Merama

Founded Year

2020Stage

Series B - III | AliveTotal Raised

$564.6MLast Raised

$39.6M | 3 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+118 points in the past 30 days

About Merama

Merama focuses on accelerating the growth of e-commerce businesses in Latin America across various categories. It partners with e-commerce brands to provide strategic investment, expertise, and proprietary technology, aiming for business performance and profitability. Merama primarily serves the e-commerce industry by helping brands scale, optimize costs, and expand internationally. It was founded in 2020 and is based in Mexico City, Mexico.

Loading...

Loading...

Research containing Merama

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Merama in 1 CB Insights research brief, most recently on Oct 5, 2023.

Oct 5, 2023 report

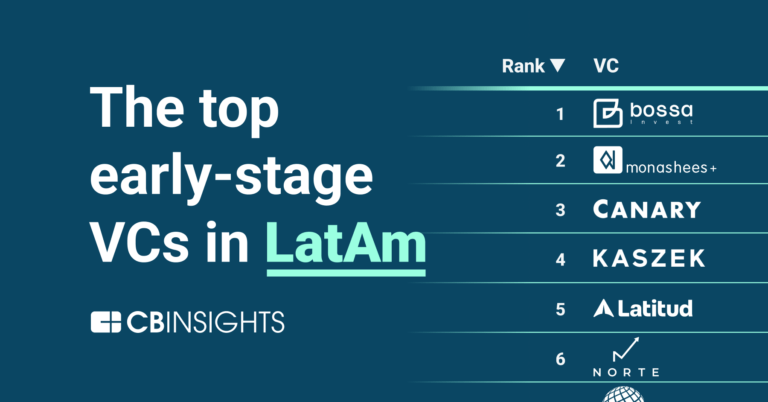

The top 25 early-stage LatAm VCsExpert Collections containing Merama

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Merama is included in 2 Expert Collections, including E-Commerce.

E-Commerce

11,224 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Unicorns- Billion Dollar Startups

1,270 items

Latest Merama News

Feb 13, 2025

Startups recebem o título de unicórnio quando o seu valor de mercado supera US$ 1 bilhão Por agora Startups recebem o título de unicórnio ao ultrapassar US$ 1 bilhão em valor de mercado — Foto: niphon/Getty Images Quando as startups alcançam o valor de mercado de US$ 1 bilhão e ainda não abriram o capital na Bolsa de Valores, elas conquistam o status de unicórnio. No Brasil, a primeira startup a garantir o título foi a 99, em janeiro de 2018. O país é líder na quantidade de unicórnios na América Latina, com 25 startups que alcançaram esse patamar, seguido pela Argentina, com sete unicórnios, e pelo México, com quatro. A startup brasileira que conquistou o título mais recentemente foi a QI Tech , que entrou para o seleto time em 2024. Fundada em 2018, a startup demorou seis anos para se tornar um unicórnio. A fintech que oferece soluções de crédito, bancárias e antifraude para mais de 400 clientes, incluindo Vivo, QuintoAndar e Shopee, foi a única a romper essa barreira no ano. Continuar lendo Gustavo Gierun, CEO da plataforma de dados Distrito, afirma que a desvalorização do real é um dos motivos que dificulta a chegada ao valuation bilionário. “O aumento da taxa de juros no Brasil contrasta com a tendência mundial de redução, tornando o mercado de investimento de risco mais cauteloso”, aponta. O Distrito divulgou nesta semana a sétima edição do levantamento Corrida dos Unicórnios, com informações sobre o ecossistema latino-americano e apresentando as 25 startups brasileiras que conquistaram o título. Leia também 1. 99 (mobilidade) Total captado: US$ 141,3 milhões 2. iFood (alimentação) Total captado: US$ 591,9 milhões 3. Nubank (finanças) Total captado: US$ 2,1 bilhões 4. Wellhub (benefícios corporativos) Total captado: US$ 605 milhões 5. Loggi (logística) Total captado: US$ 507 milhões 6. QuintoAndar (imóveis) Total captado: US$ 755,7 milhões 7. Ebanx (finanças) Total captado: US$ 430 milhões 8. WildLife (games) Total captado: US$ 180 milhões 9. Loft (imóveis) Total captado: US$ 788 milhões 10. Vtex (tecnologia) Total captado: US$ 365 milhões 11. Banco C6 (finanças) Total captado: US$ 241,6 milhões 12. Creditas (finanças) Total captado: US$ 951,9 milhões 13. MadeiraMadeira (e-commerce) Total captado: US$ 336 milhões 14. Hotmart (plataforma de cursos online) Ano em que virou unicórnio: 2021 Total captado: US$ 126,7 milhões 15. Mercado Bitcoin (finanças) Total captado: US$ 268,2 milhões 16. Unico (identidade digital) Total captado: US$ 338,1 milhões 17. CloudWalk (finanças) Total captado: US$ 340 milhões 18. Frete.com (logística) Total captado: US$ 337,8 milhões 19. Merama (e-commerce) Total captado: US$ 337 milhões 20. Facily (social commerce) Total captado: US$ 501 milhões 21. Olist (ERP) Total captado: US$ 314,2 milhões 22. Banco Neon (finanças) Total captado: US$ 726,6 milhões 23. Dock (tecnologia) Total captado: US$ 280 milhões 24. Pismo (tecnologia) Total captado: US$ 108 milhões 25. QI Tech (tecnologia) Total captado: US$ 300 milhões Siga PEGN:

