Investments

977Portfolio Exits

123Funds

16Partners & Customers

4About Mitsubishi UFJ Capital

Mitsubishi UFJ Capital or MUCAP is a venture capital firm within the Mitsubishi UFJ Financial Group. It is a commercial financial institution that specializes in healthcare, electronics, and high-technology investments. It supports companies in their pre-seed and pre-series A stages with growth capital investments, and aims to partner with the companies until initial public offering (IPO), mergers and acquisitions (M&A), and other exit strategies. It was founded in 1974 and is based in Tokyo, Japan.

Research containing Mitsubishi UFJ Capital

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Mitsubishi UFJ Capital in 3 CB Insights research briefs, most recently on Feb 4, 2025.

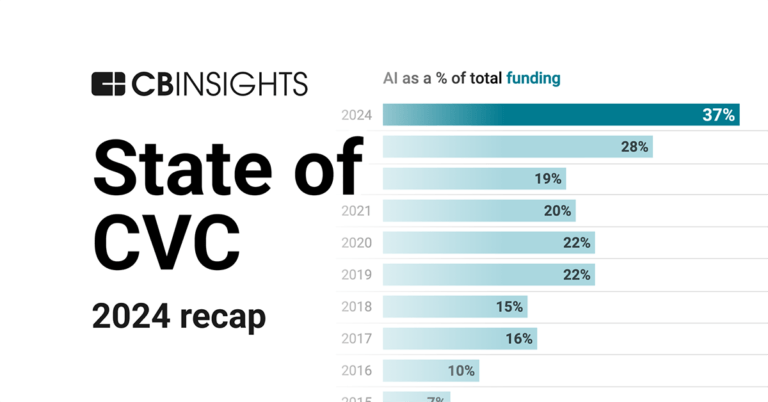

Feb 4, 2025 report

State of CVC 2024 Report

Jan 4, 2024 report

State of Venture 2023 Report

Nov 1, 2023 report

State of CVC Q3’23 ReportLatest Mitsubishi UFJ Capital News

Mar 6, 2025

Mitsubishi UFJ Capital Co., Ltd.(Mitsubishi UFJ Capital; President: Takuro Kojima, Headquarters: Tokyo)and AGC Inc. (AGC; President: Yoshinori Hirai, Headquarters: Tokyo)have signed a mandate agreement for the technical evaluation of drug manufacturing, as part of Mitsubishi UFJ Capital's investment activities in drug discovery startups, etc. In recent years, drug development has become increasingly complex and challenging due to the diversification of modalities. In order to realize innovations that will drive the next generation of new drug development, it is necessary to build a "Drug Discovery Ecosystem". This requires a comprehensive and holistic approach not only by pharmaceutical companies, academia, and start-ups, which are the main players in drug development, but also by industry, government and academia. AGC has developed a cGMP-compliant CDMO*1 business in its life science business in Japan, the U.S. and Europe, covering a wide range of modalities*2 including small molecule pharmaceutical, mammalian and microbial-based therapeutic proteins, messenger RNA, plasmid DNA, gene and cell therapy and exosomes. Under the terms of this agreement, AGC will use its extensive knowledge and experience in the CDMO business, to analyze and advise on issues that may arise during the process development and manufacturing phases from a chemistry, manufacturing, and controls (CMC) perspective for drugs developed by drug discovery startups. Mitsubishi UFJ Capital manages funds specializing in life sciences and is a leading dealmaker backed with one of the largest amounts of capital in Japan. Mitsubishi UFJ Capital has accumulated support for drug discovery start-ups based on its expertise gained through extensive experience working with pharmaceutical companies and academia. As the modalities of drugs developed by drug discovery start-ups and others diversify today, there is a need not only to reduce manufacturing risks, but also to improve the efficiency and speed of R&D and increase the probability of success. Under this agreement, Mitsubishi UFJ Capital will support drug discovery start-ups by evaluating the feasibility and implementation status of their manufacturing plans. Through this alliance, the two companies aim to contribute to the creation of a "Drug Discovery Ecosystem" and enhance Japan's drug discovery capabilities. About Mitsubishi UFJ Capital Since its establishment in 1974, Mitsubishi UFJ Capital, as the venture capital arm of Mitsubishi UFJ Financial Group, has provided industry-leading expertise and invested in a wide range of industries. In the life sciences fields, it has continuously established funds totaling 50 billion yen since its first fund in February 2017, including the Mitsubishi UFJ Life Science No. 4 Fund (20 billion yen). It is one of the largest private sector fund in total dedicated to life sciences in Japan, and invests in startups in drug discovery, regenerative medicines, medical devices, and other fields. In addition to investing in biotech startups, the fund also focuses on academic drug discovery, carve-out deals for pharmaceutical companies, investments in development projects for pharmaceutical companies, and medical device-related investments. About AGC Group's Life Science Business The AGC Group's Life Science Business is developing its CDMO business globally, engaging in contracted process development and manufacturing of pharmaceuticals and agrochemicals. We focus on small molecule pharmaceuticals and agrochemicals, leveraging AGC's long-accumulated organic synthesis technologies, as well as biopharmaceuticals, for which demand is growing worldwide, and gene and cell therapeutics, a cutting-edge field. With business sites in Japan, Europe, and the U.S., we contribute to the safe, secure, comfortable and healthy lives of people around the world by providing high-quality services that meet the diverse needs of customers in each market. *1 CDMO: Contract Development & Manufacturing Organization. A company which is contracted on behalf of another company to serve product manufacturing as well as the development of manufacturing processes. *2 Modality: A term used to describe a classification of methods and means of basic technology for drug discovery. e.g., antibody drugs, mRNA drugs. Source: AGC Inc.

