Microsoft

Founded Year

1975Stage

IPO | IPOTotal Raised

$1MDate of IPO

3/13/1986Market Cap

2841.19BStock Price

382.19Revenue

$0000About Microsoft

Microsoft operates as a technology company that focuses on software, hardware, and services. The company offers products in business productivity software, cloud computing services, personal computing devices, and gaming consoles. Microsoft serves sectors such as business, education, and gaming. It was founded in 1975 and is based in Redmond, Washington.

Loading...

Loading...

Research containing Microsoft

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Microsoft in 75 CB Insights research briefs, most recently on Mar 21, 2025.

Mar 12, 2025

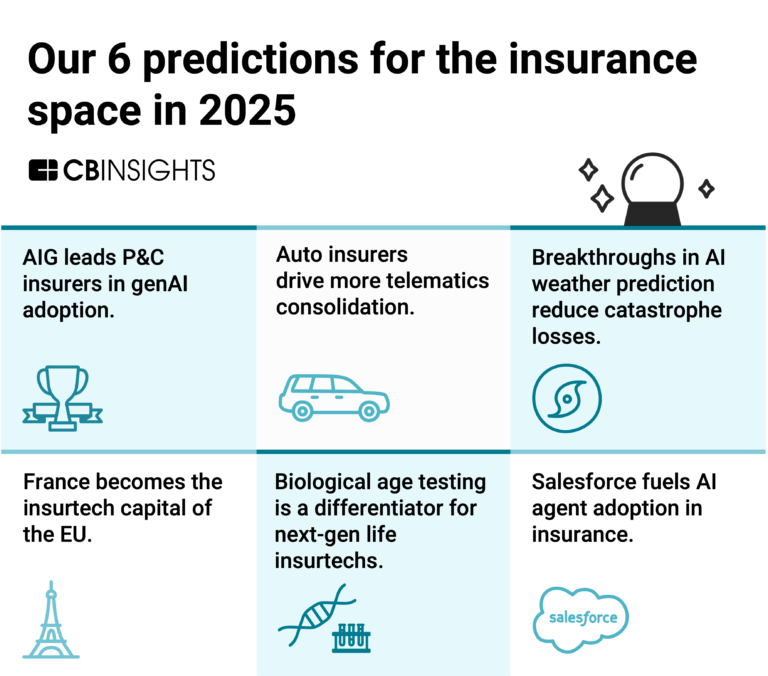

Our 6 predictions for the insurance space in 2025

Mar 6, 2025

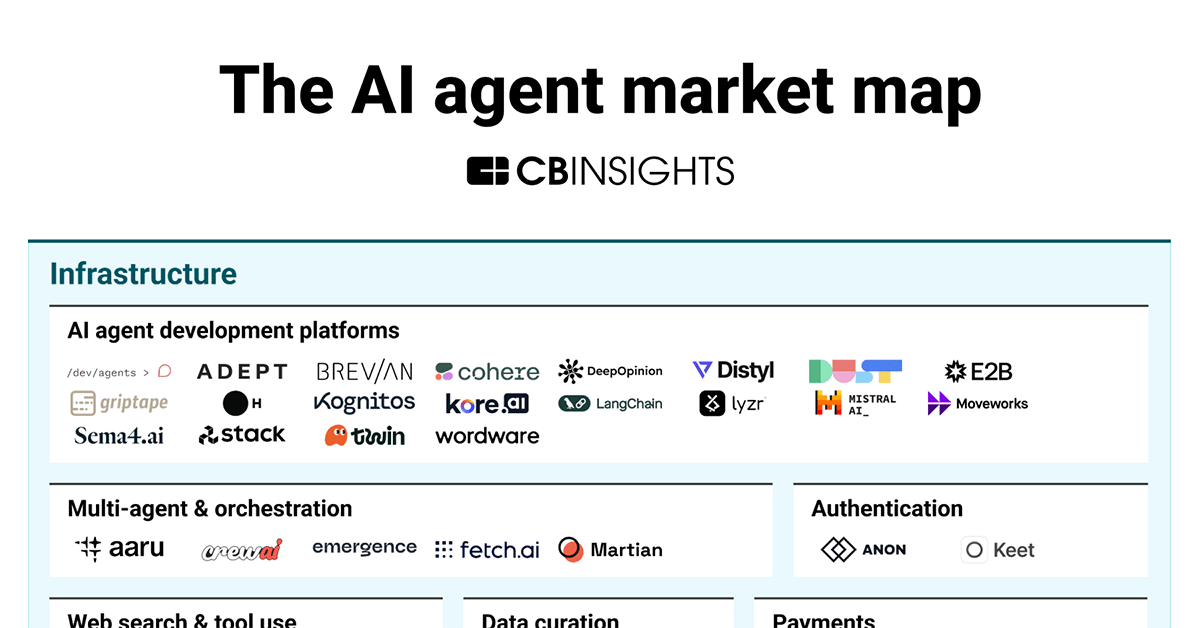

The AI agent market map

Dec 23, 2024

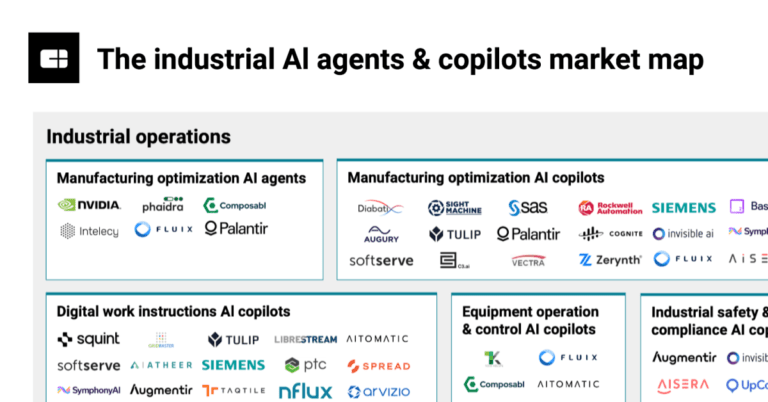

The industrial AI agents & copilots market mapExpert Collections containing Microsoft

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Microsoft is included in 13 Expert Collections, including Construction Tech.

Construction Tech

1,467 items

Companies in the construction tech space, including additive manufacturing, construction management software, reality capture, autonomous heavy equipment, prefabricated buildings, and more

E-Commerce

22 items

Fortune 500 Investor list

590 items

This is a collection of investors named in the 2019 Fortune 500 list of companies. All CB Insights profiles for active investment arms of a Fortune 500 company are included.

Conference Exhibitors

6,062 items

Companies that will be exhibiting at CES 2018

Smart Cities

2,455 items

Smart building tech covers energy management/HVAC tech, occupancy/security tech, connectivity/IoT tech, construction materials, robotics use in buildings, and the metaverse/virtual buildings.

Cybersecurity

10,544 items

These companies protect organizations from digital threats.

Microsoft Patents

Microsoft has filed 10000 patents.

The 3 most popular patent topics include:

- machine learning

- data management

- natural language processing

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

12/12/2018 | 4/1/2025 | Object recognition and categorization, Machine learning, Computer vision, Classification algorithms, Feature detection (computer vision) | Grant |

Application Date | 12/12/2018 |

|---|---|

Grant Date | 4/1/2025 |

Title | |

Related Topics | Object recognition and categorization, Machine learning, Computer vision, Classification algorithms, Feature detection (computer vision) |