Merama Frequently Asked Questions (FAQ)

When was Merama founded?

Merama was founded in 2020.

Where is Merama's headquarters?

Merama's headquarters is located at Av. Presidente Masaryk 8, Piso 5, Mexico City.

What is Merama's latest funding round?

Merama's latest funding round is Series B - III.

How much did Merama raise?

Merama raised a total of $564.6M.

Who are the investors of Merama?

Investors of Merama include Valor Capital Group, Balderton Capital, J.P. Morgan, Advent International, SoftBank Latin America Fund and 17 more.

Who are Merama's competitors?

Competitors of Merama include Nocnoc and 5 more.

Loading...

Compare Merama to Competitors

LatinxVC is an organization focused on supporting and growing the Latino/a venture capital ecosystem within the venture capital industry. It offers programs such as fellowships, mentorship, and events like the Annual Summit and Emerging Manager Showcase to help Latino/a venture investors build their careers and networks, as well as improve access to capital for Latino/a-led venture firms. The company primarily serves venture capitalists and limited partners interested in the Latino/a venture capital space. It was founded in 2019 and is based in San Jose, California.

Quinio focuses on building brands in the ecommerce sector within Latinoamerica. The company offers services such as evaluating businesses for partnerships or acquisitions and supporting brand growth through partnerships and technology-driven operations. Quinio primarily serves the ecommerce industry by seeking brands to assist in their development. It was founded in 2020 and is based in Lomas de Chapultepec, Mexico.

AngelHub partners with seed-stage tech-based startups across Latin America to accelerate their growth by investing and providing strategic advice, commercial connections, and business perks to take their business to the next level. It was founded in 2019 and is based in San Pedro, Mexico.

Endeavor Chile focuses on supporting high-impact entrepreneurs and fostering sustainable economic development. The company provides a global network and excellent services to help entrepreneurs grow their businesses, access new markets, and create quality jobs. Endeavor Chile aims to inspire successful entrepreneurs to influence the national entrepreneurial ecosystem positively. It was founded in 1998 and is based in Santiago, Chile. Endeavor Chile operates as a subsidiary of Endeavor.

Cobogo is a venture capital organization. It provides all the tools and services in one place to help digital content creators incorporate a business, raise funds, and find investors. The company was founded in 2021 and is based in Sao Paulo, Brazil.

Latino Business Action Network focuses on supporting Latino entrepreneurs through research, education, and networking within the business sector. The organization offers a Business Scaling program and a Startup Accelerator program in collaboration with Stanford University, designed to assist Latino business owners and founders. LBAN also creates a network of Latino entrepreneurship, providing support through a network of mentors, capital providers, and corporate contacts. It was founded in 2013 and is based in San Jose, California.

Loading...