Investments

1230Portfolio Exits

258Funds

32Partners & Customers

8Service Providers

1About Index Ventures

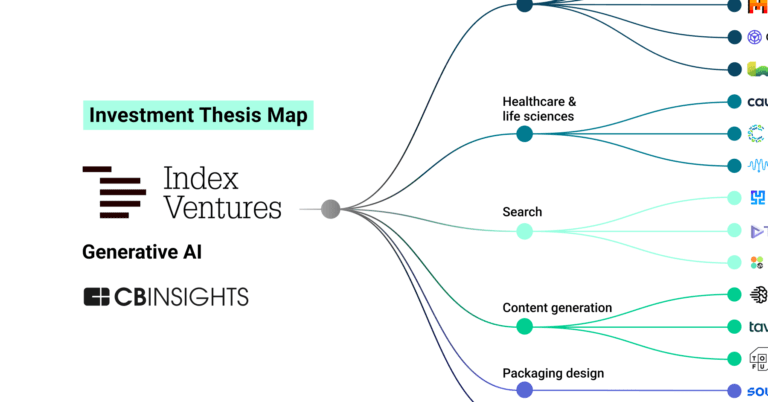

Index Ventures operates as a global venture capital firm. It invests in the commercial services, media, retail, and information technology sectors. It was founded in 1996 and is based in London, United Kingdom.

Expert Collections containing Index Ventures

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Index Ventures in 8 Expert Collections, including Direct-To-Consumer Brands (Non-Food).

Direct-To-Consumer Brands (Non-Food)

37 items

Startups selling their own branded products directly to consumers via online/mobile channels, rather than relying on department stores or big online marketplaces.

Store tech (In-store retail tech)

56 items

Startups aiming work with retailers to improve brick-and-mortar retail operations.

Food & Beverage

123 items

Travel Technology (Travel Tech)

39 items

Tech-enabled companies offering services and products focused on tourism. This collection includes booking services, search platforms, on-demand travel and recommendation sites, among others.

Education Technology (Edtech)

58 items

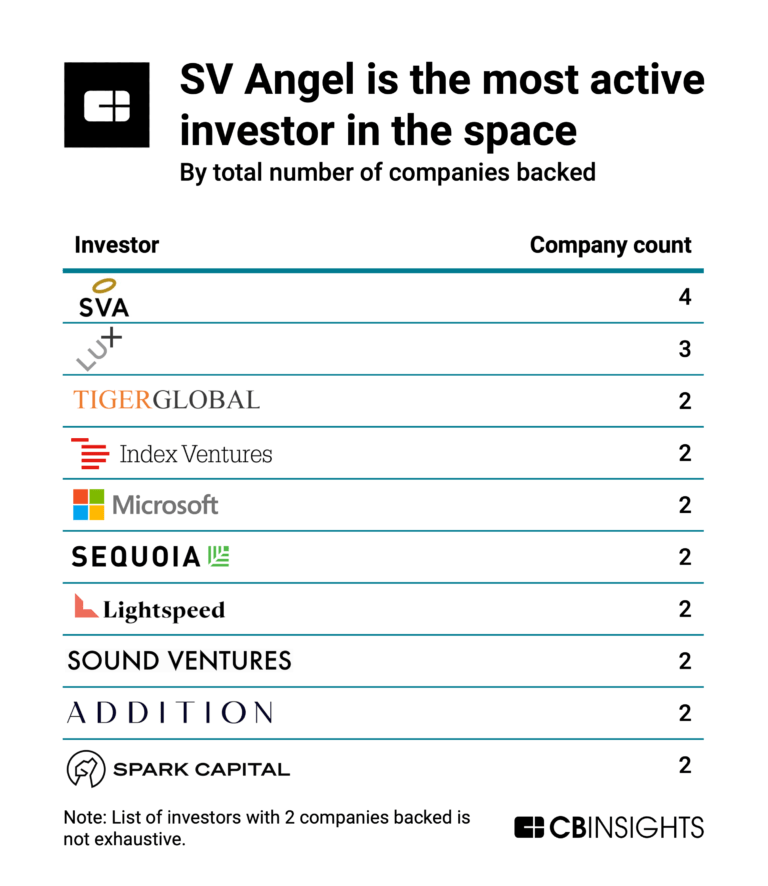

CB Insights Smart Money Investors

25 items

Research containing Index Ventures

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Index Ventures in 8 CB Insights research briefs, most recently on Jul 2, 2024.

