Indemn

Founded Year

2021Stage

Pre-Seed - II | AliveTotal Raised

$1.9MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-5 points in the past 30 days

About Indemn

Indemn focuses on machine learning to provide insurance services in the insurance industry. The company offers a self-serve platform that uses chatbots to answer insurance-related questions and allow customers to purchase coverage online. The company primarily serves the event and wedding industry. It was founded in 2021 and is based in New York, New York.

Loading...

Indemn's Products & Differentiators

Copilot

Basic AI Agent with Live Chat intervention supported by AI response recommendations

Loading...

Research containing Indemn

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Indemn in 3 CB Insights research briefs, most recently on Mar 6, 2025.

Mar 6, 2025

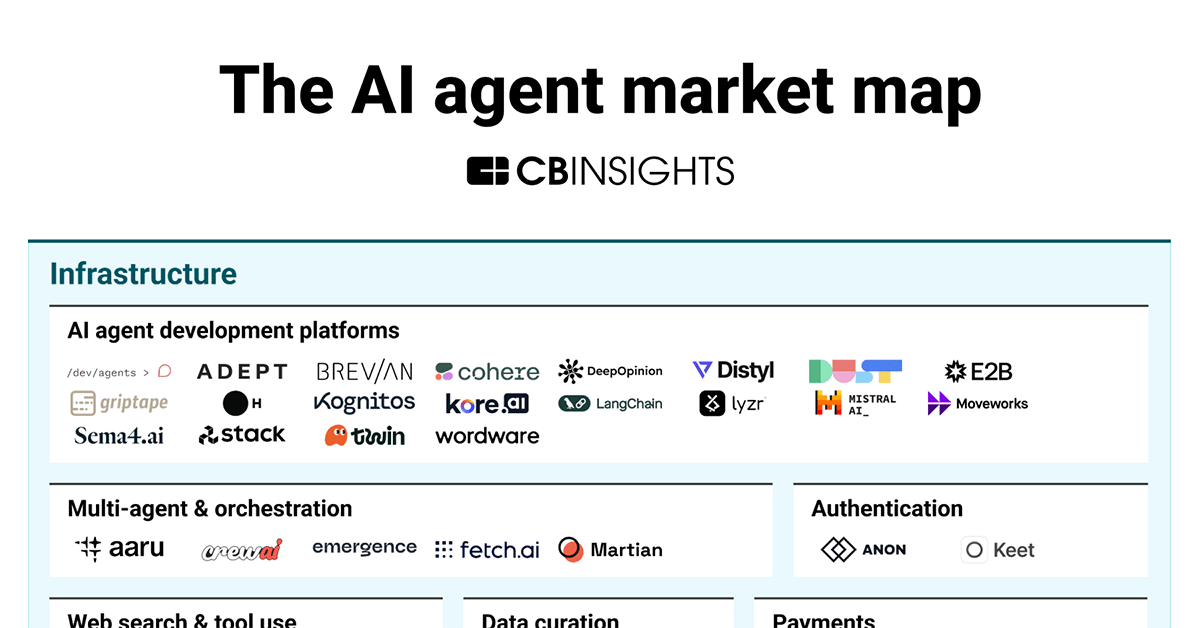

The AI agent market map

Oct 11, 2024

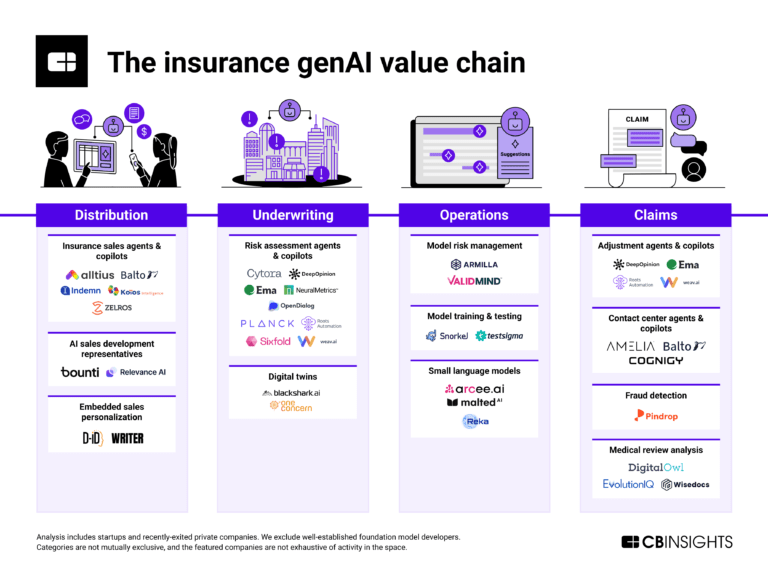

How genAI is reshaping the insurance value chainExpert Collections containing Indemn

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Indemn is included in 5 Expert Collections, including Insurtech.

