Mercury

Founded Year

2017Stage

Series B | AliveTotal Raised

$150.93MValuation

$0000Last Raised

$120M | 4 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-26 points in the past 30 days

About Mercury

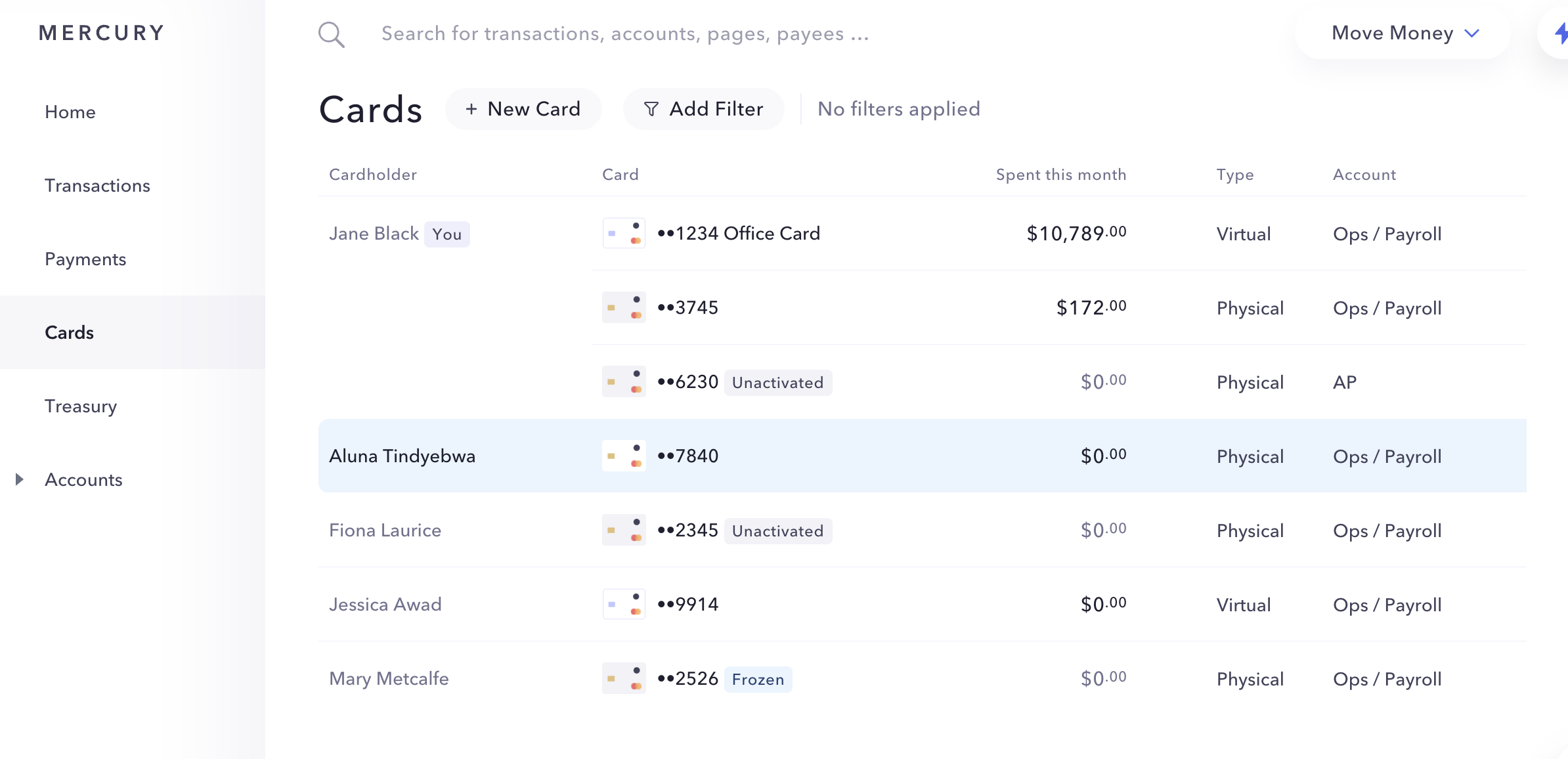

Mercury operates as a financial technology company. It offers banking accounts, currency exchange, debit cards, and international wires with operational support in the form of team management, tool integration, relevant insights on business finances, and more to its customers. It was founded in 2017 and is based in San Francisco, California.

Loading...

Mercury's Product Videos

Mercury's Products & Differentiators

Business Checking Account

Designed with startups in mind, Mercury offers scalable digital tools — plus, every account provides read-write application programming interface access to truly customize your banking.

Loading...

Expert Collections containing Mercury

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Mercury is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

SMB Fintech

1,586 items

Future Unicorns 2019

50 items

Fintech

9,451 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Digital Banking

1,105 items

Challenger bank offer digitally native banking products (checking and savings account at the most basic) and either leverage partner banks or are fully-licensed banks themselves.

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Mercury Patents

Mercury has filed 51 patents.