Jul 2, 2024 team_blog

How to buy AI: Assessing AI startups’ potential

Feb 27, 2024

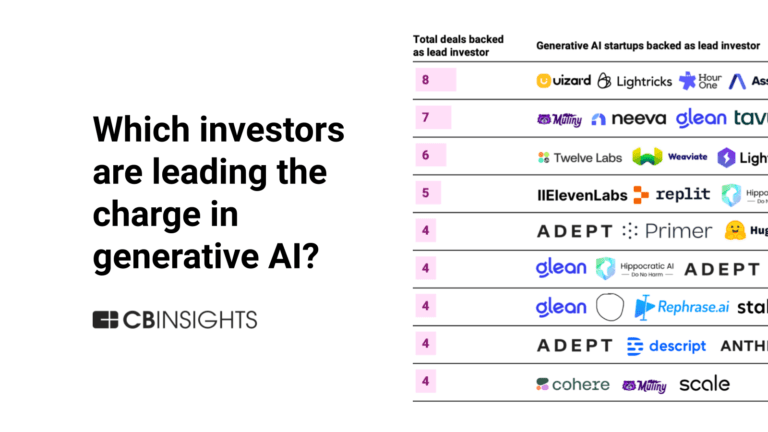

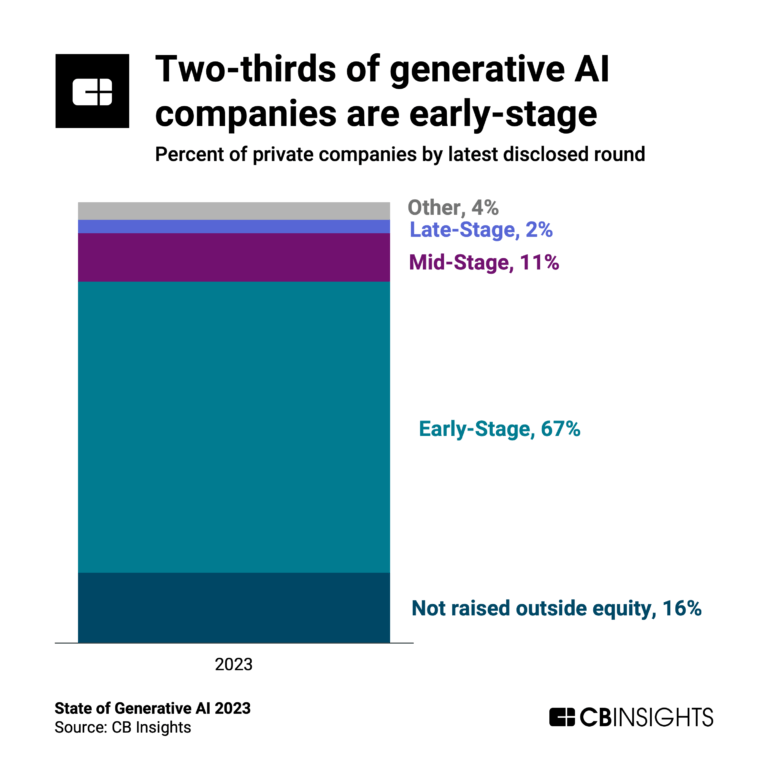

The generative AI boom in 6 charts

Jul 14, 2023

The state of LLM developers in 6 charts

Latest Index Ventures News

Mar 24, 2025

2375亿,开年最大并购诞生了 半年后,富豪回到了年轻人的办公室里,恭恭敬敬地递上了一份新的合同,诚恳地说,“上次是我欠考虑了,这次新的报价320亿美元,您看还满意吗?” 抓马的短剧反转剧情,真的在现实世界发生了。 2025年3月19日,谷歌宣布他们和Wiz达成了新的收购协议,而这次的报价已经飙升到了320亿美元(约合人民币2375亿),基本已经锁定本年度最大并购之一。 狂妄的年轻人 其次,Wiz是标准的“核心技术好,时代真需要”。 2013年,Adallom因为发现并报告了微软旗舰产品Office 365中的令牌劫持漏洞 (CVE-2013-5054)一炮而红,他们独特的洞察也收获了资本市场的认可,先后拿到了来自红杉、Index等顶级VC的多轮投资。2015年,微软以3.2亿美元的价格收购Adallom,Assaf Rappaport成功套现之外,并且成为了微软云安全部门的负责人,拥有了更广阔的技术展现舞台。 2020年成立的Wiz就是这样的集大成之作。当年一起创建Adallom、又一起加入微软的小胡子们,再次设计了一款产品,帮助企业更方便快捷地检测潜在的异常行为、分析这些异常行为可能导致的风险。 Wiz的发展速度也证明了Assaf Rappaport的团队确实拥有行业内“独一档”的能力。2022年8月,Wiz宣布他们成为了有史以来最快达到1亿美元年度经常性收入的初创公司,前后共耗时18个月。2024年2月,他们宣布年度经常性收入突破3.5亿美元,并且如果仅统计财富杂志的全球百强榜单,已经有45%的巨头公司已经成为了他们的客户。 等到谷歌发起第一次收购邀约的时候,Wiz的价值就更明显了,因为人工智能时代来了。人工智能时代的所有应用产品都依赖于存储在云服务器中的大量数据,数据安全也随之被推上了前所未有的高度。Wiz也早就意识到了这一点,近两年不仅一直在精进自己的产品力,也尝试着通过收购来武装自己。例如在2024年,他们就分别收购了云检测与响应 (CDR)技术研发商Gem Security和云原生平台Raftt。 所以虽然在拒绝了谷歌的第一次收购邀约后,有分析师嘲讽说:“Wiz被自己的狂妄自大蒙蔽了双眼”——但如果你是Assaf Rappaport,会甘心就距离IPO临门一脚的阶段,就这样把公司卖掉吗? VC的饕餮盛宴 也有阴谋论的解释认为,谷歌就没指望第一次报价就能成。当初的那笔230亿美元的报价,更像是一个公开询价,一方面试探Wiz团队的野心,另一方面对外传递出Wiz“正在考虑被收购”的信息,引诱其他潜在的竞标者也尝试提出报价——当Wiz对市场水温有了全面的洞察,谷歌又充分了解了其他对手的筹码后,这场交易也就顺理成章地可以完成了。 无论哪种说法吧,总之现在一切已经尘埃落定。谷歌以320亿美元拿下了Wiz,一举刷新他们的最大收购纪录。此前,他们最大手笔的收购发生在2012年,当时他们以125亿美元的价格买下了日薄西山的摩托罗拉。摩托罗拉这段收购的回忆也挺糟糕的,2014年他们甩卖的时候整体估值已经只有25亿美元,这些有机会后面可以细说。 对于Wiz的投资人们来说,320亿美元的价格也足够他们赚出一个盆满钵满。 从绝对值上来看,作为Wiz坚定支持者的红杉和Index吃到了最多的红利。根据计算,在完成收购交易后,红杉将至少获利30亿美元,相当于他们投资额度的25倍。而Index Ventures目前拥有12%的股份,一旦出售完成,他们预计将赚取超过38亿美元的收益。 而从倍数来看,赚得最狠的是来自一家以色列风投机构Cyberstarts。