Pharma giant Bristol Myers Squibb's 3 mega-acquisitions cap off a year of heightened big pharma M&A activity.

The most aggressively ambitious Fortune 500 company right now is not a tech company.

Pharma giant Bristol Myers Squibb (BMS) has done three $4B+ acquisitions since October. Beyond M&A, the company has been active on the partnership and investment front.

We discuss its activity — and the pharma sector more broadly — below.

M&A ACTIVITY

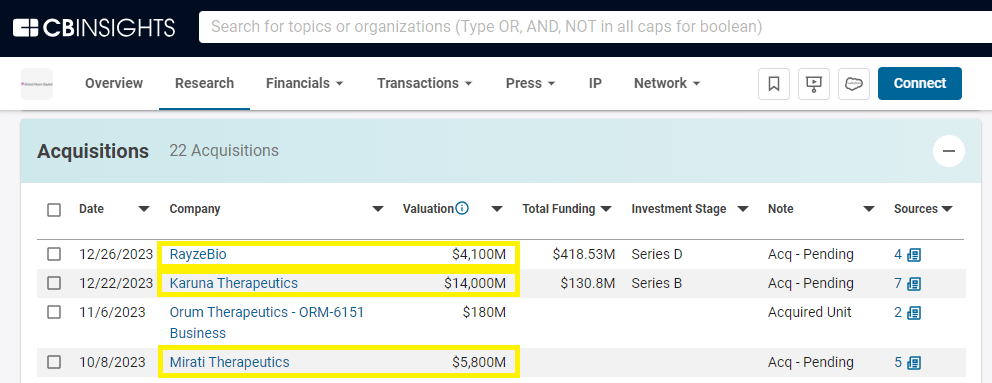

Since October, BMS has acquired 3 companies:

- Mirati Therapeutics ($5.8B) — cancer drug developer

- Karuna Therapeutics ($14B) — psychiatric and neurological drug developer

- RayzeBio ($4.1B) — radioparmaceutical cancer drug developer

LICENSING ACTIVITY

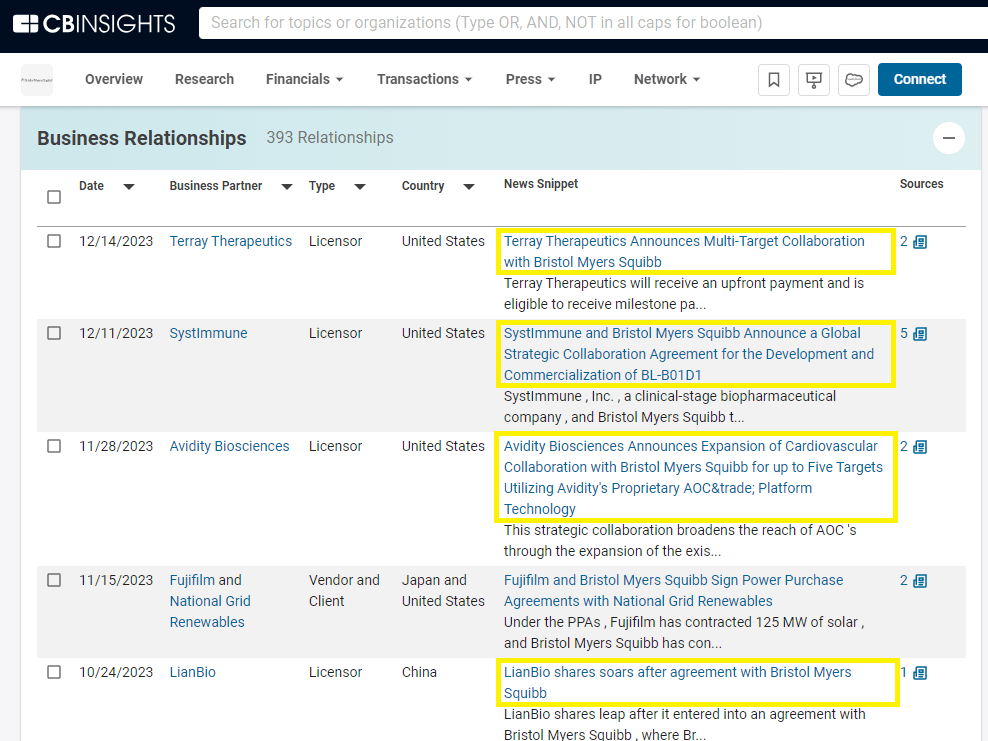

In addition to M&A, BMS has been actively striking partnership & licensing deals with other biopharma companies.

