Klaviyo

Founded Year

2012Stage

IPO | IPOTotal Raised

$778.5MDate of IPO

9/20/2023Market Cap

8.99BStock Price

33.00Revenue

$0000About Klaviyo

Klaviyo is a business to commerce (B2C) customer relationship management (CRM) platform that provides marketing automation and customer engagement solutions. The company offers services such as email and SMS marketing, customer data integration, and predictive analytics. It was founded in 2012 and is based in Boston, Massachusetts.

Loading...

ESPs containing Klaviyo

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The marketing automation personalization market is focused on providing personalized and relevant experiences to customers across various digital channels. Vendors in this market offer solutions that use AI and data analytics to create personalized content and messaging for each customer, resulting in increased engagement, conversion rates, and customer loyalty. The market includes a range of prod…

Klaviyo named as Highflier among 15 other companies, including Bloomreach, Oracle, and Attentive.

Loading...

Research containing Klaviyo

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Klaviyo in 8 CB Insights research briefs, most recently on Jan 4, 2024.

Jan 4, 2024 report

State of Venture 2023 Report

Nov 21, 2023

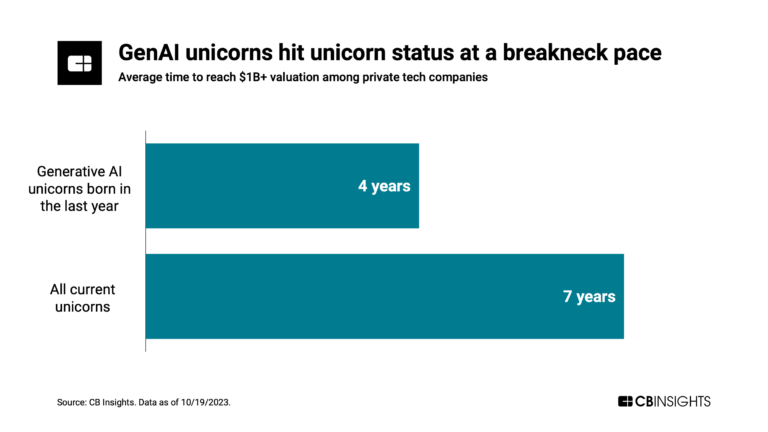

Has the global unicorn club reached its peak?

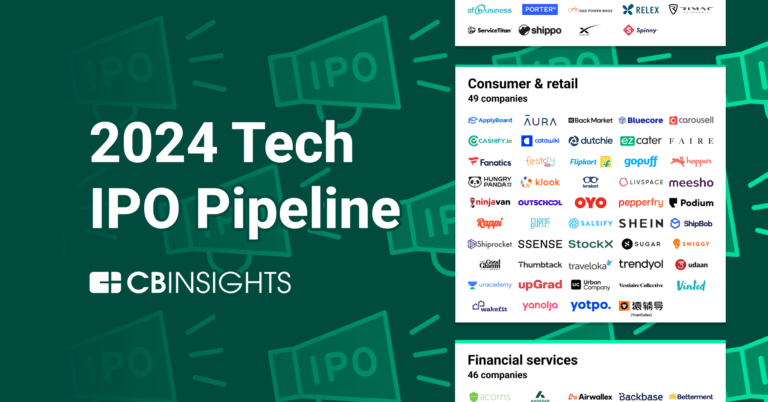

Nov 20, 2023 report

The 2024 Tech IPO Pipeline

Oct 12, 2023 report

State of Venture Q3’23 Report

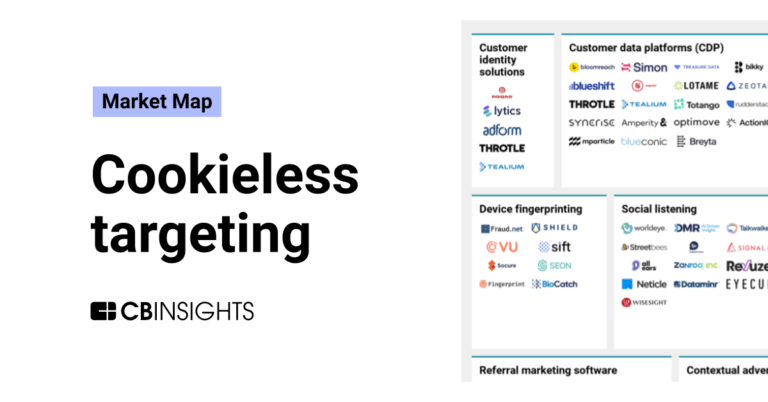

Aug 14, 2023

The cookieless targeting market map

Oct 18, 2022

The Transcript from Yardstiq: Is Okta an M&A target?

