Konfio

Founded Year

2013Stage

Line of Credit - IV | AliveTotal Raised

$1.036BLast Raised

$100M | 2 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-39 points in the past 30 days

About Konfio

Konfio specializes in providing financial solutions and payment services to small and medium-sized enterprises (SMEs). The company offers products such as business credit, corporate cards, and payment terminals. Konfio primarily serves the SME sector, offering tools and resources to help businesses grow and manage their finances. It was founded in 2013 and is based in Mexico City, Mexico.

Loading...

Loading...

Research containing Konfio

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Konfio in 2 CB Insights research briefs, most recently on Nov 17, 2022.

Mar 30, 2022

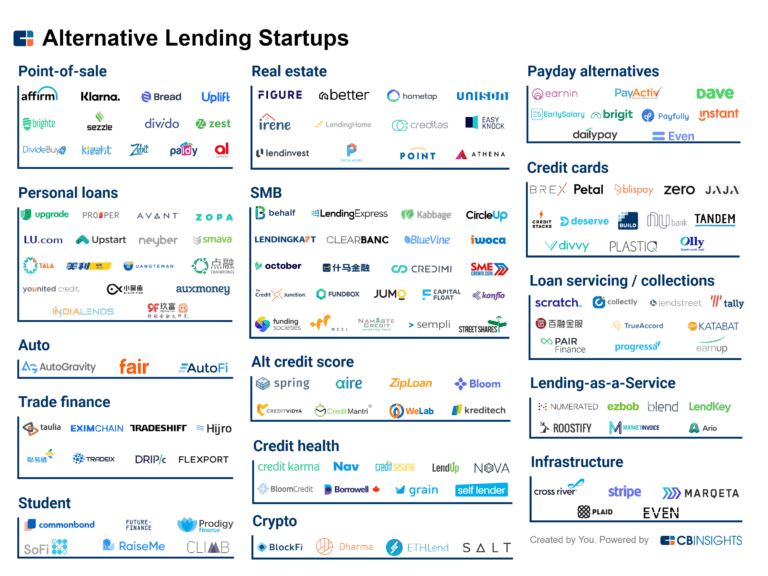

140+ startups shaping the digital lending spaceExpert Collections containing Konfio

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Konfio is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Digital Lending

