Ladder

Founded Year

2015Stage

Series D | AliveTotal Raised

$203.55MValuation

$0000Last Raised

$100M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-86 points in the past 30 days

About Ladder

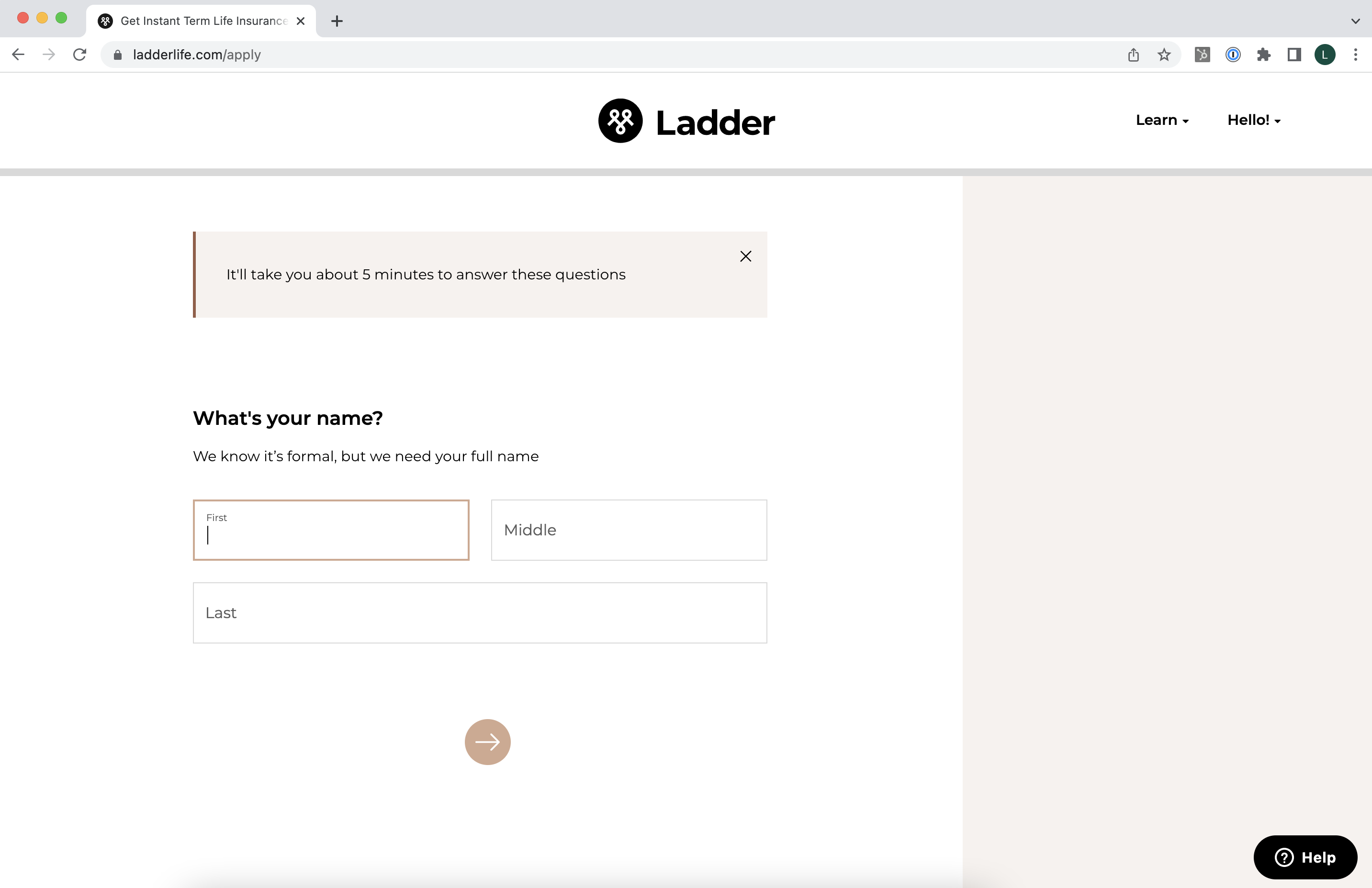

Ladder specializes in providing term life insurance through a digital platform within the insurance industry. The company offers affordable term life insurance policies with the flexibility to adjust coverage as the policyholder's life circumstances change. Ladder's services are designed to be accessible online, with a paperless application process and tools like an insurance calculator to help customers determine their coverage needs. It was founded in 2015 and is based in Palo Alto, California.

Loading...

Ladder's Product Videos

ESPs containing Ladder

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The full-stack insurtech carriers — life market comprises insurtech carriers that underwrite life insurance. Some of these carriers may also underwrite accident and disability insurance. As with established carriers, insurtech carriers will typically also be licensed by respective authorities and undergo review by rating agencies. Insurtech carriers in the life insurance industry often focus on im…

Ladder named as Leader among 7 other companies, including Lemonade, Acko, and Bestow.

Ladder's Products & Differentiators

Term Life Insurance (Online)

Ladder is the easy way to get quality term life insurance online. Answer a few questions and voilà! If you qualify, Ladder will cover you with the click of a button. The company’s smart algorithms work in real time to get you their best price, while sparing you from any lab tests for coverage up to $3M (coverage goes up to $8M, but you may be required