Mollie

Founded Year

2004Stage

Incubator/Accelerator | AliveTotal Raised

$934.32MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+60 points in the past 30 days

About Mollie

Mollie specializes in payment processing and money management for businesses. The company offers a suite of products that enable online and in-person payments, subscription management, fraud prevention, and financial reporting. It provides solutions that cater to the needs of businesses ranging from startups to enterprises, aiming to simplify the complexities of financial transactions and support business growth. The company was founded in 2004 and is based in Amsterdam, Netherlands.

Loading...

Loading...

Research containing Mollie

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Mollie in 5 CB Insights research briefs, most recently on Mar 3, 2023.

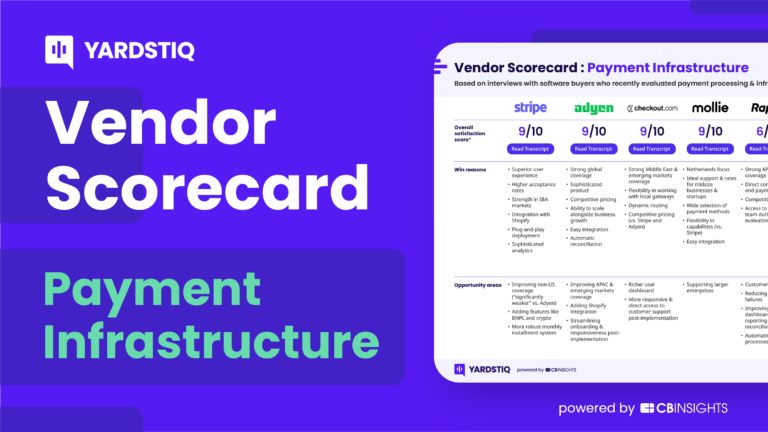

Sep 21, 2022 report

Top payment infrastructure companies — and why customers chose themExpert Collections containing Mollie

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Mollie is included in 7 Expert Collections, including E-Commerce.

E-Commerce

11,441 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Unicorns- Billion Dollar Startups

1,270 items

SMB Fintech

1,648 items

Payments

3,123 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,661 items

Excludes US-based companies

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Mollie News

Mar 18, 2025

Ruedi Maeder (mae) Bild: Worldline Mit Tap to Pay wird jedes iPhone zum Zahlterminal – ohne zusätzliche Hardware. Apple hat die neue Bezahlfunktion gestern in der Schweiz eingeführt. Tap to Pay ist ein technologischer Pfeil, den Apple schon vor zwei Jahren in den USA abgeschossen hat. Seither können Händler mit dem iPhone Zahlungen abzeptieren. Ohne Zusatzgeräte, nur mit dem Smartphone. Apple hat die mobile Bezahlmethode Tap to Pay nun auch für die Schweiz geöffnet. Was kann Tap to Pay? War bisher für Mobile Point of Sale (mPOS) jeweils ein Smartphone, ein Kartenleser und eine App notwendig, wird nun das iPhone selbst zum Komplett-Terminal, das keine weitere Hardware erfordert. Alles, was ein Händler braucht, hat er bereits in der Tasche, sein Smartphone. Immer vorausgesetzt, es kommt von Apple. Das ist praktisch für kleine Unternehmen und vor allem für Händler unterwegs. Unterwegs bedeutet: überall, wo keine Infrastruktur, kein Netzanschluss und kein Terminal zur Verfügung steht. Also zum Beispiel für Lieferdienste, am Stand auf dem Gemüsemarkt, im Verkaufswagen, am Flohmarkt, am Badestrand – wo auch immer Zahlungen nur mit dem iPhone akzeptiert und verarbeitet werden sollen. Tap to Pay akzeptiert über das iPhone (ab XS) alle Arten von kontaktlosen Zahlungen mit Kredit- und Debitkarten, Apple Pay und anderen digitalen Wallets. Um zu bezahlen halten Kunden ihr kontaktloses Zahlungsmittel in die Nähe des iPhones des Händlers, die Zahlung wird über NFC-Technologie sicher abgeschlossen. Die Technologie nutzt die integrierten Sicherheitsfunktionen des iPhones, um die Daten von Unternehmen und Kunden vertraulich und sicher zu halten. Bei der Zahlungsabwicklung speichert Apple weder Kartennummern noch Transaktionsinformationen auf Apple-Servern, das Big Tech hat deshalb keinerlei Kenntnis darüber, was gekauft wird und wer es kauft. Welche Zahlungsdienstleister unterstützen Tap to Pay in der Schweiz? Apple hat Tap to Pay gestern in der Schweiz und in Liechtenstein eingeführt. Die iOS-Apps der folgenden Zahlungsdienstleister machen ab sofort kontaktlose Zahlungen übers iPhone möglich: Adyen, Mollie, myPOS, Nexi, Stripe, SumUp und Worldline. Was Checkouts und sichere Zahlungen jederzeit, überall, schnell, einfach, ohne Gefummel und ohne Zusatzgeräte möglich macht, bringt für mobile Händler und ihre Kunden Komfort. Und für Apple ist die Technologie ein weiterer Schritt auf dem Weg zur universellen Finanz-App – mit Tap to Pay sollen dieses Mal Kleinunternehmen und Händler mit ins Finanz-App-Boot geholt werden. MoneyToday-News teilen

