差距,而相比华为,Momenta又缺乏足够稳定庞大的生态支持。 特立独行的Momenta 因此从Momenta角度来看,“从L4转到L2”是外界的普遍误解,要实现规模化的L4级自动驾驶,首先要进行L2级业务的量产,以积累数据和经验。这一理念是在2018年确立的,也正是在这一年,Momenta“从一个偏松散的研究院性质变成一个以客户价值为中心、能打硬仗、打胜仗的团队”。 Momenta先迈出了量产自动驾驶这条腿的好处,首先在于相较其他第三方智驾公司,早早实现了用技术“贴补家用”,也就是依靠和车企的技术合作收益,能够覆盖掉绝大部分研发投入,在融资并不十分容易的过去几年,这是一家智驾公司穿越周期最务实的手段。 尽管研发占比极高,但由于早期几乎不涉及 硬件 业务,所以Momenta的毛利润相当可观,“这跟 微软 卖Office是一样的,研发投入巨大,但一旦研发出来,边际成本几乎就是0”。 作为对比,2021-2023年期间,地平线累计亏损超175亿元,黑芝麻智能累计亏损近100亿元。而纵目科技、图森未来、禾多科技则已经站在破产或业务收缩的边缘。 另一个好处在于,Momenta更早也更多地积累起量产经验,以及这家公司眼中无比重要的数据。从“一个飞轮”的重要级领先于“两条腿”可以看出,更注重数据驱动的Momenta,和对手们相比更像一家数据公司而非智驾公司。 通过数据驱动自动化解决问题,是Momenta实现规模化L4的必经之路。据Momenta内部测算,量产L4需要1000亿公里的数据,相当于1000万台乘用车跑一年的时间积累的数据。单靠自有车队很难实现,因此Momenta的野心是量产自动驾驶,去卖出1000万台车。而此后完全无人驾驶的长尾问题,也同样需要依靠用L4的技术赋能量产车辆,进一步获得海量数据来进行推动。 同时因为中国的道路数据丰富度、复杂度远比欧洲、日本道路高,因此“Momenta的'黄金数据'可能比特斯拉更多"。 更务实且更早的布局是Momenta近期能够爆发的“先手”优势,2022-2024年间,Momenta量产的高阶智驾搭载车型数量分别是1款、8款、超20款。 从Momenta过去的经验来看,跟中国车企合作起码“敲门”要敲3年,国际车企“敲门”要敲5年以上,真正量产时间可能需要10年。此前Momenta跟某跨国车企从2017年开始接洽,到通过供应链准入、真正量产落地,中间花了8年时间。 墙内墙外“两开花” 与此对应的,是Momenta的全面加速。花费三年走完0~1的阶段后,1~10的阶段Momenta只用了两年,进入2025年,Momenta成为行业中第一家进入量产10~100阶段的自动驾驶公司。目前Momenta获得量产定点的数量已经超过70个,同时在开发的量产车辆有数十个。 在过去几年,Momenta或许还是一个“墙内开花墙外香”的公司,其朋友圈主要囊括了上汽集团、通用汽车、丰田、奔驰等合资和外资车企。随着比亚迪、奇瑞等中国品牌的加入,Momenta亦开始“出口转内销”。 值得注意的是,Momenta在过去之所以频频成为合资和外资车企的“救命稻草”,有技术实力原因,也有一定的运气成分在。 不管是在新能源转型还是智驾领域都有“大象转身”难题的合资和外资车企,想要快速“补课”,最缺的就是时间,引入第三方智驾供应商自然是不二之选。 头部梯队供应商的人选并不多,而Momenta一方面有更多量产经验,能够帮助车企们快速落地到产品上;另一个方面,华为和大疆在国际关系中恰巧有一定敏感性,不利于后续技术在国际市场的沿用。 因此我们会发现,这部分庞大的份额,更多被Momenta和地平线所瓜分。例如丰田+华为(硬件)+Momenta( 软件 )的组合,更多局限在国内市场,而Momenta则同时是丰田国内与全球车型的软件算法供应商。 另一方面,Momenta的乘用车前装智能驾驶解决方案Mpilot也是较为开放的方案,具备高度可定制化特点,可以适配十余种主流的智能驾驶 芯片 和不同的 传感器 方案。同时Momenta配合提供的本土化开发也极具竞争力,目前已经在德国、美国和日本等地建立了本土化团队。 至少在短时间内,Momenta的海外优势还将继续保持。在国内,逐步具备规模化优势的Momenta,在成本上也实现了更多优化空间,尤其是在20万段位已经形成一定优势。这一点从比亚迪的合作中就可看出,向来在成本端都极致压缩的比亚迪,选择采用Momenta方案,必定有成本角度的考虑。 另一个例证是日前上市的广汽丰田铂智3X,这个丰田“疯狂补课”后交出的首张答卷,将单颗 英伟达 OrinX+单颗 激光雷达 的高阶智驾打到了14万左右,其背后同样有Momenta在智驾成本控制上的一臂之力,包括后续还将很快 OTA 升级“车位到车位”这一当前最前沿的智驾体验。 铂智3X发布当晚就在行业内又一次“卷爆”了高阶智驾,上市1小时内订单量就超过一万台,这也引发圈内众多调侃,“丰田要是能早两年觉醒,现在已经没国产新能源车什么事了”。 智驾“三国杀”,Momenta还需“补板” 这种竞争格局也为Momenta带来了更多挑战。尽管在城市NOA市场份额占比优势突出,但Momenta的劣势也同样不少。 而Momenta虽然在这方面有过布局,但并不太顺利。2023年底,Momenta成立了芯片子公司“新芯航途”,瞄准20-30万元主流车型研发 算力 80TOPS的中端芯片,希望在避开英伟达Orin高成本压力的同时,也能满足车企的性价比需求。 但相比地平线的征程2-6系列的多款芯片均开始量产,即便是“蔚小理”也拿出了自产芯片,即将开始量产,Momenta的芯片始终没有进展,新芯航途目前仅完成天使轮融资。 这个结果其实也在意料之中,芯片业务需要长期持续投入,此前并无经验,也缺乏巨额资金和团队支持的Momenta,想要短时间取得突破绝非易事。有行业人士评价,“Momenta造芯片更像是IPO前的故事包装,实际落地至少需要5年,届时市场格局早已固化”。 同时,Momenta配备城市NOA技术的量产车型,在销量上相较竞争对手还有较大差距。佐思汽研数据显示,2024年1-10月,Momenta城市NOA的累计装机量为11.4万辆,而2024年问界仅M9一款产品的销量就超过15万辆。 销量上的大幅差距,必定会影响Momenta在数据驱动方面的“宏观愿景”,也将拖慢其技术优化迭代的脚步。 曹旭东在近期采访中表示,自动驾驶研发投入很大,未来会更大,如果要做到量产L4,每年的研发投入至少是百亿甚至几百亿,其中主力费用将是云端算力,如果再加上后续为量产Robotaxi做准备,Momenta还将不可避免地自建车队,这又是一个“烧钱”大头。 尽管目前看起来“不差钱”,但Momenta并未停下IPO脚步。毕竟面临困难重重,进入收获期之后,Momenta也需要准备埋下来年的“种子”了。 阅读全文 人工客服