2,374 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

SMB Fintech

1,231 items

Fintech

13,662 items

Excludes US-based companies

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Konfio News

Feb 25, 2025

A profile on VC investors ALLVP. Platzi pursues the next technological revolution with AI. Elon Musk's new biography. Sep 15, 2023 ALLVP is a venture capital firm founded in 2012 by Federico Antoni and Fernando Lelo de Larrea. They aim to finance entrepreneurs using technology to address pressing problems in Latin America. Their investments include Carrot, the first carsharing platform in Mexico City, and Cornershop, which was sold to Uber for $3 billion. ALLVP has become one of the most influential VC firms in the region, managing four institutional funds with over $350 million in assets. They focus on early-stage companies with significant growth potential in sectors such as fintech, climatech, smart cities, and human capital. ALLVP is currently raising $150 million for their fourth fund and has already invested in Sensai and Shinkansen. Subscribe The United States is seeking to reduce its dependency on China and other distant countries by shifting towards nearshoring, which involves relocating business operations to nearby countries. Latin America has become an attractive option for nearshoring, leading to increased foreign investment, including venture capital, in countries like Mexico. However, startups in the logistics and transportation industry in Latin America received less capital in 2022 compared to the previous year. Nevertheless, the trend is changing, and more investors are now betting on tech startups in the region. Nearshoring in Latin America offers advantages such as cost savings, a wide range of qualified professionals, time zone convenience, ease of communication, and a solid business environment. The region's stable economies and favorable policies make it an attractive destination for foreign investment and long-term growth. Mexican fintech firm Konfío has announced the closure of Gestionix, an ERP software company it acquired in 2020, in order to focus on its financial services for SMEs. M&A history. Konfío has previously made acquisitions to strengthen its market position, including Astro and Sr.Pago. Contalink is emerging as an alternative for independent accountants and SMEs in the changing fintech landscape. Valuation. Konfío is valued at USD$1.3 billion, and is one of the largest fintech firms in Latin America. ( Contxto ) Mexican startup Stori has acquired financial society MasCaja, expanding its offerings to include savings and investment products. Objectives. With over 2.2 million customers and a valuation of USD$1.2 billion, Stori aims to provide credit card access to 80 million Mexicans. The acquisition. Acquiring MasCaja is just the beginning for Stori, as the company plans to further expand its range of products and services and leverage its expertise in serving an underserved market. ( Contxto ) Galileo Financial Technology has launched a new platform called 'Más efectivo sin efectivo' to promote the use of electronic means over physical money in Latin America. Value proposition. The platform aims to educate people about the costs of using cash and the benefits of digital transactions. It also aims to increase trust in cashless transactions and promote financial inclusion. ( Contxto ) Platzi, the largest tech school in the Spanish-speaking world, is focused on transforming Latin America into a technological powerhouse by offering a wide range of courses in technology-related subjects. Value proposition. Platzi aims to prepare people for the AI revolution and has already started rolling out AI courses covering machine learning, natural language processing, and data science. ( Contxto ) Real estate in Mexico is undergoing a transformation with the first 100% digital and remote trust management. The trust. The trust was created for the funding and operation of the Sanâh Tulum boutique hotel, with over MX $33 million raised from 1,232 investors. This achievement opens up possibilities for investment in the Proptech-Tourism market with a secure legal structure. Highlights. The collaboration between briq.mx and Bramah Desarrollos made this possible, with technological support from Weetrust and Banco Covalto. The digitization of the legal process saves time and costs by eliminating the need for physical presence. ( Contxto ) Paymentology, a global leader in card issuance and payment processing, has announced a strategic partnership with Nelo, a consumer payment platform in Mexico. The partnership and why it’s important. The collaboration will support Nelo's Mastercard for in-person payments through Google Wallet and the launch of physical cards. The partnership will provide Nelo with a fast and scalable infrastructure solution, enabling them to extend their reach and improve financial inclusion in Mexico. ( Contxto) A new report from AgFunder reveals that agrifoodtech startups in Latin America have raised over $7.3 billion since 2018, accounting for 5% of the global market. The number of funding rounds in the region has consistently increased over the past five years, reaching 176 deals in 2022. Highlights. The top-funded areas in Latin America's agrifoodtech investment were eGrocery and Cloud Retail Infrastructure, which raised 22% of the overall funding. Top industries and companies. Food delivery and eGrocery startups have dominated the top funding rounds in the region, with companies like Rappi and iFood securing significant investments. ( AFN ) Latin American startups are focusing on sectors beyond fintech, such as healthcare, logistics, communications, and agriculture, to drive substantial disruption in the region. Value proposition. Latin America's startup scene is not just limited to fintech, with other sectors like healthcare, logistics, communications, and agriculture poised for disruption. Education is also an area where technology can play a key role in closing the skills gap. The opportunity for VC’s. Despite inflationary pressures, venture capital investment and fundraising in the region are expected to benefit from potential slowing inflation. Surviving the lack of funding. Startups are employing various strategies like reducing headcount and negotiating lower prices to cut costs and reduce burn. ( TechCrunch ) The share of new venture capital-backed startups headquartered outside of Latin America's traditional tech hubs has grown in the first half of 2023, reaching 39%. Brazil leading the funding. Emerging tech hubs include cities such as Rio de Janeiro, Lima, and Monterrey. In Brazil, startups raised USD$327 million in August, the best month for fundraising so far this year, with fintechs receiving the most capital. ( bnamericas )

Konfio Frequently Asked Questions (FAQ)

When was Konfio founded?

Konfio was founded in 2013.

Where is Konfio's headquarters?

Konfio's headquarters is located at Av. Horacio 1844-Piso 8, Mexico City.

What is Konfio's latest funding round?

Konfio's latest funding round is Line of Credit - IV.

How much did Konfio raise?

Konfio raised a total of $1.036B.

Who are the investors of Konfio?

Investors of Konfio include J.P. Morgan Chase, 500 Latam, Ford Foundation, Banamex, U.S. International Development Finance Corporation and 22 more.

Who are Konfio's competitors?

Competitors of Konfio include Tribal Credit, R2, Albo, Creze, Klar and 7 more.

Loading...

Compare Konfio to Competitors

Fondeadora is a financial technology company that provides personal and corporate banking solutions. The company offers a platform that allows users to open personal and business debit accounts and earn interest on their savings. Fondeadora primarily serves individuals and businesses seeking financial services. It was founded in 2011 and is based in Mexico City, Mexico.

Albo offers financial services for personal and business needs. The company provides personal and business debit accounts, loans, and payroll services, and facilitates cryptocurrency transactions, all managed through a single app. Albo primarily serves individuals and small to medium-sized businesses with their financial management and growth. It was founded in 2016 and is based in Mexico City, Mexico.

AlphaCredit provides credit lines to individuals and small companies in Mexico and Colombia via a programmed deduction system, which has low default rates thus allowing for low-interest rates.

Klar is a financial services company that offers credit card services, personal savings, and investment products. The company provides credit cards with no annual fees, savings accounts with daily growth, and flexible investment options with competitive returns. Klar's offerings are designed to cater to individuals seeking accessible financial products and tools for managing their finances. It was founded in 2019 and is based in Mexico City, Mexico.

Finve is a business financing platform in Mexico that aims to connect SMEs (small & medium enterprises) to investors. Per the company, they offer yields between 8% and 30% annually and aim to minimize volatility and risk through diversification.

Kueski operates as a financial technology company focused on online consumer lending within the financial services industry. The company offers personal loans and a digital payment method that allows users to make purchases in installments without a credit card. Kueski primarily serves individuals who may not qualify for traditional bank loans. It was founded in 2012 and is based in Jalisco, Mexico.

Loading...