to take an at-home test). There are no hidden fees, and you can cancel or adjust your coverage anytime. This way you can lock in your rate today and never worry about overpaying for coverage you don’t need. Ladder’s policies are issued by highly-rated insurers that have been supporting families and paying claims for decades. And if you’d rather talk to someone, Ladder’s licensed customer service team is available to help without any sales pressure.

Loading...

Research containing Ladder

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Ladder in 4 CB Insights research briefs, most recently on Feb 23, 2024.

Feb 23, 2024

The B2C US insurtech market mapExpert Collections containing Ladder

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Ladder is included in 5 Expert Collections, including Fintech 100.

Fintech 100

1,247 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Insurtech

3,303 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,464 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Insurtech 50

50 items

Report: https://app.cbinsights.com/research/report/top-insurtech-startups-2022/

InsurTech NY — Spring Conference 2025

124 items

Sponsors, speaker companies, and startup competition finalists as of 3.19.25

Ladder Patents

Ladder has filed 14 patents.

The 3 most popular patent topics include:

- neurological disorders

- civil engineering

- compact cars

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

11/30/2021 | 1/2/2024 | Technical drawing, Compact cars, Graphical projections, Video game designers, Mirrors | Grant |

Application Date | 11/30/2021 |

|---|---|

Grant Date | 1/2/2024 |

Title | |

Related Topics | Technical drawing, Compact cars, Graphical projections, Video game designers, Mirrors |