The 3 most popular patent topics include:

- videotelephony

- display devices

- electromagnetic radiation

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

2/13/2023 | 3/4/2025 | Videotelephony, Teleconferencing, Association football forwards, Groupware, Qualitative research | Grant |

Application Date | 2/13/2023 |

|---|---|

Grant Date | 3/4/2025 |

Title | |

Related Topics | Videotelephony, Teleconferencing, Association football forwards, Groupware, Qualitative research |

Status | Grant |

Latest Mercury News

Mar 27, 2025

Mercury raises $300 million on $3.5 billion valuation to expand fintech offerings SHARE Financial technology firm Mercury Financial LLC , best known for being a bank of choice for tech startups, announced today that it had raised $300 million in new funding on a $3.5 billion valuation to deliver new products, explore acquisitions and increase its headcount. Founded in 2017, Mercury is a fintech company that provides banking services tailored for startups and tech-focused businesses. The company partners with Federal Deposit Insurance Corporation-insured banks to offer business checking and savings accounts, debit cards and international wire transfers. Beyond traditional banking, Mercury integrates financial tools such as cash flow analytics and dashboards to help businesses manage their finances. The company’s platform also offers an application programming interface to allow companies to automate payments and customize their banking operations. While not its main focus, Mercury has offered venture debt financing since 2022, which provides startups with additional funding options to support their growth. Additionally, in September 2022, Mercury introduced the IO World Elite Mastercard, a corporate credit card designed to meet the spending needs of startups and tech-focused businesses. The company has more recently focused on enhancing its financial tools to streamline business operations, with a release in February seeing updates that included improved invoicing and employee receipt management features, further simplifying financial workflows for its users. While a startup raising venture capital would often be expected to have not-so-large numbers, that’s not the case for Mercury, with the company having processed $95 billion in transactions in 2023 and $156 billion in 2024. As of today, Mercury provides banking services and financial support for 200,000 “ambitious companies” across a variety of industries, including ElevenLabs Ltd., Cocolab Inc. and Bogey Bros LLC. Mercury’s Series C round was led by Sequoia Capital Management LP, with Spark Capital, Marathon Asset Management LP, Coatue Management, Charles River Ventures and Andreessen Horowitz Management also participating. “We’re looking forward to leveraging this opportunity to further accelerate our goals of driving innovation with new products, exploring acquisitions and hiring and retaining exceptional talent, all while maintaining long-term financial flexibility,” said Immad Akhund, co-founder of Mercury, in a blog post . Image: Mercury A message from John Furrier, co-founder of SiliconANGLE: Your vote of support is important to us and it helps us keep the content FREE. One click below supports our mission to provide free, deep, and relevant content.

Mercury Frequently Asked Questions (FAQ)

When was Mercury founded?

Mercury was founded in 2017.

Where is Mercury's headquarters?

Mercury's headquarters is located at 660 Mission Street, San Francisco.

What is Mercury's latest funding round?

Mercury's latest funding round is Series B.

How much did Mercury raise?

Mercury raised a total of $150.93M.

Who are the investors of Mercury?

Investors of Mercury include Andreessen Horowitz, Charles River Ventures, Coatue, Marathon, Spark Capital and 43 more.

Who are Mercury's competitors?

Competitors of Mercury include Jiko, Found, Grasshopper, Treasure, Nearside and 7 more.

What products does Mercury offer?

Mercury's products include Business Checking Account and 4 more.

Who are Mercury's customers?

Customers of Mercury include and undefined.

Loading...

Compare Mercury to Competitors

Novo develops a financial platform. It offers neo-banking facilities without traditional physical branch networks. It provides zero-balance accounts, business checking and debit card access, lending services, and more. The platform caters to small and medium enterprises (SMEs). Novo was formerly known as CLEAR Bank. The company was founded in 2016 and is based in Miami, Florida.

Lili focuses on providing business finance solutions. The company offers a range of services, including business banking, smart bookkeeping, invoice and payment management, and tax planning tools. It primarily serves the fintech industry. The company was founded in 2018 and is based in New York, New York.

Oxygen is a financial technology company. It offers services such as cashback rewards, virtual cards, early payroll access, and tools for business incorporation and invoicing. Oxygen primarily serves consumers, freelancers, solopreneurs, and small to medium-sized businesses with its financial products. It was founded in 2017 and is based in Princeton, New Jersey.

Bluevine is a financial technology company that specializes in providing business banking solutions. The company offers business checking accounts with high-yield interest, accounts payable automation, and extensive FDIC insurance, as well as business loans and credit cards designed to meet the needs of small businesses. Bluevine primarily serves the small business sector with its suite of financial products. It was founded in 2013 and is based in Jersey City, New Jersey.

Arival Bank is a digital banking platform operating in the financial technology sector. The company offers enterprise-level banking tools designed to simplify complex business banking needs, including multi-currency accounts, international payments, and advanced security measures. Arival Bank primarily serves tech startups, blockchain and web3 businesses, and digital SMEs. It was founded in 2017 and is based in Singapore.

Brex provides spend management solutions across various sectors. The company offers products including corporate cards, expense management, travel, bill pay, and banking services aimed at assisting businesses in managing spending and financial processes. Brex serves startups, mid-size companies, and enterprises with its range of financial products. Brex was formerly known as Veyond. It was founded in 2017 and is based in Salt Lake City, Utah.

Loading...