Momenta Frequently Asked Questions (FAQ)

When was Momenta founded?

Momenta was founded in 2016.

Where is Momenta's headquarters?

Momenta's headquarters is located at 5F-AB, No.8 College, No.18 Xueqing Road, Beijing.

What is Momenta's latest funding round?

Momenta's latest funding round is Series C - II.

How much did Momenta raise?

Momenta raised a total of $1.283B.

Who are the investors of Momenta?

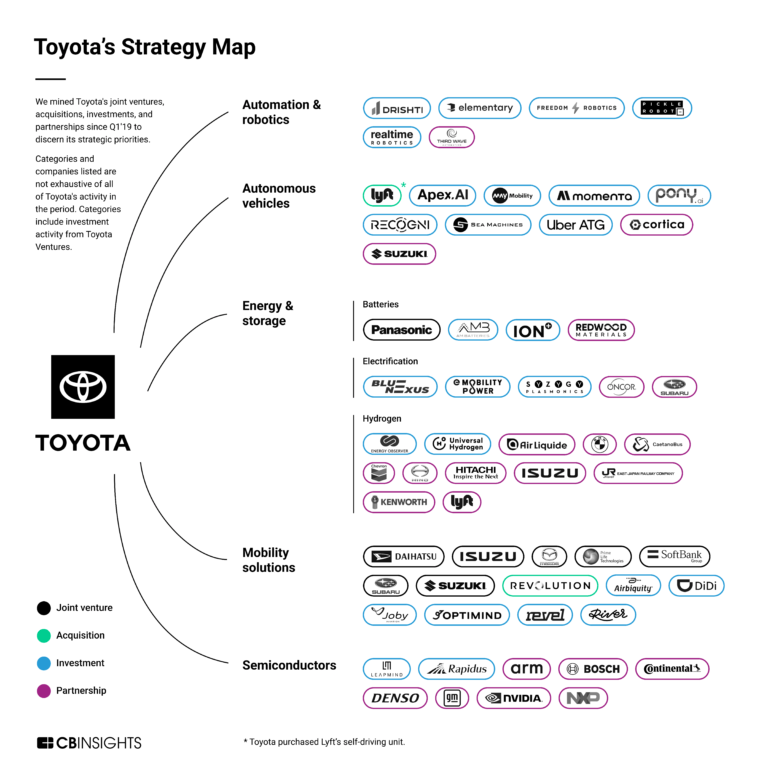

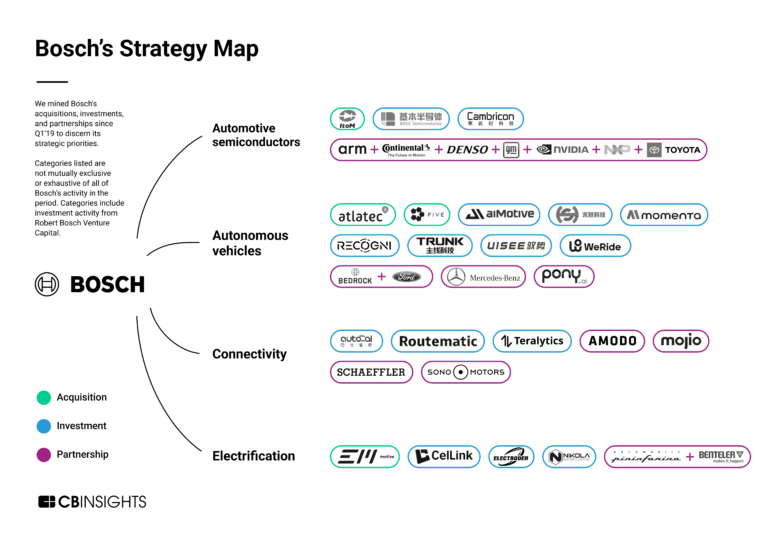

Investors of Momenta include Toyota, Bosch, Temasek, Yunfeng Capital, General Motors and 24 more.

Who are Momenta's competitors?

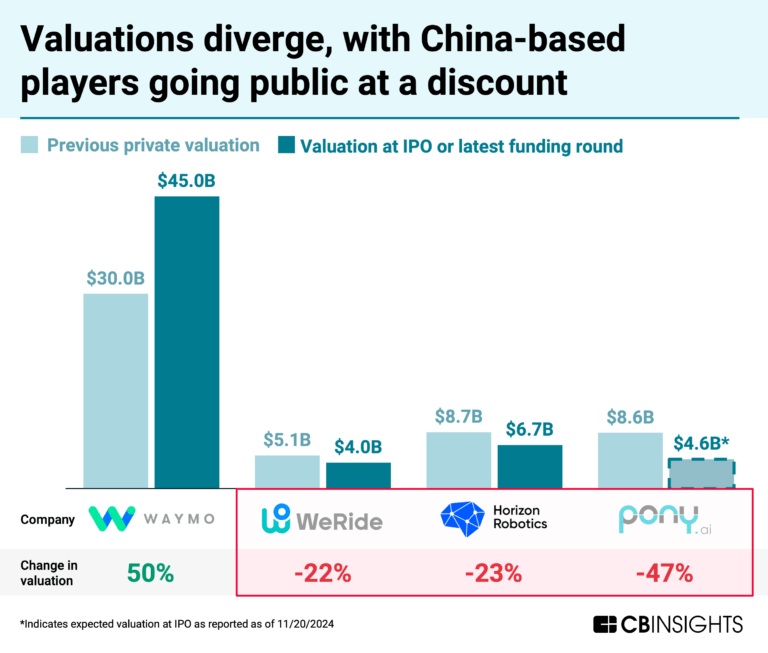

Competitors of Momenta include WeRide, Waymo, Applied Intuition, Propeller, Civil Maps and 7 more.

Loading...

Compare Momenta to Competitors

GeoDigital focuses on 3D data and spatial intelligence software for the utility and automotive industries. The company offers services such as remote sensing data, advanced analytics, and work management software to transmission and distribution utilities, aiming to improve asset performance. GeoDigital serves sectors that need digital solutions for asset management and network health. It was founded in 2005 and is based in Sandy Springs, Georgia.

Ushr, also known as Dynamic Map Platform North America, specializes in geospatial measurement and high-definition mapping for the automotive industry. The company offers precision maps and software that support advanced driver assistance systems, semi-autonomous, and autonomous driving applications. Ushr's products provide critical road data and infrastructure information for automotive manufacturers and government transportation projects. It was founded in 2017 and is based in Livonia, Michigan. Ushr operates as a subsidiary of Dynamic Map Platform.