Oct 12, 2022 report

Top marketing automation companies — and why customers chose themExpert Collections containing Klaviyo

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Klaviyo is included in 4 Expert Collections, including Conference Exhibitors.

Conference Exhibitors

5,302 items

Targeted Marketing Tech

453 items

This Collection includes companies building technology that enables marketing teams to identify, reach, and engage with consumers seamlessly across channels.

Loyalty & Rewards Tech

178 items

NRF Big Show 2025: Exhibitors

959 items

Klaviyo Patents

Klaviyo has filed 34 patents.

The 3 most popular patent topics include:

- data management

- digital marketing

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

3/30/2023 | 2/4/2025 | Content management systems, Website management, Free content management systems, Web applications, Web frameworks | Grant |

Application Date | 3/30/2023 |

|---|---|

Grant Date | 2/4/2025 |

Title | |

Related Topics | Content management systems, Website management, Free content management systems, Web applications, Web frameworks |

Status | Grant |

Latest Klaviyo News

Mar 22, 2025

Klaviyo (NYSE:KVYO) Coverage Initiated by Analysts at Stephens Posted by MarketBeat News on Mar 22nd, 2025 Stephens started coverage on shares of Klaviyo ( NYSE:KVYO – Free Report ) in a research report report published on Wednesday, Marketbeat.com reports. The brokerage issued an overweight rating and a $43.00 target price on the stock. Several other brokerages have also commented on KVYO. Wells Fargo & Company dropped their price target on Klaviyo from $48.00 to $45.00 and set an “equal weight” rating for the company in a research note on Thursday, February 20th. Mizuho raised their price target on shares of Klaviyo from $42.00 to $52.00 and gave the company an “outperform” rating in a report on Thursday, February 20th. Barclays increased their price objective on shares of Klaviyo from $47.00 to $51.00 and gave the stock an “overweight” rating in a research report on Thursday, February 20th. Robert W. Baird increased their price target on Klaviyo from $52.00 to $54.00 and gave the company an “outperform” rating in a report on Thursday, February 20th. Finally, Canaccord Genuity Group boosted their price objective on Klaviyo from $40.00 to $50.00 and gave the stock a “buy” rating in a research note on Thursday, February 20th. Five investment analysts have rated the stock with a hold rating and fourteen have issued a buy rating to the company’s stock. According to MarketBeat.com, the stock presently has a consensus rating of “Moderate Buy” and an average target price of $49.89. Get Klaviyo alerts: Shares of NYSE:KVYO opened at $32.99 on Wednesday. The company has a market cap of $9.01 billion, a P/E ratio of -183.30 and a beta of 0.86. The business has a fifty day simple moving average of $41.23 and a 200-day simple moving average of $38.65. Klaviyo has a 52 week low of $21.26 and a 52 week high of $49.55. Klaviyo ( NYSE:KVYO – Get Free Report ) last posted its quarterly earnings data on Wednesday, February 19th. The company reported ($0.06) EPS for the quarter, missing analysts’ consensus estimates of $0.06 by ($0.12). The company had revenue of $270.16 million for the quarter, compared to analyst estimates of $257.24 million. Klaviyo had a negative net margin of 4.92% and a positive return on equity of 0.89%. Sell-side analysts expect that Klaviyo will post 0.04 earnings per share for the current fiscal year. Insiders Place Their Bets In related news, President Stephen Eric Rowland sold 4,536 shares of Klaviyo stock in a transaction on Wednesday, January 15th. The stock was sold at an average price of $40.04, for a total value of $181,621.44. Following the transaction, the president now directly owns 260,403 shares in the company, valued at $10,426,536.12. The trade was a 1.71 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this link . Also, CFO Amanda Whalen sold 15,000 shares of the company’s stock in a transaction on Friday, March 14th. The shares were sold at an average price of $33.54, for a total value of $503,100.00. Following the sale, the chief financial officer now directly owns 349,623 shares of the company’s stock, valued at approximately $11,726,355.42. This represents a 4.11 % decrease in their ownership of the stock. The disclosure for this sale can be found here . Insiders sold 2,126,246 shares of company stock worth $69,799,958 over the last ninety days. Company insiders own 53.24% of the company’s stock. Institutional Trading of Klaviyo A number of hedge funds have recently bought and sold shares of the company. Advisors Asset Management Inc. raised its position in Klaviyo by 145.6% during the third quarter. Advisors Asset Management Inc. now owns 1,363 shares of the company’s stock valued at $48,000 after acquiring an additional 808 shares in the last quarter. CIBC Private Wealth Group LLC increased its position in Klaviyo by 169.5% during the fourth quarter. CIBC Private Wealth Group LLC now owns 1,752 shares of the company’s stock worth $72,000 after buying an additional 1,102 shares during the last quarter. Tower Research Capital LLC TRC raised its holdings in Klaviyo by 77.5% during the fourth quarter. Tower Research Capital LLC TRC now owns 1,874 shares of the company’s stock valued at $77,000 after buying an additional 818 shares in the last quarter. West Tower Group LLC acquired a new stake in shares of Klaviyo in the third quarter worth about $177,000. Finally, SBI Securities Co. Ltd. bought a new stake in shares of Klaviyo during the 4th quarter worth about $196,000. 45.43% of the stock is owned by hedge funds and other institutional investors. About Klaviyo

