hepster

Founded Year

2016Stage

Series B | AliveTotal Raised

$32.2MLast Raised

$11.24M | 2 yrs agoAbout hepster

hepster specializes in providing online insurance services across various sectors. Its main offerings include insurance for bicycles, electronic devices, pets, sports equipment, travel, and personal liability, all managed digitally for ease of use. hepster primarily caters to individual consumers seeking situational lifestyle insurance and businesses looking for corporate insurance solutions. It was founded in 2016 and is based in Rostock, Germany.

Loading...

hepster's Products & Differentiators

API

The insurance product can be seamlessly integrated into existing B2B customer journeys. The API endpoints are flexible and modular.

Loading...

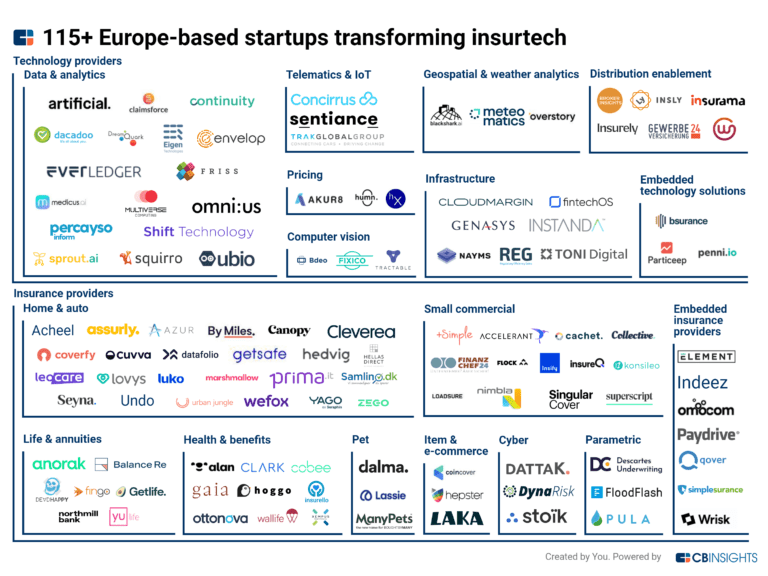

Research containing hepster

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned hepster in 1 CB Insights research brief, most recently on Sep 7, 2022.

Expert Collections containing hepster

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

hepster is included in 2 Expert Collections, including Insurtech.

Insurtech

4,487 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

13,662 items

Excludes US-based companies

Latest hepster News

Oct 16, 2024

News Provided By Share This Article Embedded Insurance Global Market Report 2024 – Market Size, Trends, And Forecast 2024-2033 You Can Now Pre Order Your Report To Get A Swift Deliver With All Your Needs” — The Business Research Company LONDON, GREATER LONDON, UNITED KINGDOM, October 16, 2024 / EINPresswire.com / -- The embedded insurance market has grown rapidly, rising from $82 billion in 2023 to $97.57 billion in 2024, with a CAGR of 19%. Growth drivers include regulatory support, cost-effectiveness, rising awareness of cyber and environmental risks, and increasing urbanization rates. What Is The Estimated Market Size Of The Global Embedded Insurance Market And Its Annual Growth Rate? The embedded insurance market is projected to see rapid expansion, reaching $196.5 billion by 2028, with a CAGR of 19.1%. Growth factors include improved customer experience, market penetration, risk management, and data security. Trends include IoT integration, blockchain technology, microinsurance, and telematics-based insurance. Explore Comprehensive Insights Into The Global Embedded Insurance Market With A Detailed Sample Report: Growth Driver of The Embedded Insurance Market The increasing use of digital platforms is expected to drive the embedded insurance market. Digital platforms simplify purchasing, managing, and customizing insurance policies, providing greater convenience. These platforms integrate insurance services into non-insurance applications, enhancing accessibility. The U.S. Bureau of the Census reported an 8.6% increase in e-commerce sales in the first quarter of 2024 compared to 2023, with e-commerce accounting for 15.9% of total retail sales. This growth in digital platforms will boost the embedded insurance market. Explore The Report Store To Make A Direct Purchase Of The Report: Which Market Players Are Driving The Embedded Insurance Market Growth? Major companies operating in the embedded insurance market are Zurich Insurance Group Ltd., The Chubb Corporation, Acko General Insurance Ltd., Root Insurance Company, Next Insurance Inc., Zego, Lemonade Insurance Agency LLC, Vouch Inc., Getsafe GmbH, Hippo Enterprises Inc, Qover S.A./N.V, Hepster, Cover Genius Insurance Services LLC, Cuvva, Sure Inc., wefox Insurance AG, SimpleSurance, Akur8 SAS, Trōv, CoverWallet Inc., Slice Insurance Technologies Inc., Boost Insurance USA Inc., Kasko Ltd., Bimaplan, Bsurance GmbH Major players in the embedded insurance market are working on advanced embedded insurance solutions that utilize artificial intelligence to streamline claims processing, personalize insurance offerings, enhance risk assessment, and improve customer service. The integration of AI in embedded insurance automates processes, refines risk assessment, customizes offerings, and simplifies claims. How Is The Global Embedded Insurance Market Segmented? 1) By Type: Intrinsic Insurance, Opt-Out Bundled Insurance, Opt-In Bundled Insurance, Billboard Insurance 2) By Channel: Online, Offline 3) By Industry: Automotive, Healthcare, Real Estate, Consumer Products, Travel And Hospitality, Other Industries Geographical Insights: Asia-Pacific Leading The Embedded Insurance Market Asia-Pacific was the largest region in the embedded insurance market in 2023. North America is expected to be the fastest-growing region in the forecast period. The regions covered in the embedded insurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. Embedded Insurance Market Definition Embedded insurance involves integrating coverage directly into the purchasing process of products or services, bundling insurance with related goods or services to simplify the process for customers. This strategy aims to make insurance more accessible and convenient, thereby increasing adoption by removing the need for a separate purchasing decision. Embedded Insurance Global Market Report 2024 from The Business Research Company covers the following information: • Market size data for the forecast period: Historical and Future • Macroeconomic factors affecting the market in the short and long run • Analysis of the macro and micro economic factors that have affected the market in the past five years • Market analysis by region: Asia-Pacific, China, Western Europe, Eastern Europe, North America, USA, South America, Middle East and Africa. • Market analysis by countries: Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA. An overview of the global embedded insurance market report covering trends, opportunities, strategies, and more The Embedded Insurance Global Market Report 2024 by The Business Research Company is the most comprehensive report that provides insights on embedded insurance market size, drivers and trends, embedded insurance market major players, competitors' revenues, market positioning, and market growth across geographies. The market report helps you gain in-depth insights into opportunities and strategies. Companies can leverage the data in the report and tap into segments with the highest growth potential. Browse Through More Similar Reports By The Business Research Company: Insurance Agencies Market 2024

