Kissht

Founded Year

2015Stage

Angel | AliveTotal Raised

$154.5MAbout Kissht

Kissht is a financial technology platform that provides personal and business loans. The company uses a digital loan process that requires no physical documentation, allowing for the disbursement of funds to customers' bank accounts. Kissht's services are aimed at consumers looking for financial solutions. It was founded in 2015 and is based in Mumbai, India.

Loading...

Loading...

Research containing Kissht

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Kissht in 1 CB Insights research brief, most recently on Sep 13, 2022.

Sep 13, 2022

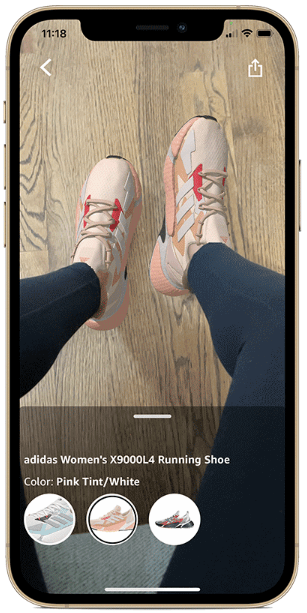

3 retail tech trends to watch in Q3’22Expert Collections containing Kissht

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Kissht is included in 5 Expert Collections, including Store tech (In-store retail tech).

Store tech (In-store retail tech)

1,766 items

Companies that make tech solutions to enable brick-and-mortar retail store operations.

Digital Lending

2,374 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Payments

3,123 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech 100

500 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Fintech

13,662 items

Excludes US-based companies

Latest Kissht News

Mar 19, 2025

Endiya Partners founders (from left) Ramesh Byrapaneni, Abhishek Srivastava and Sateesh Andra. 19 March, 2025 Endiya Partners has closed its third venture capital fund at $100 million, backed by the International Finance Corporation (IFC) and Asian Infrastructure Investment Bank (AIIB). Founded in 2015, Endiya is known as an early backer of high-growth companies such as HR tech unicorn Darwinbox; AI startup Myelin Foundry; compliance automation firm Scrut Automation; and lending platform Kissht, which is preparing for an IPO. Kissht is targeting a valuation of over Rs 5,000 crore ($600 million) when it lists later this year.

Kissht Frequently Asked Questions (FAQ)

When was Kissht founded?

Kissht was founded in 2015.

Where is Kissht's headquarters?

Kissht's headquarters is located at LBS Marg, Kurla West, Mumbai.

What is Kissht's latest funding round?

Kissht's latest funding round is Angel.

How much did Kissht raise?

Kissht raised a total of $154.5M.

Who are the investors of Kissht?

Investors of Kissht include Sachin Tendulkar, Trifecta Capital Advisors, Endiya Partners, Vertex Ventures SE Asia, Brunei Investment Agency and 9 more.

Who are Kissht's competitors?

Competitors of Kissht include Tala, Prodigy Finance, Revfin, MyShubhLife, ZestMoney and 7 more.

Loading...

Compare Kissht to Competitors

Branch International provides digital banking services. The company offers financial products including loans, money transfers, bill payments, investments, and savings, accessible through a smartphone app. Branch serves individuals in emerging markets. It was founded in 2015 and is based in Mumbai, India.

Tala serves as a financial platform focused on providing digital financial services across multiple sectors. The company offers instant access to credit, payments, savings, and transfer services through its app, utilizing AI for personalized financial solutions. Tala primarily serves individuals who seek to manage their finances with innovative technology. Tala was formerly known as InVenture. It was founded in 2011 and is based in Santa Monica, California.

Prodigy Finance specializes in education loans for international students pursuing master's degrees. The company offers collateral-free loans to cover tuition and living expenses, aimed at students who wish to study abroad without the need for a co-signer or collateral. Prodigy Finance primarily serves the higher education sector, facilitating access to top-tier educational institutions globally. It was founded in 2007 and is based in London, United Kingdom.

Brighte is a financial services company that offers financing solutions for solar panels, energy-efficient home products, and electrification services, serving homeowners interested in sustainable energy technologies. It was founded in 2015 and is based in Sydney, Australia.

Upgrade specializes in personal loans and credit card products. The company offers financial services including personal loans, credit card options, and savings accounts. Upgrade primarily serves individuals seeking solutions such as debt consolidation, home improvements, or major purchases. It was founded in 2016 and is based in San Francisco, California.

CASHe is a financial technology company that offers personal loans and credit lines. The company provides personal loans for various purposes, including travel, education, and home renovation, as well as pre-approved credit limits and Buy Now, Pay Later options. CASHe primarily targets working millennials and individuals looking for financial solutions. It was founded in 2016 and is based in Mumbai, India.

Loading...