Klaviyo Frequently Asked Questions (FAQ)

When was Klaviyo founded?

Klaviyo was founded in 2012.

Where is Klaviyo's headquarters?

Klaviyo's headquarters is located at 125 Summer Street, Boston.

What is Klaviyo's latest funding round?

Klaviyo's latest funding round is IPO.

How much did Klaviyo raise?

Klaviyo raised a total of $778.5M.

Who are the investors of Klaviyo?

Investors of Klaviyo include Shopify Ventures, Summit Partners, Accel, Owl Rock Capital Group, Keith Block and 14 more.

Who are Klaviyo's competitors?

Competitors of Klaviyo include Act-On Software, Bluecore, Brevo, Madwire, Blueshift and 7 more.

Loading...

Compare Klaviyo to Competitors

ActiveCampaign focuses on customer experience automation, operating within the marketing automation, email marketing, and Customer Relationship Management (CRM) sectors. The company offers services, including email marketing, marketing automation, e-commerce marketing, and CRM tools designed to help businesses engage meaningfully with their customers. ActiveCampaign primarily serves businesses of all sizes across various sectors, with a particular emphasis on the e-commerce industry. It was founded in 2003 and is based in Chicago, Illinois.

Brevo provides customer relationship management and marketing services. The company offers tools for businesses to execute digital marketing campaigns, send transactional messages, and utilize marketing automation features. It primarily serves the marketing industry. Brevo was formerly known as SendinBlue. It was founded in 2012 and is based in Paris, France.

Bluecore provides retail marketing technology focused on customer identification and movement within the purchase funnel. It offers a platform for enterprise brands to automate personalized marketing campaigns across various channels, utilizing real-time data and predictive analytics. Bluecore's solutions are tailored for the retail sector, with the goal of improving customer retention and supporting growth for brands. Bluecore was formerly known as TriggerMail. It was founded in 2013 and is based in New York, New York.

Rokt focuses on electronic commerce technology. The company offers solutions to increase revenue, acquire customers at scale, and form relationships with existing customers. Its solutions include optimizing and monetizing the checkout experience, providing payment providers during checkout, and offering premium post-purchase offers. The company operates in the e-commerce sector. It was founded in 2012 and is based in New York, New York.

Attentive provides a personalized text messaging platform. It offers a short message service (SMS) marketing platform allowing retail and electronic commerce brands to connect with consumers, providing solutions such as marketing automation, growth marketing, retention marketing, audience management, messaging, and business intelligence. It offers its services to electronic commerce and the retail sector. The company was founded in 2016 and is based in Hoboken, New Jersey.

ForMotiv specializes in behavioral analytics within the insurance sector and provides insights into the intent and risk associated with digital applicants. The company offers solutions that analyze behavioral data in real-time to predict user intent and assess risk, which aids in improving conversion rates and reducing fraud. ForMotiv's services are primarily utilized by the insurance industry, enhancing digital experiences and decision-making processes for life, home, auto, and commercial insurance providers. It was founded in 2018 and is based in Philadelphia, Pennsylvania.

Loading...