Lydia

Founded Year

2013Stage

Series C | AliveTotal Raised

$260.33MValuation

$0000Last Raised

$100M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-60 points in the past 30 days

About Lydia

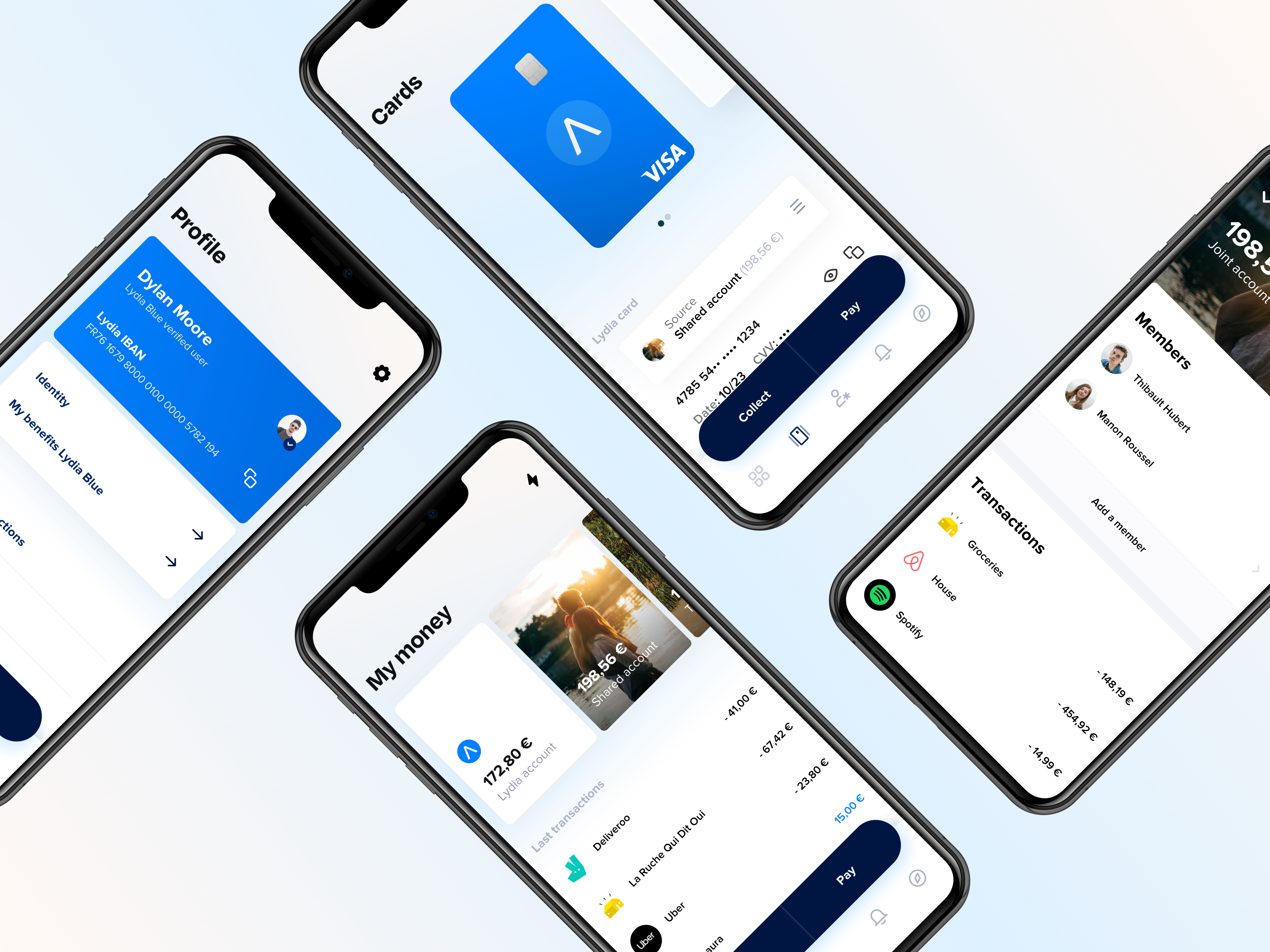

Lydia is a financial technology company that specializes in mobile and digital banking services. The company offers a range of products, including a digital current account, multi-account management, and tools for shared expenses, catering to the needs of modern consumers seeking efficient and secure online financial management. Lydia's services are designed to facilitate everyday banking, instant money transfers, and secure online payments without fees on international transactions. It was founded in 2013 and is based in Paris, France.

Loading...

Lydia's Product Videos

Lydia's Products & Differentiators

Lydia Free

A current account for occasional use

Loading...

Expert Collections containing Lydia

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Lydia is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Payments

3,123 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,661 items

Excludes US-based companies

Digital Banking

1,105 items

Challenger bank offer digitally native banking products (checking and savings account at the most basic) and either leverage partner banks or are fully-licensed banks themselves.

Fintech 100

249 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Lydia Patents

Lydia has filed 1 patent.