hepster Frequently Asked Questions (FAQ)

When was hepster founded?

hepster was founded in 2016.

Where is hepster's headquarters?

hepster's headquarters is located at Am Kreuzgraben 1a, Rostock.

What is hepster's latest funding round?

hepster's latest funding round is Series B.

How much did hepster raise?

hepster raised a total of $32.2M.

Who are the investors of hepster?

Investors of hepster include Element Ventures, Seventure Partners, Claret Capital Partners, Mittelständische Beteiligungsgesellschaft Mecklenburg-Vorpommern, InsurTech NY and 6 more.

Who are hepster's competitors?

Competitors of hepster include Bikmo and 7 more.

What products does hepster offer?

hepster's products include API and 4 more.

Loading...

Compare hepster to Competitors

Indeez is an InsurTech company that focuses on providing sustainable and inclusive insurance benefits within the financial services and green mobility sectors. The company offers a range of insurance products, including accident and sickness coverage, professional indemnity, and public liability, designed to protect independent workers and support business growth. Indeez primarily serves sectors such as mobility, freelancing, staffing, delivery, and banking. It was founded in 2020 and is based in Paris, France.

Debeka is a mutual insurance association that specializes in a variety of insurance and financial services. The company offers products such as private health insurance, property and life insurance, vehicle coverage, and financial planning solutions like Bausparen. Debeka primarily serves private households and small to medium-sized businesses. It was founded in 1905 and is based in Koblenz, Germany.

Bike-ID provides bicycle protection and security within the insurance industry. The company has a bicycle registry, security solutions, and insurance services to protect bicycles. These services are intended for individuals and businesses seeking bicycle identification. It was founded in 2014 and is based in Berlin, Germany.

MIOO Cycling focuses on streamlining bicycle ownership and maintenance within the cycling industry. The company offers a comprehensive platform that allows bike owners to book services, subscribe to insurance, and access a mobile bike service, as well as join a community for cycling support. MIOO primarily serves the cycling community and individuals looking for convenient bike maintenance solutions. It was founded in 2019 and is based in Stockholm, Sweden.

INZMO is an insurance provider focusing on digital insurance solutions for individuals and businesses. The company offers insurance products for mobile phones, bicycles, laptops, e-scooters, and more. INZMO provides a user-friendly app, fast claims reporting, and 24/7 customer support. It was founded in 2015 and is based in Tallinn, Estonia.

Embea operates in the insurance industry and offers digital life and insurance plans. It provides coverage against severe life risks such as critical illnesses, accidents, and death. It primarily sells to companies of all sizes, embedding their insurance products into their apps and services. It was founded in 2022 and is based in Berlin, Germany.

Loading...