Hawk

Founded Year

2018Stage

Series C | AliveTotal Raised

$27MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+88 points in the past 30 days

About Hawk

Hawk specializes in anti-money laundering (AML) and counter-financing of terrorism (CFT) technology within the financial services industry. The company offers a suite of tools that leverage explainable artificial intelligence to enhance risk detection, streamline compliance, and reduce operational costs. Hawk's products are designed to screen payments, monitor transactions, and assess customer risk, ensuring adherence to global regulatory standards. It was founded in 2018 and is based in Munich, Germany.

Loading...

Hawk's Product Videos

ESPs containing Hawk

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The anti-money laundering (AML) software market helps detect, prevent, and mitigate the risks associated with money laundering and financial crimes. Solutions in this market analyze large volumes of data and identify suspicious activity for further investigation. This allows financial institutions and other regulated entities to monitor transactions, screen customers and counterparties, and conduc…

Hawk named as Challenger among 15 other companies, including NICE, Onfido, and TrueLayer.

Hawk's Products & Differentiators

Payment Screening

Screen counterparties against Sanctions and Country lists in real-time. Cleanse data and tune name-matching.

Loading...

Research containing Hawk

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Hawk in 3 CB Insights research briefs, most recently on Dec 14, 2023.

Dec 14, 2023

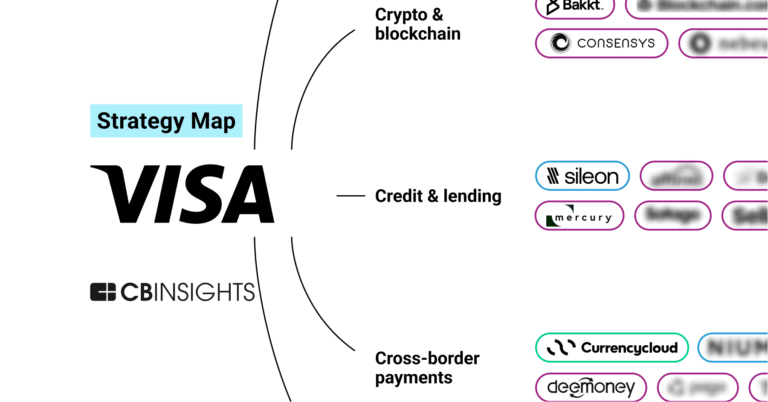

Cross-border payments market mapExpert Collections containing Hawk

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Hawk is included in 7 Expert Collections, including Regtech.

Regtech

1,921 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

Digital Lending

2,477 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Artificial Intelligence

9,986 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Fintech

13,661 items

Excludes US-based companies

Digital Banking

104 items

Fintech 100 (2024)

100 items

Latest Hawk News

Mar 25, 2025

How AI-Powered Fintech Startups Are Transforming Global Financial Services Nickie Louise Posted On March 25, 2025 The financial technology (fintech) sector is undergoing a major transformation, driven by artificial intelligence (AI) and machine learning. AI-powered fintech startups are revolutionizing financial services by automating investment strategies, enhancing fraud detection, and improving credit scoring. These innovations are attracting substantial investment—global fintech funding reached $51.2 billion in 2023, according to CB Insights. AI’s role in financial market forecasting is expanding, with machine learning models analyzing vast datasets to detect trends and optimize trading strategies. AI-based platforms track Bitcoin price USD , applying deep learning techniques to assess market sentiment and predict potential price swings. As financial markets become increasingly data-driven, AI is proving indispensable in helping investors and institutions make informed decisions. AI in Wealth and Asset Management Robo-advisors are now commonplace in wealth and asset management. They identify investment patterns, enhance portfolio performance and develop individualized approaches to managing finances. Companies such as Betterment and Wealthfront are using automated AI-powered platforms to provide retail investors with automated proxy funds at a reasonable cost. A Deloitte study revealed that 80% of financial companies predict AI will be vital for wealth management by 2025. These platforms use real-time market information to modify investment approaches along with funds, thus minimizing human error alongside its risks. AI-Enabled Fraud Detection and Risk Evaluation Fraudulent financial activities cost global companies over $42 billion each year, as per PwC’s Global Economic Crime Survey. The old-fashioned method of eliminating fraudulent activities relies on manual processes that rigidly check a set of static rules and are incapable of addressing dynamically changing cyber threats. Real-time anomaly detection and predictive analytics are helping AI-powered fintech startups eliminate fraud. Companies like Hawk AI and Feedzai utilize the power of machine learning to monitor and check for fraud and other suspicious activities by analyzing numerous transactions every second. Predictive AI also improves identity verification processes along with biometric authentication to provide an additional layer of protection against cybercrime. AI-Enhanced Lending and Credit Rating AI-based lending platforms are incorporating nontraditional data sources, providing other companies, which previously wouldn’t have qualified for credit, to take loans. Unlike the conventional credit scoring systems that put so much emphasis on credit history, AI-powered models focus on online activity, shopping activity, employment background, and other forms of mobile phone interactions to make different evaluations. For instance, Upstart, which is a lending platform that uses AI, analyzes borrower risk by applying machine learning technologies rather than relying on credit scores. With the use of this new approach, loan approval accuracy increased by 20–30% as well as reduced probable chances of defaults. In the same fashion, Zest AI helps lenders support the underbanked by providing more accurate and unbiased models of credit risk. Moreover, AI is greatly transforming automated loan underwriting by increasing the speed of approvals and decreasing the time needed to process applications from weeks to minutes. This gives borrowers access to financing sooner, while financial institutions can improve their risk management processes with the additional data provided. AI in Compliance and Financial Surveillance One of the most difficult and expensive areas in the financial industry is compliance management, due to penalties reaching millions for non-compliance. Startups in AI-driven RegTech (regulatory technology) solutions assist fintechs with the automation of compliance, transaction monitoring and detection of financial crimes. ComplyAdvantage and Ascent are startups that examine suspected faces and compliance risks with the use of RegTech AI systems that look at transaction records. The AI systems scan changes in regulations from around the world as they happen, ensuring that financial institutions follow the rules and never fall behind the constantly changing requirements. A Juniper Research Report stated that the RegTech industry is expected to reach $16 billion by 2025, with market compliance leaders being powered by AI. With the tightening of regulations globally, compliance will be met effectively and cost-efficiently with the help of AI by startups and institutions alike. Role of AI in Predicting Trends and Forecasting Financials Investors appreciate the assistance AI offers in forecasting market movements and are making more AI-informed decisions. Using historical data along with real-time analytics, AI-powered platforms study the market and recognize investment trends for forecasting future prices of assets. For instance, certain AI models observe USD prices of Bitcoin and utilize deep learning to determine if the conditions for purchase or sale are favorable, especially within the context of rapidly changing environments. An algorithm’s ability to identify thousands of signals at any given time gives traders a head start in these competitive markets where speed is essential and human intervention is limited. AI has extended its applications beyond crypto markets to equities, forex, real estate, and commodities, making accurate and timely financial predictions available to all. The Future of AI in Fintech The newest startup AI adaptations in fintech range from automating finance to enhancing predictive analytics and even improving fraud detection. AI is bound to affect: Banking services to be more personalized and engaging with constituents’ expense behavior. An AI-implemented portfolio performance investment optimizer. Better cyber fraud security tools for preventing more advanced forms of hacking. The McKinsey report shows that AI can potentially enable banks and other finance institutions to cut operational costs and improve productivity by as much as 25% by 2030. Unfortunately for the fintech newcomers, being competitive in the game is no longer an option; it is necessary to clash with the already automated ecosystem using AI-driven strategies. Conclusion The era of change for AI-empowered fintech startups has arrived, rapidly transforming the efficiency, security, and, above all, accessibility of financial services. The application of AI in automated wealth management, lendin,g and even fraud detection has redefined the way the expenditure of financial institutions is managed. The continuous development of AI technology will allow more fintech startups to widen the scope of financial inclusion and ease the complexity of investment decisions, along with fraud prevention. After all, the more clients are involved, the quicker the evolution of fintech we are promised. 0