Cyberstarts对Wiz的首笔投资出现在2020年2月,当时Wiz完成了总体规模为5400万美元的种子轮融资,而Cyberstarts的出资额为640万美元。后来他们不断加码,据一位内部人士透露,目前他们持股的比例为4.1%,这将为他们带来13亿美元的回报。再加上此前Cyberstarts此前卖出过1.2亿美元的Wiz老股,这意味着Cyberstarts在Wiz这个项目上总共获利超过14亿美元,回报倍数高达222倍。 这么刺激的数字让Next Wave NY合伙人Shai Goldman在社交媒体上忍不住感叹:“Cyberstarts创造了风险投资历史上回报率最高的案例之一……作为LP,将Fund 1(Cyberstarts的首期基金)作为投资选择确实带来了惊喜!” 当然这里还可以联动此前的一条消息。那就是今年以来的股权投资回报案例,也是通过并购创造的,也发生在网络安全领域:

Index Ventures Investments

1,230 Investments

Index Ventures has made 1,230 investments. Their latest investment was in Temporal as part of their Series C - II on March 31, 2025.

Index Ventures Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

3/31/2025 | Series C - II | Temporal | $146M | No | 3 | |

3/11/2025 | Series A - II | Cartesia | $64M | No | 2 | |

2/27/2025 | Series B | Taktile | $54M | No | 5 | |

2/14/2025 | Series A | |||||

2/13/2025 | Series A |

Date | 3/31/2025 | 3/11/2025 | 2/27/2025 | 2/14/2025 | 2/13/2025 |

|---|---|---|---|---|---|

Round | Series C - II | Series A - II | Series B | Series A | Series A |

Company | Temporal | Cartesia | Taktile | ||

Amount | $146M | $64M | $54M | ||

New? | No | No | No | ||

Co-Investors | |||||

Sources | 3 | 2 | 5 |

Index Ventures Portfolio Exits

258 Portfolio Exits

Index Ventures has 258 portfolio exits. Their latest portfolio exit was Wiz on March 18, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

3/18/2025 | Acquired | 33 | |||

2/6/2025 | Asset Sale | 2 | |||

12/12/2024 | IPO | Public | 7 | ||

Date | 3/18/2025 | 2/6/2025 | 12/12/2024 | ||

|---|---|---|---|---|---|

Exit | Acquired | Asset Sale | IPO | ||

Companies | |||||

Valuation | |||||

Acquirer | Public | ||||

Sources | 33 | 2 | 7 |

Index Ventures Acquisitions

1 Acquisition

Index Ventures acquired 1 company. Their latest acquisition was Dubsmash on April 15, 2019.