Insurtech

4,489 items

Fintech

9,451 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Artificial Intelligence

7,221 items

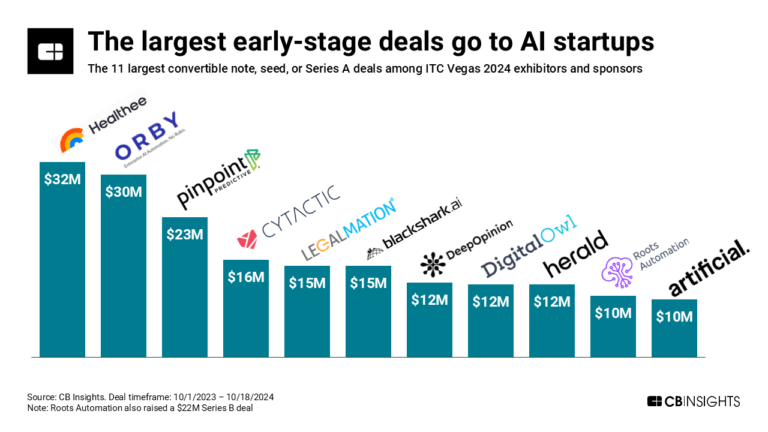

ITC Vegas 2024 - Exhibitors and Sponsors

699 items

Created 9/9/24. Updated 10.22.24. Company list source: ITC Vegas. Check ITC Vegas' website for final list: https://events.clarionevents.com/InsureTech2024/Public/EventMap.aspx?shMode=E&ID=84001

AI agents

286 items

Companies developing AI agent applications and agent-specific infrastructure. Includes pure-play emerging agent startups as well as companies building agent offerings with varying levels of autonomy. Not exhaustive.

Latest Indemn News

Jan 27, 2025

Background: 30 Years of Superior Service GIC Underwriters is a licensed wholesale broker and managing general agent (MGA) offering personal and commercial lines products in Arizona, Florida, Georgia, and Texas. GIC attributes its 30 years of success to superior service, product offerings, and a commitment to meeting the needs of its producers. The company prides itself on its market knowledge and for being an early adopter of technology, so it can provide a better experience to brokers and consumers. Challenge: Scaling GIC’s Exceptional Customer Service Every day GIC’s hard-working and highly skilled team of 6 customer service representatives (CSRs) respond to broker inquiries via phone, email, and live chat. While this team has deep industry expertise and knowledge of GIC’s programs, they often spend countless hours answering the same basic questions about risk appetite, quote generation, and coverage details. This problem becomes even more pronounced during peak hours. The routine, repetitive work pulls valuable resources away, which could have been used to answer more important questions about underwriting decisions and new business opportunities. “GIC needed a way to maintain our high service standards, while freeing our experts to focus on what they do best.” – Juan Carlos Diaz-Padron, Chief Underwriting Officer, GIC Underwriters Solution: Using AI to Take GIC’s High Service Standards to the Next Level Before engaging with Indemn, GIC had already built a successful chat system, but they knew artificial intelligence could take it further. After evaluating several AI solutions, they found most fell short on two critical needs: Providing immediate and accurate responses to broker inquiries Routing escalations and questions outside of an AI agent’s knowledge base to human CSRs quickly After doing some research, GIC came across Indemn’s Broker Portal Assistant . “We were exploring adding an AI component internally, but Indemn had already done the heavy lifting with an out-of-the-box solution,” Diaz-Padron recalled. To start, Indemn worked closely with GIC to convert their marketing materials, appetite documents, and company resources into a finely tuned, insurance-specific knowledge base. GIC implemented Indemn’s AI agent into their broker portal with a single line of code. Testing in a sandbox environment lasted less than 7 days. Indemn’s APIs enabled GIC to track individual agent interactions. Crucially, complex queries were automatically routed to human CSRs, ensuring a seamless and frustration-free experience for brokers. “Ensuring a smooth transition to a live agent for complex issues was paramount,” Diaz-Padron states. “The system provides immediate assistance without any obstacles or frustration.” To keep improving, GIC took advantage of Indemn’s Agent Copilot feature, a human-in-the-loop mechanism allowing experts to join any ongoing AI-broker exchange. By providing real-time feedback to the AI, refining responses, and updating the knowledge base, the team continually sharpened the agent’s accuracy. This hands-on oversight, combined with ongoing data analysis, cut AI hallucinations by 95% and guaranteed that responses stayed closely aligned with GIC’s vetted information and business goals. “It was very important for us that if someone needed to talk to a human, the system could connect them with a CSR fast. With Indemn’s platform there was no pushback, no frustration – just immediate help when needed.” – Juan Carlos Diaz-Padron, Chief Underwriting Officer, GIC Underwriters Results: Service Team Scales with Less and Generates More Revenue, While Agents Grow More Satisfied The results were immediate. In the first week, their AI agent answered 19% of all broker inquiries. After 60 days it answered 46% of incoming questions with 95% accuracy. In addition to answering many common and repetitive inquiries, some of the other benefits GIC saw included: Higher service marks across the board Increased broker satisfaction due to 24/7 access to instant answers. Underwriters and CSRs freed to focus on complex underwriting and new business. Surprisingly, GIC’s AI agent drove higher engagement with newly appointed producers by efficiently answering questions about the fit for new business opportunities, helping those still learning GIC’s product appetite. “While our customer service team was initially skittish about adding AI, they’re now enthusiastic supporters because they have fewer chats to handle, and it allows them to focus on more meaningful work” – Juan Carlos Diaz-Padron, Chief Underwriting Officer, GIC Underwriters Every AI interaction is automatically categorized and summarized, providing GIC with valuable data on broker behavior, market trends, and emerging opportunities. Leveraging Indemn’s AI Studio and REST APIs , GIC is building custom workflows based on the most frequent broker requests. GIC is already streamlining tasks like payment status checks and policy updates. Looking ahead in 2025, they plan to integrate Indemn’s AI agents across phone and email channels, and automate quoting for high-volume products. This is a strategic move to build a more scalable, resilient, and partner-centric business. By automating routine tasks, underwriters and CSRs can focus their expertise on complex underwriting and strategic growth, ultimately delivering greater value and ensuring long-term success.