Status | Grant |

Latest Microsoft News

Apr 3, 2025

April 2, 2025 12:15 PM 6 min read Gold Outshines Tech Stocks And Bitcoin, As Bulls And Bears Battle Ahead Of Trump Tariff Announcement Follow Enter your email to get Benzinga's ultimate morning update: The PreMarket Activity Newsletter Comments Gold Outshines Please click here for an enlarged chart comparing Invesco QQQ Trust Series 1 (QQQ), SPDR S&P 500 ETF Trust (SPY) which represents the benchmark stock market index S&P 500 (SPX), iShares Bitcoin Trust ETF (IBIT), and SPDR Gold Trust (GLD). Note the following: The chart shows that for this volatile period since the peak in tech stocks, gold has outperformed as follows: Gold has outperformed SPY by 15.02%. Gold has outperformed QQQ, which represents tech stocks, by 18.13%. Gold has outperformed bitcoin ETF (IBIT) by 19.93%. In the Core Model Portfolio, allocation to GLD has been 5% – 8%. In the Lower Exposure Model Portfolio, the allocation to GLD has been 4% – 6%. In addition, there is also a GLD trade around position in our ZYX Allocation – the allocation to precious metals has been 5% – 8% of the portfolio. As full disclosure and as a reference, allocation to bitcoin ETF (IBIT) has been 0% – 2% in our ZYX Allocation Core Model Portfolio and 0% in the Lower Exposure Model Portfolio. Further, partial profits have been taken three times on IBIT, leaving only a very small position in our Model Portfolio. For the period shown on the chart, bitcoin volatility is about 300% that of gold. Prudent investors focus on risk adjusted returns. Risk adjusted returns on bitcoin must be significantly higher than gold to match the return in gold. The chart is also very instructive in that Wall Street's consensus at the beginning of the chart period was the total opposite of what has happened. President Trump is scheduled to make a tariff announcement today at 4pm ET. A battle royale has been raging between stock market bulls and bears ahead of President Trump's announcement. Yesterday, stock market bulls got the upper hand, aided by blind money. In the early trade this morning, stock market bears have the upper hand. It is worth repeating what we shared with you yesterday: There are divergent opinions on how the stock market will behave after Trump reveals his tariff plan on Liberation Day. Permabulls are expecting a rip-roaring rally and urging their followers to aggressively buy stocks. Permabears are expecting a big market drop. In our analysis, prudent investors should ignore both the permabulls and the permabears. In our analysis, how the market behaves after Trump’s reveal will come down to the difference between expectations about tariffs that are built into the market and what Trump reveals. If the tariffs Trump reveals are less onerous than market expectations, the stock market will go up. If the tariffs Trump reveals are more onerous than market expectations, the stock market will go down. The latest ISM manufacturing data shows stagflation – growth is slowing and prices are rising. ISM Manufacturing Index came at 49.0% vs. 49.8% consensus. More importantly, Prices Paid Index came at 69.4 vs. 64 consensus. As a reference, the index was at 62.4 in February. ADP is the largest private payroll processor in the country. ADP uses its data to provide a glimpse of the official jobs report, the mother of all reports, that will be released on Friday at 8:30am ET. The just released ADP employment change came at 155K vs. 120K consensus. This indicates that the jobs picture remains strong. As we have shared with you before, prudent investors need to be aware that jobs data can deteriorate very quickly. It is important to stay alert. Prudent investors should also keep in mind that ADP data does not include government employees. Tesla Inc (TSLA) delivery data impacts stock market sentiment. For this reason, prudent investors should pay attention to Tesla delivery data. Tesla produced over 362K vehicles vs. over 412K consensus and delivered over 336K vehicles vs. over 378K consensus and whisper numbers of around 360K. As of this writing in the premarket, these numbers are negatively impacting stock market sentiment. Magnificent Seven Money Flows In the early trade, money flows are negative in Apple Inc (AAPL), Amazon.com, Inc. (AMZN), Alphabet Inc Class C (GOOG), Meta Platforms Inc (META), Microsoft Corp (MSFT), NVIDIA Corp (NVDA), and (TSLA). In the early trade, money flows are negative in S&P 500 ETF (SPY) and Nasdaq 100 ETF (QQQ). Momo Crowd And Smart Money In Stocks Investors can gain an edge by knowing money flows in SPY and QQQ. Investors can get a bigger edge by knowing when smart money is buying stocks, gold, and oil. The most popular ETF for gold is SPDR Gold Trust (GLD). The most popular ETF for silver is iShares Silver Trust (SLV). The most popular ETF for oil is United States Oil ETF (USO). Bitcoin Protection Band And What To Do Now It is important for investors to look ahead and not in the rearview mirror. Our proprietary protection band puts all of the data, all of the indicators, all of the news, all of the crosscurrents, all of the models, and all of the analysis in an analytical framework that is easily actionable by investors. Consider continuing to hold good, very long term, existing positions. Based on individual risk preference, consider a protection band consisting of cash or Treasury bills or short-term tactical trades as well as short to medium term hedges and short term hedges. This is a good way to protect yourself and participate in the upside at the same time. You can determine your protection bands by adding cash to hedges. The high band of the protection is appropriate for those who are older or conservative. The low band of the protection is appropriate for those who are younger or aggressive. If you do not hedge, the total cash level should be more than stated above but significantly less than cash plus hedges. A protection band of 0% would be very bullish and would indicate full investment with 0% in cash. A protection band of 100% would be very bearish and would indicate a need for aggressive protection with cash and hedges or aggressive short selling. It is worth reminding that you cannot take advantage of new upcoming opportunities if you are not holding enough cash. When adjusting hedge levels, consider adjusting partial stop quantities for stock positions (non ETF); consider using wider stops on remaining quantities and also allowing more room for high beta stocks. High beta stocks are the ones that move more than the market. Traditional 60/40 Portfolio Probability based risk reward adjusted for inflation does not favor long duration strategic bond allocation at this time. Those who want to stick to traditional 60% allocation to stocks and 40% to bonds may consider focusing on only high quality bonds and bonds of five year duration or less. Those willing to bring sophistication to their investing may consider using bond ETFs as tactical positions and not strategic positions at this time. The Arora Report is known for its accurate calls. The Arora Report correctly called the big artificial intelligence rally before anyone else, the new bull market of 2023, the bear market of 2022, new stock market highs right after the virus low in 2020, the virus drop in 2020, the DJIA rally to 30,000 when it was trading at 16,000, the start of a mega bull market in 2009, and the financial crash of 2008. Please click here to sign up for a free forever Generate Wealth Newsletter .