Date | Investment Stage | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Total Funding | Note | Sources |

|---|---|---|---|---|---|---|

4/15/2019 | Seed / Angel | $22.25M | Acq - Fin | 2 |

Date | 4/15/2019 |

|---|---|

Investment Stage | Seed / Angel |

Companies | |

Valuation | |

Total Funding | $22.25M |

Note | Acq - Fin |

Sources | 2 |

Index Ventures Fund History

32 Fund Histories

Index Ventures has 32 funds, including Index Ventures Growth VI.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

7/26/2021 | Index Ventures Growth VI | $2,000M | 1 | ||

7/26/2021 | Index Ventures XI | $900M | 1 | ||

7/26/2021 | Index Origin | $200M | 3 | ||

5/19/2020 | Index Ventures X (Jersey) | ||||

5/19/2020 | Index Ventures Growth V (Jersey) |

Closing Date | 7/26/2021 | 7/26/2021 | 7/26/2021 | 5/19/2020 | 5/19/2020 |

|---|---|---|---|---|---|

Fund | Index Ventures Growth VI | Index Ventures XI | Index Origin | Index Ventures X (Jersey) | Index Ventures Growth V (Jersey) |

Fund Type | |||||

Status | |||||

Amount | $2,000M | $900M | $200M | ||

Sources | 1 | 1 | 3 |

Index Ventures Partners & Customers

8 Partners and customers

Index Ventures has 8 strategic partners and customers. Index Ventures recently partnered with Latham & Watkins on September 9, 2022.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

9/26/2022 | Vendor | United States | 1 | ||

6/9/2022 | Vendor | ||||

4/26/2017 | Partner | ||||

1/9/2014 | Partner | ||||

1/9/2014 | Vendor |

Date | 9/26/2022 | 6/9/2022 | 4/26/2017 | 1/9/2014 | 1/9/2014 |

|---|---|---|---|---|---|

Type | Vendor | Vendor | Partner | Partner | Vendor |

Business Partner | |||||

Country | United States | ||||

News Snippet | |||||

Sources | 1 |

Index Ventures Service Providers

1 Service Provider

Index Ventures has 1 service provider relationship

Service Provider | Associated Rounds | Provider Type | Service Type |

|---|---|---|---|

Counsel | General Counsel |

Service Provider | |

|---|---|

Associated Rounds | |

Provider Type | Counsel |

Service Type | General Counsel |

Partnership data by VentureSource

Index Ventures Team

17 Team Members

Index Ventures has 17 team members, including current Founder, General Partner, Neil Rimer.

Name | Work History | Title | Status |

|---|---|---|---|

Neil Rimer | Founder, General Partner | Current | |

Name | Neil Rimer | ||||

|---|---|---|---|---|---|

Work History | |||||

Title | Founder, General Partner | ||||

Status | Current |

Compare Index Ventures to Competitors

Bessemer Venture Partners works as a venture capital firm with offices in New York, Silicon Valley, Boston, Mumbai, and Herzliya. Bessemer primarily invests in early-stage opportunities but also participates in late-stage financing and occasionally makes seed-stage investments as well. The firm invests in the following areas: cleantech, data security, financial services, healthcare, online retail, and SaaS. Bessemer Venture Partners typically makes investments in the range of $4M–$10M. It was founded in 1911 and is based in San Francisco, California.

Accel is a venture capital firm that invests in and partners with teams from the inception of private companies through their growth phases, primarily in the technology sector. Accel was formerly known as Accel Partners. It was founded in 1983 and is based in Palo Alto, California.

Sequoia Capital is a venture capital firm that focuses on supporting startups from inception to initial-public offering (IPO) within sectors. They provide investment funding and strategic support to help companies grow and succeed. Sequoia Capital primarily serves technology-driven sectors and businesses aiming to become market leaders. It was founded in 1972 and is based in Menlo Park, California.

Kleiner Perkins serves as a venture capital firm with a focus on technology and life sciences sectors. The company invests in innovative and forward-thinking startups, offering financial support and strategic partnerships to help them grow. Kleiner Perkins primarily serves sectors such as software, biotechnology, healthcare, and internet technology. It was founded in 1972 and is based in Menlo Park, California.

General Catalyst works as a venture capital firm focused on early-stage and transformational investments within the technology and market-leading business sectors. The firm supports exceptional entrepreneurs building innovative technology companies, offering funding and strategic guidance to help them grow. General Catalyst primarily sells to sectors such as fintech, health assurance, consumer, and enterprise industries. It was founded in 2000 and is based in San Francisco, California.

Lightspeed Venture Partners operates as an early-stage venture capital firm. It focuses on accelerating disruptive innovations and trends in the enterprise and consumer sectors. It was founded in 2000 and is based in Menlo Park, California.

Loading...