Indemn Frequently Asked Questions (FAQ)

When was Indemn founded?

Indemn was founded in 2021.

Where is Indemn's headquarters?

Indemn's headquarters is located at 5 Union Square West, New York.

What is Indemn's latest funding round?

Indemn's latest funding round is Pre-Seed - II.

How much did Indemn raise?

Indemn raised a total of $1.9M.

Who are the investors of Indemn?

Investors of Indemn include Markd, Everywhere Ventures and AfterWork.

Who are Indemn's competitors?

Competitors of Indemn include Kyber and 3 more.

What products does Indemn offer?

Indemn's products include Copilot and 2 more.

Who are Indemn's customers?

Customers of Indemn include GIC, https://www.markel.com/ and https://www.insurancetrak.com/.

Loading...

Compare Indemn to Competitors

Statflo focuses on providing compliant business texting solutions and operates within the telecommunications, financial services, and insurance sectors. The company offers a business text messaging platform that enables frontline teams to engage with customers through personalized messages, streamlining customer communications. Primarily, Statflo's services are utilized by the telecom, financial institutions, and insurance industries. It was founded in 2012 and is based in Toronto, Canada.

Userbot focuses on generative AI for conversational automation in business sectors. The company provides tools for creating virtual assistants, AI voice technology, and digital human avatars for customer interactions through chat, voice calls, and messaging. Userbot serves sectors including healthcare, finance, public administration, retail, and energy & utilities. It is based in Milan, Italy.

Front is a modern customer service platform that specializes in enhancing customer experiences and operational efficiency within the customer support sector. The company offers a suite of tools, including an omnichannel inbox, AI chatbots, live chat, and workflow automation to streamline communication and support processes. Front's platform is designed to facilitate real-time team collaboration and provide actionable service analytics to businesses of various sizes. It was founded in 2014 and is based in San Francisco, California.

tawk.to is a company that specializes in customer communication and management software in the tech industry. The company offers a range of services including live chat, ticketing, and a knowledge base for customer self-service, as well as virtual assistant services. Their primary market includes businesses across various sectors that require customer interaction and management tools. It is based in Las Vegas, Nevada.

Serviceform provides website lead generation and customer engagement solutions for various industries, focusing on real estate and automotive sectors. The company offers tools including chatbots, dynamic forms, and landing pages to assist in converting web visitors into leads, as well as platforms for managing customer relationships and communication. Serviceform's products serve businesses aiming to improve their online presence and optimize their lead management processes. It was founded in 2017 and is based in Turku, Finland.

charles is a WhatsApp marketing platform specializing in conversational commerce and customer engagement. The company offers automation tools to help businesses generate revenue through WhatsApp, create targeted campaigns, and manage customer conversations effectively. charles primarily serves mid-size to enterprise-level brands, integrating with their customer relationship management (CRM) and marketing teams. It was founded in 2019 and is based in Berlin, Germany.

Loading...