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

6/28/2013 | 12/2/2014 | Grant |

Application Date | 6/28/2013 |

|---|---|

Grant Date | 12/2/2014 |

Title | |

Related Topics | |

Status | Grant |

Latest Lydia News

Mar 26, 2025

Dépendre d’une seule source de revenus est un risque majeur pour toute entreprise. En 2025, la diversification financière est devenue essentielle pour sécuriser ses revenus et optimiser sa rentabilité. Que ce soit en complément d’une activité principale ou pour bâtir un patrimoine sur le long terme, multiplier les sources de revenus permet d’anticiper les imprévus et de gagner en liberté financière. Sécuriser ses finances grâce à la diversification Une entreprise peut être impactée par de nombreux facteurs externes : crises économiques, évolutions réglementaires, fluctuations du marché. En diversifiant ses revenus, en limitant ces risques et en assurant une stabilité financière. L’exemple de Lydia, fintech française spécialisée dans les paiements mobiles, illustre cette stratégie. Initialement centrée sur le transfert d’argent , elle a élargi son offre avec des comptes bancaires, des crédits et des services d’investissement et pu renforcer ainsi sa solidité face aux évolutions du secteur financier. Générer des revenus passifs pour plus de liberté Les revenus passifs permettent de générer de l’argent sans intervention constante. L’immobilier locatif reste une valeur sûre, notamment avec des solutions comme Masteos qui facilitent la gestion. De leur côté, les entrepreneurs du numérique mettent sur le marketing d’affiliation et la vente de formations pour monétiser leur expertise sans contrainte quotidienne. Monétiser son expertise et son réseau Le consulting, le coaching et les conférences sont des moyens efficaces de valoriser son savoir-faire. Jean Rivière, expert en marketing numérique, vend ses formations premium aux entrepreneurs cherchant à améliorer leur communication en ligne. En structurant son offre et en proposant un accompagnement personnalisé, il a transformé son expertise en une entreprise rentable, sans frais fixes importants. Créer une boutique en ligne pour générer des revenus automatiques Lancer un e-commerce permet d’ajouter une source de revenus évolutive sans contrainte géographique. Grâce à Shopify et aux solutions d’impression à la demande comme T-Pop, les entrepreneurs peuvent vendre des produits physiques sans gérer de stock ni logistique. Des marques comme Cabaïa , spécialisée dans les accessoires, ont su bâtir un modèle économique performant en combinant e-commerce et storytelling de marque. Une boutique en ligne bien optimisée peut rapidement devenir un levier financier important, surtout si elle est couplée à une bonne stratégie de marketing digital. Exploiter l’économie des abonnements pour une rentabilité stable Les modèles d’abonnement permettent de générer des revenus récurrents et de fidéliser une clientèle sur le long terme. Que ce soit dans le secteur du contenu, du coaching ou des produits physiques, ce modèle assure une meilleure visibilité financière et réduit la dépendance aux nouvelles ventes. Des entreprises comme Le Petit Ballon, qui proposent une sélection de vins en abonnement, ont prouvé l’efficacité de ce système. En offrant une expérience unique et une valeur ajoutée constante à leurs abonnés, elles maximisent leur rentabilité tout en limitant les coûts d’acquisition client. Construire un système automatisé pour ne plus dépendre d’un seul canal La diversification ne signifie pas s’éparpiller, mais créer un écosystème automatisé où chaque source de revenus fonctionne de manière fluide. Les entrepreneurs utilisent des outils comme Systeme.io pour automatiser leurs ventes, ConvertKit pour fidéliser leur audience et Podia pour vendre des formations sans intervention manuelle. Partager

Lydia Frequently Asked Questions (FAQ)

When was Lydia founded?

Lydia was founded in 2013.

Where is Lydia's headquarters?

Lydia's headquarters is located at 14 avenue de l'Opera, Paris.

What is Lydia's latest funding round?

Lydia's latest funding round is Series C.

How much did Lydia raise?

Lydia raised a total of $260.33M.

Who are the investors of Lydia?

Investors of Lydia include Tencent, Accel, Dragoneer Investment Group, Founders Future, Echo Street Capital and 10 more.

Who are Lydia's competitors?

Competitors of Lydia include Revolut, Monese, Monzo, Adro, Orange Bank and 7 more.

What products does Lydia offer?

Lydia's products include Lydia Free and 2 more.

Loading...

Compare Lydia to Competitors

Monzo engages as a digital bank that operates in the financial services sector, offering various banking products and services through its mobile app. The company provides personal and business accounts, savings and investment options, and credit and loan products. Monzo primarily serves individual consumers and businesses. Monzo was formerly known as Mondo. It was founded in 2015 and is based in London, United Kingdom.

Bunq focuses on providing financial services. The company offers a range of banking products, including savings accounts, full bank accounts, and multi-currency banking, all accessible through a mobile application. Bunq primarily serves individual consumers and businesses looking for modern, hassle-free banking solutions. It was founded in 2012 and is based in Amsterdam, Netherlands.

Bancacao is a developer of banking products. The company's Tzune is a digital financial services platform that offers fair, contactless, and personal solutions.

Varo is a digital bank that focuses on providing premium banking services through a mobile app. The company offers access to high-yield savings accounts, quicker access to funds, and automatic saving tools without the need for physical branches. Varo serves customers seeking convenient and modern banking solutions. Varo was formerly known as Ascendit Holdings. It was founded in 2015 and is based in San Francisco, California.

Tandem Bank provides digital banking services in the financial sector. The company offers financial products including savings accounts, green home improvement loans, energy-efficient mortgages, and motor finance for eco-friendly vehicles. Tandem Bank serves individuals making environmentally conscious financial decisions. It was founded in 2013 and is based in Blackpool, England.

Starling Bank is a digital bank that focuses on providing a range of banking services within the financial sector. The company offers personal and business banking solutions, including current accounts, overdrafts, loans, and money transfer services, all accessible through an intuitive mobile app. Starling Bank primarily serves individuals and businesses looking for modern, mobile-first banking experiences. It was founded in 2014 and is based in London, United Kingdom.

Loading...