Hawk Frequently Asked Questions (FAQ)

When was Hawk founded?

Hawk was founded in 2018.

Where is Hawk's headquarters?

Hawk's headquarters is located at Friedenstrasse 22B / i3, Munich.

What is Hawk's latest funding round?

Hawk's latest funding round is Series C.

How much did Hawk raise?

Hawk raised a total of $27M.

Who are the investors of Hawk?

Investors of Hawk include Picus Capital, Macquarie Capital, Rabobank, BlackFin Capital Partners, Sands Capital and 12 more.

Who are Hawk's competitors?

Competitors of Hawk include Flagright, Featurespace, ComplyAdvantage, SmartSearch, Salv and 7 more.

What products does Hawk offer?

Hawk's products include Payment Screening and 3 more.

Who are Hawk's customers?

Customers of Hawk include North American Bancard, RatePay and Moss.

Loading...

Compare Hawk to Competitors

ComplyAdvantage offers artificial intelligence-driven solutions for fraud and anti-money laundering (AML) risk detection within the financial services industry. The company provides services including customer and company screening, ongoing monitoring, transaction and payment screening, and fraud detection. It serves sectors such as banking, cryptocurrency, insurance, lending, and wealth management. The company was founded in 2014 and is based in London, United Kingdom.

Resistant AI works in fraud prevention and detection within the financial technology sector. The company provides services for detecting document fraud, automating document workflows, and improving transaction monitoring systems with artificial intelligence. It serves the fintech and financial services industry, focusing on risk and compliance teams within these sectors. Resistant AI was formerly known as Bulletproof AI. The company was founded in 2019 and is based in Prague, Czech Republic.

Unit21 focuses on risk and compliance operations in the financial services sector, providing a platform for transaction monitoring, fraud prevention, case management, and consortium data for fraud detection. The company serves financial institutions, fintech companies, marketplaces, neobanks, payment processors, and cryptocurrency businesses. It was founded in 2018 and is based in San Francisco, California.

Silent Eight specializes in leveraging artificial intelligence to combat financial crime within the financial technology sector. The company offers a suite of AI-driven solutions that streamline alert processing, enhance due diligence through name screening, and provide real-time transaction screening and continuous monitoring to detect suspicious activities. The company's solutions primarily serve financial institutions looking to comply with anti-money laundering and counter-terrorist financing regulations. It was founded in 2013 and is based in Singapore.

SEON focuses on fraud prevention and anti-money laundering (AML) compliance. The company offers products that include digital footprint analysis, device intelligence, and artificial intelligence (AI) and machine learning to detect and prevent fraudulent activities in real-time. SEON's solutions address various use cases such as account takeover, bonus abuse, and transaction monitoring. It was founded in 2017 and is based in Budapest, Hungary.

Trapets is a company that works in the area of financial crime prevention within the technology sector. Its offerings include anti-money laundering solutions, know-your-customer processes, and market surveillance technology to help businesses comply with regulations and combat financial crime. Trapets serves banks, credit institutions, investment companies, insurance companies, and payment service providers. It is based in Stockholm, Sweden.

Loading...