Mitsubishi UFJ Capital Investments

977 Investments

Mitsubishi UFJ Capital has made 977 investments. Their latest investment was in Emium as part of their Seed VC - II on March 26, 2025.

Mitsubishi UFJ Capital Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

3/26/2025 | Seed VC - II | Emium | $3.98M | Yes | Aozora Corporate Investment, Beyond Next Ventures, and DNX Ventures | 2 |

3/18/2025 | Seed VC - II | RegCell | $8.5M | Yes | 2 | |

3/13/2025 | Seed VC - III | Hutzper | No | Chugin Capital Partner, Fuji Electric, Leave a Nest Capital, ORIX, ROHTO Pharmaceutical, and Safie Ventures | 3 | |

3/7/2025 | Series B | |||||

2/28/2025 | Series B |

Date | 3/26/2025 | 3/18/2025 | 3/13/2025 | 3/7/2025 | 2/28/2025 |

|---|---|---|---|---|---|

Round | Seed VC - II | Seed VC - II | Seed VC - III | Series B | Series B |

Company | Emium | RegCell | Hutzper | ||

Amount | $3.98M | $8.5M | |||

New? | Yes | Yes | No | ||

Co-Investors | Aozora Corporate Investment, Beyond Next Ventures, and DNX Ventures | Chugin Capital Partner, Fuji Electric, Leave a Nest Capital, ORIX, ROHTO Pharmaceutical, and Safie Ventures | |||

Sources | 2 | 2 | 3 |

Mitsubishi UFJ Capital Portfolio Exits

123 Portfolio Exits

Mitsubishi UFJ Capital has 123 portfolio exits. Their latest portfolio exit was Dynamic Map Platform on March 27, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

3/27/2025 | IPO | Public | 3 | ||

3/27/2025 | Acquired | 2 | |||

2/24/2025 | Asset Sale | 3 | |||

Date | 3/27/2025 | 3/27/2025 | 2/24/2025 | ||

|---|---|---|---|---|---|

Exit | IPO | Acquired | Asset Sale | ||

Companies | |||||

Valuation | |||||

Acquirer | Public | ||||

Sources | 3 | 2 | 3 |

Mitsubishi UFJ Capital Fund History

16 Fund Histories

Mitsubishi UFJ Capital has 16 funds, including Mitsubishi UFJ Life Science II.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

2/20/2019 | Mitsubishi UFJ Life Science II | Multi-Stage Venture Capital | Closed | $91.32M | 1 |

2/20/2019 | Mitsubishi UFJ Capital VII | Multi-Stage Venture Capital | Closed | $136.98M | 1 |

2/20/2017 | Mitsubishi UFJ Life Science I | Multi-Stage Venture Capital | Closed | $88.37M | 1 |