Mollie Frequently Asked Questions (FAQ)

When was Mollie founded?

Mollie was founded in 2004.

Where is Mollie's headquarters?

Mollie's headquarters is located at Keizersgracht 126, Amsterdam.

What is Mollie's latest funding round?

Mollie's latest funding round is Incubator/Accelerator.

How much did Mollie raise?

Mollie raised a total of $934.32M.

Who are the investors of Mollie?

Investors of Mollie include Leading European Tech Scaleups, Technology Crossover Ventures, Blackstone, Alkeon Capital Management, HMI Capital and 11 more.

Who are Mollie's competitors?

Competitors of Mollie include Payaut, Stripe, Hokodo, Vyne, Kody and 7 more.

Loading...

Compare Mollie to Competitors

Stripe provides services for businesses to manage online and in-person payments. It offers products including payment processing application programming interfaces (APIs), payment tools, and solutions for handling subscriptions, invoicing, and financial reports. Stripe serves sectors such as e-commerce, Software as a Service (SaaS), platforms, marketplaces, and the creator economy. Stripe was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

Till Payments is a global fintech company that operates in the payments industry. The company provides a range of payment solutions, including online and in-person payment processing, as well as a consolidated platform for managing transactions and payment methods. Its services are primarily used by businesses across various sectors to streamline their payment systems. Till Payments was formerly known as SimplePay. It was founded in 2012 and is based in Macquarie Park, Australia.

Lemonway is a payment institution that specializes in providing payment processing and wallet management solutions for marketplaces, crowdfunding platforms, and e-commerce websites. The institution offers a modular payment system that enables clients to handle transactions, from collection to disbursement, with a focus on KYC/AML regulatory compliance. Lemonway primarily serves the e-commerce industry, crowdfunding platforms, and other online marketplaces. It was founded in 2007 and is based in Paris, France.

Slice specializes in financial operating systems that provide a platform that redefines the concept of an operating system for money management within the financial technology sector. The company offers a product called MoneyOS, which allows businesses to collect and structure financial data from various sources into a comprehensive ledger, providing real-time financial visibility and automated control over suppliers, as well as the ability to execute financial strategies effectively. Slice's solutions are designed to serve a wide range of clients, including marketplaces, credit card issuers, banks, and other financial institutions. It was founded in 2020 and is based in Porto Alegre, Brazil.

Truust is a company that focuses on providing smart payment solutions in the fintech industry. It offers services such as facilitating online sales, crowdfunding, and managing money flows, with features like escrow payments, split payments, and digital wallets. The company primarily serves sectors such as ecommerce, crowdfunding platforms, and other fintech companies. It was founded in 2018 and is based in Barcelona, Spain.

Optty is a universal payments platform that specializes in the integration and orchestration of global payment methods and complimentary services across multiple sectors. The company offers a single API integration that allows access to a wide range of payment options, including buy now pay later (BNPL), digital wallets, card payments, gift cards, cryptocurrency, loyalty points, bank transfers, and peer-to-peer payments, simplifying transactions and promoting financial inclusivity. Optty primarily serves the e-commerce industry, providing solutions that cater to merchants, payment service providers, and financial institutions. It was founded in 2021 and is based in Singapore.

Loading...