Microsoft Frequently Asked Questions (FAQ)

When was Microsoft founded?

Microsoft was founded in 1975.

Where is Microsoft's headquarters?

Microsoft's headquarters is located at One Microsoft Way, Redmond.

What is Microsoft's latest funding round?

Microsoft's latest funding round is IPO.

How much did Microsoft raise?

Microsoft raised a total of $1M.

Who are the investors of Microsoft?

Investors of Microsoft include Technology Venture Investors.

Who are Microsoft's competitors?

Competitors of Microsoft include VMware, Sabio Group, Dell Technologies, SoftBank, Google and 7 more.

Loading...

Compare Microsoft to Competitors

Movate is a technology and customer experience services company focused on IT services, transformation, and customer service across various sectors. The company offers services including infrastructure management, cloud enablement, cybersecurity, workplace solutions, and experience transformation. Movate serves industries such as telecommunications, media, smart mobility, technology, gaming, retail, e-commerce, emerging brands, and the BFSI sector. Movate was formerly known as CSS. It was founded in 1996 and is based in Plano, Texas.

Softchoice is a software-focused IT solutions provider that operates in the technology sector. The company offers services in cloud migration and workplace technology solutions, as well as IT decision-making support. It was founded in 1989 and is based in Toronto, Canada. In March 2025, Softchoice was acquired by World Wide Technology at a valuation of $1.03B.

Huawei operates in information and communications technology (ICT) infrastructure and smart devices. The company offers products and services including smartphones, personal computers, tablets, wearables, audio devices, routers, enterprise networking equipment, cloud services, and digital power solutions. Huawei serves sectors such as telecommunications, education, finance, electric power, manufacturing, airports, and urban rail. It was founded in 1987 and is based in Shenzhen, China.

Sabio Group is a digital customer experience (CX) transformation company operating in the technology and customer service sectors. The company offers various services such as artificial intelligence (AI) and automation solutions, data insights, cloud transformation, networking services and infrastructure, and customer experience management. It primarily caters to industries such as banking, insurance, housing, retail, and telecommunications. The company was founded in 1998 and is based in London, United Kingdom.

Constellation Software provides industry-specific software. The company acquires, manages, and builds vertical-market software businesses that provide mission-critical software solutions. Its operations are organized into two segments: the public sector and the private sector. The portfolio companies serve various markets, including communications, credit unions, beverage distribution, tour operators, auto clubs, textiles and apparel, hospitality, and community care. The company was founded in 1995 and is based in Toronto, Canada.

Zhongxingxin Telecom provides telecommunications services including mobile communication, legal services, and business information. It was founded in 1985 and is based in Shenzhen, Guangdong.

Loading...