Modern Life

Founded Year

2021Stage

Seed VC - II | AliveTotal Raised

$15MLast Raised

$15M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-151 points in the past 30 days

About Modern Life

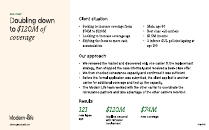

Modern Life operates in life insurance technology and advisory services within the insurance industry. Its offerings include a brokerage platform and support to help advisors secure life insurance coverage for clients with planning and underwriting needs. Modern Life serves the insurance advisory sector, providing services to assist advisors and their clients in the life insurance process. It was founded in 2021 and is based in New York, New York.

Loading...

Modern Life's Product Videos

Modern Life's Products & Differentiators

Modern Life platform

Fully integrated, digital end-to-end experience for life insurance quoting, application and management for financial advisors.

Loading...

Expert Collections containing Modern Life

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Modern Life is included in 1 Expert Collection, including Fintech.

Fintech

9,451 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Latest Modern Life News

Mar 24, 2025

Modern Life has launched Express Decision, a digital underwriting platform developed in partnership with Munich Re Life US and Ameritas. The platform leverages electronic health records and third-party data to streamline underwriting and reduce the time needed to complete life insurance applications. Applicants often receive a decision instantly—without needles, lab work, or phone interviews—after completing a digital health assessment and signing documents electronically. At launch, Express Decision is available for individuals applying for term life insurance with instant decisions offered for eligible applicants seeking up to $2 million in coverage. Applicants can also apply for up to $20 million in coverage, which involves human underwriters but follows the same digital process. The product includes full features such as policy riders and convertibility to permanent life insurance. Express Decision is currently available in 48 states. “Life insurance today is a complex financial product that requires financial professionals to navigate an often extensive, lengthy application and underwriting process.Express Decision is a transformative capability to give clients an exceptional experience—with instant or fast decisions—without sacrificing on cost or quality. By building the full end-to-end digital delivery experience coupled with proprietary products, we’ve transformed the experience for the 500,000 financial professionals who distribute life insurance every year.” – Michael Konialian, Modern Life Founder and CEO.

Modern Life Frequently Asked Questions (FAQ)

When was Modern Life founded?

Modern Life was founded in 2021.

Where is Modern Life's headquarters?

Modern Life's headquarters is located at 295 Lafayette Street, New York.

What is Modern Life's latest funding round?

Modern Life's latest funding round is Seed VC - II.

How much did Modern Life raise?

Modern Life raised a total of $15M.

Who are the investors of Modern Life?

Investors of Modern Life include Thrive Capital, Gilgamesh and Abstract.

Who are Modern Life's competitors?

Competitors of Modern Life include Dale Underwriting Partners.

What products does Modern Life offer?

Modern Life's products include Modern Life platform.

Loading...

Compare Modern Life to Competitors

Blooma offers commercial real estate (CRE) lending solutions within the financial technology sector, providing a platform for deal screening, portfolio monitoring, and risk management for CRE lenders. It was founded in 2018 and is based in Encinitas, California.

Assivo specializes in business process outsourcing services, focusing on data management and support functions across various sectors. The company offers a range of services including data entry, processing, cleansing, enrichment, as well as support for loan processing, underwriting, accounting, finance, and insurance. Assivo primarily serves growth companies and small to middle-market businesses looking to scale operations, cut costs, and enhance their data capabilities. It was founded in 2016 and is based in Naperville, Illinois.

Kin provides affordable home insurance solutions within the insurance industry. The company offers a range of products, including homeowners, mobile homes, condos, flood, landlord, and hurricane insurance, all designed to protect customers' properties and interests in the event of disasters or other damages. Kin's insurance products are tailored to meet the needs of homeowners and property investors, offering customizable policies and direct purchasing options to keep costs down. Kin was formerly known as Bright Policy. It was founded in 2016 and is based in Chicago, Illinois.

Apollo Partners is an integrated insurance group that operates in the insurance sector, offering various insurance and reinsurance products. The company provides solutions across domains including Property, Casualty, Marine, Energy & Transportation, Specialty, and Reinsurance, as well as digital and embedded risk programs. Apollo Partners also offers managing agency services and claims management. It was founded in 2009 and is based in London, England.

Dale Underwriting Partners is an independent underwriting business specializing in insurance and reinsurance across multiple sectors. The company offers a diverse range of products including casualty, property insurance, property reinsurance, marine treaty reinsurance, energy coverage, and specialty risks, with a focus on providing high-quality service and underwriting expertise. Dale Underwriting Partners primarily serves the insurance and reinsurance sectors, with a strong emphasis on North American markets as well as a global client base. It was founded in 2014 and is based in London, England.

BMS Group operates as an independent specialist brokerage. It focuses on providing solutions in the fields of reinsurance, wholesale, and direct insurance. The company offers a range of services including reinsurance solutions, wholesale insurance, direct insurance services, and capital advisory. BMS Group caters to various sectors including marine, energy, financial institutions, and construction, among others. It was founded in 1980 and is based in London, United Kingdom.

Loading...