Status | Grant |

Latest Ladder News

Jul 12, 2024

Published [hour]:[minute] [AMPM] [timezone], [monthFull] [day], [year] SUNNYVALE, Calif. - November 19, 2020 - ( Newswire.com ) SafeButler, a YCombinator-funded startup allowing customers to shop insurance efficiently , and Ladder, a company making life insurance digital and convenient, have partnered with each other to simplify the life insurance shopping process for consumers. Now, consumers who qualify can get instant life insurance coverage through Ladder at a very affordable rate through the free secure online service SafeButler. “Our customers use SafeButler to get guaranteed renters insurance quotes from top insurance companies,” Vincent Wei, CEO of SafeButler, said. “The partnership with Ladder allows us to provide a similar experience for life insurance with prestigious and convenient choices from trusted brands.” Life insurance is important for financial planning. Founded in 2015, Ladder has allowed people to access life insurance with technology, financial, and insurance expertise. Outstanding investors, such as Lightspeed, 8VC, and Thomvest, have funded the company. With Ladder’s API integration, SafeButler can return a quote to policy seekers within seconds seamlessly. Consumers can conveniently get a personalized quote in as few as five steps. The partnership meets SafeButler’s goal of saving customers’ time and money by providing genuine quotes from insurance companies and providers. In addition, customers do not need to re-enter the same information on Ladder’s website. “We integrated with Ladder because Ladder is dedicated to providing an easy and affordable life insurance product,” Wei added. “The API integration allows us to present accurate quotes from Ladder to our customers in as little as 30 seconds.” About SafeButler SafeButler is a free service on a mission to help consumers effortlessly compare insurance. It is a YCombinator-funded startup that uses AI and automation to simplify the shopping process and provide the best insurance choices for consumers, saving time and money. In addition to delivering instant life insurance quotes from Ladder and guaranteed renters insurance quotes from top insurance companies, SafeButler offers connections for auto and homeowner insurance. While they take their role of consumer insurance assistant seriously, they also like to have a little fun; check out their Insurance Jokes page if you’re in the mood for a chuckle. For more information, visit safebutler.com . Media Contact The Associated Press is an independent global news organization dedicated to factual reporting. Founded in 1846, AP today remains the most trusted source of fast, accurate, unbiased news in all formats and the essential provider of the technology and services vital to the news business. More than half the world’s population sees AP journalism every day. The Associated Press

Ladder Frequently Asked Questions (FAQ)

When was Ladder founded?

Ladder was founded in 2015.

Where is Ladder's headquarters?

Ladder's headquarters is located at 100 Forest Ave, Palo Alto.

What is Ladder's latest funding round?

Ladder's latest funding round is Series D.

How much did Ladder raise?

Ladder raised a total of $203.55M.

Who are the investors of Ladder?

Investors of Ladder include Thomvest Ventures, CE Innovation Capital, OMERS Private Equity, Geodesic Capital, Lightspeed Venture Partners and 12 more.

Who are Ladder's competitors?

Competitors of Ladder include Plum Life, viteSicure, Bubble, PolicyGenius, Everyday Life Insurance and 7 more.

What products does Ladder offer?

Ladder's products include Term Life Insurance (Online).

Loading...

Compare Ladder to Competitors

Ethos provides life insurance solutions. It offers predictive analytics and data science technologies for life insurance policies. It covers expenses such as a home mortgage, debt, college tuition, and more. It was founded in 2016 and is based in Austin, Texas.

Bestow operates as an insurance technology company and develops products and software for insurance companies. It provides an application programming interface (API), enabling partners to offer life insurance coverage to customers. The company was formerly known as Coverlife. It was founded in 2017 and is based in Dallas, Texas.

Everyday Life Insurance specializes in providing term and whole life insurance policies within the insurance industry. The company offers an online platform for individuals to apply for life insurance, featuring a simple application process, personalized policy recommendations, and the option for no medical exam insurance. Everyday Life Insurance primarily serves individuals and families seeking financial security through life insurance. It was founded in 2018 and is based in Boston, Massachusetts.

iCover provides algorithmic underwriting for the life insurance industry, utilizing predictive analytics in the underwriting process. The company has a platform that enables insurers to assess, price, and deliver life insurance policies to customers quickly. iCover's services are aimed at insurance carriers and distributors looking to develop their digital offerings and customer experience. It was founded in 2018 and is based in Chesterfield, Missouri.

PolicyMe is a technology company that operates in the life insurance industry within the financial services sector. The company offers term life insurance, critical illness insurance, and health and dental insurance, providing coverage for medical care expenses. PolicyMe serves individuals seeking insurance products. It was founded in 2018 and is based in Toronto, Canada.

Wysh is a financial services company that provides life insurance products. The company offers term life insurance policies that do not require medical exams and allow for quick coverage decisions. Wysh primarily serves individual customers looking for financial protection for their families. It was founded in 2021 and is based in Milwaukee, Wisconsin.

Loading...