You can see 4 licensing deals it’s struck just since October as well courtesy of CB Insights commercial transaction data.

INVESTMENT ACTIVITY

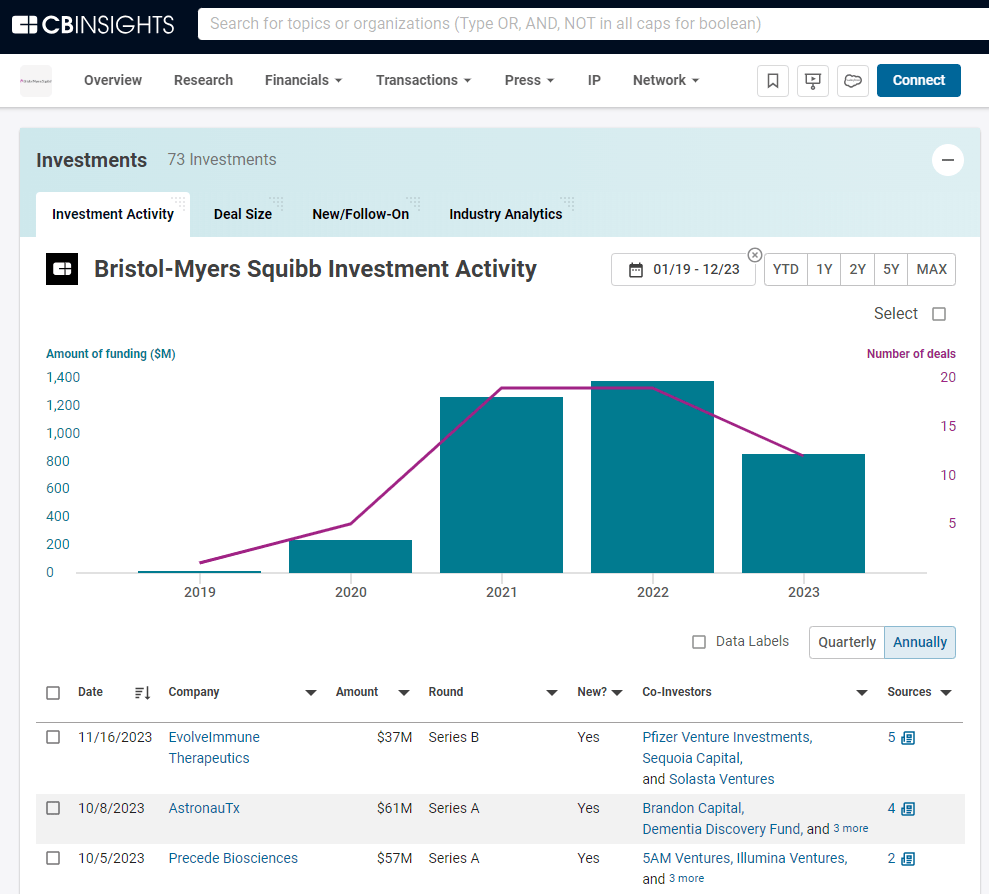

And finally, the pharma giant remained an active corporate venture capital investor in 2023.

Its deal activity held up pretty well in an otherwise down year for venture.