Kaarta focuses on real-time localization and mapping technology within the mobile 3D scanning sector. The company provides products that convert local environment data from sensors into usable information for determining position and surroundings without relying on existing infrastructure or GPS. Kaarta's solutions serve sectors that need spatial awareness and mapping. Kaarta was formerly known as Real Earth, Inc.. It was founded in 2016 and is based in Pittsburgh, Pennsylvania.

Artisense specializes in computer vision and sensor fusion software for the automation of robots, vehicles, and spatial intelligence applications. The company offers a platform that utilizes cameras for highly accurate, robust, and safe navigation in any environment, compatible with low-cost hardware. Artisense primarily serves sectors that require precise positioning such as the robotics industry, automotive industry, and fleet management. It was founded in 2018 and is based in Munich, Germany.

Sanborn is a provider of geospatial solutions and services in the geospatial technology sector. The company offers services, including aerial mapping, spatial analysis, software solutions, and program support. Sanborn serves sectors such as transportation, resource management, broadband, public works, mineral exploration, and healthcare. It was founded in 1866 and is based in Colorado Springs, Colorado. Sanborn operates as a subsidiary of Daily Mail and General Trust.

Propeller is a company specializing in providing drone technology and data solutions for the construction, mining, and waste management sectors. Their main offerings include a cloud-based platform for mapping, measuring, and managing worksites with survey-grade accuracy, as well as tools for earthwork tracking, volume calculations, and subcontractor management. It was founded in 2014 and is based in Surry Hills, New South Wales.

Loading...