2/20/2017 | Mitsubishi UFJ Capital VI | ||||

11/30/2015 | Mitsubishi UFJ Venture Fund II |

Closing Date | 2/20/2019 | 2/20/2019 | 2/20/2017 | 2/20/2017 | 11/30/2015 |

|---|---|---|---|---|---|

Fund | Mitsubishi UFJ Life Science II | Mitsubishi UFJ Capital VII | Mitsubishi UFJ Life Science I | Mitsubishi UFJ Capital VI | Mitsubishi UFJ Venture Fund II |

Fund Type | Multi-Stage Venture Capital | Multi-Stage Venture Capital | Multi-Stage Venture Capital | ||

Status | Closed | Closed | Closed | ||

Amount | $91.32M | $136.98M | $88.37M | ||

Sources | 1 | 1 | 1 |

Mitsubishi UFJ Capital Partners & Customers

4 Partners and customers

Mitsubishi UFJ Capital has 4 strategic partners and customers. Mitsubishi UFJ Capital recently partnered with AGC on March 3, 2025.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

3/4/2025 | Partner | Japan | Mitsubishi UFJ Capital ; President : Takuro Kojima , Headquarters : Tokyo ) and AGC Inc. -LRB- AGC Inc. ; President : Yoshinori Hirai , Headquarters : Tokyo ) have signed a mandate agreement for the technical evaluation of drug manufacturing , as part of Mitsubishi UFJ Capital 's investment activities in drug discovery startups , etc. . | 1 | |

8/19/2021 | Partner | ||||

1/10/2019 | Partner | ||||

1/23/2015 | Vendor |

Date | 3/4/2025 | 8/19/2021 | 1/10/2019 | 1/23/2015 |

|---|---|---|---|---|

Type | Partner | Partner | Partner | Vendor |

Business Partner | ||||

Country | Japan | |||

News Snippet | Mitsubishi UFJ Capital ; President : Takuro Kojima , Headquarters : Tokyo ) and AGC Inc. -LRB- AGC Inc. ; President : Yoshinori Hirai , Headquarters : Tokyo ) have signed a mandate agreement for the technical evaluation of drug manufacturing , as part of Mitsubishi UFJ Capital 's investment activities in drug discovery startups , etc. . | |||

Sources | 1 |

Mitsubishi UFJ Capital Team

10 Team Members

Mitsubishi UFJ Capital has 10 team members, including current President, Kei Andoh.

Name | Work History | Title | Status |

|---|---|---|---|

Kei Andoh | President | Current | |

Name | Kei Andoh | ||||

|---|---|---|---|---|---|

Work History | |||||

Title | President | ||||

Status | Current |

Compare Mitsubishi UFJ Capital to Competitors

Spiral Ventures is a venture capital firm. The film invests in fintech, logistics/transportation, artificial intelligence, IoT, sharing economy, marketplace, HR tech, big data, media platforms, healthcare, and online advertising sectors. Spiral Ventures was formerly known as IMJ Investment Partners. Spiral Ventures was founded in 2012 and is based in Tokyo, Japan.

Inclusion Japan is a venture capital firm that invests in startups and provides consultancy services to large enterprises. The company collaborates with startups and offers consultancy to enterprises for business development. It was founded in 2011 and is based in Tokyo, Japan.

Skyland Ventures is a Japanese investment company focused on seed-stage startups. It provides cashback and MEV (Miner Extractable Value) solutions with BNB, Polygon chain, etc. The company was founded in 2012 and is based in Tokyo, japan.

31VENTURES is the corporate venture capital arm ("Venture Co-creation Department") of Mitsui Fudosan, engaging in the seed stage to Series A investments. Its primary investment focus is real estate, IoT, security, energy and green tech, sharing economy, fin-tech, e-commerce, robotics, and life sciences. The company was founded in 2015 and is based in Tokyo, Japan.

Samurai Incubate operates as a venture capital firm. The company primarily invests in early-stage startups and provides growth support, including assistance with development plans, human resources, and fundraising strategies. It also offers incubation services for companies related to personal computers, mobile media, and software as a service (SaaS), as well as for executive, management, marketing, sales, and human resource departments. It was founded in 2008 and is based in Tokyo, Japan.

TSUCREA is a professional group focused on startup support and business incubation within the entrepreneurial ecosystem. The company offers mentorship to entrepreneurs, operates accelerator programs, and contributes to the creation of successful startups for a better future. TSUCREA collaborates with entrepreneurs to foster innovation in society and enhance the global 'startup quality' through shared growth experiences. It is based in Tokyo, Japan.

Loading...