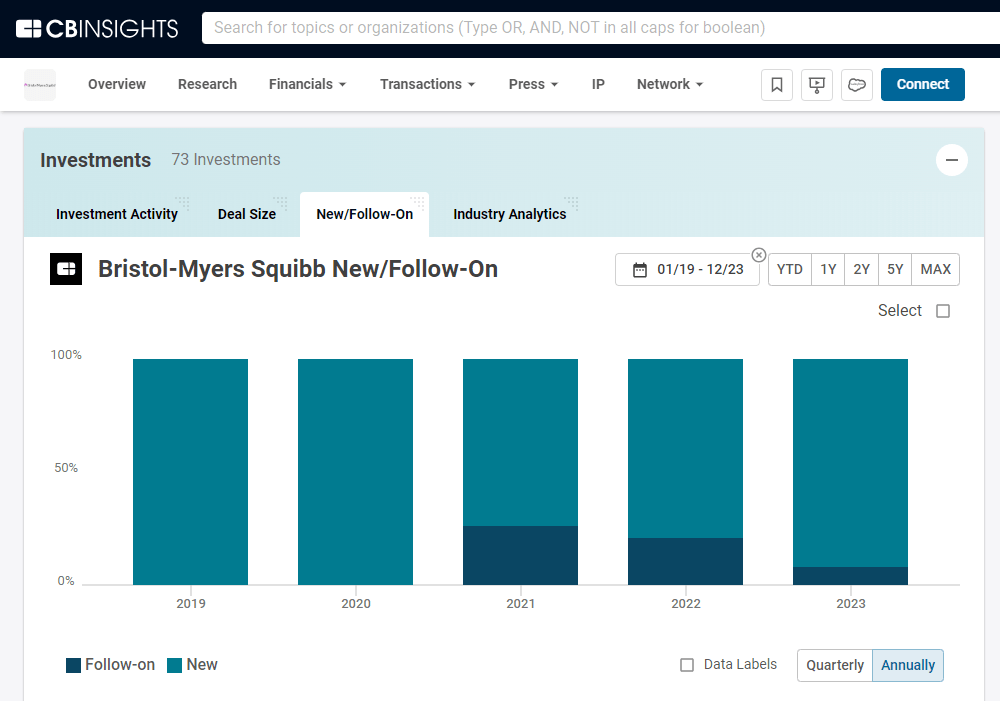

Within its venture investments, BMS is deploying money into new companies and not just following on in existing investments as the graph below illustrates.

BIG PHARMA ACQUISITIONS

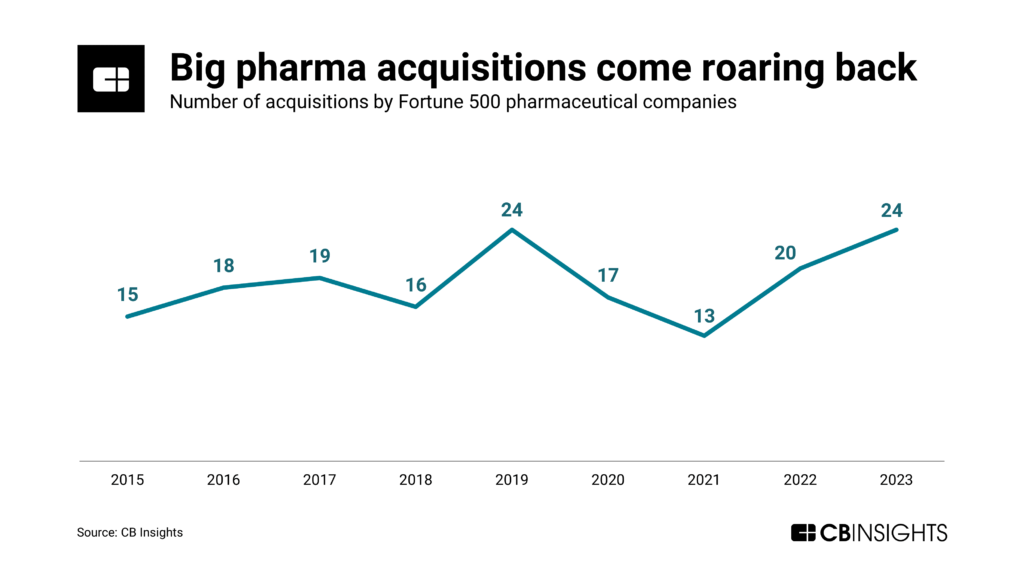

Pharma giants are sitting on a lot of cash, and with some having drug pipelines that need replenishment, 2024 should be a big year for M&A activity in the pharma space overall.

2023 already marked a major upswing in activity.

Pfizer completed its $43B acquisition of Seagen in December. Meanwhile, AbbVie announced back-to-back acquisitions worth nearly $19B combined in Q4.

Heading into 2024, BMS has likely put everyone else’s corp dev and licensing/R&D teams on alert that it’s go time.

For customers who want to dig into Fortune 500 pharma M&A activity on CB Insights, check out this search here.

If you aren’t already a client, sign up for a free trial to learn more about our platform.